Prior to the past several trading sessions, the stock market had been trading much better on the long side.

A lower-than-expected inflation report for October coupled with a less-hawkish tone from Fed Chairman Jerome Powell in November twice ignited the market higher over the past month.

Now, investors are grappling with a key question: How much gas is left in the tank?

While the Fed appears likely to be less hawkish moving forward -- with forecasts calling for a 0.5-percentage-point rate hike in December rather than 0.75 point -- the move would still be hawkish. Further, the Fed plans to maintain a restrictive policy for the foreseeable future.

When put together with a potential recession -- in part, signaled by the widening spread between short- and long-term Treasury yields -- investors aren’t sure if they should take a risk-on or risk-off approach.

Theory is one thing; price action is another. But even in that context, the signals are mixed.

The short-term trend is bearish, as the S&P 500 has fallen in five straight trading sessions. The long-term trend is also bearish, as the index has fallen 17% this year and tumbled into a bear market.

But the intermediate-term trend has been more bullish, with the S&P 500 back above its 50-day moving average and up 13.5% from the low, even accounting for the recent correction.

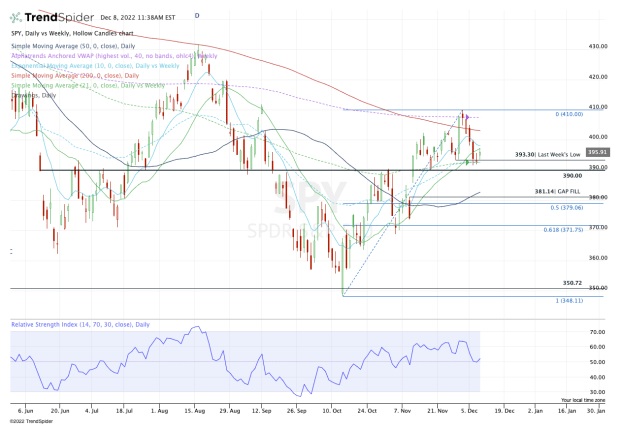

Trading the S&P 500

Chart courtesy of TrendSpider.com

Utilizing the SPDR S&P 500 ETF Trust (SPY), one can clearly see the messy price action.

On the plus side, the SPY is holding the 10-week and 21-week moving averages, and is staying above last week’s low of $393.30.

Working in the bears’ favor is the fact that the SPY is below the 10-day, 21-day and 200-day moving averages.

In my opinion, we’re setting up for a potential binary reaction to the approaching data.

We get a look at inflation via the producer-price-index report on Friday and the consumer-price-index report on Tuesday. On Wednesday, the Fed will deliver its interest-rate decision.

If those reports and decisions are favorable, the SPY likely roars back through $400 and retests the recent high at $410.

If the information supports the bear case, the S&P ETF seems likely to break below the key $390 level and tests down into the $379 to $382 area. There the SPY finds the 50-day moving average, 50% retracement and a gap-fill level.

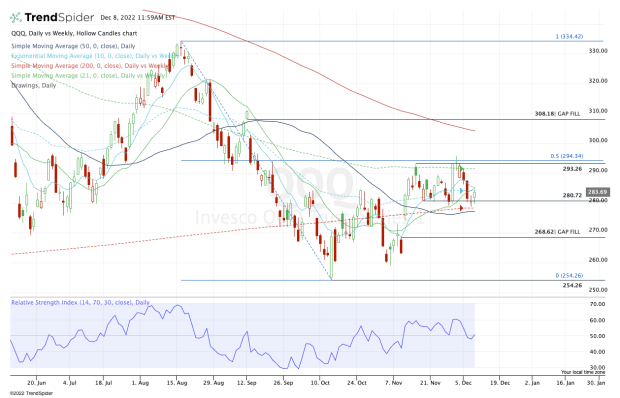

Trading the Nasdaq

Chart courtesy of TrendSpider.com

The Nasdaq has been the laggard of the four major US indexes this year. It’s down 29.2% on the year vs. just a 7% decline for the Dow and a 19.5% decline in the Russell 2000.

So it’s not surprising that the Invesco QQQ Trust Series (QQQ) is trapped between many key levels and does not have as bullish a chart as the others.

That said, I’m going to keep the QQQ simple.

A bullish reaction puts $293 to $295 in play. This area has been resistance. If the reaction is truly bullish, the QQQ will break out over this area, with nothing standing in its way until it hits the 200-day moving average and the gap-fill level near $308.

If the reaction is bearish, the $277 to $280 area will likely fail as support. Not only have buyers been stepping in at this area, but it’s also where the 50-day and 200-week moving averages come into play.

A break of this area opens the door down to the $268.62 gap-fill level from November. Below that and $260 or lower could be on the table.