Ad-tech company Madhive has received a $300 million investment from Goldman Sachs Asset Management.

Goldman gets a significant minority stake in Madhive, whose platform helps broadcasters sell connected TV inventory to local advertisers looking for additional reach. The deal values Madhave at just under $1 billion.

Some of the money will go to Madhive founders Adam Helfgott and Tom Bollich. The rest will go to expanding the company, which will increase its headcount by 20% from 200 currently by the end of the year.

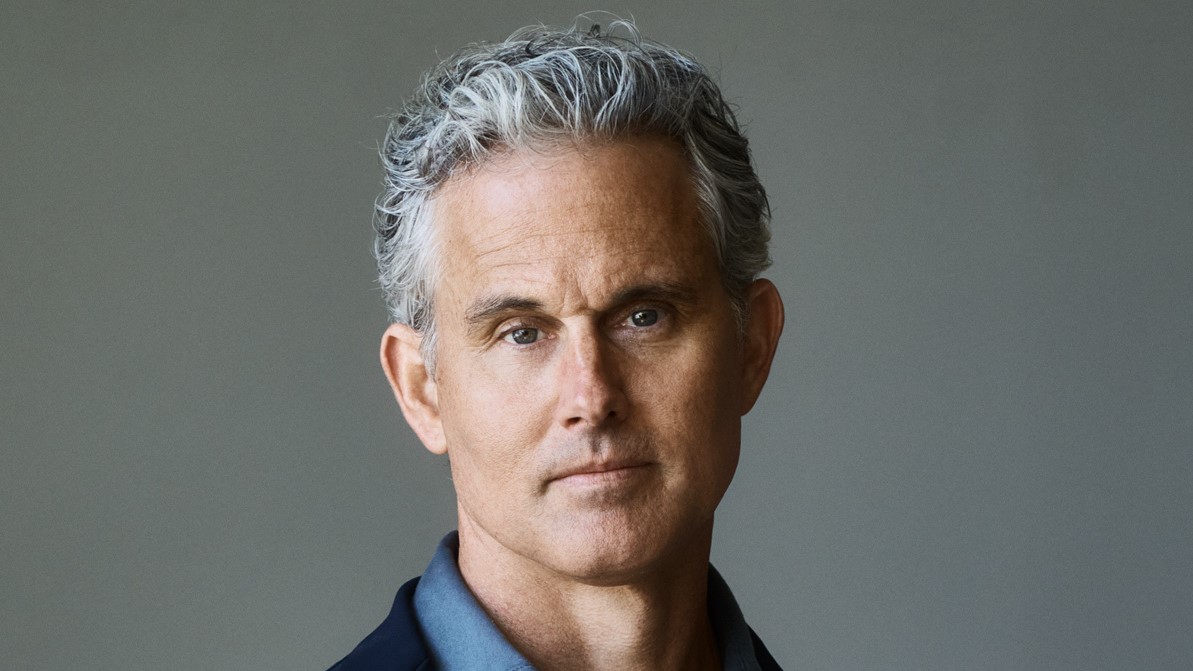

When the deal closes, Helfgott will step down as CEO and become a strategic advisor and chairman of the board. He will be succeeded as CEO by Spencer Potts, currently Madhive’s president.

Potts told Broadcasting+Cable that Madhive had only previously raised $7 million and wasn’t really looking for capital. It has revenue of about $125 million and is profitable, with between $40 million and $50 million in earnings last year.

But after a meeting at CES, Goldman convinced Madhive that its growth could be accelerated with Goldman’s help and cash.

Madhive has operated under the radar, because customers use its CTV capabilities under their own brands. Without a real sales team, the company has added a series of broadcast clients starting with Tegna. Since then it has added E.W. Scripps, the Fox Television Stations, Hearst Television and TelevisaUnivision.

Potts said the company has just formally named a sales team.

“We’re a technology firm built around CTV campaigns and ad decisioning,” Potts said.

“There are some powerful scaling opportunities,” Potts said.

Madhive’s end-to-end tech stack can be used to put other media companies into the CTV business. Madhive is also looking to work with direct-to-consumer streaming platforms and get into the national CTV business, he said.

Also Read: MadHive To Spend $100 Million To Expand Google Cloud Usage

“They can use our platform to add incremental revenue and sell connected TV. “We just want to be infrastructure that people can build products on, powered by our Madive technology, " Potts said.

“We want to continue to work with our broadcasters with workflow software that will help them accelerate the transition from linear to streaming,” he added. Goldman’s capital and its merger and acquisition expertise will also help it with bolt-on acquisitions to add capabilities in areas including measurement, data and workflow.

The deal exemplifies that while the TV ad market is soft, investor interest in ad tech remains robust.

Goldman has invested in a number of ad tech companies including iSpot.TV, Human, GumGum and Innovid.

“We have been deeply impressed with Madhive’s growth and success in the local CTV advertising market within just seven years since its inception,” said Leonard Seevers, a partner and co-head of technology, media and telecom investments in the private equity business within Goldman Sachs.

“We believe Madhive’s purpose-built, end-to-end CTV platform which enables hyper-local precision targeting at national scale is truly differentiated within the ad-tech ecosystem,” added Joon Park, a managing director in the private equity business within Goldman Sachs. “We see tremendous growth ahead in the company’s existing and adjacent markets and look forward to supporting Madhive to further accelerate the company's journey.”

Even before the Goldman investment, Madhive has hired a number of senior executives including chief revenue officer Jon Kaplan, a former Google and Pinterest executive; senior VP of sales Kristin Wnuk, previously with Roku and Hulu, and chief technology officer Darien Ford, who had been with Affirm and Capital One Software.