The Reserve Bank governor, Philip Lowe, faced a second parliamentary hearing in Canberra today.

The ASX200 index lost 1.2 per cent in value for the week, as global markets weighed heavily on sentiment.

Disclaimer: this blog is not intended as investment advice.

Key events

Live updates

Wrapping up

By Gareth Hutchens

That's it from me today.

Thanks for staying with me on the Phil Lowe blog.

We've got more interest rate increases in the pipeline, and house prices still have a way to fall.

What will next week's wage data show?

Have a good weekend.

Asian and US markets

By Gareth Hutchens

Elsewhere in Asia:

- Japan's Nikkei 225 index is down 0.7%, to 27,502 points

- Hong Kong's Hang Seng is down 0.7%, to 20,829 points

The three major stock markets in the US lost a lot of ground in their session last night (it's currently 12.23am in New York and 9.23pm in California).

- Dow Jones lost 1.26%, to 33,696 points

- S&P500 lost 1.38%, to 4,090 points

- Nasdaq lost 1.93%, to 12,442 points

Trades settle and market closes lower

By Gareth Hutchens

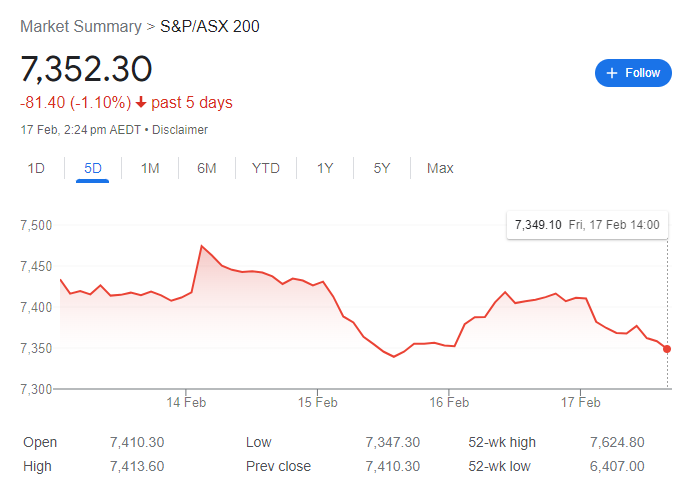

With trading settling after the close, it looks like the ASX200 index will close on 7,346.8 points, down 0.86 per cent from yesterday.

For the week, it means the index has shed 1.17 per cent in value.

An old warning from Bernie Fraser

By Gareth Hutchens

If the RBA freely admit that interest rates are a blunt instrument with a long lag for demonstrated efficacy, why are they continuing to push rates instead of taking at least a quarter to review the impact of their moves? The market is not that fast in response except those (as AGAIN) freely admitted by the RBA, who are already borderline.

- Concerned

Very good point.

In 1996, then-RBA governor Bernie Fraser, when talking about the bank's recently-minted independence, had a question.

He said even though the RBA had just gained independence from political interference, how could it keep its independence from financial markets?

"It would be ironic if one form of influence were to be substituted for another, if the short termism of politicians were to be replaced by the short-termism of the financial markets," he said.

"Most financial-market participants rate low inflation ahead of the Reserve Bank's other objectives. This reflects a number of factors, but the financial harm that is done to holders of bonds when inflation and interest rates rise is the main one.

"We see their [understandable] priorities in market reactions to different economic indicators: Weak economic activity and employment numbers, for example, are generally welcomed because they imply lower inflation and higher bond prices, while strong numbers are generally frowned upon because of concerns that they will be followed by higher inflation and interest rates down the track."

He also warned that if the RBA was going to keep targeting inflation, it would have to deliver for the community.

"To actually deliver low inflation, the central bank needs credibility in labour and other markets more than it does in the financial markets," he said.

"To build this broad community support for its anti-inflation objective, the bank also needs to build credibility in relation to its other objectives. Community support for low inflation is likely to dissipate unless the bank can help to deliver some gains in employment and living standards."

The last 10 minutes

By Gareth Hutchens

We're heading into the final 10 minutes of trading for the day.

I'm sorry if I spent too much time on Phil Lowe today, and not enough time on market news.

But lots of people have been wanting to hear the governor's comments, especially since he's come back from his summer break in a hawkish mood.

The cricket score

By Gareth Hutchens

Would you believe it.

In their second test against India, the Australian men's test team is sitting on 0-26 in their first innings.

No wicket in the first 9 overs? Let me rub my eyes.

Unfriendly advice on a Friday afternoon

By Gareth Hutchens

Maybe the RBA would be better at predicting and understanding supply side shocks if they ditched their ill suited models and tried reading tea leaves, chicken entrails or perhaps their own belly button fluff.

- Miaow Miaow I'm a Cow

Miaow Miaow has some wisdom to share

How high will rates go?

By Gareth Hutchens

The major banks have their own teams of economists who work independently of bank management.

Their job is to run their eye over economic data and produce their own forecasts for major macroeconomic indicators.

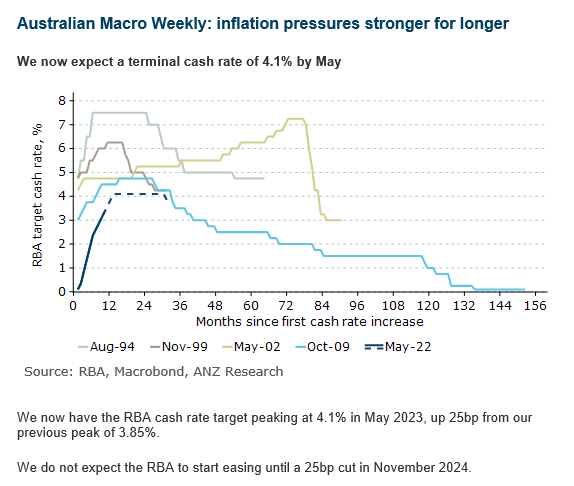

ANZ's economics team put this graph out this afternoon.

They're now forecasting the RBA will keep lifting the cash rate target until it hits 4.1% in May.

It previously thought the RBA would stop lifting rates when they hit 3.85%.

It thinks the cash rate will stay steady at 4.1% for a while, and the RBA won't start cutting rates until November next year.

This graph compares the current rate hikes to previous rate hike cycles.

RBA boss admits rates are causing pain

By Gareth Hutchens

My colleague Nassim Khadem has written on one of the news lines from today's hearings.

Value lost over the week

By Gareth Hutchens

This shows you how the ASX200 index has tracked since Monday.

It's on track to finish the week down more than 1 per cent.

How do you define grilling?

By Gareth Hutchens

Why does the media keep on referring to a grilling of the RBA Governor when the vast majority of questions would have been anticipated and neither committee 'laid a glove on him'.

- GWK

Maybe he got the blue rare steak treatment.

It still touches the grill, if only for a few seconds.

Supply shocks and 1970s stagflation

By Gareth Hutchens

The oil supply shocks in the 1970s were a major factor driving the inflation of that decade.

It's pretty well agreed that part of the reason why stagflation (ie stagnating growth, rising inflation) emerged as a phenomenon in the 1970s is because policymakers didn't fully grasp the significance of those supply shocks.

It took policymakers time to wrap their heads around it.

But once Australia was hit by those supply shocks and inflation began to surge, it was much easier in those days for wages to chase inflation higher, because the labour market was structured very differently back then.

In that decade, centralised wage fixing, arbitration, and the prevalence of industry-wide bargaining meant that significant wage increases in one part of the economy could very quickly flow through to other parts of the economy.

Inflation expectations could actually be acted upon, because unions had far more power to demand and receive higher pay rises regularly.

But fast forward to today and the Dr Lowe says he's very concerned about inflation and inflation expectations.

He acknowledges that this inflationary episode was mostly caused by supply shocks, and that higher prices are now spreading through the domestic economy.

But he says the RBA's models aren't well suited for supply shocks (even after all these years).

And he doesn't seem to talk much about how little bargaining power workers have these days, compared with the 70s, even though that would clearly be impacting our modern inflation expectations dynamics.

As I said earlier, employees may expect inflation to remain high, but what can they do about it?

They can try to demand higher pay rises, but the world's changed. Bargaining power is not what it was. They won't be getting 15% pay increases year after year.

It's not the 1970s anymore.

The RBA's model and supply shocks

By Gareth Hutchens

Okay, I've found the part in the tape where Dr Lowe talks about supply shocks.

This is what he said about the RBA's models:

"Our models are not well suited for supply shocks. We have a big supply shock and then it effects the NAIRU and the estimate of, kind of the, infrastructure [indecipherable mumbling], it just can't deal with supply shocks."

That's quite a thing to say.

As the RBA pointed out last week, a recent modelling effort suggested that supply shocks accounted for 75% of the inflation that has occurred in Australia.

It sounds like those supply shocks have impacted its models for unemployment and investment and everything, making it harder to forecast what might happen on the ground.

Some real estate agents also deserve blame

By Gareth Hutchens

The lifting of rents should be less blamed on "landlords" and supply issues rather those rental agencies, which are the biggest beneficiaries of this and their business model supports such rent gouging. On top of that, their attitudes toward renters are unbelievable. Renters pay their salaries but they (agents) are the boss.

- Faizan

Another comment from a reader

Thank you

By Gareth Hutchens

Hi there, Just wanted to comment that this is the first time I’ve read along with a live thread of the Reserve Bank Governor, but it was absolutely awesome. I’m a 30 year old married bloke with a one year old and a mortgage and the state of the economy is scaring me for the future, mortgage up, price of food/fuel/utility bills all up etc. Reading along with Gareth’s commentary was great, what these economists say goes way over my head but he’s interpreted it for me pretty well. Thanks to all at the ABC for helping regular people understand the things that effect them 👍🏻

- LR

No problem at all, LR. Thanks for reading.

QBE shares jump 8% on profit result

By Gareth Hutchens

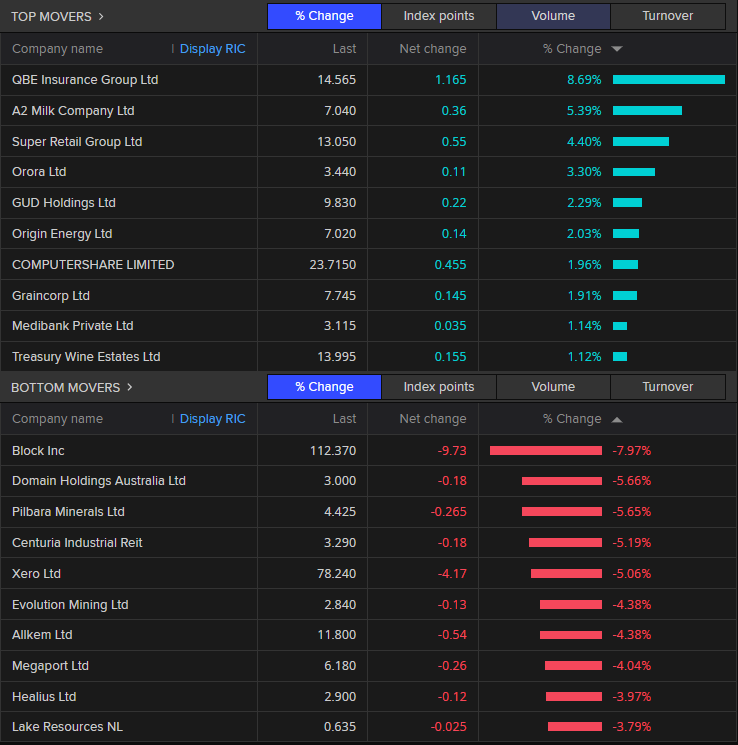

If we turn back to the stockmarket, here's a look at the 10 stocks that have made the biggest gains and the 10 that have made the biggest losses today (as of 1pm).

QBE Insurance has seen its share price jump 8.7% on the back of positive full-year profit results.

It has announced statutory net-profit after tax of $770 million in FY22, compared with $750 million in FY21.

"In a backdrop underscored by heightened inflation, geopolitical tensions, and elevated catastrophe activity, QBE's underwriting performance demonstrated improved resilience, with the adjusted combined operating ratio of 93.7% improving by 1.3% compared to the prior period," it said in a statement.

"Strong premium growth continued, with group-wide renewal rate increases of 7.9% in FY22, which supported gross written premium growth of 13%."

A national service

By Gareth Hutchens

With Dr. Lowe talking about the two types of people, how is it fair that mortgage holders are held hostage by raising interest rates, while those without don't have to sacrifice for the 'greater good of the Australian economy'?

- Jonathan

It's a good question.

But here's something else to think about.

Under the current system, it's taken for granted that a certain level of unemployment helps to keep a lid on inflation and wages growth.

According to Professor Ross Garnaut, in recent years (in the lead-up to the pandemic) that meant hundreds of thousands of people were kept unnecessarily unemployed.

They were also being asked to take one for Team Australia, for the greater good of the economy.

Was their national service officially recognised and properly compensated?

It wasn't. Unemployment payments have not grown in line with average weekly earnings over the last 25 years. They've drifted lower and lower.

Our models aren't well suited for supply shocks

By Gareth Hutchens

There's something I only half heard.

There was a point in there, towards the end, where Dr Lowe said the RBA's economic models "are not well suited for supply shocks."

That's a fairly important point, you'd think.

Especially given the role supply shocks have played in this inflationary episode (and the role they played in stagflation in the 1970s).

I'll have to see if I can go back and find it in the tape.

Rates cuts next year?

By Gareth Hutchens

And the final point of the hearing.

Dr Lowe says it's plausible that interest rates in Australia could start falling next year.

He says market pricing seems to suggest that interest rates will start falling in other major economies this year.

But for Australia, that's more likely to happen next year (at this stage).

So, a couple more rate rises to come in Australia this year, then they'll remain at a certain level for a while, then they could start coming down next year.

And with that, we're done.

Who is causing the demand-side inflation right now?

By Gareth Hutchens

Dr Lowe is asked where demand-side inflation is coming from right now.

He says he doesn't want to signal any group out.

But he says the economy broadly has two groups of people in it who have very different spending patterns right now.

He says people with mortgages are not spending very much, because they're trying to keep on top of rising interest costs.

But there's another group of people who don't have a mortgage but who have jobs, regular incomes, and savings, and they're spending quite a lot.

"It's a very disparate story across the population," he said.