The ASX 200 followed Wall Street down on Thursday, and companies posted a mixed bag of results, including Megaport and AGL. Find out how the day unfolded on our live blog.

Disclaimer: This blog is not intended as investment advice.

Key events

To leave a comment on the blog, please log in or sign up for an ABC account.

Live updates

How we ended up at 4:30pm AEDT

By Emilia Terzon

- ASX 200: -0.5pc to 7,490 points

- All Ords: -0.6pc to 7,696 points

- Australian dollar: +0.5 at 69.22 US cents

- Dow Jones (close): -0.6% to 33,949 points

- S&P 500 (close): -1.1pc to 4,118 points

- Nasdaq (close): -1.7pc to 11,910 points

- Nikkei: -0.5pc to 27,460 points

- FTSE (close): +0.3pc to 7,885 points

- EuroStoxx 600 (close): +1.3pc to 459 points

- Brent crude: +1.4pc to $US85.04/barrel

- Spot gold: +0.2% to $US1,888/ounce

- Iron ore: +0.5% to $US121.55 a tonne

-

Bitcoin: -1.3% to $US22,836

AGL has its worst intraday trade in 15 years

By Emilia Terzon

The electricity provider AGL had a shocking day. (Dad joke).

According to Reuters, its shares tumbled 12% by mid-session on Thursday, which is its worst intraday trade since 2007.

It recovered some ground from there and finished down around 9 per cent.

This is all after it posted a $1b six month loss, off the back of plant outages and soaring supply costs.

UBS analysts called the trading update "a soft result with slower than expected pass-through of rising electricity prices".

Jefferies analysts called the results announcement "a very weak set of numbers".

You can read more about that backstory on this blog.

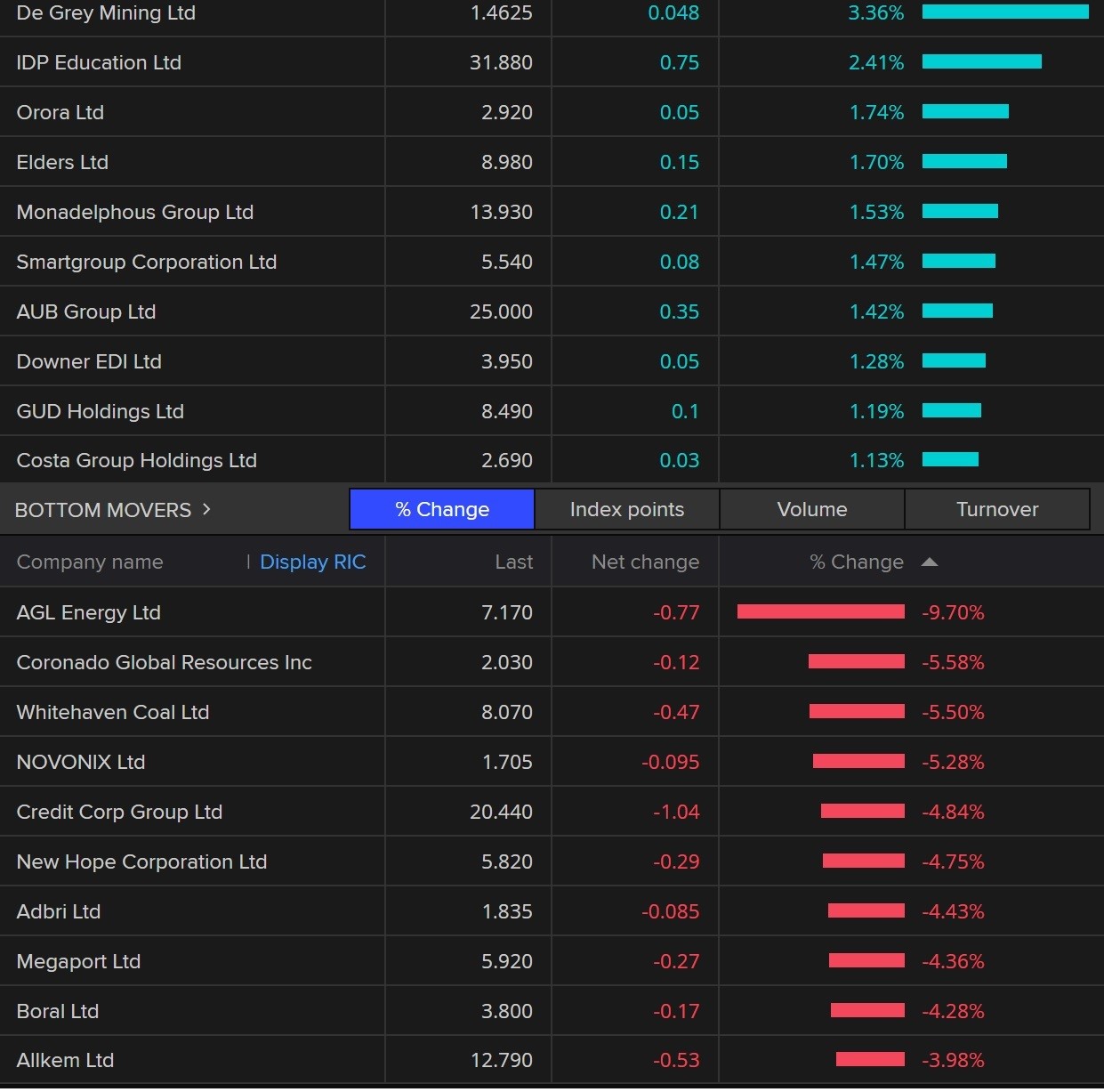

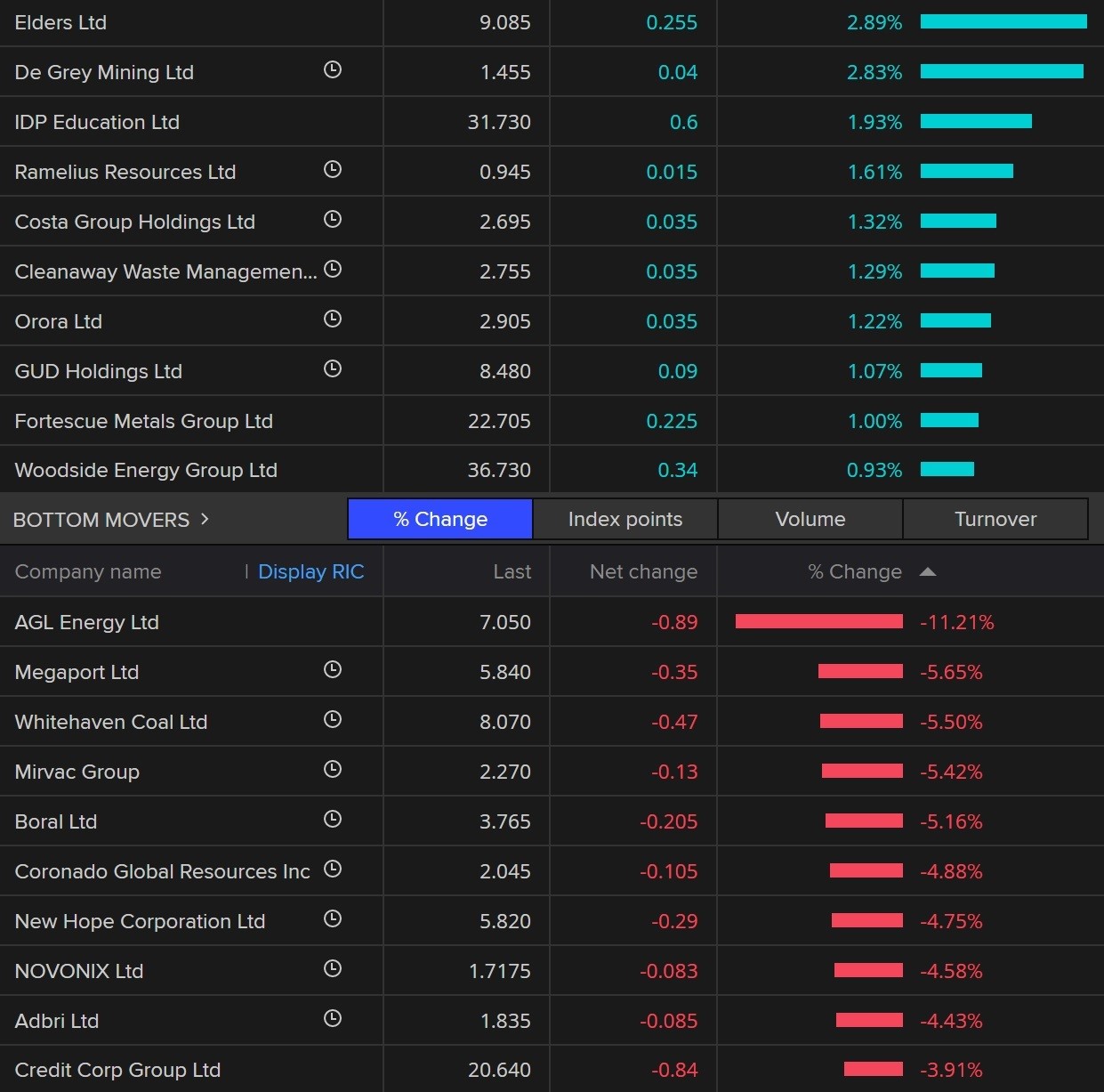

Meanwhile, the overall ASX 200 has closed down around 0.5 per cent. AGL was its biggest loser, but there were others too!

We haven't chatted about Elders today.

It's one of the gainers today as investors buy back stock after it lost a lot of ground this week.

The agribusiness' CEO has been speaking to journalists at another publication, and they say the initial sell off happened after inoccouous comments at investor briefings about cattle prices.

I guess that puts the stock in cattle?

Anyways, I'll get out of here before I make you listen to anymore bad jokes. We'll be back here again tomorrow.

Miners and finance dragging down ASX 200

By Emilia Terzon

The losses are getting deeper on the ASX 200 and we have 10 out of 11 of the sectors in the red.

Export reliant miners are down the most at 0.6%. That is as iron ore prices swing around while investors reassess near-term demand prospects in top steel producer China.

Sector major BHP Group, Rio Tinto and Fortescue Metals fell between 0.5% and 0.8%.

Financials are off 0.3%. You can read below in this blog about how all of the Big Four have now hiked their interest rates on variable home loans (and some deposits) after the RBA's decision on Tuesday to raise by 0.25 per cent to 3.35.

AGL is still the biggest loser after it's $1b loss announced today.

Google's bot Bard make a boo boo, and other reasons why Alphabet is down today

By Emilia Terzon

So Google's owner closed down 7.7 per cent on Wall Street.

It's not the worst Alphabet Inc has seen in recent months.

That low point down in November was as the tech sector in general was really starting to feel global recession concerns.

But anyways, back to today's dump.

In good news for humans, it appears to be linked to Alphabet's new AI program not being quite smart enough (yet).

It just premiered "Bard" as hype surrounded rival AI program ChapGPT, which is partnering with Google's rival Microsoft.

Well, Bard made a bad.

In an advertisement for Bard, the bot is asked: "What new discoveries from the James Webb Space Telescope can I tell my 9-year-old about?"

It got it wrong. Not that we'd know the answer, either.

You can find out what Bard answered to the question, and which answer NASA is rebuking, in this ABC News story.

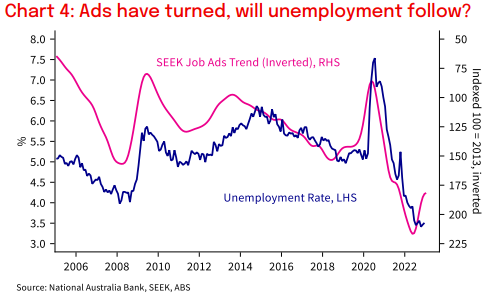

New year, new job? Advertisements rose in January for the first time in eight months

By Rachel Pupazzoni

Hello, Rachel Pupazzoni jumping in with some news on the jobs front!

Businesses were in hiring mode in January.

The monthly NAB Seek job ads report shows a 2.8 per cent increase in the number of roles being advertised in the first month of this year.

It 's the first increase in job ads after seven months in a row of falls.

Check out this chart showing the jump in pink. The blue line shows the unemployment rate, which is currently 3.5 per cent.

We'll get the latest snapshot of employment figures and see if there's been any change to the unemployment rate, next week.

NAB economist Taylor Nugent said is appears the labour market is normalising.

He noted he'll be watching the data closely in coming months, pointing out that seasonal adjustment challenges (start of a new year, summer holidays, Christmas casuals) added a source of uncertainty at this time of year.

"The earlier rapid normalisation was likely driven by a combination of normalising labour supply as migrants, students and backpackers return to Australia as well as less extreme labour demand as the post-pandemic employment recovery matured."

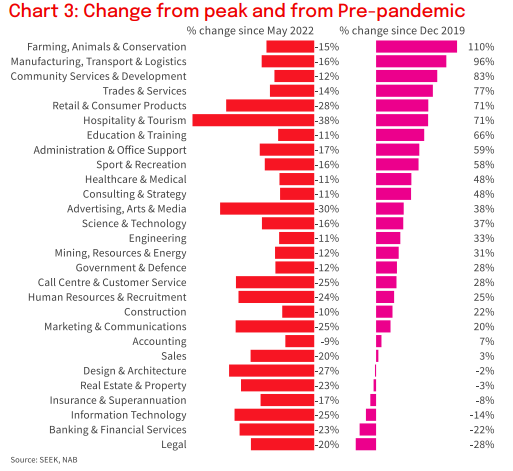

Job Ads on Seek are 39 per cent higher than pre-pandemic December 2019 levels and show labour demand is still strong.

The biggest jump in job ads in January was in Tasmania (up 8.5 per cent), the smallest increase was in Victoria (up 1.5 per cent).

White collar industries saw the biggest ad increases:

- Architecture and Design: up 11.2 per cent

- Consulting and Strategy: up 8.4 per cent

-

Accounting: up 7.6 per cent

-

HR and Recruitment: up 5.5 per cent

NAB forecasts the unemployment rate will move toward 4 per cent by the end of 2023.

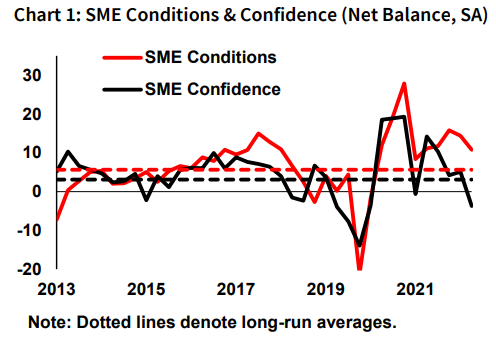

While we're speaking of NAB - they've also released their quarterly survey of small and medium businesses, which reveals conditions eased in the last three months of 2022, though they're still above their long-run average.

Business conditions fell three points to +11 index points (the long-run average is +6).

But confidence fell into negative territory, as cost pressures and price growth remain high.

Confidence fell nine points to be in negative territory at -4 index points.

The fall in confidence was seen across the board with SMEs of all sizes recording negative confidence readings.

NAB chief economist Alan Oster said in a statement:

"Confidence fell in Q4 across our surveys, with concerns about the global economy, rate rises and high inflation weighing on the outlook.

"Supply chain issues and labour shortages remained a pressing concern for SMEs in Q4.

"Like larger firms, there was some evidence that cost pressures were easing late in the year, but price growth remained very elevated."

Why the the RBA's cash rate should be above 4 per cent, according to Deutsche Bank

By Michael Janda

Deutsche Bank's local economist Phil ODonaghoe sparked a bit of a kerfuffle last week when suggesting that the RBA should raise its cash rate target above 4 per cent.

As of Tuesday, it stands at 3.35 per cent, so that would mean at least another three rate rises.

He put another note out today explaining his reasoning in more detail.

Odonaghoe used something called the "Taylor rule" — named after the economist who came up with it — to calculate that the cash rate should be around 4.5 per cent.

However, Deutsche Bank's current forecast is below that, at 4.1 per cent, because:

"We are still worried about the impact on household cash flows from the unprecedented shock to financial obligations from the RBA's aggressive hiking cycle, and what that might mean for consumption.

"But our sense is, since December, the economy has proven more resilient than we (and we suspect the RBA) had expected."

He says Australia continues to lag behind some other central banks in its interest rate response to inflation.

"What struck us was what the rule had to say about the RBA cash rate relative to same formula applied to the Federal Reserve.

"Where the rule prescribed a change in Fed funds of 'only' +25bps [basis points] (from pre February FOMC levels), the same formulation sought a change in the RBA cash rate of +150bps [+1.5 percentage points] (from pre February RBA meeting levels)."

How well the Taylor rule accounts for the imminent reset of hundreds of thousands of fixed mortgages at interest rates more than double what borrowers have become accustomed to paying we will find out over the course of 2023 and 2024…

My colleague David Taylor wrote this piece earlier this week analysing the reaction to Odonaghoe's original note from last week.

Here is where we're sitting at 12pm AEDT

By Emilia Terzon

- ASX 200: -0.2pc to 7,515 points

- All Ords: -0.2pc to 7,722 points

- Australian dollar: +0.5 at 69.22 US cents

- Dow Jones (close): -0.6% to 33,949 points

- S&P 500 (close): -1.1pc to 4,118 points

- Nasdaq (close): -1.7pc to 11,910 points

- Nikkei: -0.5pc to 27,460 points

- FTSE (close): +0.3pc to 7,885 points

- EuroStoxx 600 (close): +1.3pc to 459 points

- Brent crude: +1.4pc to $US85.04/barrel

- Spot gold: +0.2% to $US1,888/ounce

- Iron ore: +0.5% to $US121.55 a tonne

-

Bitcoin: -1.3% to $US22,836

All of the big four banks passing on latest rate hike

By Emilia Terzon

Like a deck of cards.

ANZ and NAB had already annouced on Tuesday that they were passing on the RBA's latest rate hike of 0.25 per cent to people with variable home loans.

CBA and Westpac made us sweat it out two days.

As well as passing on the hike to homeowners, CBA says it's also going to raise deposit rates on some of its products, GoalSaver and YouthSaver.

And Westpac is doing this for eSaver and Westpac Life.

Here is an explainer we had on ABC News on rates day with Sally Tindal from RatesCity.

She says on a $500,000 homeloan, you are now paying $908 more a month than before the rate hikes (all nine of them) started back in May last year.

That is, of course, if you were unlucky enough to have been on variable loan during this rocky period. We know many are on fixed and soon they'll be facing this cliff...

ASX 200 opens down with AGL the top loser

By Emilia Terzon

Shareholders won't be enjoying AGL's results today.

The power retailer is down almost 8 per cent on its half year earnings results. (More on what they say in posts below.)

Meanwhile, Megaport is the top gaining stock so far, after the tech company posted it's half year earnings too.

What's behind AGL's billion dollar loss?

By Michael Janda

AGL posted a $1.075 billion statutory loss, but an $87 million "underlying profit", what's the difference you may ask?

The so-called statutory result is the one that complies with internationally accepted legal accounting standards — that's why it's always the figure we on the ABC News business team report first and foremost.

The underlying figure is one devised between a company and its accountants. That doesn't mean it's wrong or misleading — companies generally say it's designed to give shareholders a better picture of how the business is performing.

The reason is that the underlying figure generally excludes "one-offs", especially things like asset value changes.

In AGL's case this half-year there were two major groups of one-off losses.

The first was a dramatic billion-dollar write-down in the value of its coal-fired power stations in light of its plan to shut some of them earlier than previously planned.

The second was a "a decrease in the fair value of energy-related derivatives of $869 million".

This relates mainly to a practice called "hedging".

Companies that are exposed to more volatile markets often lock in prices in advance to avoid any nasty surprises.

In this case, AGL has locked in various energy supply contracts at higher prices that subsequently fell, especially after the energy regulator's wholesale electricity market intervention and the government's gas price cap.

It has previously benefited by locking in lower prices before sudden spikes up, so it's a case of swings and roundabouts for the company and one reason why it focuses on underlying profit as a better measure of its ongoing business performance.

The bad news for AGL was that its underlying profit also slumped 55 per cent and was nearly half the average analyst forecast.

The 8 cents per share dividend was also about half of what most analysts expected.

Barrenjoey analyst Dale Koenders summed it up in his quick initial reaction.

"Misses market on lower EBITDA [earnings before interest, tax, depreciation and amortisation] and NPAT [net profit after tax] level. FY23 [financial year 2023] guidance narrowed lower, FY24 outlook appears less positive."

No wonder its share price was thumped 7.2 per cent to sit at $7.37 in the first half hour of trade.

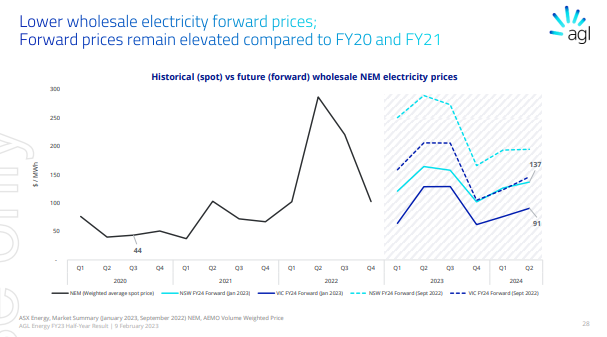

Although RBC analyst Gordon Ramsay is a little more upbeat.

"AGL continues to have a positive outlook for the period beyond FY23 from the capture of higher wholesale electricity pricing in FY24 and FY25 in comparison to historical C&I contract positions locked in 2-3 years ago.

"AGL further expects higher sustained wholesale electricity prices to deliver improved retail pricing outcomes."

(Not this Gordon Ramsay).

And speaking of gas.... #ICYMI

By Emilia Terzon

Here's a story my colleage Rhiana Whitson had on ABC's The Business last night.

And the online write-up with more detail.

AGL takes a $1b hit and flags power bill increases

By Emilia Terzon

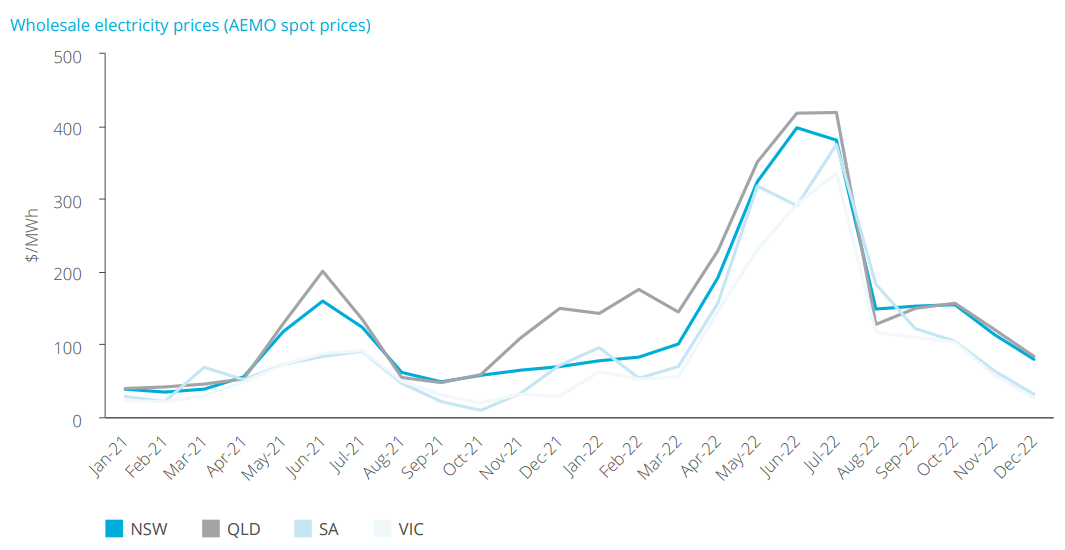

Australia's biggest power company has reported a statutory loss of more than $1b.

This was after AGL booked substantial losses on financial instruments and had a large write-down in the value of their coal-fired power stations.

AGL's given us a nice reminder of how much prices surged last year:

Despite a recent slump in wholesale power prices, AGL is flagging further power bill pain ahead for its customers.

It's also flagged higher power bills:

AGL's practice of resetting prices to consumer customers annually on a rolling forward curve and recontracting C&I and derivatives on a two to three year forward time frame, means the current higher prices will translate into higher contracted prices in the future.

And there's this line:

"sustained periods of higher wholesale electricity prices are expected to flow through to retail pricing outcomes"

It's also noted that total wholesale gas costs were up just 9.4 per cent, "largely driven by international events impacting gas prices, partly offset by lower haulage costs".

Overall, it's consumer gas gross margin was up 16.5 per cent, "driven by favourable price changes, partly offset by lower average demand due to change in customer behaviour".

ASX to follow US as Alphabet's stock declines on AI

By Emilia Terzon

Good morning!

Sorry to sound like a broken record but we have rate hikes dominating markets again this morning. Are you over it yet?

US markets are down as FOMC officials reiterate Fed chair Jerome Powell's comments this week that more rate hikes will be needed to tame inflation. Some are even saying that hitting around 5 per cent is a possibilty.

For further a glimmer of what could happen, markets will be watching US jobless data (their unemployment figures) out around 12:30am AEDT. If they stay near 2022 lows, it'll be more ammunition to keep raising rates.

Meanwhile, we've got more tech layoffs in the US. Ipek Ozkardeskaya at Swissquote Bank says the "good news" is that the losses of 8,000 combined at Dell and Zoom will probably not impact the jobs data.

And speaking of tech, there's an interesting story in Google's Alphabet today. After leaks to the media, it officially premiered it's new AI search feature "Bard" which is essentially its new rival to the talk of the town, ChatGPT, partnered with Microsoft.

Markets aren't liking Alphabet's pitch. Its stock is down 7.6 per cent. Which is far lower than the overall Nasdaq index.

We'll be here all morning. Grab a coffee.

Where we are sitting at 7:30am AEDT

By Emilia Terzon

- ASX 200 futures: -0.5pc to 7,421 points

- Australian dollar: +0.5 at 69.22 US cents

- Dow Jones: -0.6% to 33,950 points

- S&P 500: -1.1pc to 4,119 points

- Nasdaq: -1.7pc to 11,888

- FTSE (close): +0.3pc to 7,885 points

- EuroStoxx 600 (close): +1.3pc to 459 points

- Brent crude: +1.4pc to $US85.04/barrel

- Spot gold: +0.2% to $US1,888/ounce

- Iron ore: +0.5% to $US121.55 a tonne

- Bitcoin: -1.3% to $US22,836