Shares of Lyft (LYFT) are not getting the lift that long investors were hoping for on Friday morning.

Quite the opposite: At last check, the stock was down 35% after the ride-share company’s disappointing quarterly report.

While the company topped revenue estimates, guidance was well short of analysts' expectations. For next quarter, management expects revenue of $975 million vs. consensus expectations of $1.1 billion.

Adding insult to injury, Uber (UBER) shares this week hit a 52-week high after better-than-expected earnings. That said, Uber stock is down around 5% after a two-day pullback.

Not helping matters is a weak broad market.

Given the news, let’s take a look at Lyft stock.

Trading Lyft Stock on Earnings

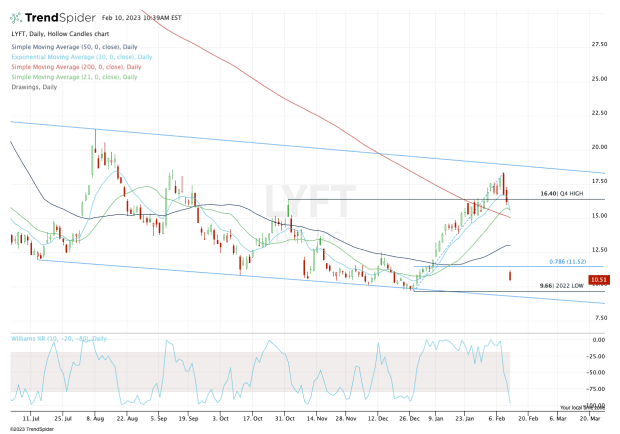

Chart courtesy of TrendSpider.com

Friday’s post-earnings gap down is dealing a blow to the chart. The technicals have turned decisively bearish with the stock’s 35% plunge.

The move has sent Lyft stock gapping below the 10-day, 21-day, 50-day and 200-day moving averages. It also gapped below the 50%, 61.8% and 78.6% retracements.

It’s also below all its weekly and monthly moving averages.

In other words, Lyft stock is getting destroyed from the perspective of technical analysis. Uber stock is thus vastly more attractive than Lyft at this moment.

From here, use the 78.6% retracement and today’s high of $11.22 as the upside levels to clear.

If Lyft stock can regain these marks, it opens the door to $12.50 and the 50-day moving average.

On the downside, keep a close eye on the current 52-week low of $9.66. If the shares retest this measure, the bulls must watch carefully how it’s handled.

A break of this level and a bounce back above it could set up a bullish reversal. But clean beak of this mark could open the door to downtrend resistance (blue line), a measure that’s been in play for several quarters.