In the most recent quarter, Lucid Group, Inc. (LCID) revealed disappointing revenue and earnings, which fell below Wall Street's estimates. Compounding these lower-than-anticipated financial results, the high-end electric vehicle (EV) manufacturer also disclosed delivery figures notably below predictions.

Specifically, Lucid Group reported 1,404 Air sedan deliveries for the second quarter, indicating a deficit of roughly 600 units compared to what analysts had forecasted. Simultaneously, the company manufactured just 2,173 vehicles at its Arizona-based plant, a downturn of 6% from the previous quarter.

Despite manufacturing setbacks, the automaker reassured stakeholders that it is committed to achieving its annual production target. It further confirmed that the eagerly anticipated Gravity SUV launch will go ahead later this year. However, ongoing supply chain problems still cast a shadow on these affirmations. To suffice its objectives, the company must drastically accelerate its production rates.

In a more hopeful development, LCID reported strengthening its liquidity position, which reached $6.25 billion in the second quarter, mainly due to a significant $3 billion capital raise, aiming to keep the company financially stable through 2025.

Nonetheless, considering the company's poor financial performance, persistent supply chain disruptions, and the highly competitive EV market landscape, the investment potency of LCID currently remains questionable. The key metrics substantiating this cautious investment perspective will be elaborated upon subsequently. So, it may be advisable to hold off on purchasing LCID shares at this juncture.

Analyzing Lucid Group's Financial Performance from 2020-2023

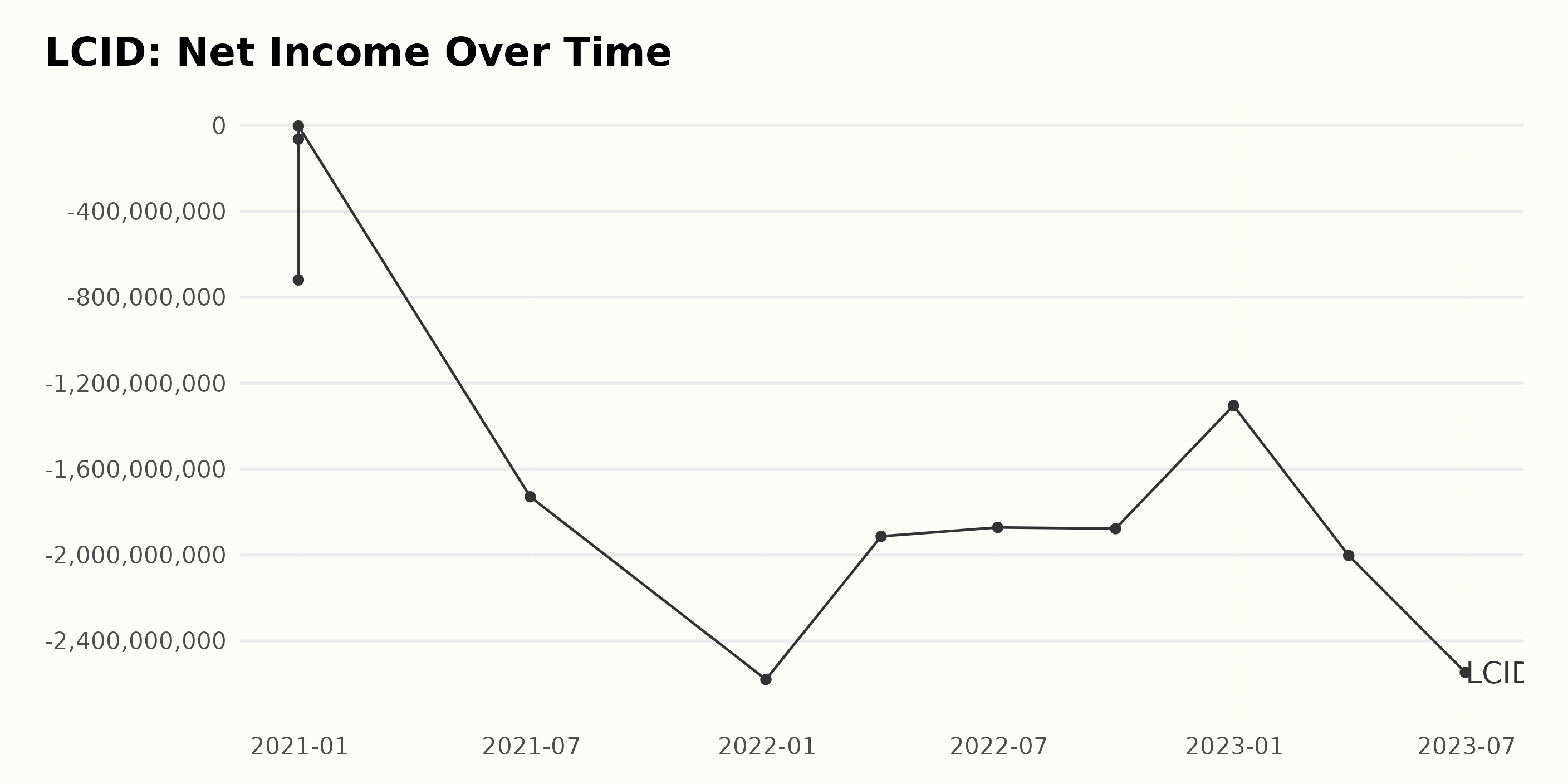

The trailing-12-month net income of LCID has displayed a fluctuating yet overall downward trend over three years based on the provided data series.

- On December 31, 2020, the Net Income was at -$719.38 million.

- By June 30, 2021, the Net Income had significantly fallen to -$1.72 billion.

- This figure further dropped by December 31, 2021, to a low of -$2.57 billion. Starting from 2022, the company's Net Income has become relatively stable while maintaining a loss-driven status.

- The first quarter of 2022 ended with a Net Income of -$1.91 billion.

- Consecutive quarters (end of June and September) presented a minor reduction in losses, however, still remained firm at around -$1.87 billion.

- A notable improvement was observed by the end of the year, December 31, 2022, where the Net Income stood at -$1.3 billion.

Moving into the year 2023, the first half reported escalating negative growth: -

- As of March 31, 2023, the Net Income was -$2 billion.

- As of June 30, 2023, the Net Income further plummeted to -$2.54 billion.

Overall, comparing the last recorded value with the first, the net income saw an increasing negative growth rate. The Net Income deteriorated from -$719.38 million as of December 31, 2020, to -$2.54 billion by June 30, 2023. This marks a need for strategic financial planning and operations' reassessment to steer LCID towards profitability.

The Gross Margin of LCID has shown significant fluctuations across the course of three years, with a considerable shift towards a negative trajectory.

- As of December 31, 2020, the Gross Margin stood at 22.8%.

- A positive shift was observed by June 30, 2021, with a reported Gross Margin of 28.9%. This signifies a growth rate of approximately 26.75%.

- However, by December 31, 2021, a major downturn was recorded in the Gross Margin, falling to -471.3% - indicating a substantial setback.

- The continuation of 2022 brought no relief, with the Gross Margin remaining in negative territory; -374.4% as of March 31, and -281.6% by June 30.

- A slight improvement was seen by September 30, 2022 with a Gross Margin of -213.7%, maintaining the negative trend even though the value improved slightly.

- Wrapping up the year, December 31, 2022, exhibited a somewhat steadier figure of -170.7%.

- Moving into 2023, the first quarter ended at -171.5% (March 31), marginal growth from the previous quarter.

- Unfortunately, the second quarter of 2023 reports a slight decline once more, bringing the Gross Margin to -187.2% (June 30).

To conclude, despite the early growth in 2021, a significant downturn has observed in LCID's Gross Margin since late 2021, resulting in negative gross margins. Most importantly, recent data, particularly the last value (-187.2%), underlines this ongoing negative trend. The overall growth from December 2020 to June 2023 reveals a substantial decrease by approximately 921.93%. Despite fluctuation, no return to positive ground has seen during the given period. However, slight improvements have been observed since hitting the low in 2021, which may foretell gradual recovery or at least slowing down of this negative trend.

The reported Return on Assets (ROA) for LCID reveals a trend of gradual improvement over the assessed period.

- By June 30, 2021, LCID's ROA was at -2.02%, reflecting an unfavorable position.

- Improved returns marked the end of 2021, as ROA strengthened to -1.08% by December 31.

- Further progress was seen in early 2022, registering a ROA of -0.33% by March 31 and a slight enhancement to -0.262% by June 30.

- This upward trend continued into the third quarter, with the ROA marginally bettering to -0.2.56% at the end of September 2022.

- The year ended with a significantly improved ROA of -0.178% on December 31, 2022. However, the first half of 2023 reversed this earlier progress.

- The ROA declined from its improved stance at the end of 2022 to -0.275% by March 31, 2023, before deteriorating further to -0.324% by June 30.

In summary, LCID's overall trend suggests a long-term improvement in ROA, it remained in negative territory.

Looking at the data from November 2021 through October 2023 for the Analyst Price Target of LCID:

- The price target started off at $29 on November 12, 2021.

- There was a substantial increase to $44 within a week by November 19, 2021.

- The highest analysts' price target was observed on December 23, 2021, at $58.13.

- Afterward, the price target generally decreased over the two-year period, with some periods of stability.

- The most stable period was noticed from January through February in 2022 when the price target remained steady at $57.

- By May 20, 2022, there was a notable drop to $38.8.

- The value reached below $30 for the first time on August 12, 2022 ($30) and maintained it till the end of 2022.

- The Analyst Price Target fell below $20 on December 23, 2022 ($18).

- It reached $10 by May 19, 2023, stabilizing around this value until August 11, 2023.

- From then on, the Price Target exhibited further reduction till it stabilized at $7.75 by September 22, 2023.

Calculating the growth rate in this context would result in a negative percentage because the last reported figure is lower than the starting value. Hence, we have a decrease of approximately 73% as the price target dropped from an initial $29 down to $7.75 by the end of the period.

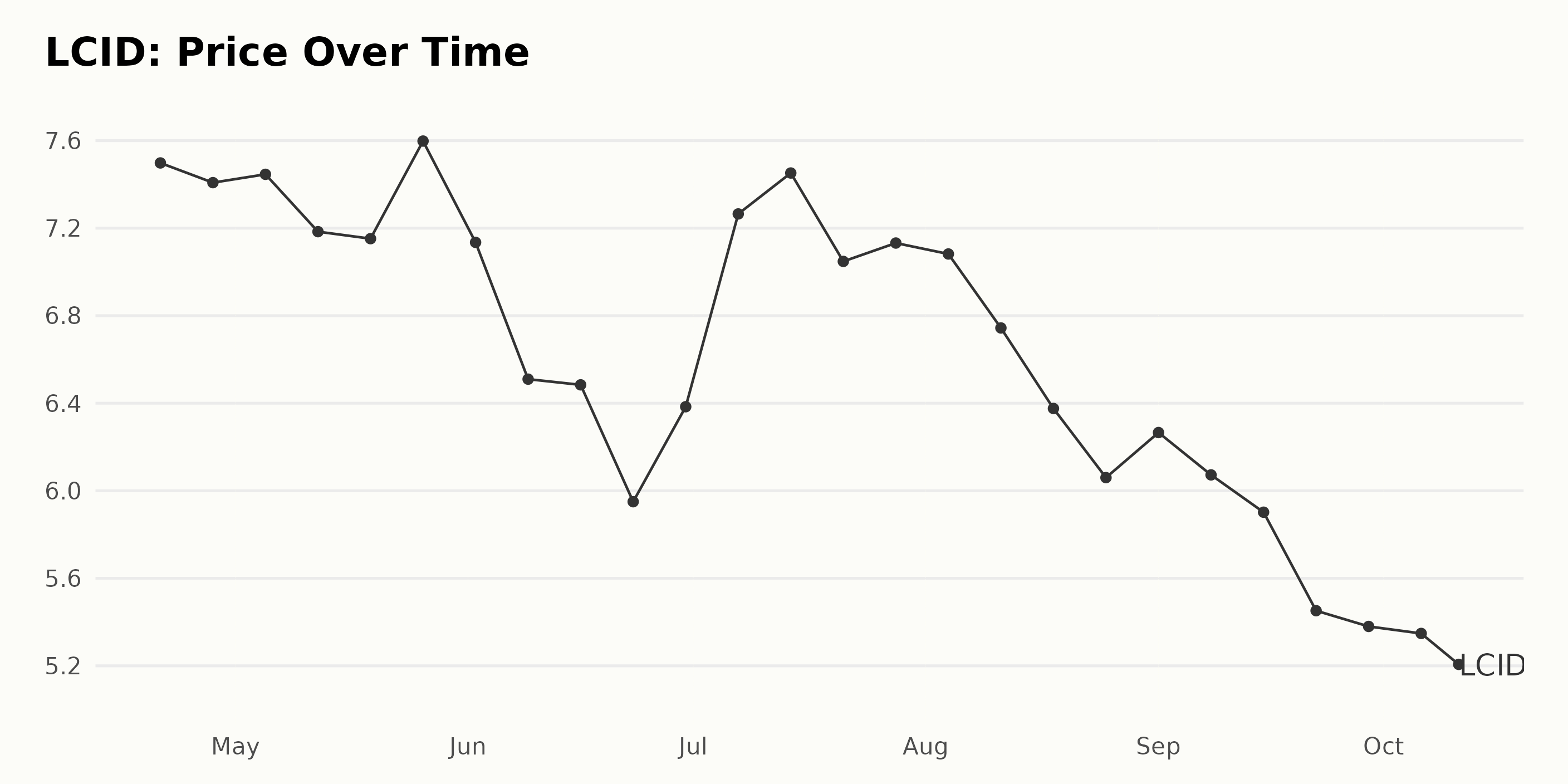

An Overview of LCID's Share Price: A Consistent Downward Trend from April to October 2023

The data for LCID's share price spans from April 21, 2023, to October 11, 2023. Based on the presented data, the share price of LCID exhibits a downward trend over this span.

- On April 21, 2023, the share price starts at $7.50.

- Towards the end-May 2023, the price sees a slight bump, peaking at $7.60 on May 26, 2023.

- The share price then experienced a dip in June 2023, reaching a low of $5.95 by June 23, 2023.

- A slight recovery is observed in July 2023, with the price climbing to $7.45 by July 14, 2023.

- However, it continues to fall through August to September 2023, finally reaching a low point at $5.20 by October 11, 2023.

The average drop in value between consecutive weeks is around $0.074 (rounded to 2 significant digits), which indicates a consistent decline over time. Thus, we can say that LCID's share price has a negative growth rate during this period, and the trend generally shows a tempo of deceleration. Here is a chart of LCID's price over the past 180 days.

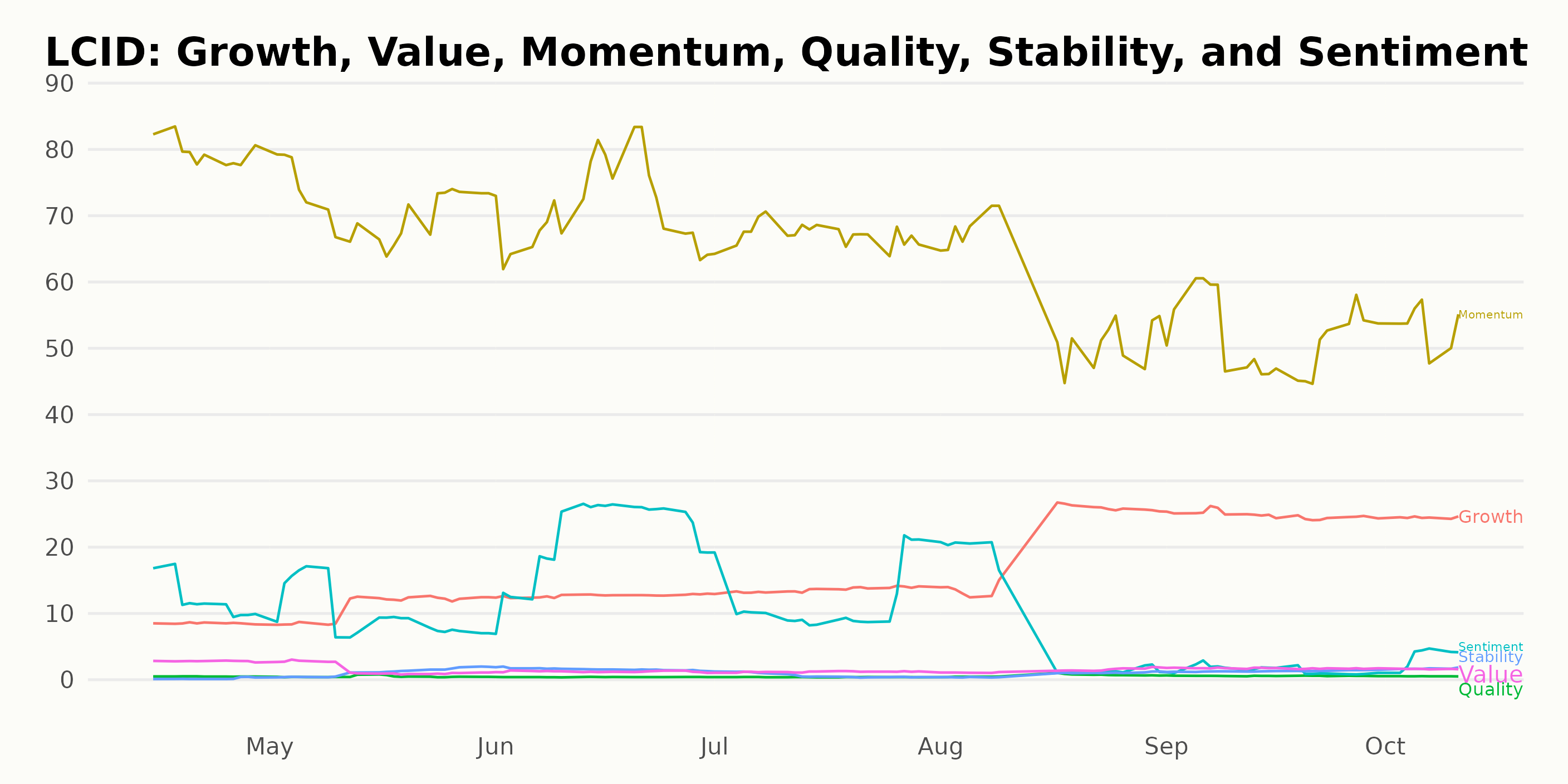

Analyzing LCID's Momentum, Growth, and Sentiment Trends from April to October 2023

LCID has an overall F rating, translating to a Strong Sell in our POWR Ratings system. It belongs to the Auto & Vehicle Manufacturers category.

Below are the three most noteworthy POWR Ratings dimensions for LCID:

- Momentum: This dimension exhibited the highest ratings for LCID. It started with a value of 80 in April 2023, making it the highest-rated aspect then. However, there was a clear downward trend over time, with the value dropping to 53 by October of the same year.

- Growth: Growth showed an interesting upward trend over the same period. In April 2023, the growth value was at 9, but this increased significantly to 24 by October 2023. This indicates a substantial improvement in growth over this timeframe.

- Sentiment: Although not as high as either momentum or growth, sentiment is worth noting due to its fluctuation. It peaked at 22 in June 2023 but saw a large decrease to 1 by September 2023. Afterward, we see a small uptick to 4 by October 2023, showcasing that sentiment fluctuates often within this period.

How does Lucid Group, Inc. (LCID) Stack Up Against its Peers?

Other stocks in the Auto & Vehicle Manufacturers sector that may be worth considering are Fiat Chrysler Automobiles N.V. (FCAU), Stellantis N.V. (STLA), and Honda Motor Company Ltd. (HMC) -- they have better POWR Ratings.

What To Do Next?

43 year investment veteran, Steve Reitmeister, has just released his 2024 market outlook along with trading plan and top 11 picks for the year ahead.

LCID shares were trading at $5.21 per share on Thursday morning, down $0.13 (-2.43%). Year-to-date, LCID has declined -23.72%, versus a 15.10% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics.

Lucid Group (LCID) Stock Watch: Buy or Hold This Week? StockNews.com