Shares of Lululemon Athletica (LULU) are getting stretched on Friday — and not in a good way.

The stock is down more than 13% at last check after the company delivered disappointing third-quarter results.

The athleisure-apparel retailer beat on earnings and revenue expectations, although guidance for next quarter was a tad underwhelming.

Management expects fourth-quarter earnings in the range of $4.20 to $4.30 a share vs. consensus expectations of $4.30 a share. On the revenue front, management expects a range of $2.605 billion to $2.655 billion vs. consensus estimates of $2.65 billion.

The report appears to be weighing on Nike (NKE) a bit, with those shares down 1.4%. But it’s got bulls wondering if this is a warning sign or an opportunity in Lululemon stock.

Trading Lululemon Stock on Earnings

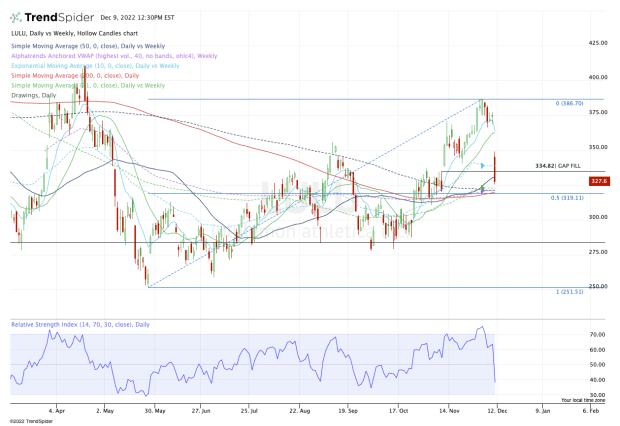

Chart courtesy of TrendSpider.com

With the move lower, Lululemon stock is knifing through the prior gap-fill level near $335, as well as the 10-week and 50-day moving averages.

For active bulls, that was an area to hold, but so far the stock is failing to do so.

But you know what? That’s okay. It gives us a clue about which group — the buyers or the sellers — is taking active control of the stock.

Plus, there’s a much bigger zone of interest.

That comes into play at the $320 to $325 area. In that zone, we have the daily and weekly VWAP measures, the 50% retracement and the 21-week, 50-week and 200-day moving averages.

In other words, it’s vital support.

If this area holds, I’m looking for a potential rebound back over the 50-day moving average and potentially to $350. Above that and the bulls may turn their attention to the $363 level, where Lululemon currently finds its 10-day and 21-day moving averages.

Above that is the gap-fill level near $368.50.

On the downside, a break of $320 could open the door down to $300. If that area doesn’t draw in buyers, Lululemon stock may wither down to the $270 to $275 area, which has been pretty solid support this year.