Since becoming a regular on “Shark Tank” in season 3, Mark Cuban has invested around $20 million in 85 companies. A recent interview with Cuban highlighted his worst investment from the show and also showed a common misconception with return on investment from the Shark’s deals.

What Happened: Appearing on the Full Send Podcast, Cuban said he has not made back the $20 million he has invested in 85 startups on Shark Tank.

When articles and Twitter posts started mentioning how Cuban's Shark Tank investments are currently at a loss, the entrepreneur was quick to clear the air.

“What I said was on a cash basis for my Shark Tank companies, I hadn’t taken in more than I put out. On a market to market basis, which most VCs (venture capital) use, I’m doing great,” Cuban tweeted.

Cuban tweeted he’s not a fan of the market to market valuations used by private equity and venture capitalist firms.

“Should illiquid valuations count?” Cuban asked.

A Twitter user asked Cuban if he should get the benefit of returns on investments that haven’t been exited yet if they’re winners.

“I’ll realize those gains when a transaction happens. But you don’t know when or how much ‘til that point in time,” Cuban said.

Related Link: Mark Cuban On The Nightmare Waiting For The Crypto Industry

Key Investments: Cuban recently commented on the Full Send Podcast about his worst investment from Shark Tank.

In 2013, Cuban and four other Sharks invested in a company called Breathometer, which was pitched as “the world’s first smartphone breathalyzer.”

The pitch by Charles Michael Yim was the first in Shark Tank history to land investments from all five Sharks on the show. The five Sharks, including Cuban, invested a combined $1 million for a 30% stake in the company.

Yim said Cuban invested $500,000 of the $1 million total, more than the other Sharks. The Breathometer founder said the company recently agreed to be acquired, which could help recoup some of the original investment, valuing the company at $3.3 million.

Cuban said he would text Yim and ask why he wasn’t working and get a response that he was networking. Eventually, the money the Sharks invested was gone and Yim transitioned away from the Breathometer and worked with Philips on Mint, a product that detects bad breath.

“It was a great product. But, the guy – Charles – I’d look at his Instagram and he’d be in Bora Bora,” Cuban said of Yim. “Two weeks later, he’d be in (Las) Vegas partying, and then he’d be on Necker Island with Richard Branson.”

The Federal Trade Commission filed a complaint against Breathometer and Yim in 2017 with allegations of misleading customers and lacking scientific evidence.

“That was my biggest beating,” Cuban said.

Yim told CNBC that the comments from Cuban were “completely off (base).” Yim argued that he didn’t blow the money on personal travel, and the meeting with Branson got him a place in the 2015 Branson’s Extreme Tech Challenge pitch competition. Yim did admit to not doing proper testing of his products.

Cuban told Benzinga about one of the most surprising success stories he's had from Shark Tank. Cuban was asked which investment on Shark Tank surprised him the most in terms of return on investment.

“Cycloramic had to pivot to computer vision. They did and we killed it when sold it to Carvana,” Cuban told Benzinga.

Cycloramic had to pivot to computer vision. They did and we killed it when sold it to carvana

— Mark Cuban (@mcuban) July 25, 2022

Cycloramic was featured on season 5 of Shark Tank with Bruno Francois looking for $90,000 for 5% of his company that used an iPhone to take a 3D panoramic photo. When the company was pitched, Cycloramic was selling its app for 99 cents on the Apple Inc (NASDAQ:AAPL) iTunes store and had over $175,000 in sales.

The pitch attracted offers from Lori Greiner, Cuban, Daymond John, Kevin O’Leary and guest shark Steve Tisch.

Cuban offered $1 million for 30% of the company and was countered by Francois with a pitch of partnering with Greiner for $500,000 for 15% of the company. Cuban and Greiner agree to the deal.

Downloads of the app hit 8 million in the week after the company aired on Shark Tank. Francois also created Selfie 360 and Car 360, two new products that expanded the reach of the company. The success of Car 360 and its ability to create interactive 360 degree images for car sales sites led to a buyout by Carvana Inc (NYSE:CVNA) for $22 million in 2018.

Benzinga’s Take: Shark Tank began airing on ABC, a unit of The Walt Disney Company (NYSE:DIS) in 2009. Cuban has appeared as a regular Shark on 11 of the 13 seasons, with his first appearances coming as a guest Shark in season 2.

Cuban’s investments in companies on Shark Tank are listed on his website and show many companies that could be buyout candidates or companies that have grown their sales since the original investments.

Sharks and early stage investors in companies often have to wait years to see their original investment back or a gain on their stake. Some companies do not make it and end up going bankrupt or turning into a loss for investors.

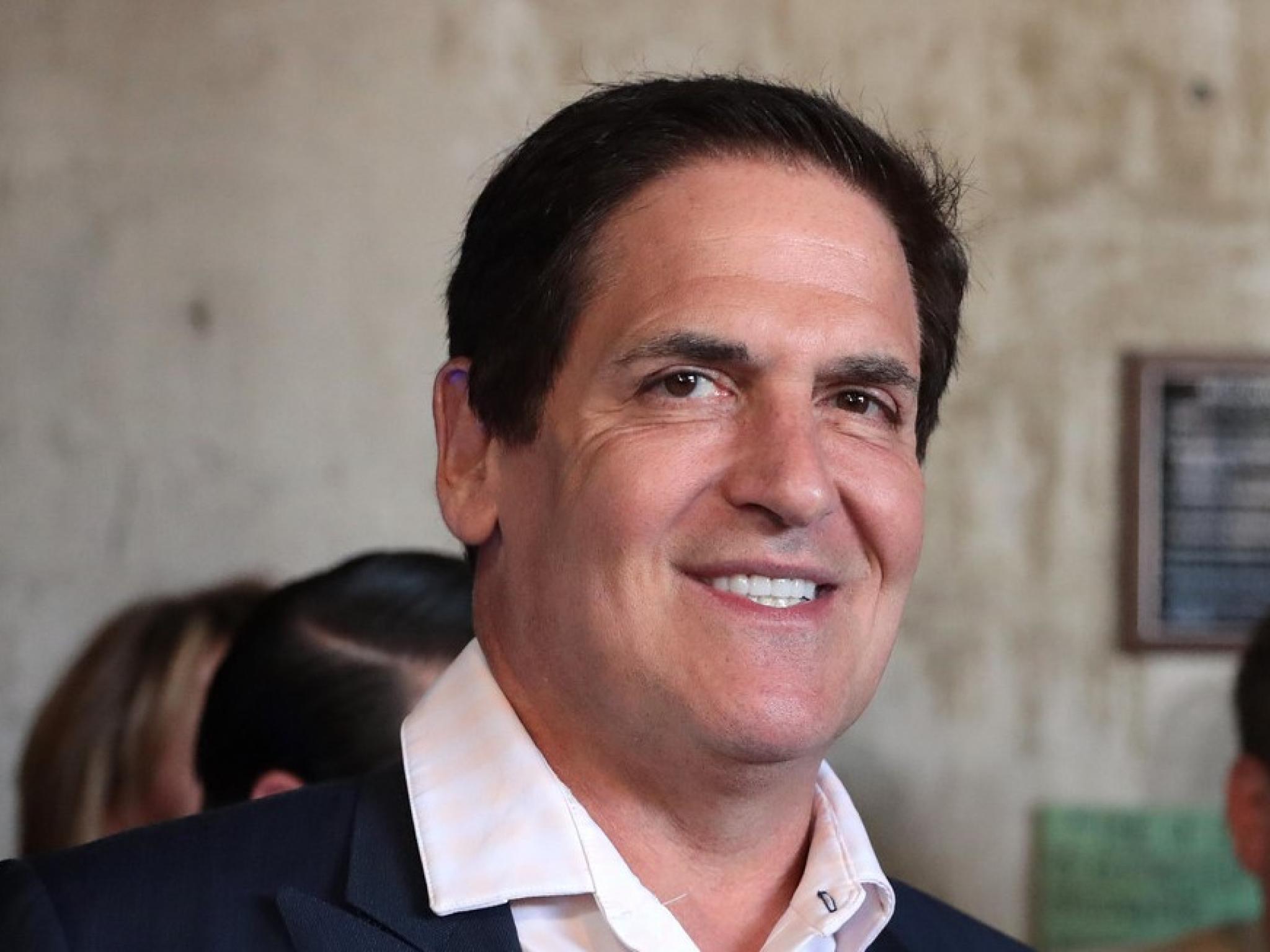

Photo: Courtesy of Gage Skidmore on flickr