The Australian share market has slipped with investors awaiting tonight's federal budget, and the Commonwealth Bank says customers are feeling the strain of higher interest rates and the rising cost of living as it delivers a $2.6 billion quarterly profit.

Disclaimer: this blog is not intended as investment advice.

Key events

Live updates

Markets snapshot at 4:30pm AEST

By Sue Lannin

ASX 200: down 0.2% to 7,264

All Ordinaries: down 0.2% to 7,457

Australian dollar: down 0.1 per cent to 67.74 US cents

Nikkei 225: up 1% to 29,243

Shanghai Composite: down 0.8% to 3,368

Dow Jones: down 0.2% to 33,619

S&P 500: flat at 4,138

Nasdaq Composite: up 0.2% to 12,257

FTSE: up 1% to 7,778

DAX: down 0.05% to 15,953

CAC 40: up 0.1% to 7,441

Spot gold: up 0.3% to $US2,026.85 an ounce

Brent crude: down 0.8% to $US76.42 a barrel

Bitcoin: down 0.3% to $US27,475

Goodnight and enjoy the budget!

By Sue Lannin

Thanks for joining me today on the ABC's Markets Blog.

Tune in again tomorrow when we will follow all the market reaction to tonight's federal budget.

You can watch the budget at 7.30pm AEST on ABC TV and the ABC News Channel live stream.

And the Business program will have a budget special at 9:30pm AEST.

In the meantime, check out the ABC's budget blog with my colleagues Bridget Judd, Shiloh Payne and Kate Ainsworth.

High inflation hurting shoppers

By Sue Lannin

We heard earlier from the Bureau of Statistics that Australians are buying less because of the high cost of living.

Australian retail sales volumes fell 0.6 per cent over the first few months of the year.

National Australia Bank also saw consumer spending decline in April according to its transaction data, with the decline driven by services including hospitality, construction, arts, recreation and travel.

NAB chief economist Alan Oster says " the ongoing softness in our transaction data suggests there is some slowing in consumer spending.”

Here's more from my colleague David Taylor for the Drum.

Australian market in the red ahead of budget

By Sue Lannin

The Australian share market has ended slightly lower on budget day.

The federal government will hand down the budget for 2023 in a little over three hours time.

The ASX 200 index fell 0.2 per cent to 7,264, with nearly all sectors in the red, except the financial index, which eked out a small gain.

The Commonwealth Bank (+0.2 per cent) recouped a 1 per cent early loss after delivering a rise in quarterly profit, but warning of a rise in loan losses because of higher interest rates.

And the Australian dollar (-0.15 per cent) slipped to 67.72 US cents after weak Chinese trade data.

It rose above 68 US cents overnight to a three week high.

Chinese imports contracted sharply in April, while exports also slowed.

Inbound shipments fell 7.9 per cent over the year, while exports rose 8.5 per cent, easing back from a nearly 15 per cent annual surge in March.

Teals say gas tax increase is 'timid'

By Sue Lannin

The Federal Government will outline plans to raise oil and gas taxes in tonight's budget, but the "teal independents" on the cross bench and the Greens say the changes don't go far enough.

Treasurer Jim Chalmers says the Petroleum Resource Rent Tax will be increased to bring in an extra $2.4 billion over the next four years.

But the government needs the support of Parliament to pass the changes.

Independent MP Sophie Scamps wants the tax to be redesigned to raise more money from fossil fuel giants.

"The government's timid changes to our PRRT means that Australians will be continued to be duded when it comes to the sale of our offshore resources and we've got to remember that these resources belong to all Australians and at the moment we are just not benefiting as we should be," she said.

The PRRT is a 40 per cent tax on the income from offshore projects and has long been criticised for not raising enough money from energy giants.

That's because the costs can be deducted and used as tax credits to reduce income tax.

Projects that come under the PRRT are not charged royalties or excise.

The changes mean that rather than allowing companies to fully deduct their project costs against income, deductions will be capped at 90 per cent.

The oil and gas industry has welcomed the planned changes saying that they already pay their fair share of tax.

Lobby group, the Australian Petroleum Production & Exploration Association, says the changes get the balance right "between the undeniable need for a strong gas sector to support reliable electricity and domestic manufacturing for decades to come and the need for a more sustainable national budget".

"PRRT revenues are already at their highest level ever, forecast to deliver revenue of more than $11 billion over the forward estimates," APPEA chief executive Samantha McCulloch said.

However, multinational tax expert, Jason Ward, from the Centre for International Corporate Tax Accountability and Research, told me on ABC News Channel that the PRRT needs to be higher.

Markets snapshot at 2:30pm AEST

By Sue Lannin

ASX 200: down 0.25% to 7,259

All Ordinaries: down 0.25% to 7,453

Australian dollar: steady at 67.85 US cents

Nikkei 225: up 1% to 29,232

Shanghai Composite: up 0.4% to 3,408

Dow Jones: down 0.2% to 33,619

S&P 500: flat at 4,138

Nasdaq Composite: up 0.2% to 12,257

FTSE: up 1% to 7,778

DAX: down 0.05% to 15,953

CAC 40: up 0.1% to 7,441

Spot gold: up 0.1% to $US2,023.36 an ounce

Brent crude: down 0.4% to $US76.70 a barrel

Bitcoin: up 0.3% to $US27,631

Household spending falls

By Sue Lannin

The Commonwealth Bank's Household Spending Intentions survey fell 4.3 per cent in April, but that was partly because of fewer trading days because of the Easter and Anzac Day holidays.

The CBA says the index was led lower by reduced spending in home buying, health and fitness, transport, and household services.

Higher energy bills saw spending on utilities continue to climb, up by 7 per cent from April last year, the fastest since 2018.

CBA chief economist Stephen Halmarick says household spending is being hit by the higher cost of borrowing, with annual spending rates edging down.

"With the RBA increasing interest rates again in early May to 3.85 per cent we consider monetary policy to be highly restrictive," Mr Halmarick said.

"We continue to expect the lagged effect of higher interest rates to see household spending weaken as the year progresses."

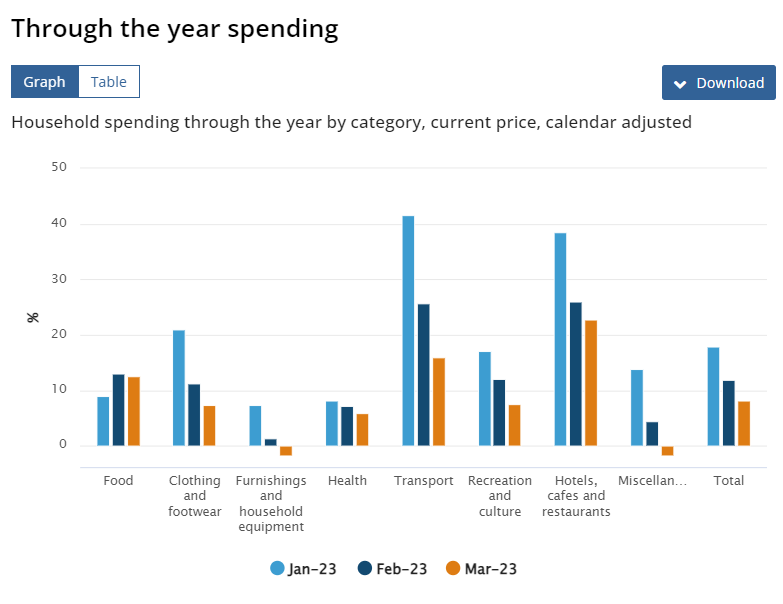

Household spending growth slows

By Sue Lannin

The higher cost of living is hurting hip pockets.

The Bureau of Statistics says consumers are cutting back, with the annual pace of household spending slowing down.

Household spending rose 8.2 per cent over the year to March with spending increasing for both goods and services.

It rose by nearly 12 per cent in February from a year ago, which was the weakest annual growth since March last year.

The March increase was driven by spending on hotels, cafes and restaurants, which saw a 23 per cent increase in spending, and a 16 per cent rise in transport costs.

ABS head of business indicators Robert Ewing said inflation was making prices more expensive and therefore increasing spending.

"Rising prices are contributing to this growth," he said.

"Services price inflation rose 6.1 per cent - it's largest rise since 2001 - and goods price inflation rose 7.6 per cent (over the year to March)."

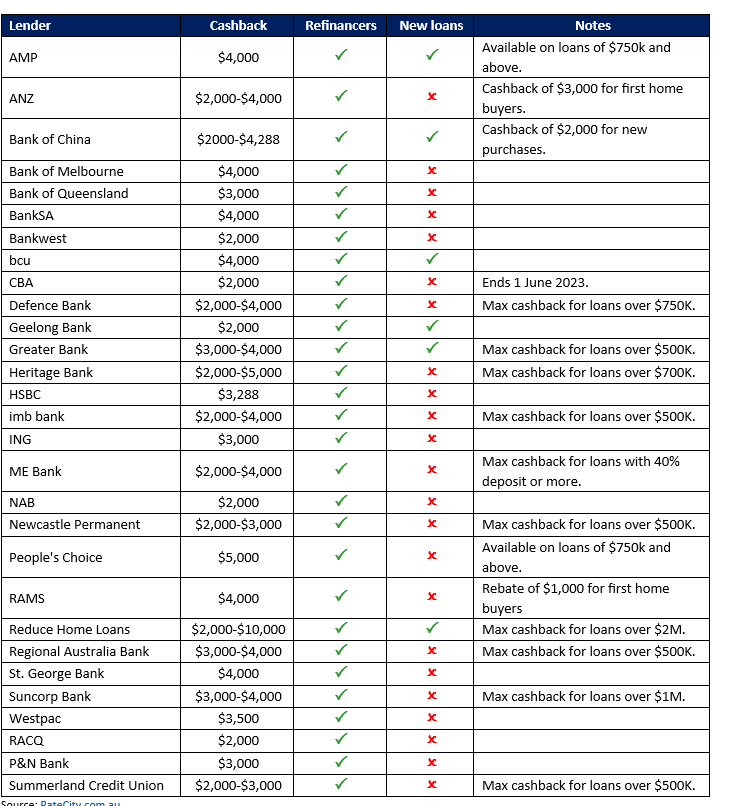

CBA ends cashbacks for mortgage customers

By Sue Lannin

In a sign of the profit margin pressure from fierce competition among the big banks for mortgage borrowers, the Commonwealth Bank will stop offering $2000 cashbacks to new home loan customers.

The other big banks have also been offering thousands of dollars in cashbacks to new mortgage borrowers, including those who are switching lenders for a better deal (refinancing).

But the banks are starting to cut back on the deals with the CBA ceasing its offer from June 1.

In addition, RateCity says over the past couple of months, CBA and the other big banks have been reducing discounts for new mortgage customers, including raising rates above Reserve Bank increases.

"Cashback deals have become a hot potato for the banks, with CBA the first of the big four to drop them this year," said RateCity research director Sally Tindall.

"The big banks have been at the centre of the refinancing storm over the last 12 months, throwing down competitive new customer discounts and cold hard cash to tempt borrowers to switch."

"Now they are looking to take shelter from it."

"The other big banks could well fold on their cashback deals in coming months, but if they're looking for growth, they've just been handed a reason to keep these deals on the table."

Qantas outsourcing battle before High Court

By Sue Lannin

A battle between Qantas and the Transport Workers Union is being played out in the High Court in Canberra today over the outsourcing of 1700 ground staff.

Qantas is appealing a ruling that found outsourcing ground crew jobs during the pandemic was illegal.

The Federal Court has twice ruled in favour of the Transport Workers Union, who say the outsourcing decision breached the Fair Work Act.

Qantas has told the High Court that it gave the union and workers the chance to come up with an alternative plan, but their proposed savings were dwarfed by the $100 million that outsourcing would achieve.

The airline also said its decision was made at a time where workers had "less muscle" for industrial action because they weren't working.

The Transport Workers Union told reporters today that half of the 1700 ground staff sacked by Qantas in 2020 are yet to find meaningful work, while a third are suffering mental distress.

TWU national secretary, Michael Kaine, says Qantas should be compensating workers, instead of "spending eye watering amounts in legal warfare."

"The Transport Workers Union, and we understand the Minister for Industrial Relations, will ask the court to dismiss the case."

"In essence, we'll be saying that the Fair Work Act is designed to protect workers, allow them to exercise their workplace rights, not give companies like Qantas open slather to sack workers."

Here's the background from High Court reporter Elizabeth Byrne.

NT forecasts budget surplus by 2026

By Sue Lannin

The Northern Territory treasurer Eva Lawler has handed down the 2023 budget, predicting the territory will be back in surplus by the 2026-27 financial year.

Spending on infrastructure is the big ticket item, with a record $2.1 billion spend next financial year, mainly on transport.

The budget doesn't factor in potential revenue from big projects like fracking, which have not been given the green light.

However, the forecast surplus relies on major projects going ahead, in particular, Santos' controversial Barossa gas project in the Timor Sea, which is being challenged by traditional owners.

Here's more from the ABC's Matt Garrick.

Markets snapshot at 12:30pm AEST

By Sue Lannin

ASX 200: down 0.3% to 7,253

All Ordinaries: down 0.3% to 7,447

Australian dollar: steady at 67.81 US cents

Nikkei 225: up 0.8% to 29,168

Dow Jones: down 0.2% to 33,619

S&P 500: flat at 4,138

Nasdaq Composite: up 0.2% to 12,257

FTSE: up 1% to 7,778

DAX: down 0.05% to 15,953

CAC 40: up 0.1% to 7,441

Spot gold: up 0.1% to $US2,023.36 an ounce

Brent crude: down 0.4% to $US76.70 a barrel

Bitcoin: up 0.3% to $US27,641

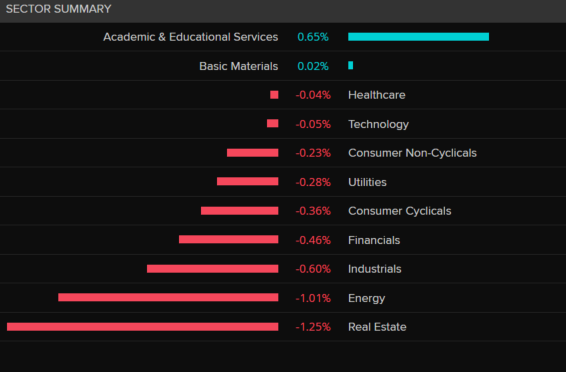

Market in the red over lunchtime

By Sue Lannin

It's a quiet day on the markets ahead of tonight's federal budget.

The ASX 200 index is down one quarter of a percentage point to 7,259 with nearly all sectors in the red.

Financial stocks have recovered lost ground with the financials index slightly higher.

The Commonwealth Bank -0.15 per cent) has come off its early lows after reporting a rise in quarterly profit, but warning of tougher times ahead because higher interest rates.

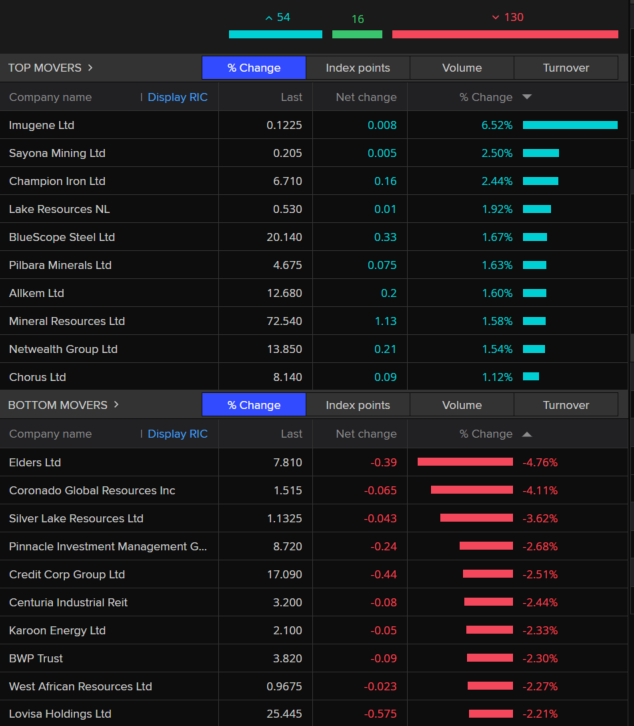

Biotech Imugene (+6.5 per cent) is the best performer, while gold miner Silver Lake Resources (-4.7 per cent) is the worst performer on the ASX 200 index.

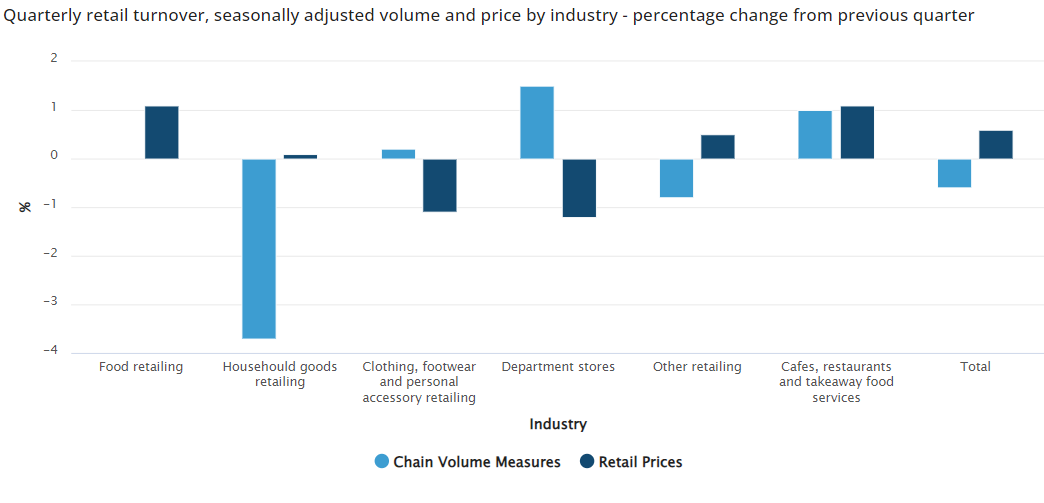

Retail sales volumes fall over March quarter

By Sue Lannin

There's more signs of the strain that higher interest rates are putting on households, with people buying less but paying higher prices.

The latest quarterly data from the Australian Bureau of Statistics shows that retail sales volumes fell 0.6 per cent over the first few months of the year to $96.17 billion, following a 0.3 per cent fall over the December quarter.

ABS head of retail statistics Ben Dorber says retail sales volumes dropped as the higher cost of living pressures weighed on household spending.

“Outside of the COVID-19 pandemic period, this is the largest fall in retail sales volumes since the September quarter 2009,” Mr Dorber said.

"Retail prices rose for the sixth straight quarter, but price growth this quarter is the smallest since September 2021."

That was because of discounts on clothing and large household items like furniture and electronic goods.

Food prices went up, and sales at cafes, restaurants, and takeaway food services rose, boosted by the return of cultural and sporting events.

The 'drover's dog' and the budget surplus

By Sue Lannin

If you think those comments from shadow treasurer Angus Taylor that a "drover's dog" could have delivered a budget surplus this year sound familiar, you would be right.

They were used by then opposition leader Bill Hayden during a Labor Party leadership spill in February 1983.

Mr Hayden resigned as party leader and then shadow industrial relations minister Bob Hawke was elected as leader.

Afterwards Mr Hayden said "a drover's dog could lead the Labor Party to victory, the way the country is."

The Labor party won the election and Mr Hawke became prime minister.

So Mr Taylor's inspiration comes from the Labor Party!

Here's more on the budget and the "drover's dog" from senior business correspondent Peter Ryan.

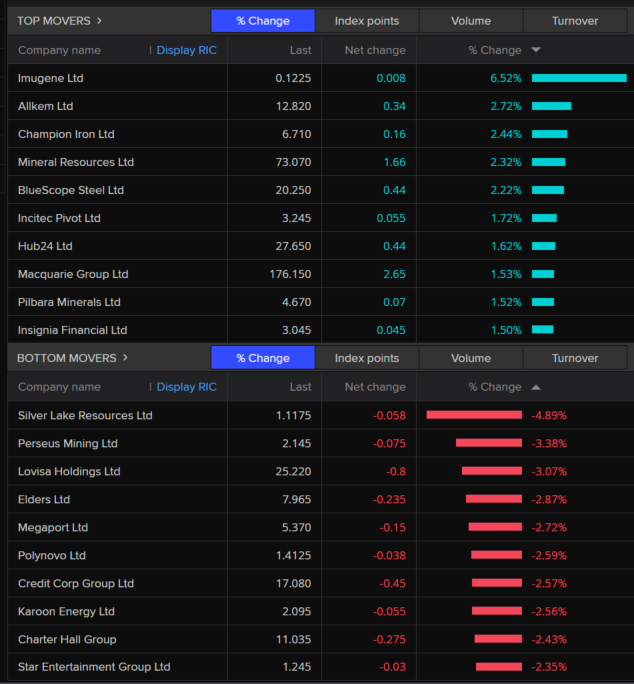

ASX movers and shakers

By Sue Lannin

Here are the sectors and companies moving the ASX 200 this morning as investors await tonight's federal budget.

Most industry sectors are in the red with the falls led by real estate, energy and industrial firms.

The Commonwealth Bank has lost 0.7 per cent after delivering a better than expected quarterly net profit of $2.6 billion as the chief executive Matt Comyn warned that "many of our customers are feeling the strain of higher interest rates and the rising cost of living."

Biotech Imugene (+4.4 per cent) is the best performer in the ASX 200, while farm business Elders (-4.6 per cent) is the worst performer.

Telstra outage fixed

By Sue Lannin

Telstra says the problems facing millions of customers trying to make mobile phone calls has now been fixed.

Most people affected were in New South Wales and Queensland but triple zero calls and mobile data weren't impacted.

The outage began late last night and Telstra has apologised to customers for any inconvenience.

Markets snapshot at 11:30am AEST

By Sue Lannin

ASX 200: down 0.26% to 7,258

All Ordinaries: down 0.3% to 7,452

Australian dollar: down 0.03% at 67.80 US cents

Dow Jones: down 0.2% to 33,619

S&P 500: flat at 4,138

Nasdaq Composite: up 0.2% to 12,257

FTSE: up 1% to 7,778

DAX: down 0.05% to 15,953

CAC 40: up 0.1% to 7,441

Spot gold: up 0.1% to $US2,023.36 an ounce

Brent crude: down 0.4% to $US76.70 a barrel

Bitcoin: up 0.3% to $US27,641

Telstra mobile phone outage

By Sue Lannin

If you are a Telstra customer you may be facing some problems this morning making mobile phone calls, particularly in New South Wales and Queensland.

Telstra says it's working urgently to fix the problems.

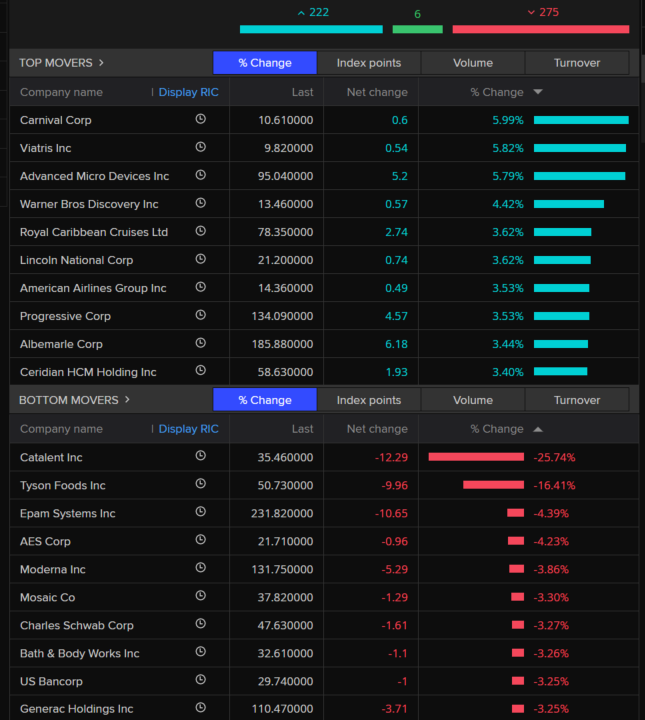

S&P 500 movers and shakers

By Sue Lannin

Here's what happened on the S&P 500 overnight, which ended flat overnight at 4,138.

Pharmaceutical firm Catalent (-25.7 per cent) and Tyson Foods (-16.4 per cent) weighed on the benchmark index.

But consumer staples, technology, financial and energy firms limited the losses.