Rising interest rates set by the Bank of England can be good news for savers – but only if your bank actually passes on those rising rates to you and your cash. This isn’t always the case, however, so that’s where Plum Interest comes in.

Plum Interest is currently set at a highly-competitive 5.00 percent VAR, as of 20 November 2023, or as much as 5.15 percent VAR for Plum Premium subscribers. Even at the lower rate, a pot of cash created with a £2,000 deposit and topped up by just £175 a month could earn £150 with Plum Interest in a single year, or over £400 by the end of year two, with a total fund value of over £6,600. Capital at risk if you invest. Returns not guaranteed.

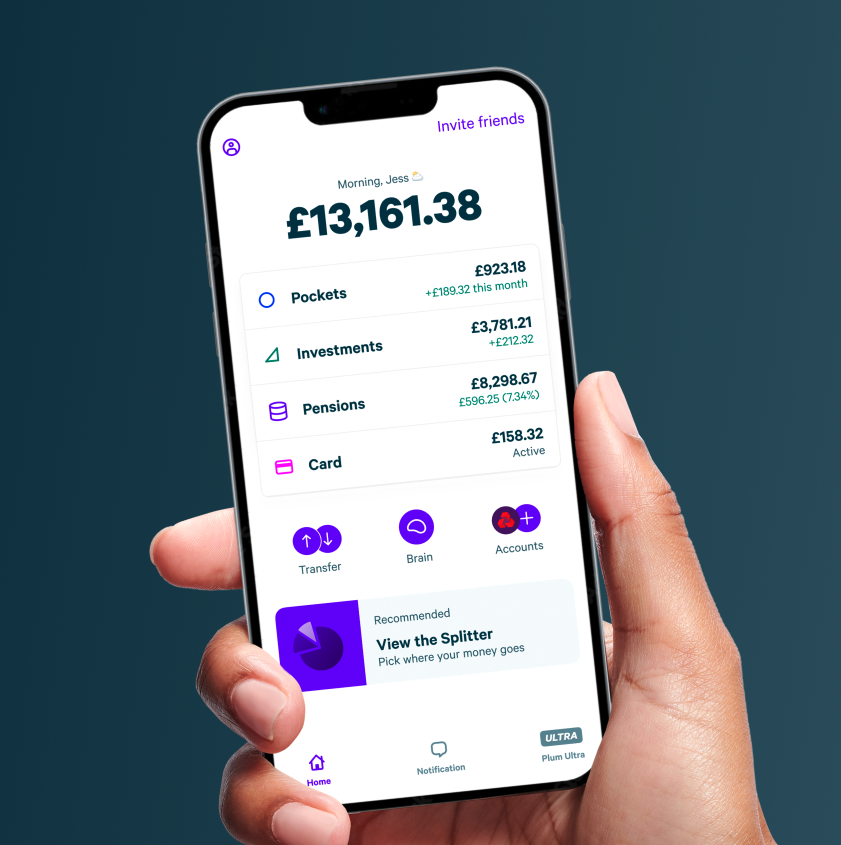

Discover how Plum Interest can help you grow your savings

Smart saving with Plum

Instead of locking a large sum of money away for several years at a time, like some investment products, Plum is an app designed for spenders to tuck away any spare money they have left over at the end of each month. It’s all too easy to roll this money into next month’s budget, or blow it on a treat before your next pay day. But saving and investing even small amounts can quickly yield impressive returns like those outlined above.

See how saving even small amounts can yield impressive returns with Plum.

Earn more with Plum Interest, withplum.com

With the Bank of England hiking the base interest rate to 5.25 percent, with Plum Interest, that same money could be earning 5.00 percent – and that’s after Plum takes its annual fee of 0.25 percent.

A part of the free Plum app, Plum Interest invests in a sterling short-term Money Market Fund (MMF) provided by BlackRock. Instead of buying stocks and shares, investing in money market funds is a way to access a diversified investment portfolio that is professionally managed. Plum says its Plum Interest product only contains high-quality investments, like interest-generating government bonds, and money is only loaned on a short-term basis to reputable companies and governments.

Investing with contfidence, withplum.com

As such, Plum Interest is an investment product. This means past performance is not indicative of future success, returns are not guaranteed and your capital is at risk. Plum is not a bank, but it is regulated by the Financial Conduct Authority and Plum interest products are protected by FSCS. This means your money is safeguarded by a regulated custodian, and if anything happens to Plum or its fund provider, customer assets will be returned. If Plum defaults, the value of your assets is protected by the FSCS up to £85,000.

Designed as a short-term investment product, Plum Interest offers a variable annual rate of 5.00 percent (correct as of 20 November 2023).

Innovative savings plans, withplum.com

To get started with Plum, download the free app and create an account, then connect your bank account – all major UK banks are supported – and set up your own smart rules. This sees the app act like a personal assistant, sending notifications to let you know when money has been saved. For example, you can set a “Naughty Rule” where money is automatically set aside when you spend with one of your chosen naughty retailers, such as a fast-food restaurant.

Other automated-deposit rules include options that put away either an extra penny per day (2p on day two, 3p on day three, etc.) or extra £1 per week (£2 on week two, and so on) for a year. One rule even makes a deposit into your account each day it rains where you live, creating a literal rainy day fund. Plum also uses AI to help work out how much you can save, based on your monthly income and expenses, and new customers can receive £20 cashback too by going through our link.

Get £20 free cashback when you hold £500 in your Plum account for 6 months.*

As well as Plum Interest, the Plum app also lets users invest their spare cash in stocks, funds and SIPPs (self-invested personal pensions). The free Basic tier gives investors access to 1,200 stocks, while the Premium tier (priced at £9.99 a month) unlocks 3,000 stocks and over 20 investment funds. Users of all tiers can consolidate their existing pensions schemes into a Plum SIPP, open up virtual piggy banks known as pockets, and access an easy-access savings pocket provided by Investec Bank Plc. and offering up to 4.21 percent AER.