Whales with a lot of money to spend have taken a noticeably bearish stance on PayPal Holdings.

Looking at options history for PayPal Holdings (NASDAQ:PYPL) we detected 11 trades.

If we consider the specifics of each trade, it is accurate to state that 27% of the investors opened trades with bullish expectations and 45% with bearish.

From the overall spotted trades, 2 are puts, for a total amount of $80,100 and 9, calls, for a total amount of $720,345.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $50.0 to $130.0 for PayPal Holdings during the past quarter.

Insights into Volume & Open Interest

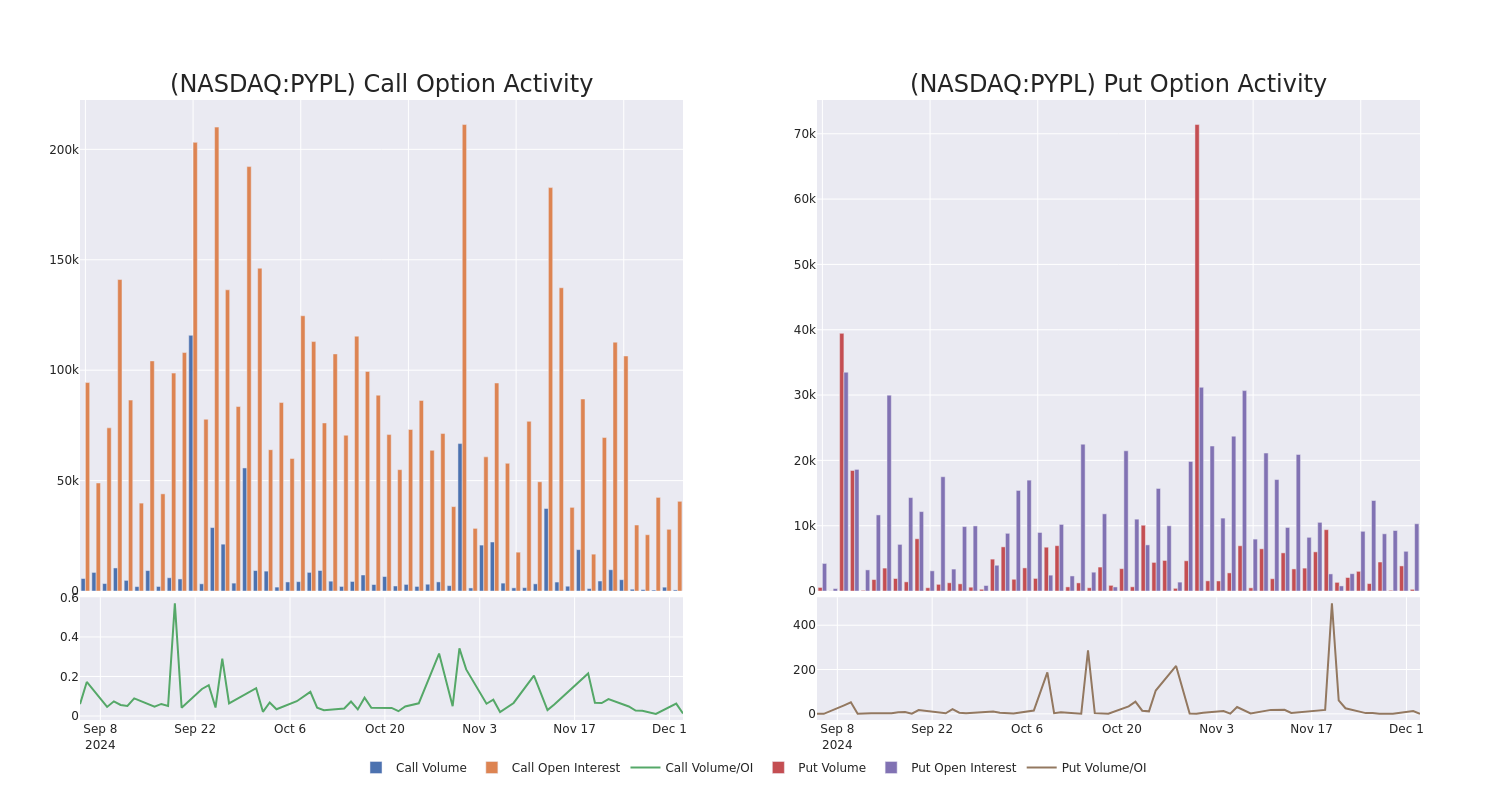

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in PayPal Holdings's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to PayPal Holdings's substantial trades, within a strike price spectrum from $50.0 to $130.0 over the preceding 30 days.

PayPal Holdings Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PYPL | CALL | TRADE | BEARISH | 03/21/25 | $18.0 | $17.75 | $17.75 | $70.00 | $355.0K | 3.2K | 200 |

| PYPL | CALL | TRADE | BEARISH | 01/15/27 | $8.75 | $8.25 | $8.25 | $130.00 | $82.5K | 130 | 105 |

| PYPL | CALL | TRADE | BEARISH | 06/20/25 | $28.8 | $28.3 | $28.4 | $60.00 | $56.8K | 2.3K | 20 |

| PYPL | CALL | SWEEP | NEUTRAL | 02/21/25 | $9.3 | $9.25 | $9.25 | $80.00 | $50.8K | 1.2K | 70 |

| PYPL | CALL | TRADE | BULLISH | 01/16/26 | $24.1 | $23.95 | $24.1 | $70.00 | $48.2K | 3.0K | 25 |

About PayPal Holdings

PayPal was spun off from eBay in 2015 and provides electronic payment solutions to merchants and consumers, with a focus on online transactions. The company had 426 million active accounts at the end of 2023. The company also owns Venmo, a person-to-person payment platform.

PayPal Holdings's Current Market Status

- Currently trading with a volume of 3,815,285, the PYPL's price is down by -0.81%, now at $85.83.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 64 days.

Professional Analyst Ratings for PayPal Holdings

1 market experts have recently issued ratings for this stock, with a consensus target price of $88.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * In a cautious move, an analyst from Piper Sandler downgraded its rating to Neutral, setting a price target of $88.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest PayPal Holdings options trades with real-time alerts from Benzinga Pro.