/Lululemon%20Athletica%20inc_%20phone%20and%20website%20by-%20T_Schneider%20via%20Shutterstock.jpg)

Vancouver, Canada-based lululemon athletica inc. (LULU) designs, distributes, and retails technical athletic apparel, footwear, and accessories for women and men under the lululemon brand. It is valued at a market cap of $20.7 billion.

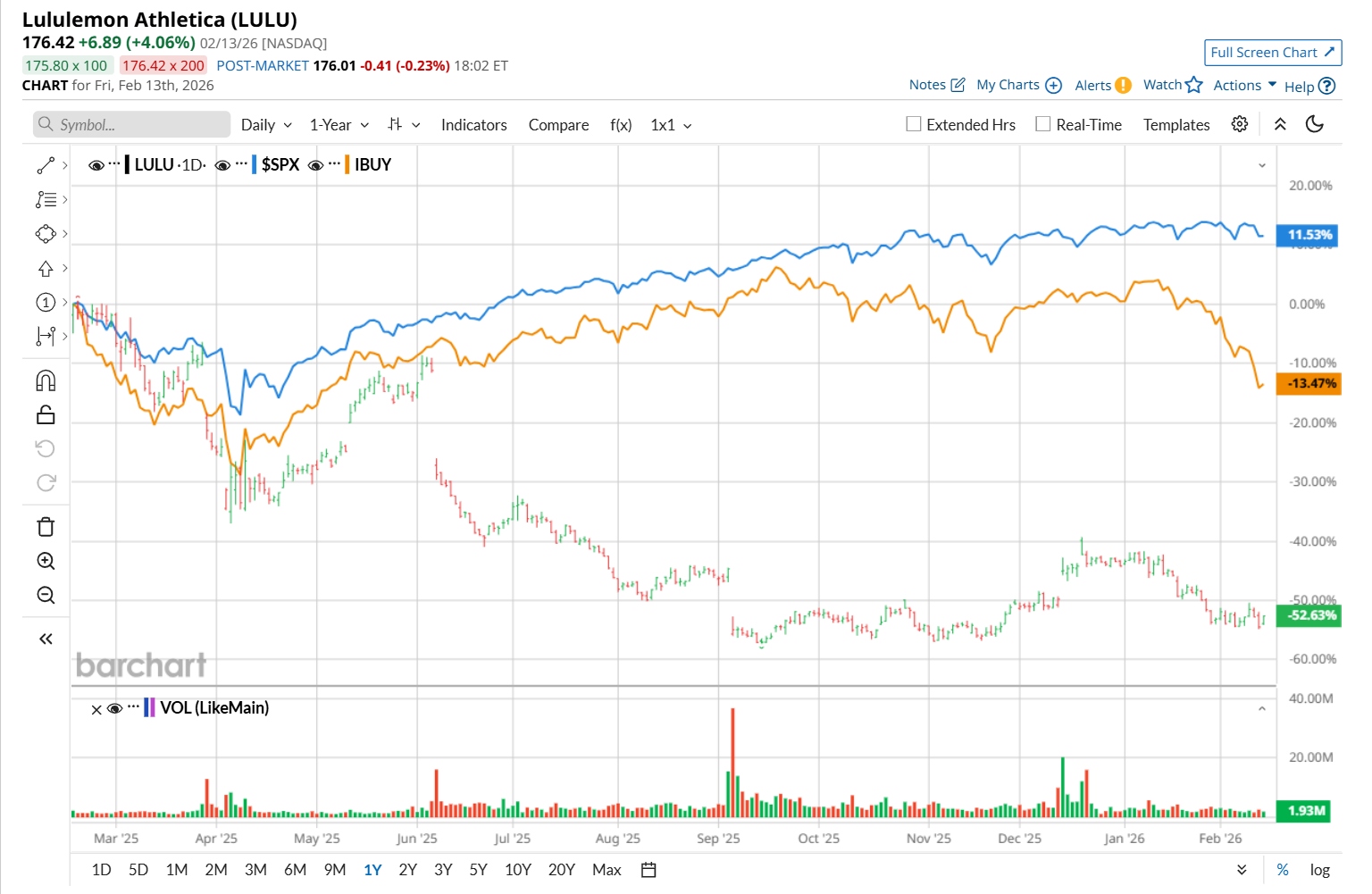

This apparel retail company has notably lagged behind the broader market over the past 52 weeks. Shares of LULU have declined 54.9% over this time frame, while the broader S&P 500 Index ($SPX) has soared 11.8%. Moreover, on a YTD basis, the stock is down 15.1%, compared to SPX’s marginal drop.

Narrowing the focus, LULU has also underperformed the Amplify Online Retail ETF (IBUY), which decreased 12.3% over the past 52 weeks and 13.9% on a YTD basis.

On Dec. 11, LULU posted better-than-expected Q3 results, and its shares surged 9.6% in the following trading session. Due to strong growth in international net revenue, the company’s total revenue climbed 7.1% year-over-year to $2.6 billion, surpassing Wall Street expectations by 3.6%. Meanwhile, its EPS declined 9.8% from the year-ago quarter to $2.59, but handily topped analyst expectations of $2.22.

For the current fiscal year, ending in January, analysts expect LULU’s EPS to decline 10.8% year over year to $13.06. The company’s earnings surprise history is promising. It exceeded the consensus estimates in each of the last four quarters.

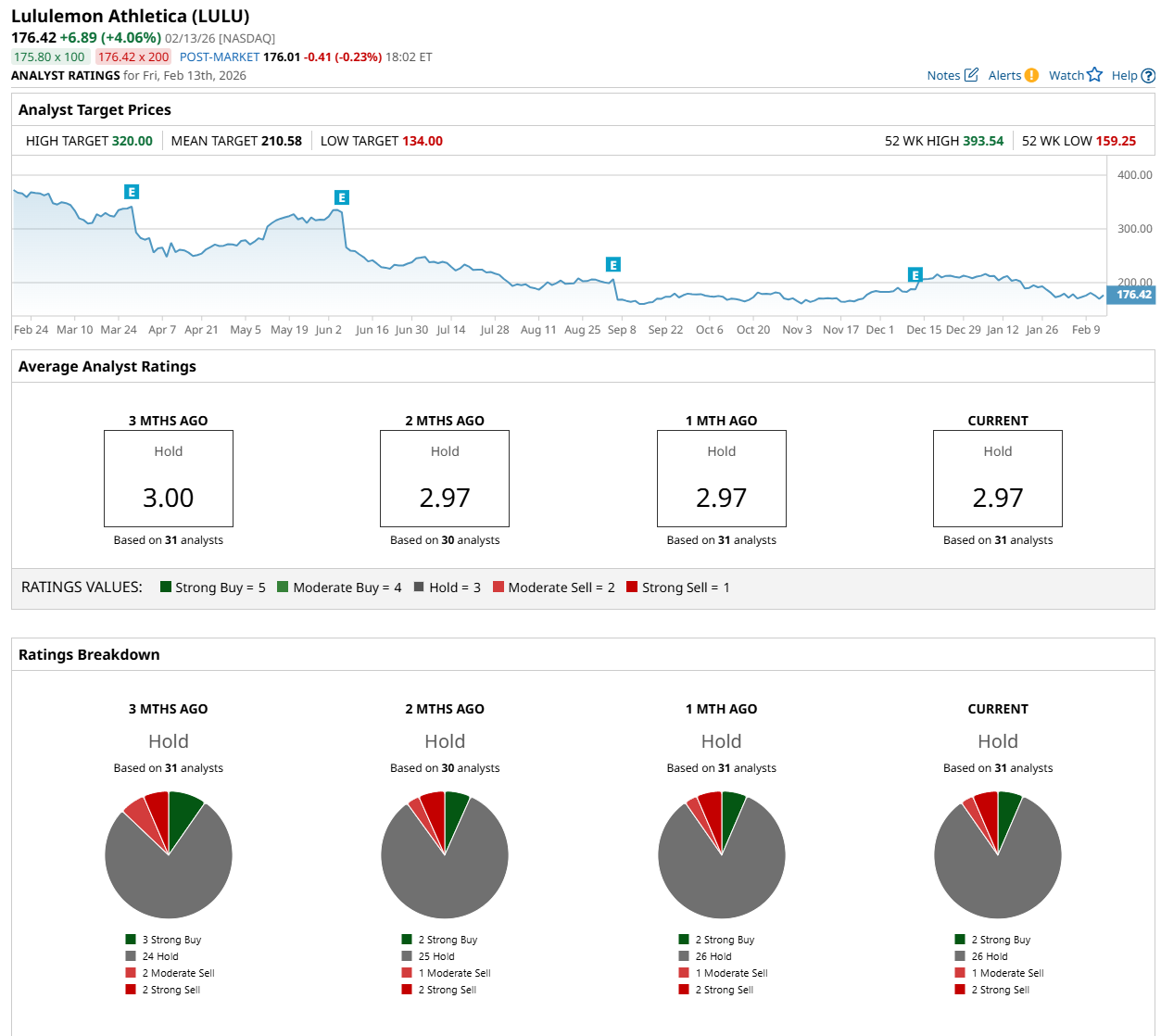

Among the 31 analysts covering the stock, the consensus rating is a "Hold,” which is based on two “Strong Buy,” 26 “Hold,” one "Moderate Sell,” and two “Strong Sell” ratings.

The configuration is slightly less bullish than three months ago, with three analysts suggesting a “Strong Buy” rating.

On Jan. 20, JPMorgan Chase & Co. (JPM) maintained a "Neutral" rating on LULU and raised its price target to $209, indicating an 18.5% potential upside from the current levels.

The mean price target of $210.58 represents a 19.4% premium to its current price levels, while its Street-high price target of $320 suggests an ambitious 81.4% potential upside from the current levels.