Australia's stock market only just managed to gain ground today, despite a buoyant start in the morning.

Lithium and gold stocks performed well, but coal and energy stocks lost ground despite reports that Chinese officials will lift a two-year ban on Australian coal imports.

Disclaimer: this blog is not intended as investment advice.

Key events

Live updates

Until tomorrow

By Gareth Hutchens

Thanks for having me today.

I'll be back on the markets blog tomorrow.

With shares on Australia's public stock exchange gaining some value overall today, other major stock markets in the region are also up.

As of 4.50pm AEDT, Japan's Nikkei 225 index is up 0.43 per cent, to 25,827 points, and Hong Kong's Hang Seng is up 1.18 per cent, to 21,041 points.

The Australian dollar is currently trading at US68.18 cents, down 0.25 per cent.

The first three trading days of 2023

By Gareth Hutchens

That's it for trading today.

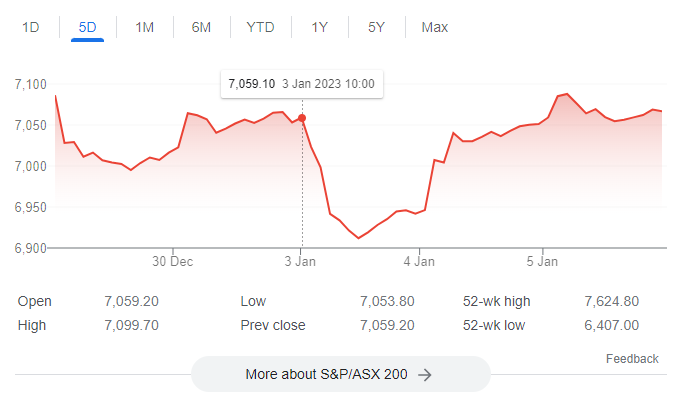

The graph below shows how the ASX200 index has moved in the first three trading days of 2023.

There was a significant sell-off on Tuesday 3, followed by a fightback on Wednesday 4, and today the index only just managed to scrape a little bit higher again.

The index ended today on 7,063.60 points, up 0.06 per cent, from 7,059.20 points yesterday.

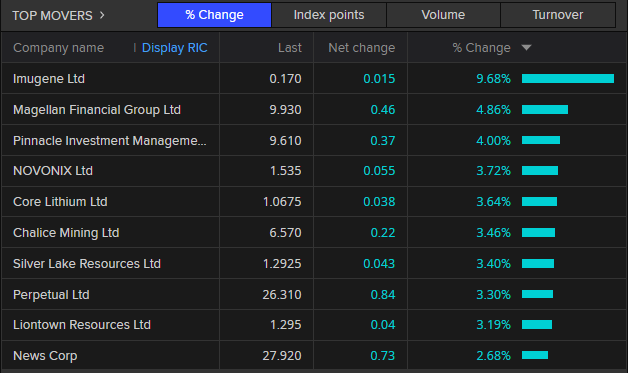

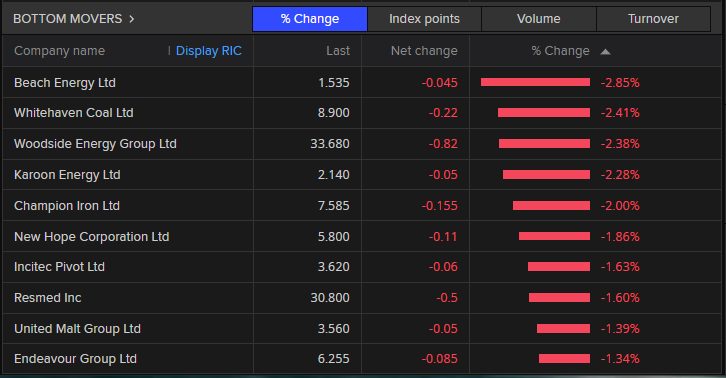

Best and worst performers

By Gareth Hutchens

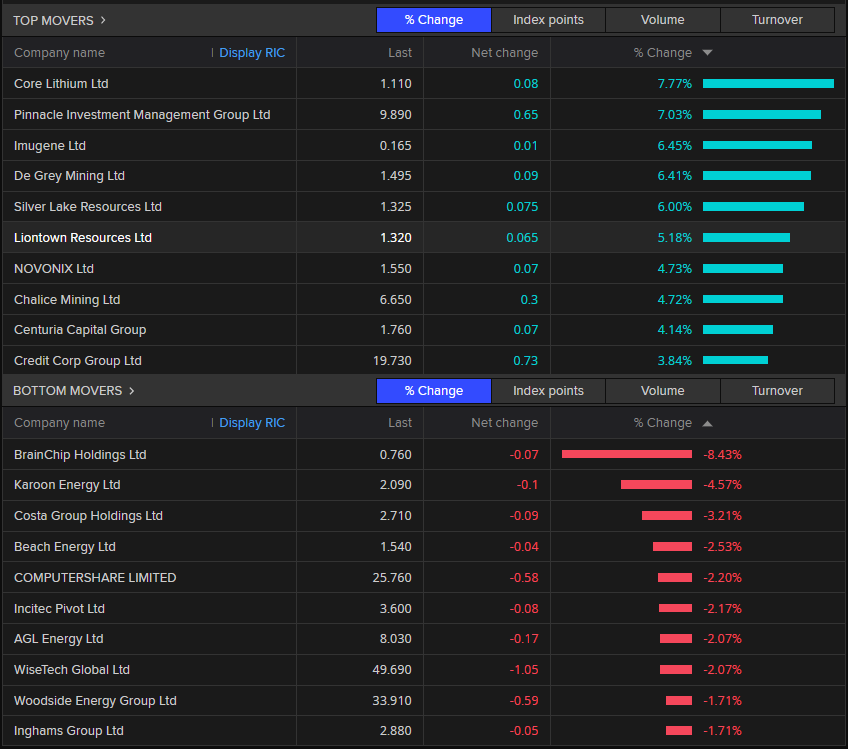

For individual stocks, here are the top and bottom performers.

Lithium and gold stocks were among the 10 best performers, while energy and coal companies were among the 10 worst.

Sector summary

By Gareth Hutchens

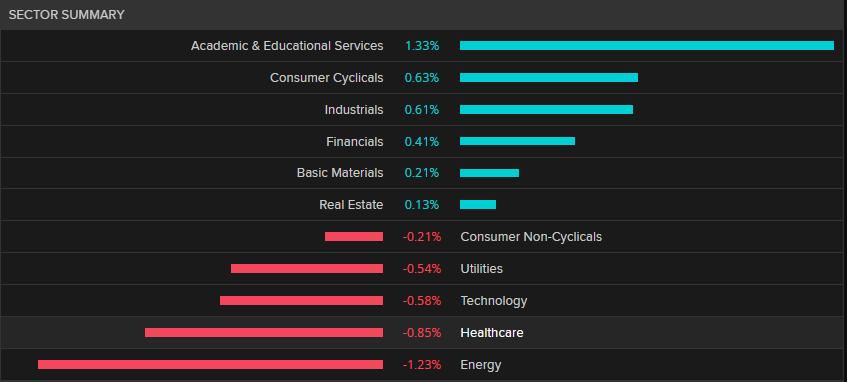

This is how the sectors performed today.

The gains were led by academic and educational services stocks, followed by consumer cyclicals, industrials, and financials.

But the index was weighed down by losses among energy, healthcare, and technology stocks.

Trade closes ever-so-slightly higher

By Gareth Hutchens

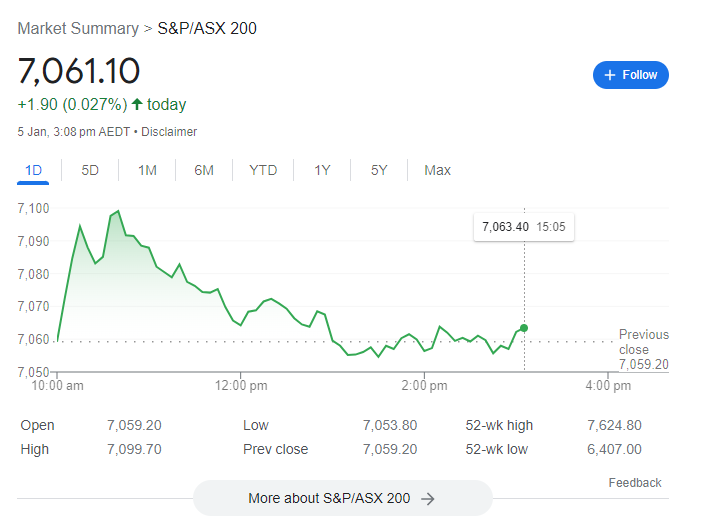

Trading on the Australian Securities Exchange has closed for the day.

And as the final trades settle, it looks like the index has only just managed to gain ground today.

Squint, and you may be able to see it.

The index rose by 4.4 points, or 0.062 per cent.

Global investors unite on shareholder resolution targeting Glencore’s coal production

By Gareth Hutchens

Major institutional investors from Europe, the United Kingdom and Australia have co-filed a shareholder resolution at the world’s largest coal trader, Glencore plc, seeking greater transparency on how the company’s thermal coal production aligns with the Paris objective of keeping global temperature increase to 1.5°C.

According to a press release issued by the group:

"The global coalition of institutional investors, collectively representing $US2.2 trillion of assets under management, include: Legal and General Investment Management (LGIM), one of Europe’s largest asset managers; Swiss based Ethos Foundation, on behalf of large Swiss pension fund members of the foundation, including Pensionskasse Post and Bernische Pensionskasse (BPK); Vision Super, an Australian industry super fund; and HSBC Asset Management.

"This is the first time investors have filed a climate resolution specifically focusing on Glencore’s thermal coal production, and is a significant escalation of pressure on Glencore, already on notice after nearly one quarter of shareholders rejected its climate plan in 2022.

"The proposals, facilitated and co-filed with the Australasian Centre for Corporate Responsibility(ACCR) and UK-based responsible investment NGO ShareAction, ask Glencore to disclose how its projected thermal coal production and thermal coal capital expenditure aligns with the Paris Agreement’s goals and the International Energy Agency (IEA) Net Zero Emissions pathway.

US Fed to lift rates above 5 per cent?

By Gareth Hutchens

My colleague Sue Lannin spoke to Mahjabeen Zaman, head of foreign exchange research at ANZ, about where the US Federal Reserve is going.

Ms Zaman expects rates above 5 per cent and sees a mild US recession this year.

The current Federal Reserve interest rate is 4.25 to 4.50 per cent.

ASIC issues fines for greenwashing to Black Mountain Energy Limited

By Gareth Hutchens

The Australian Securities and Investments Commission (ASIC) has issued infringement notices to listed energy company Black Mountain Energy Limited.

ASIC says BME has paid $39,960 to comply with three infringement notices.

They're in relation to concerns about alleged false or misleading sustainability-related statements made to the Australian Securities Exchange (ASX) between 23 December 2021 and 8 September 2022.

According to the regulator's website, the infringement notices were issued in relation to statements contained in three ASX announcements made by BME which claimed that:

- BME was creating a natural gas development project with ‘net-zero carbon emissions’, and

- the greenhouse gas emissions associated with Project Valhalla would be net zero.

ASIC says it was concerned that BME either did not have a reasonable basis to make the representations, or that the representations were factually incorrect.

BME paid the infringement notices on 3 January 2023. Payment of an infringement notice is not an admission of guilt or liability.

Asian markets today

By Gareth Hutchens

Let's take a look at major stock markets in the Asia Pacific. As of 3.20pm AEDT:

- Japan's Nikkei 225 index: up 0.27 per cent, to 25,788 points.

- Hong Kong's Hang Seng index: up 1.01 per cent, to 21,003 points.

Final hour of trade

By Gareth Hutchens

As we enter the final hour of trade for the day, the ASX200 index is barely back into positive territory.

A former darling on the London Stock Exchange

By Gareth Hutchens

And regarding that story about Benedict Cumberbatch and the dark side of wealth accumulation through history.

One of the best books I've read in this space is The Anarchy (2019), by the historian William Dalrymple.

It's about the history of the British East India Company.

It tells how the for-profit company, with backing of the British parliament, by 1803 had raised a private army of 200,000 men - twice the size of the British army - and "subdued" or directly seized an entire subcontinent.

As Dalrymple tells it:

"We still talk about the British conquering India, but that phrase disguises a more sinister reality. It was not the British government that began seizing great chunks of India in the mid-eighteenth century, buy a dangerously unregulated private company headquartered in one small office, five windows wide, in London.

"Historians propose many reasons for the astonishing success of the Company: the fracturing of Mughal India into tiny, competing states; the military edge that Frederick the Great's military innovations had given the European Companies; and particularly the innovations in European governance, taxation and banking that allowed the Company to raise vast sums of ready money at a moment's notice.

"Yet perhaps the most crucial factor of all was the support that the East India Company enjoyed from the British parliament ... Parliament backed the company with state power: the ships and soldiers that were needed when the French and British East India Companies trained their guns on each other."

Dalrymple says the East India Company also probably invented corporate lobbying.

"In 1693, less than a century after its foundation, the EIC was discovered for the first time to be using its own shares for buying parliamentarians, annually shelling out £1,200 a year to prominent MPs and ministers.

"The parliamentary investigation into this, the world's first corporate lobbying scandal, found the EIC guilty of bribery and insider trading."

He says the company stripped India of so much wealth to send back to England that it changed the course of history.

And it had an influence on the American War of Independence.

"Before long the EIC was straddling the globe. Almost single-handedly it reversed the balance of trade, which from Roman times on had led to a continual drain of Western bullion eastwards. The EIC ferried opium east to China, and in due course fought the Opium Wars in order to seize an offshore base at Hong Kong and safeguard its profitable monopoly in narcotics.

"To the West it shipped Chinese tea to Massachusetts, where its dumping in Boston harbour triggered the American War of Independence. Indeed, one of the principal fears of the American Patriots in the run-up to the war was that Parliament would unleash the East India Company in the Americas to loot there as it had done in India.

"In November 1773, the Patriot John Dickinson described EIC tea as 'accursed trash,' and compared the potential future regime of the East India Company in America to being 'devoured by Rats'.

"This 'almost bankrupt company', he said, having been occupied in wreaking 'the most unparalleled Barbarities, Extortions and Monopolies' in Bengal, had now 'cast their Eyes on America, as a new theatre, whereon to exercise their Talents of Rapine, Oppression and Cruelty'."

That private company with a handful of directors and a small office in London ended up ruling over a population of 50 to 60 million people in India.

One of its directors even admitted that the EIC was "an empire within an empire" with the power to make war or peace anywhere in the East. The company came close to generating half of Britain's trade at one point.

It's a brilliant book. A genuine page-turner.

Amazon to lay off more than 18,000

By Gareth Hutchens

Amazon.com Inc's layoffs will now stretch to more than 18,000 roles, according to Reuters.

The cuts will mostly impact the company's e-commerce and human resources organisations, with the group bracing for likely slower growth this year.

Amazon is the second-largest private employer in the US, after Walmart.

Its layoffs will now surpass the 11,000 jobs cut at Facebook-parent Meta Platforms, as well as reductions at other tech-industry peers.

ASX200 slips into negative territory

By Gareth Hutchens

We're just past the halfway mark of trading for the day.

After jumping higher in the first hour of trade, the ASX200 index has been slowly dropping.

It's currently sitting lower than yesterday's close.

Where does wealth come from?

By Gareth Hutchens

Let's zoom out a little.

When looking at the daily movements of stock prices, it's useful to bear in mind what stock exchanges are for.

They're a meeting place for people to buy and sell shares in public companies.

They play a crucial role in "capital accumulation" because they give companies a forum with which to raise money from the public, and that money can then be used to expand their business and hopefully lead to further profits.

But it's not the only place where wealth is generated. Capital accumulation has its extremely dark side, too.

In the antebellum United States, the institution of slavery was so profitable for southern planters that the Mississippi River valley had more millionaires per person (among its white population) than any other region, at one stage.

And the story below touches on the same theme.

It regards Barbados's attempt to seek reparations from the colonial powers for nearly four centuries of slavery.

It tells the story of the English actor Benedict Cumberbatch, and how his ancestors came to be one of the richest families in Britain at one point.

Does the world have enough lithium reserves?

By Gareth Hutchens

This is from Hannah Ritchie, the head of research at Our World in Data based out of the University of Oxford.

Top movers at midday

By Gareth Hutchens

But let's have a look at the top movers today.

As of midday (AEDT), some of the top movers are lithium companies, which continues a theme from recent weeks.

Core Lithium, Silver Lake Resources, and Liontown Resources are all among the top performers so far.

You also have Chalice Mining, which explores for elements like nickel, copper, and cobalt, which are used in lithium ion batteries.

Limited boost to trade flows for Australian coal?

By Gareth Hutchens

Let's jump back to that Bloomberg report on Chinese imports of Australian coal.

The article made the point that a lot has changed in the two years since China imposed its ban on Australian coal imports, with Australian exporters shifting their focus to other markets.

It suggested it may take a while for Australian coal exporters to really gain from China's decision:

"Australia’s exporters have already switched focus to markets elsewhere in Asia and Europe amid an energy crisis that’s intensified global competition for the commodity, potentially limiting the impact of any policy reversal by China.

"Even so, there will likely be demand for Australian supplies that are known for their high quality. China’s return as a buyer of the cargoes could also help spur prices higher and there will be an overall “impact on sentiment from evidence of improving relations with China,” said Ray Attrill, head of currency strategy at National Australia Bank Ltd. in Sydney.

"There’s also currently only limited volumes available on the spot market, and China has boosted domestic coal output to a record to limit reliance on imports. “As far as actual trade flows — a big yawn,” said Tim Baker, head of macro research at Deutsche Bank AG in Sydney. “Aussie coal exports have been exceptionally strong despite China not taking any.”

"Even so, there will likely be demand for Australian supplies that are known for their high quality. China’s return as a buyer of the cargoes could also help spur prices higher and there will be an overall “impact on sentiment from evidence of improving relations with China,” said Ray Attrill, head of currency strategy at National Australia Bank Ltd. in Sydney.

Coal and energy stocks down

By Gareth Hutchens

After the first hour of trading the ASX200 is up around 0.3 per cent.

But coal exporters and oil and gas companies are running against the tide by carrying losses.

The six stocks with the largest losses this morning are:

- Beach Energy (oil and gas exploration)

- Whitehaven Coal (coal producer)

- Woodside Energy (LNG and crude oil)

- Karoon Energy (oil and gas exploration)

- Champion Iron (iron ore)

- New Hope (coal producer)

US poised to overtake Australia as world's top LNG exporter

By Gareth Hutchens

Reuters has an interesting report.

It says the US is on track to overtake Australia as the world's top LNG exporter this year once its fire-damaged Texas plant is restarted.

According to the story:

A June fire sidelined Freeport LNG, the second biggest U.S. export facility, and cut U.S. exports of the fuel by about 2 billion cubic feet per day (bcfd).

That outage dropped the United States behind top exporter Australia as global demand for the fuel boomed.

In 2022, U.S. exports of natural gas as LNG rose 8 per cent to 10.6 bcfd, just shy of Australia's 10.7 bcfd.

The United States remained ahead of Qatar, which in third place shipped 10.5 bcfd, according to data provider Refinitiv.

The loss of Freeport LNG's supply at mid-year took away the U.S. chance to take the crown as top exporter in 2022. Freeport LNG said it expects to resume processing in the second half of January, pending regulatory approvals, which would tip the production balance back toward the United States.

With no new LNG plants expected to enter service in Australia until around 2026 and in Qatar until around 2025, analysts have said they expect their production to remain about the same amount in 2023 as in 2022.

Market up in first 30 minutes of trade

By Gareth Hutchens

The ASX200 index is trading higher after 30 minutes of trading this morning.

After closing yesterday on 7,059.2 points, it jumped to 7,098.7 points in the first 20 minutes of trading this morning.

But it's eased off slightly since then.

It's currently trading around 7,081.3 points, up 0.3 per cent from yesterday.