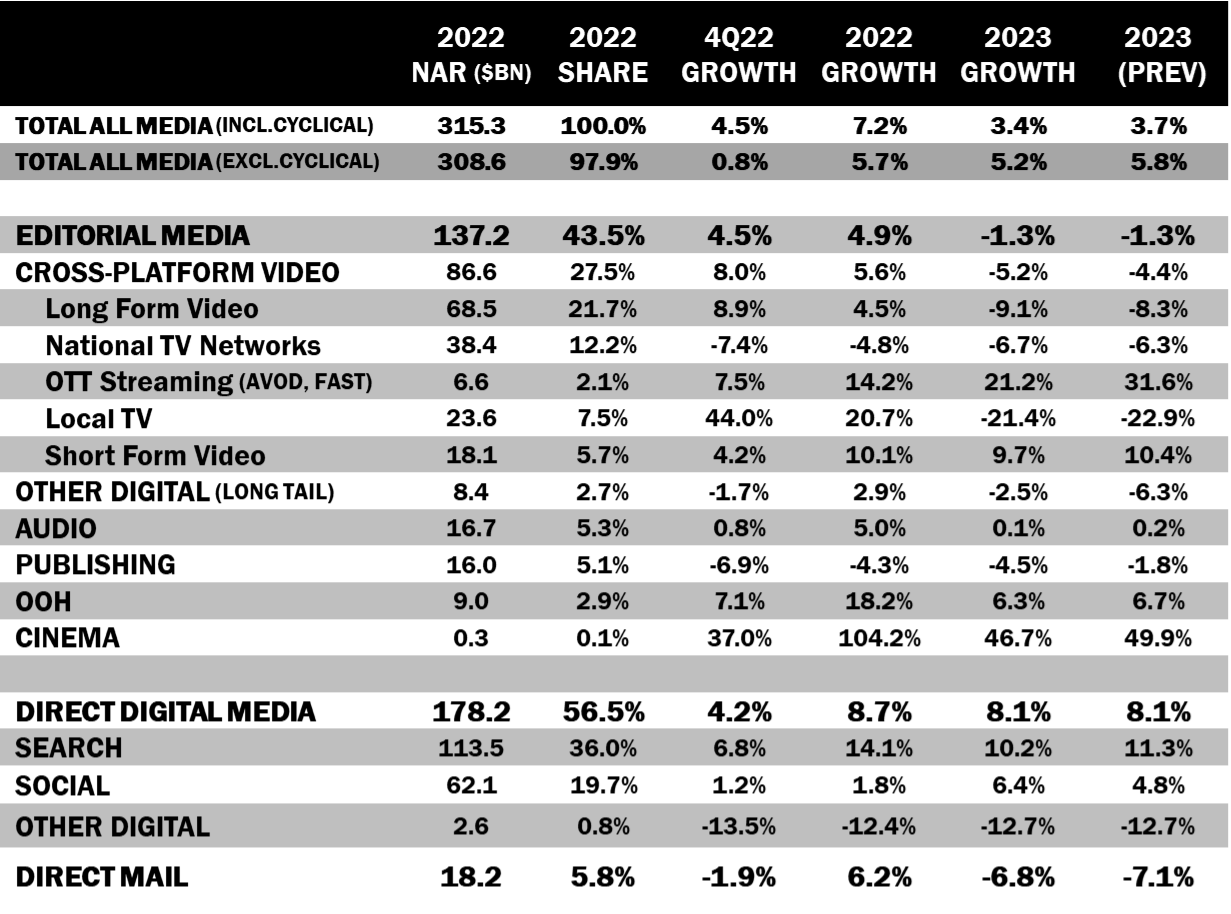

NEW YORK—New forecasts from media agency Magna are predicting that long form video advertising will be down by 9.1% in 2023 while OTT streaming (AVOD and FAST channel) spending will climb by 21.2%.

In contrast, after record political spending in 2022, the local TV ad spend will plummet by 21.4% and national TV will slip by 6.7%. The declines for national TV ad spending were slightly higher than the earlier 6.3% forecasted drop while the forecast for local TV was slightly better than the 22.9% drop previously predicted.

Overall cross platform video would decline by 5.2%, a worse outlook than the previously forecast 4.4% decline.

Magna reported that U.S. media owners advertising revenues grew by a decent 6% in 2022 (excluding cyclical ad spend) to reach $315 billion and that the ad spend slowed down significantly through the second half, with fourth quarter ad sales flat year-over-year.

Looking at 2023, there are mixed economic signals (slow but continued GDP growth, receding inflation, resilient job market) while financial turbulence is generating anxiety among consumers and businesses, Magna reported.

“In a similar economic climate, ten or twenty years ago, the U.S. advertising market would almost certainly fall off a cliff,” explained Vincent Létang, executive vice president, global market research at MAGNA, and author of the report. “Things are different in 2023 because of media innovation fueling marketing demand. The organic drivers that boosted the ad market in 2021 and the first half of 2022 are still around and mitigating the impact of stressful economic signals. Such organic drivers include the rise of retail media networks which are redirecting billions of marketing budgets dollars into advertising formats. In addition, with long-form OTT streaming going mainstream and increasingly ad-supported, brands finally find cost-effective solutions to reconnect with audiences that had become hard and expensive to reach through linear television. These are some of the reasons why advertising spending continued to grow in the second half of 2022, despite economic uncertainty, war, inflation, and very high growth comps. For the same reasons, MAGNA expects advertising activity to continue to grow, albeit at a slower pace, in 2023. An additional growth factor for 2023 is the recovery of the automotive market, a top five vertical for most media types in America”.