Many investors are trying to figure out what impact the presidential election will have on stocks. Looking back at prior elections provides helpful context.

Let’s start with George W. Bush’s victory in 2000. The S&P 500 fell 13% in 2001 and 23% in 2002. But it’s hard to blame that on Bush.

🐂Free Newsletter From TheStreet - TheStreet 🐻

Stocks already were sliding in 2000 as the dot.com bubble began to burst. Bill Clinton caught the right end of the economic cycle in 1993-2000, and Bush caught the wrong end.

But then Bush benefited from the inevitable economic rebound. His tax cuts helped drive it, though they also widened the budget deficit. The S&P 500 soared 26% in 2003 and kept on climbing until 2008.

Shutterstock

Then came the financial crisis, which drove the index down 38% that year. Barack Obama was elected in November 2008, and initially, his election meant little, as the S&P 500 kept sinking until March.

But most experts agree that Obama and the Federal Reserve did an excellent job of bringing the economy and financial system back from the brink.

The S&P 500 jumped 23% in 2009 and ascended further in five of Obama's seven remaining years.

The Trump and Biden impact on stock market returns

The stock market’s reaction to Donald Trump’s 2016 election win was quite interesting. Many experts thought he and his mumble-jumble approach to economic policy would hurt the market.

Stocks did dive the night of Trump’s election, but they quickly rebounded, jumping 19% in 2017 and continuing that trend for two of the next three years. Trump’s tax reduction and deregulatory policy helped boost the economy, though government debt exploded.

Related: Stanley Druckenmiller offers bold view on stocks, election

When Joe Biden won the 2020 election, Trump and some other conservatives predicted the stock market would dive. It didn’t. Fiscal stimulus from Biden and monetary stimulus from the Fed helped drive the economy to steady growth.

The stock market has registered more than 20% returns in three of Biden’s four years of office.

Presidents’ policies do impact stocks, but there are plenty of other factors at work. Many experts argue that the market is now overvalued.

Stock valuations and history send signals

As of Oct. 18, the S&P 500 traded at 21.9 times analysts’ earnings estimates for the next 12 months, according to FactSet. That’s well above the five-year average of 19.5 and the 10-year average of 18.1.

If stock prices fall as investors seek to push the ratio closer to historical norms, it may not matter who’s in the Oval Office.

Related: Veteran fund manager delivers blunt words on stock market

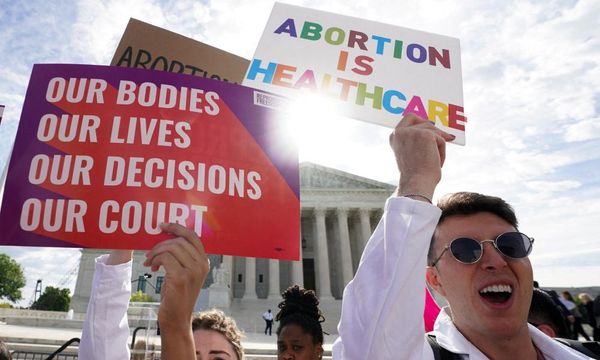

So, what are we to make of the Trump-Kamala Harris matchup? Given how close the contest appears to be based on Presidential polls, it may take days to determine the winner. Stocks could seriously slump if that’s the case.

Political instability may be the biggest danger investors ever face, especially when there’s a threat of civil unrest. If you’re a long-term investor, that actually could create buying opportunities for you.

BlackRock’s take on election and markets

The conventional wisdom is that Trump will be good for stocks, but Harris won’t. But take that with a large grain of salt. It could be that Trump would spark social instability or that Harris would be good for business.

Expert Stock Picks:

- Veteran investment strategist puts 3 top stocks in focus

- $4 billion fund manager puts 3 top stocks in focus

- $7 billion fund manager chooses Amazon and other growth stocks

Jean Boivin, managing director of BlackRock Investment Institute, says financial markets aren’t taking the threat of a disputed election seriously enough. (the Institute is money-management titan BlackRock’s research arm.)

There could be “weeks of very disrupting legal battles” that will upset markets, he told Bloomberg.

“I don’t think that’s in the price. And if you want to prepare for some scenario where you need to react, I think that’s one of those scenarios that could be bad for markets.” But he recommends against short-term trading around the election, calling it “a fool’s errand.”

Related: Veteran fund manager sees world of pain coming for stocks