The Australian share market has closed lower, led by losses in resources and basic materials, in the wake of fertiliser and explosive chemicals manufacturer Incitec Pivot's profit falling 7.9 per cent on last year.

It followed the latest wages data for the March quarter, which showed only a marginal increase to Australian pay packets as inflation sits at 7 per cent.

Look back on the day's financial news as it happened with our blog.

Disclaimer: this blog is not intended as investment advice.

Key events

Live updates

Here's how the market ended as of 4:15pm AEST

By Kate Ainsworth

- ASX 200 : -0.5% to 7,199 points

- All Ords: -0.5% to 7,389 points

- Australian dollar: -0.3% at 66.37 US cents

- On Wall Street: Dow -1%, S&P 500 -0.6%, Nasdaq +0.1%

- In Europe: FTSE 100 -0.3%, Stoxx 50 flat

- Spot gold: flat at $US1,987.79/ounce

- Brent crude: -0.7% at $US74.38/barrel

- Iron ore: -0.6% $US104.40 a tonne

- Bitcoin: flat at $US26,986.68

ASX finishes lower, led by losses in resources

By Kate Ainsworth

The ASX has finished its Wednesday trade lower, down 0.5% to 7,199 points.

Only two sectors gained territory during trade, with technology and utilities sectors up 0.5% each, while energy stocks finished flat.

Basic materials and resources were the biggest losers for the day, down 0.8%, while financials finished lower at 0.6%.

The top five performers for the day were:

- Life360 +5.7%

- Lake Resources +5.3%

- Domain Holdings +2.6%

- United Malt Group +2.1%

- AGL Energy +1.9%

At the other end, Incitec Pivot remained the worst performer, down -8%. Other losses went to:

- Core Lithium -5.4%

- Sandfire Resources -4.9%

- Imugene -4.2%

- Sayona Mining -3.3%

Overall, it was a fairly flat day of trading, with today's wage price data from the ABS also not really having a major impact on markets.

But that might all change tomorrow when unemployment figures are released at 11:30 — and regardless, we'll be back blogging all the developments bright and early.

You can look back on Wednesday's developments below, or download the ABC News app and subscribe to our range of news alerts for the latest news.

The US debt ceiling crisis could 'be like 2008 again' — here's why

By Kate Ainsworth

If you're not completely up-to-date on the US debt ceiling crisis, don't worry — I've got you covered.

Even if you're well-versed in the debt ceiling (you are on a business and markets blog, after all), it's back in the headlines after US President Joe Biden postponed his trip to Australia and Papua New Guinea so he could return after the G7 meeting in Japan to continue negotiations.

So what's the current state of play with the debt ceiling, and what could it mean for us here in Australia?

Here's something I pulled together to help us make sense of it all:

'We want the very best people' on the RBA board, Shadow Treasurer says

By Kate Ainsworth

Shadow Treasurer Angus Taylor was speaking at the National Press Club earlier this afternoon, and was asked about who he would like to see replace RBA governor Philip Lowe, after his tenure ends in September.

He wouldn't say who he wanted to potentially replace Mr Lowe, but says the "very best people" need to be on the board.

Here's the full exchange:

Q: September this year is when Dr Philip Lowe's tenure as RBA governor ends. And the government consulted you extensively — well, consulted you on the RBA Review, and they usually run it past the Opposition when they appoint a new governor. Who would you like to see take the job?

Angus Taylor: They consult. They do not necessarily ask for advice. I have appreciated the collaborative and bipartisan approach to the review. I think it has been important.

The RBA, whilst it is clear it has made errors in the recent past, people have paid a high price for those errors, a high price, I also think it is an incredibly important institution in our country. It did help to slay those inflation demons of the 1970s and 80s I talked about earlier.

The worst thing we could do now is undermine it. That is why I am always so cautious about criticising decisions. They are decisions by an independent Reserve Bank, and we want the very best people available to be making those decisions on the Reserve Bank Board and the monetary policy board if we get to that.

I will not make any commentary on who should be in what position, but I will say we want the very best.

Former ACCC chair 'shocked but not surprised' at PwC crisis

By Kate Ainsworth

Former chairman of the ACCC, Allan Fels, says he's "shocked but not surprised" at the tax leak scandal that's engulfing PwC.

He says the scandal reignites the debate over whether auditing and advisory arms at the Big Four consulting firms needs to be separated.

It comes as Labor Senator Deborah O'Neill says criminal penalties should be considered in the wake of the crisis.

You can listen to the latest from senior business correspondent Peter Ryan below.

Eyes on the RBA in three weeks

By Gareth Hutchens

Our colleagues Michael Janda and Rhiana Whitson have put this story together on the wage price index.

It covers the bases nicely and points towards next month's RBA board meeting.

Public sector wages

By Gareth Hutchens

The Australian Public Service Commission have just made an APS wide pay offer of 4% +3% +3%, which sounds ok compared to 3.7%. But if more recent wage increases in the private sector are between 4-6%, is this actually a low ball offer when you look across the economy and consider CPI increases?

- Tess

It was a combined offer of 10.5% over three years (compared with forecast inflation of 12 per cent across that period).

Workers had lodged a claim for a 20% wage increase over three years, so the offer is well below that.

The workers have until May 30 to accept or reject the offer.

WATCH: Companies forced to share gender pay gap data

By Kate Ainsworth

From early next year, companies with more than 100 workers will have to publish detailed reports on what pay men and women receive for the same work.

My colleague, business reporter Daniel Ziffer took a look at the laws that will see companies held to account on narrowing the gender pay gap:

Here's what the market looks like at 1pm AEST

By Kate Ainsworth

- ASX 200 : -0.5% to 7,199 points

- All Ords: -0.4% to 7,391 points

- Australian dollar: +0.2% at 66.67 US cents

- On Wall Street: Dow -1%, S&P 500 -0.6%, Nasdaq +0.1%

- In Europe: FTSE 100 -0.3%, Stoxx 50 flat

- Spot gold: +0.2% at $US1,992.32/ounce

- Brent crude: +0.2% at $US75.07/barrel

- Iron ore: -0.6% $US104.40 a tonne

- Bitcoin: +0.4% at $US27,049.49

The reality of the deterioration in real wages

By Gareth Hutchens

Callam Pickering is a former RBA economist who's now a senior economist at Indeed Hiring Lab (a labour market research outfit).

Here's what he said in his note today. It's worth quoting at length:

"Australian wages rose by 0.8% in the March quarter - falling short of market expectations - to be 3.7% higher than a year ago.

"While Australian wages are growing at their fastest annual pace in a decade, the reality is that the purchasing power of Australian incomes has crashed.

“The disconnect between wage growth and inflation is devastating for households across the country, with cost-of-living pressures easily outstripping wage gains.

“Adjusted for inflation, Australian wages have fallen by 3.2% over the past year and by 7.2% since their peak.

"More than a decade of hard-won wage gains - our blood, sweat and tears - lost over the course of just one year.

"Unless you’ve received a promotion or changed employer recently, there is a good chance that your salary buys a lot less now than it did a year ago.”

“While public sector wages rose by 0.9% in the March quarter, compared to an 0.8% gain for the private sector, wage pressures continue to be strongest across the private sector. The reason why public sector wages grew more in the March quarter was due to a higher than normal share of public sector jobs receiving a pay rise rather than that pay rise itself being particularly large.”

“Overall the public sector has been a bit of a drag on the overall wage recovery and that appears likely to continue in the near-term.”

“While forward-looking measures of labour demand have moderated a little recently, with job vacancies falling from their peak, ongoing skill shortages could contribute to stronger wage growth over the remainder of the year.

"This could be partly offset by high immigration which is slowly addressing some of these existing talent shortages.”

Implications for monetary policy

“While quarterly wage growth did fall short of market expectations, they appear to be in line with the latest forecasts from the RBA’s Statement on Monetary Policy.

"The RBA anticipates that further rate hikes might be necessary to reduce the current inflation outbreak and there is nothing in these wage figures that contradicts that assessment.

“The RBA is concerned about the stickiness of inflation, particularly in the service sector. Domestic sources of inflation appear to be holding up, even as foreign sources of inflation start to subside. Consequently, in the near-term it appears more likely than not that the RBA will hike rates again by mid-year.”

“Nevertheless, we anticipate that the Australian economy will slow considerably over the second half of the year. This is centered on the belief that household conditions will deteriorate due to the combination of much higher mortgage repayments, softish asset prices and the unprecedented decline in inflation-adjusted wages.

"This is a recipe for an economic slowdown if ever I’ve seen one.”

Here's also put together this graph on Twitter, which adjusts the WPI for inflation:

Another rate hike coming?

By Gareth Hutchens

Is +0.8% enough WPI for RBA to hike rates next month (all other factors considered) ?

- VB

Reading the notes of economists that are coming through, it doesn't look like these wage figures will twist the RBA's arm either way.

Wage growth has come in slightly lower than expected, but that's it. The RBA board might still want to lift rates from here, but these data won't be pressuring them to.

How nominal wages compare to inflation

By Gareth Hutchens

Hi Gareth, how does the increase in wages compare to the era when inflation was in the RBA target range? Are wages generally below inflation?

- Bill

Hi Bill, I've put this graph together so you can visualise it.

The numbers are in original terms (so slightly different to seasonally adjusted numbers), and they only go back to 1998.

But it's pretty close. The RBA only started officially targeting inflation in 1993.

You can see how much higher inflation is running above nominal wages at the moment, which explains why the "real" value of workers wages is deteriorating.

They've been deteriorating for a while now.

The WPI measures the cost of a "fixed basket of labour"

By Gareth Hutchens

Here's how to think about the Wage Price Index (WPI).

It's conceptually similar to the Consumer Price Index (CPI).

The CPI is a measure of the average change, over time, in the prices paid by households for a fixed "basket of goods" - so it measures inflation in the prices paid by households for consumer goods.

The WPI works similarly, but it's for employers.

It measures the average change, over time, in the prices paid by employers for a fixed "basket of labour" - so it measures inflation in the prices paid by employers for worker's labour (with wages and salaries).

What do you want to know about the wages data?

By Kate Ainsworth

Wondering what today's wages data means for you, inflation, or the RBA's thinking ahead of next month's interest rate decision?

You're in luck — my colleague and all-round superstar, business reporter Gareth Hutchens is here to answer your burning questions!

Use the big blue button up top to ask, and Gareth will answer them shortly.

Pay packets have increased slightly, ABS wage data shows

By Kate Ainsworth

The official Wage Price Index from the Bureau of Statistics shows pay packets lifted 0.8% in the March quarter and 3.7% over the year to March.

Economists had generally expected wages to lift 0.9 per cent in the quarter and 3.6 per cent over the year.

The wage data is a key economic indicator used by the Reserve Bank ahead of its interest rate decision next month.

Here's how the market looks as of 10:55am AEST

By Kate Ainsworth

- ASX 200 : -0.9% to 7,170 points

- All Ords: -0.9% to 7,360 points

- Australian dollar: flat at 66.50 US cents

- On Wall Street: Dow -1%, S&P 500 -0.6%, Nasdaq +0.1%

- In Europe: FTSE 100 -0.3%, Stoxx 50 flat

- Spot gold: +0.1% at $US1,991.49/ounce

- Brent crude: -0.4% at $US74.64/barrel

- Iron ore: -0.6% $US104.40 a tonne

- Bitcoin: +0.6% at $US27,113

ASX opens lower as Incitec Pivot falls after posting lower profit

By Kate Ainsworth

As expected, the Australian share market has followed in Wall Street's footsteps and opened lower.

It's down -0.9% as of 10:45am, with all sectors in the red (with the exception of technology and utilities).

Incitec Pivot has shed the most value so far this morning, thanks to posting lower profit of $353.6 million

Its profit is down 7.9% compared to this time last year.

The top movers so far (although they are subdued) in the early half include:

- Life360 +2.16%

- Xero +1.7%

- REA Group +1.5%

- Virgin Money UK +1.45

- James Hardie Industries +1.4%

At the other end, the losses are a tad more dramatic:

- Incitec Pivot -6.1%

- Paladin Energy -3.8%

- Sayona Mining -3.3%

- Perseus Mining -3.1%

- Regis Resources -2.8%

Research into '4 day week' companies shows big improvements in absenteeism, sick days, retention

By Daniel Ziffer

A pilot project of the radically reducing hours and getting employees to work a 4-day week has shown promising results.

4 Day Week Global, a group that advocates for the concept, has released research of Australian companies that have taken it up.

It shows benefits to "health and wellbeing, productivity, gender equity" and the environment (largely from reducing commuting).

The idea isn't to squeeze the standard 38 or 40-hour week into four long days, but reducing hours and having employees work just four day across the week.

Businesses including an accounting firm, an engineering consultancy, a community mental health service, a property management company and a marketing agency took party.

Most (41%) had different days off, to keep the doors open.

Over 36% had Fridays (or mostly Fridays) off, 9% had Mondays or Fridays off, 9% had Wednesdays (or mostly Wednesdays) off, and 5% had Wednesdays or Fridays off.

People stay longer, healthier

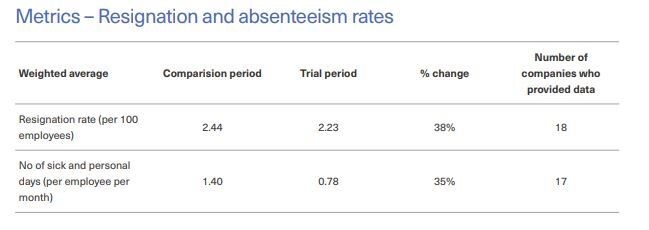

The firms found absenteeism - the number of sick and personal days per employee per month - dropped by 35% (from 1.40 to 0.78) for the trial period.

The resignation rate fell 38% (from 2.44 per 100 employees to 2.23)

Bosses happier too

On a scale of 1 to 10, companies rated the impact of the trial at 8.2/10, with improvements to productivity, recruitment and performance.

Of the 20 companies examined, 95% were maintaining the trial into the future.

Chinese economy not really helping global demand

By Michael Janda

Some analysis of China's industrial output and fixed asset investment data, which was out yesterday arvo, from CBA's commodity analyst Vivek Dhar.

This data is important because China is the biggest customer for a lot of Australia's commodities, notably of course iron ore.

Most of that goes into making steel for infrastructure and apartments, and the news on that front is mixed.

Infrastructure, supported by the government, seems to be solid:

"China's Fixed Asset Investment (FAI) lifted 4.7%/yr in the first four months of 2023, well below forecasts of 5.7%/yr," noted Mr Dhar.

"A further breakdown of China's FAI showed that infrastructure investment still remained strong. Infrastructure investment increased 8.5%/yr in the first four months of 2023. Policy support for infrastructure investment looks like the main pathway that authorities will choose to help China's economy."

But the private sector of the Chinese economy, notably the property sector, is looking very weak:

"The contraction in China's property investment accelerated further in April, highlighting ongoing challenges facing China's property sector. The indicator most aligned with commodity demand (particularly steel consumption) – floor space of newly constructed houses (in square metres) – fell ~28%/yr in April. China's floor space of newly constructed houses has declined ~21%/yr in the first four months of 2023 after plunging ~39%/yr in 2022," Mr Dhar observed.

"However, industrial output likely best demonstrated the pressure faced by China's commodity intensive economy last month. China's industrial output rose by 5.6%/yr in April, up from a 3.9%/yr increase in March, but well below forecasts of 10.9%/yr. The strong market expectation for industrial output growth reflected the adverse economic impact of the Shanghai's strict COVID 19 lockdown in April 2022. In seasonally adjusted terms, China's industrial output fell by 0.47%/mth in April. The last time that China's industrial output contracted was in November last year. Perhaps most concerning though was the last time that China's industrial output contracted more than it did in April was February 2020 – when China's nationwide COVID 19 lockdown was implemented early in the pandemic. Output growth in China's downstream sectors (i.e. automobiles, micro computers and mobile phones) fared worse than upstream sectors (i.e. cement, steel, coal, natural gas, electricity)."

Wages data the key focus today

By Michael Janda

The Australian Bureau of Statistics is releasing the Wage Price Index (WPI) at 11:30am AEST.

What is it?

Put simply, it's a measure of how workers' base pay is changing, and excludes the effect of boosts like bonuses, overtime, hours worked, promotions or shifting jobs/employers.

It's the change in how much people are getting paid per hour for doing the same job for the same employer, and thus pretty much akin to the inflation rate for wages.

It's important for the RBA for two reasons. The first is that higher pay rises mean households have more money to spend, which means more demand and that generally keeps consumer price inflation higher — businesses have no reason to cut prices if people are still buying their goods or services.

The second is that wages are a large input cost for most businesses, the largest for many.

This is especially so in the services sector, where the most recent inflation figures showed an acceleration in price rises.

If wages rise too fast, the RBA is concerned businesses will pass through those increased costs, sending inflation higher still.

The good news (or bad news if you desperately need a pay rise to keep up with your mortgage/rent/grocery bills) is that there's been few signs of wages across the board rising particularly fast.

The economist forecasts for today's WPI centre on pay rises of 0.9% over the March quarter and 3.6% over the past year, up from 0.8% and 3.3% in the December quarter reading.

Given that consumer price inflation was 7% over the March quarter, workers are still expected to be taking a big real pay cut, but at least they're not contributing much to inflation in Australia.