The Australian share market has ended its day slightly lower, weighed down by financial and energy stocks, as both sides of US politics fail to resolve their debt ceiling stand-off.

Cautious investors are also awaiting key US inflation figures that could influence whether the US Federal Reserve lifts or cuts interest rates later this year.

Disclaimer: this blog is not intended as investment advice.

Key events

To leave a comment on the blog, please log in or sign up for an ABC account.

Live updates

Market snapshot at 4:15pm AEST

By David Chau

-

ASX 200: -0.1% at 7,256 points

- All Ords: -0.1% at 7,452

- Australian dollar: +0.1% at 67.65 US cents

- Spot gold: -0.3% at $US2,029 / ounce

- Brent crude: -0.8% to $US76.86 / barrel

- Iron ore: +1.5% to $US103.55 / tonne

- Bitcoin: +0.1% to $US27,689

- Nikkei: -0.4% at 29,137 points

- Hang Seng: -0.6% at 19,756

- Shanghai Composite: -1.4% at 3,312

Markets lower ahead of key US inflation update

By David Chau

The local share market closed marginally lower, as investors cautiously await tonight's US inflation figures.

The ASX 200 fell 0.1%, to finish at 7,256 points.

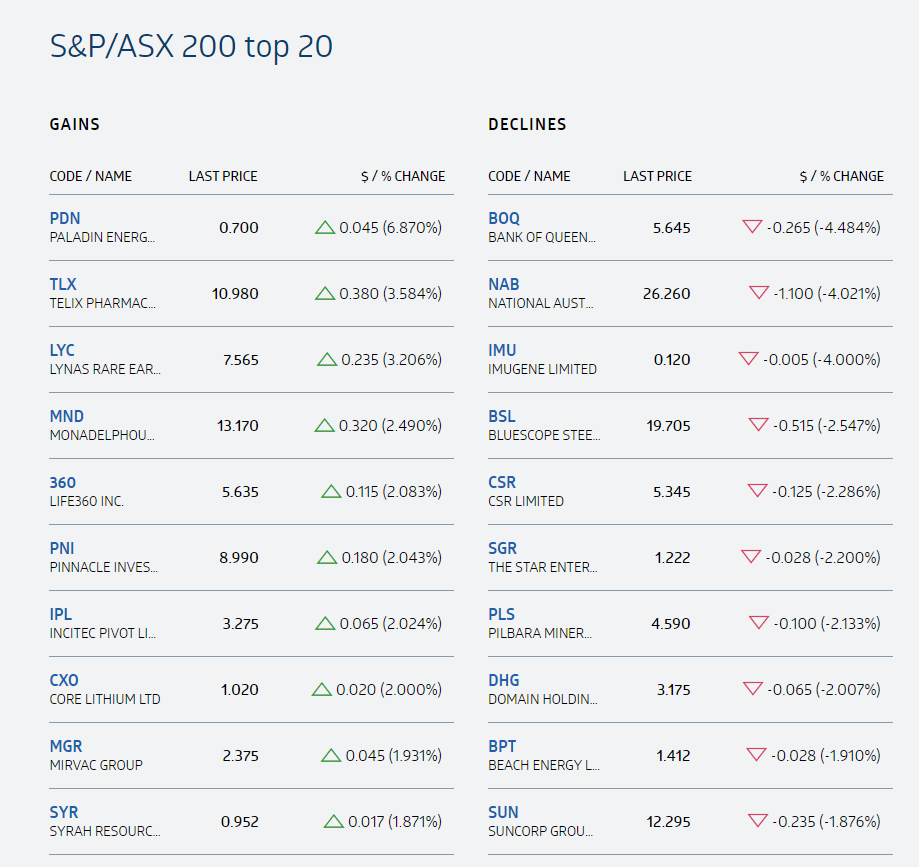

Some of today's best performing stocks include Paladin Energy (+8.4%), Mondalelphous (+3.5%), Telix Pharmaceuticals (+3.3%) and Lynas Rare Earths (+3.3%).

At the other end of the spectrum, NAB (-4%) and Bank of Queensland (-4.2%) fell sharply as both stocks are trading ex-dividend. Shares of AMP (-2.2%), Domain (-1.9%), Bluescope Steel (-3.3%) and Pilbara Minerals (-3%) were also among the worst performers.

The Australian dollar was steady at 67.6 US cents, while the US dolar index dipped slightly to 101.64 points.

It come as US President Joe Biden and top lawmakers failed to break a deadlock on the debt ceiling crisis.

Debt ceiling stand-off

Mr Biden and House of Representatives Speaker Kevin McCarthy remained divided over raising the $US31.4 trillion debt limit following talks on Tuesday (local time), with just weeks to go before the United States may be forced into an unprecedented default.

"There has been a lot of attention lately on the debt ceiling issues," said Carol Kong, a currency strategist at Commonwealth Bank.

"I don't think the issue will be resolved anytime soon.

"Typically, in the past, the issues usually get resolved very last minute.

"So that means there could be some more volatility in markets ... and I think the [US] dollar could weaken even further, as we have seen in the past."

Looking for signs of sticky inflation

Economists polled by Reuters expect core consumer prices in the United States to rise 5.5% on a year-on-year basis for the month of April.

A stronger-than-expected reading could prove a headache for the Federal Reserve, which had just last week opened the door to a pause in its aggressive tightening cycle, having delivered 10 consecutive rate hikes since March 2022.

"The bar is high for a Fed response to data surprises in either direction," said Vishnu Varathan, head of economics and strategy at Mizuho Bank.

"Having concluded 500 basis points of rate hikes and anticipating some credit tightening from a shake-down amongst regional banks, the Fed is unlikely to tighten further on merely 'sticky' inflation, instead requiring re-acceleration of inflation."

Money markets are pricing in a roughly 80% chance that the Fed will keep rates on hold at its next meeting in June, and expect rate cuts to begin in July through to the end of the year.

Rising expectations that the Fed will begin cutting rates later this year have been driven by recent stress in the banking sector following the collapse of Silicon Valley Bank in March.

Elon Musk says Twitter will soon allow calls and encrypted messaging

By David Chau

Twitter chief executive Elon Musk has revealed details about new features including adding calls and encrypted messaging coming to the social media platform.

Last year, Musk flagged plans for "Twitter 2.0 The Everything App", which he said would have features such as encrypted direct messages (DMs), longform tweets and payments.

"Coming soon will be voice and video chat from your handle to anyone on this platform, so you can talk to people anywhere in the world without giving them your phone number," Musk said in a tweet on Tuesday.

The call feature on Twitter will bring the micro-blogging platform into line with the likes of Meta's social media applications, Facebook and Instagram, which have similar features.

Musk said a version of encrypted direct messages will be available on Twitter starting Wednesday (US time), but did not say if calls will be encrypted.

Twitter this week said it will start a cleansing process by removing and archiving accounts that have been inactive for several years.

NAB and Bank of Queensland trading ex-dividend

By David Chau

The ASX 200 is on track to end its day slightly lower, with banking and energy stocks weighing on the market.

Shares of NAB (-4%) and Bank of Queensland (-4.5%) fell sharply as both companies are trading ex-dividend today.

It means if you didn't already own shares in these banks, you won't receive its next dividend payment.

BlueScope Steel, Pilbara Minerals and Domain are also some of today's worst performing stocks.

On the flip side, today's top performers include Paladin Energy (+6.9%), Lynas Rare Earths (+3.2%) and Core Lithium (+2%).

Virgin Australia says IPO planning advanced, finalising capital return

By David Chau

Planning for Virgin Australia's upcoming initial public offering (IPO) is "well advanced", chairman Ryan Cotton said on Wednesday in an internal email that also outlined bonus payments to the airline's shareholders and staff after a return to profit.

Cotton said Australia's second-biggest airline was days away from finalising a capital return.

Investors led by US private equity firm Bain Capital will share a $730 million payment, according to Reuters, citing a source who was not authorised to speak publicly.

It will be structured as a capital reduction rather than a dividend, with Bain Capital taking around 90% followed by Richard Branson's Virgin Group with 5% and the rest going to the remaining shareholders, the source added.

A Virgin Australia spokesperson confirmed the contents of the internal email. A Bain Capital spokesperson declined to comment.

The airline had sought up to $450 million of loans for the capital return, Reuters reported in March.

The rewards to staff and shareholders come as Virgin Australia, the key domestic rival to Qantas, prepares for what is likely to be one of the country's biggest listings this year.

"I can also confirm the IPO planning is well advanced," Cotton said in the email to staff seen by Reuters.

"While there is still no date set and our ultimate window of opportunity will depend on market conditions, we are hopeful this process will progress over the coming quarters," he added.

Virgin Australia chief executive Jayne Hrdlicka said on Monday that she would take several weeks of leave to spend time with family after the death of her husband from cancer.

In an email drafted before her departure that accompanied Cotton's, she said the payments to staff and shareholders reflected the "monumental feat" of returning the airline to profitability for the first time in more than a decade.

Bain Capital bought Virgin Australia in 2020 after it was placed in voluntary administration.

Banking and oil stocks drag ASX lower

By David Chau

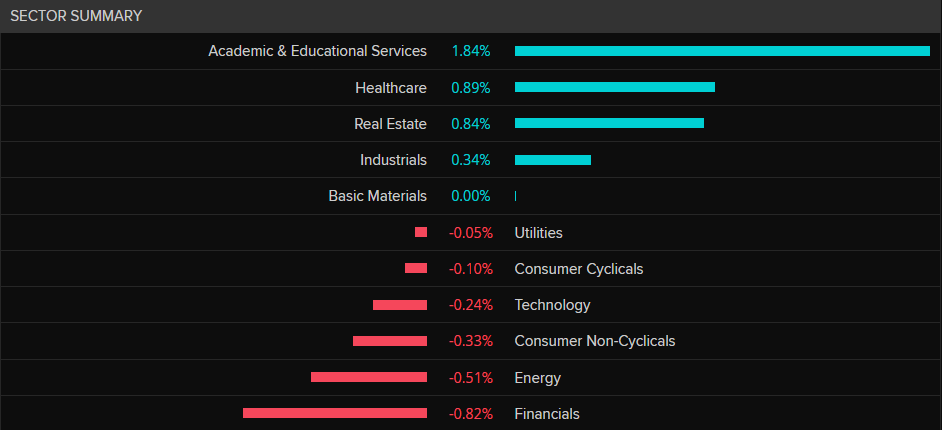

On a day that the Australian share market is down slightly, healthcare (+0.9) and real estate (+0.8%) are some of today's best performing sectors.

They are being driven higher by shares of Telix Pharmaceuticals (+2.8%), Mirvac (+2.2%) and Growthpoint Properties (+1.9%).

On the flip side, the financials (-0.8%) and energy (-0.5%) are today's weakest performers.

It comes after steep falls in the shares of Bank of Queensland (-4.5%), NAB (-4.1%), Santos (-1.2%) and Beach Energy (-1.9%).

ASX slips ahead of US inflation figures

By David Chau

The Australian share market is struggling to advance today, ahead of some hotly-anticipated inflation figures from the United States that could determine whether the world's biggest economy cuts interest rates later this year.

By 1:10pm AEST, the benchmark ASX 200 was down 0.2% to 7,253 points.

The Australian dollar was steady at 67.6 US cents.

US consumer price inflation figures (for the month of April) will be released at 10.30pm AEST.

Economists expect the headline CPI to hold steady at an annual 5% and core CPI to moderate very slightly to 5.5%.

But if inflation turns out to be sticky (or higher than those estimates), it would conflict with market bets that US rates will fall.

Meanwhile, US President Joe Biden and top lawmakers failed to break a deadlock over raising the $US31.4 trillion debt limit, but vowed to meet again with just weeks before the country may be forced into an unprecedented default.

Market snapshot at 11:35am AEST

By David Chau

-

ASX 200: -0.2% at 7,248 points

- All Ords: -0.2% at 7,445

- Australian dollar: flat at 67.6 US cents

- Spot gold: flat at $US2,033 / ounce

- Brent crude: -0.3% to $US77.23 / barrel

- Iron ore: +1.5% to $US103.55 / tonne

- Bitcoin: +0.2% to $US27,727

- Nikkei: -0.4% at 29,129 points

- Hang Seng: flat at 19,861

-

Shanghai Composite: flat at 3,358

Bubs Australia sacks its CEO and co-founder Kristy Carr

By David Chau

Infant formula maker Bubs Australia has sacked its chief executive and co-founder Kristy Carr "with immediate effect".

In a statement, the company said it was due to "failure to comply with reasonable Board directions".

Bubs said it had also fired its former executive chairman Dennis Lin.

This is the reason the company provided for this extraordinary move:

“Noting the recent deterioration in Bubs’ financial performance over the half year, the non-executive directors considered the time was right for a change in leadership and to change the governance framework of the company to ensure that it aligns with ASX corporate governance principles and best practice."

Sacking coincides with poor financial performance

What's also extaordinary is that the Bubs board of directors did not bother to hide their negativity towards their co-founder and former chairman.

Normally, when a top executive is forced to quit, the business would claim they "resigned" due to health problems, or a desire to "spend more time with their family".

Last year, Bubs' share price surged when the United States was experiencing an extreme shortage of baby formula.

The company exported large quantities of its product to the US, and was personally thanked by President Joe Biden at a virtual roundtable of infant formula manufacturers from across the world.

But since the year began, its share price has collapsed by 50%.

In February, Bubs Australia reported a half-year loss of $44 million. (It was a huge downgrade compared to the $702,000 half-year loss it announced the year before).

The company announced Katrina Rathie as its new chairwoman last month, while Richard Paine will act as interim CEO until a permanent replacement is found.

Risk of "possibly two more" rate rises in the coming months: economist

By Daniel Ziffer

Economist David Bassanese of Betashares says the "unambiguously expansionary" budget will fuel pressure for the Reserve Bank of Australia to lift rates - as it continues it's fight against inflation.

With growth domestic product (GDP) - the value of all goods and services produced in a given period - set to lift about 1.5% over the next two years, he says that means...

"This adds to the risk that the RBA will feel the need to raise interest rates at least once and possibly twice more in the coming months".

If that comes to pass, the around one-third of Australians who are currently paying off a mortgage would be hit with higher repayments.

Despite a review of the RBA calling on the central bank to give equal priority to the concepts of full employment and steady inflation between 2-3%, the bank's recent decisions have confirmed it is on a mission to lower inflation at the cost of higher unemployment.

Mr Bassanese praises the budget...

"The Budget is admirable in that most of the extra budget bounty from a resilient economy and higher export commodity prices is being saved rather than spent (unlike, say, during the commodity boom under then Treasurer Peter Costello). It’s also hard to argue over the areas in which money has been spent – mainly helping the least well off in the community"

But says it should have gone harder.

"(It) again makes no real effort to tighten the budget to support monetary policy in helping to rein in inflation and tackle Australia’s now ingrained structural budget deficit. The disappointment is not that the Government has attempted to support some of the less well-off in the community, but rather that greater effort was not made at a still relatively early stage in the electoral cycle to introduce tougher measures elsewhere in the economy."

Multinationals to pay a minimum 15% tax in budget hit

By Daniel Ziffer

Crack out the world's smallest violin to play a sad song for multinational corporations that have boosted their profit by billions through shifting it around the world ... and might not be able to do so as easily in future.

My colleague, Nassim Khadem, has covered this issue for years — check out her explainer at the bottom of this post.

The key issue is some multinational companies shift profits from countries with higher corporate tax rates like Australia (25-30%) to places like Singapore (17%) or the Cayman Islands (0%).

It's expensive, complicated and contentious.

But legal.

Change is coming

Treasuries around the world have gotten wise and have slowly been working together to make it harder. (Even though, at the same time, people have been working on the opposite side and trying to get around the new laws).

Liam Delahunty, partner at consulting firm RSM Australia, noted new "global minimum tax" reforms for multinationals. This is the next phase of tax reform around the world and installs a minimum tax rate of 15 per cent.

"Australia is one of 135 countries and jurisdictions collaborating on global measures to tackle tax avoidance through the OECD’s BEPS two-pillar reform plan – so the global minimum tax reforms are neither new nor unexpected"

But what is new, Mr Delahunty said, is the speed.

"There are firm start dates which don’t allow for any significant transition time and also come on the back of changes to thin capitalisation rules and intangible assets – both of which are due to commence from income years commencing on or after 1 July 2023, but are yet to be legislated."

What this means is the 15 per cent global minimum tax for large multinational enterprises will kick in from 1 January 2024.

There are only "very modest revenue projections" from the measures, so the government doesn't foresee a bounty of riches coming from it.

But it may stop the money-shuffle, and see more of it land here in Australia where the profits are being made.

Latitude's data security being investigated after cyber-attack

By Emilia Terzon

We have a big update on Latitude's cyberattack.

Regulators across Australia and New Zealand are now investigating the financial service company's customer data retention policies and protection.

Latitude was hit by a cyber-attack in March.

At least 7.9 million Australian and NZ drivers licences were eventually confirmed as stolen, and 6.1 million customer records.

Some of the customer data stolen was provided before 2013 — including some dating back to 2005.

It included information from before Latitude was Latitude, and was instead an entity under GE Money.

Now, the Office of the Australian Information Commissioner (OAIC) and the New Zealand Office of the Privacy Commissioner (OPC) have commenced a joint investigation into the company's personal information handling practices.

In joint statement they said:

The OAIC investigation will focus on whether Latitude took reasonable steps to protect the personal information they held from misuse, interference, loss, unauthorised access, modification or disclosure.

The investigation will also consider whether Latitude took reasonable steps to destroy or de-identify personal information that was no longer required.

If the investigation finds serious and/or repeated interferences with privacy in contravention of Australian privacy law, then the Commissioner has the power to seek civil penalties through the Federal Court of up to $50 million for each contravention.

Six entities under Latitude are being investigated.

The company has a range of services, including pay-day lending, buy now pay later services with retailers, and insurance across Australia and NZ.

A spokesperson for Latitude says:

Latitude has been working closely with the OAIC and the OPC since the cyber-attack and will continue to fully cooperate as they undertake their investigation.

Send our journalist an email on terzon.emilia@abc.net.au if you are a Latitude customer who is worried about your data.

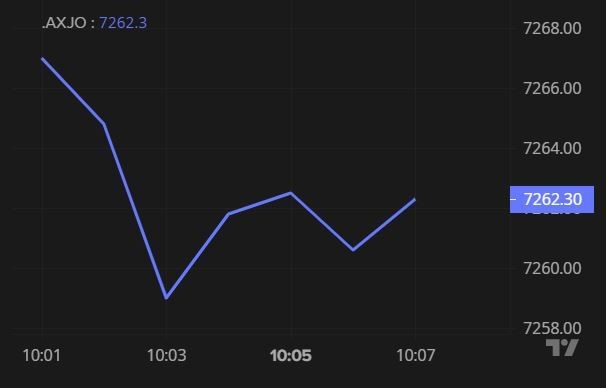

Markets opens with 'yeah nah' response to budget

By Daniel Ziffer

The ASX 200 has fallen in the opening minutes of trade, dropping 0.26% or 18.8 points.

It's currently at 7,245.60 points.

The index tracks the fortunes of the top 200 listed companies on the Australian stock market.

It is not 'the economy' but it is a key indicator of how people feel about the prospects for businesses at a given moment.

At this moment it's 0.26% worse than where it was when trading ended yesterday, before the federal budget was revealed in full.

What's in the budget for business owners?

By David Chau

The federal budget didn't offer a huge amount for business owners.

One of the noteworthy incentives was an amnesty for some businesses that are behind on their taxes.

So if your business tax bill was due between 31 December 2019 and 29 February 2022 and you still haven't paid it, the ATO won't fine you if you lodge your taxes by the end of this year.

But that only applies to small businesses with yearly turnover of less than $10 million.

The government is also offering tax rebates for investments in 'electrification' (say, if they bought heat pumps, battery storage, induction, and energy efficient fridges).

You can watch my short and easy-to-understand summary here:

AAA credit rating reaffirmed after budget by ratings agency

By Daniel Ziffer

As a person, your credit rating is a summary of whether you're a 'good risk'.

If you're not — say you've been late with paying your bills or defaulted on a mortgage — you'll pay a higher interest rates on loans to take account of the fact you're more risky (for the lender) than other people.

For nations, it's similar.

Ratings agencies work out if you, a company or a nation are a 'good risk'. New comments from Fitch Ratings in the wake of the 2023 Australian federal budget are broadly supportive

"The return to a underlying cash surplus in the current fiscal year and clear improvement in the federal government's fiscal position over the budget's forecast horizon is supportive of Australia's 'AAA' sovereign rating," said Jeremy Zook, director, sovereigns, APAC at Fitch Ratings.

"Fiscal outcomes are stronger than what we expected when we last affirmed Australia's rating with a Stable outlook in December 2022."

It also says the budget won't boost inflation.

Mr Zook does see "structural budget pressures" over the medium-term and warns that risks to the rating could build with spending demands "particularly the NDIS"."The government's decision to allow higher than expected revenue collection to flow through to improved budget outcomes by keeping spending relatively contained, points to a commitment to its fiscal strategy and is not likely to contribute to inflationary pressures in the economy.

We think the budget assumptions are reasonable and commodity price assumptions remain modest compared to our forecasts. Still, downside risks persist given the weak global outlook, elevated inflation and high interest rates

What does this mean for the years ahead?

By Daniel Ziffer

We can get very caught up in the urgency of now as we assess who's 'won' and 'lost' in the federal budget.

My colleague Gareth Hutchens has examined the broader themes of the budget, and what it means for the years and decades ahead. Check it out.

US debt ceiling debate weighs on Wall Street

By David Chau

Wall Street has posted moderate losses, and the negative sentiment is likely to weigh on Australian markets this morning.

Investors traded more cautiously ahead of a meeting between US President Joe Biden, Republican House Speaker Kevin McCarthy and other congressional leaders at the White House on Tuesday (local time), to discuss the debt ceiling stand-off.

The Dow Jones, S&P 500 and Nasdaq Composite fell by 0.2%, 0.5% and 0.6%, respectively.

Markets are waiting to hear the outcome of a meeting on Tuesday (local time) between US President Joe Biden,

Worries of a potential government default loom over Washington as early as June 1, if Congress does not act to resolve the deadlock.

The Democratic president is calling on lawmakers to raise the federal government's self-imposed borrowing limit without conditions.

But the Republican House speaker, Mr McCarthy, has said his chamber will not approve any deal that does not cut spending to address a growing budget deficit.

Past debt ceiling fights have typically ended with a hastily arranged agreement in the final hours of negotiations, thus avoiding a default.

In 2011, the scramble prompted a downgrade of the country's top-notch credit rating.

Veterans of that battle warn the current situation is even riskier because political divides have widened.

Economists warn a lengthy default could send the US economy into a deep recession with soaring unemployment, while destabilising the global financial system that's built on US bonds.

Full budget wrap in The Business

By Daniel Ziffer

Catch up on last night's comprehensive wrap of the federal budget with a special extended edition of The Business.

Small business owners, Finance Minister Katy Gallagher and our panel of experts pick apart the highlights and key themes revealed in the budget documents.

Market snapshot at 9am AEST

By David Chau

- ASX SPI futures: -0.3% at 7,235 points

- ASX 200 (Tuesday close): -0.2% at 7,264

- Australian dollar: flat at 67.6 US cents

- Dow Jones: -0.2% to 33,562 points

- S&P 500: -0.5% to 4,119

- Nasdaq Composite: -0.6% to 12,180

- Stoxx Europe 600: -0.3% to 465 points

- Spot gold: +0.1% to $US2,035 / ounce

- Brent crude: +0.3% to $US77.23 / barrel

- Iron ore: +1.5% to $US103.55 / tonne

- Bitcoin: -0.2% to $US27,593

Budget repair? "Missed opportunity" says former Treasury official

By Daniel Ziffer

A small and extremely rare surplus (spending less money than we make) has been banked by the federal government in its budget.

But a former Treasury official says the Treasurer has avoided what was an opportunity to pay down our debt — set to top $1 trillion — as we pay more on interest payments for it.

Hear more about it from my colleague Peter Ryan here.

ABC/Reuters