The Direxion Daily Semiconductor Bear 3X Shares (NYSE:SOXS) was flying higher during Friday's session after gapping up to start Thursday’s trading day and rallying 6.37% off the open.

The semiconductor sector recently suffered a downturn that took shares of Advanced Micro Devices, Inc (NASDAQ:AMD) and NVIDIA Corporation (NASDAQ:NVDA) down about 33% and 35%, respectively, off their mid-August highs.

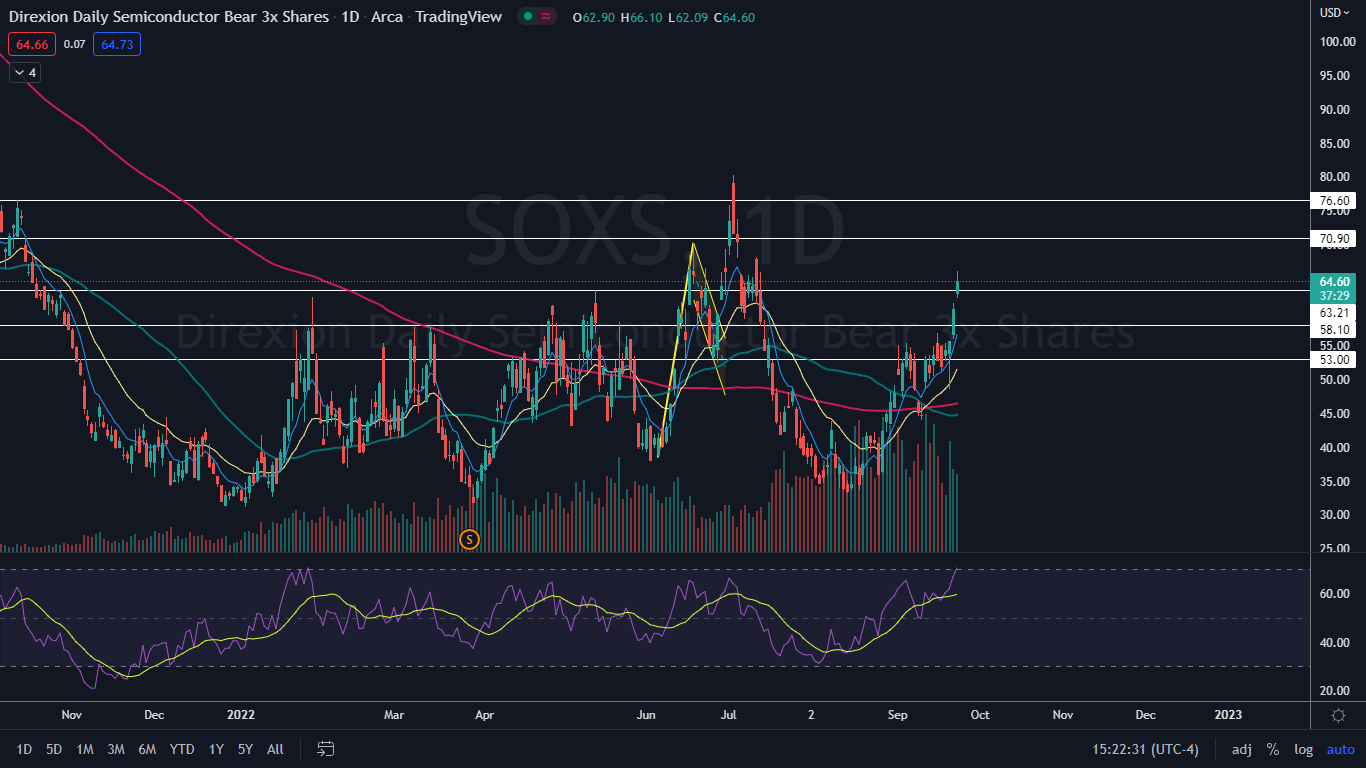

SOXS’s reversed course into an uptrend on Aug. 15 and the ETF has since made a consistent series of higher high and higher lows within the pattern.

On Friday, the upper wick forming on SOXS could indicate the ETF is about to retrace to the downside, which could, in turn, signal a bullish bounce for AMD and Nvidia.

SOXS is a triple leveraged fund that offers 3x daily short leverage to the PHLX Semiconductor Index. The ETF tracks inversely to a number of semiconductor companies through its four holdings, with Goldman Sachs Trust Financial Square Treasury Instruments Fund Institutional and a mutual fund making up 58% of its weighted holdings.

The other two funds making up the remainder of SOXL’s weightings are Dreyfus Government Cash Management Funds Institutional, weighted at 23.28%, and the U.S. dollar, with an 18.33% weighting.

It should be noted that leveraged ETFs are meant to be used as a trading vehicle as opposed to a long-term investment by experienced traders. Leveraged ETFs should never be used by an investor with a buy and hold strategy or those who have low risk appetites.

Want direct analysis? Find me in the BZ Pro lounge! Click here for a free trial.

The SOXS Chart: If SOXS closes the trading day on Friday with a long upper wick, the ETF will print a shooting star candlestick, which could indicate lower prices will come on Monday. The stock market is due for a bounce, but the S&P 500’s strong downtrend indicates a lower high is the most likely scenario, which could provide a solid entry for bearish traders looking to trade SOXS.

- If SOXS reverses to the downside, traders will want to watch for the ETF to print a reversal candlestick above the most recent higher low, which was formed on Wednesday at $48.61. After a retracement, a bullish reversal could be signaled with the formation of a doji or hammer candlestick.

- SOXS is trading above the eight-day and 21-day exponential moving averages (EMAs), with the eight-day EMA trending above the 21-day, which is bullish for the bear ETF and bearish for the market. When SOXS falls lower, the eight-day EMA may act as support and as a pivot point for the ETF.

- SOXS has resistance above at $70.90 and $76.60 and support below at $63.21 and $58.10.