Rio Tinto has confirmed that employee data stolen in last month's cyber hack through third-party file transfer service GoAnywhere has been posted on the dark web.

Earlier, RBA governor Philip Lowe told the National Press Club it was "way too early" to discuss potential interest rate cuts, while the Australian share market closed slightly higher.

Look back at the day's financial news and insights from our specialist business reporters as they happened with our blog.

Disclaimer: This blog is not intended as investment advice.

Key events

Live updates

How the market finished at 4:20pm AEST

By Kate Ainsworth

- ASX 200 : +0.02% to 7,237 points

- All Ords: +0.04% to 7,434 points

- Australian dollar: -0.33% to 67.28 US cents

- Dow Jones: -0.59% to 33,402 points

- S&P 500: -0.58% to 4,100 points

- Nasdaq: -0.52% to 12,126 points

- FTSE: -0.5%to 7,634 points

- EuroStoxx: +0.1% to 4,351 points

- Spot gold: +0.2% at $US2,024.19/ounce

- Brent crude: +0.39% at $US85.26/barrel

- Iron ore: -1.7% to $US118.75 a tonne

- Bitcoin: +1.02% at $US28,551

NAB now believes interest rates have peaked

By Michael Janda

Butting in with a late breaking post.

NAB's economics team has just changed its interest rate forecast for the third time this year … back to where it was at the start of the year.

The bank's economists now believe the cash rate has peaked at 3.6 per cent, although they say there is still the risk of one more rate rise in either May or June if economic data remains reasonably robust.

However, if the RBA hasn't got around to that increase by early June, then NAB expects that economic events will overtake the central bank.

"In our view, waiting for more than a few months would see the RBA overrun by slowing consumption data and a deteriorating labour market outlook meaning the RBA will remain on hold as inflation moderates."

NAB's peak cash rate forecasts have yo-yoed from 3.6 per cent at the start of this year, to 4.1 per cent in mid-February, back down to 3.85 per cent last week and now 3.6 per cent.

Today's change in the forecast is driven by yesterday's decision from the RBA to hold rates steady for the first time since a year earlier, along with Philip Lowe's speech today explaining that call, which I cover in more detail here:

ASX finishes slightly higher, led by industrial gains

By Kate Ainsworth

The ASX finished the day of trading slightly higher, up 0.02% to 7,237 points.

It was a mixed day for sectors, with industrials, healthcare and technology gaining slightly (up 0.97%, 0.79% and 0.53% respectively).

Core Lithium was the top mover of the day, gaining 8.39% thanks to its first shipment of materials heading to China.

Meanwhile the academic and educational services sector shed the most during trade, down 1.89%.

Magellan Financial Group suffered the biggest drop, down 4.75% due to its net outflows of $3.9 billion in March, compared to $0.8 billion in February.

Whitehaven Coal also ended the trading day lower, down 3.71%.

And that brings the market blog to a close for another day — thanks for following along.

We'll be back to do it all again bright and early tomorrow.

Watch: Porter Davis homes in limbo

By Kate Ainsworth

In the flurry of the RBA's interest rate decision yesterday, administrators held the first creditors meeting for the collapsed home builder Porter Davis.

Liquidators have told home buyers they're hopeful of finding a buyer, but customers in the early stages of construction have likely lost their deposits.

You can watch the full report from Melbourne reporter Elise Kinsella below:

Online retailer Book Depository to close after 20 years

By Kate Ainsworth

I come with bad news for book worms — the Book Depository has announced it's shutting its (virtual) doors later this month, after its parent company Amazon flagged "role eliminations".

The international retailer, based in the UK, will close by April 26, but will provide support for any order issues until June 23.

As for why Book Depository is closing? The company's announcement didn't give a reason, but last month Amazon CEO said the company was planning to cut around 27,000 jobs — but didn't say how many of those were from Book Depository.

Want to know more? Dannielle Maguire has you covered:

Rio Tinto confirms stolen employee data posted online

By Kate Ainsworth

Rio Tinto has confirmed data stolen during a security incident last month has been posted online by the cyber criminal group responsible for the hack.

Last month Rio Tinto disclosed that personal data from former and current employees had been stolen by a cyber criminal group which had hacked Fortra's GoAnywhere, a cloud-based product that manages file transfers.

At the time, Rio Tinto said payroll information, such as pay slips and overpayment letters that belonged to a small number of employees from January 2023 had possibly been seized by the group.

Now, Rio Tinto has confirmed that stolen data has been released onto the dark web by the cyber criminal group.

"Data the criminal group has stolen includes the personal information of a small number of current and former Rio Tinto employees," a spokesperson for the company told the ABC.

"At Rio Tinto, the safety of our people is our top priority, and that includes cyber safety. We recognise that this may be distressing and express our sincere apologies to everyone who has been affected.

"We have contacted all impacted employees to provide them with information about the stolen data and offer our full support, including connecting them with a list of services available to safeguard their online identity."

It's unclear the number of employees, past and present, who have been impacted by the breach.

Here's how the market looks at 2:25pm AEST

By Kate Ainsworth

- ASX 200 : -0.1% to 7,229 points

- All Ords: -0.1% to 7,424 points

- Australian dollar: -0.06% to 67.47 US cents

- Dow Jones: -0.59% to 33,402 points

- S&P 500: -0.58% to 4,100 points

- Nasdaq: -0.52% to 12,126 points

- FTSE: -0.5%to 7,634 points

- EuroStoxx: +0.1% to 4,351 points

- Spot gold: +0.13% at $US2,022.65/ounce

- Brent crude: +0.49% at $US85.36/barrel

- Iron ore: -1.7% to $US118.75 a tonne

- Bitcoin: +0.97% at $US28,533

On the "per capita recession"

By Gareth Hutchens

Just a note on that point in Philip Lowe's Q&A, where he was asked about the falling rate of economic growth per person in Australia.

Dr Lowe didn't want to entertain the expression "per capita recession."

But it is useful to think about the concept.

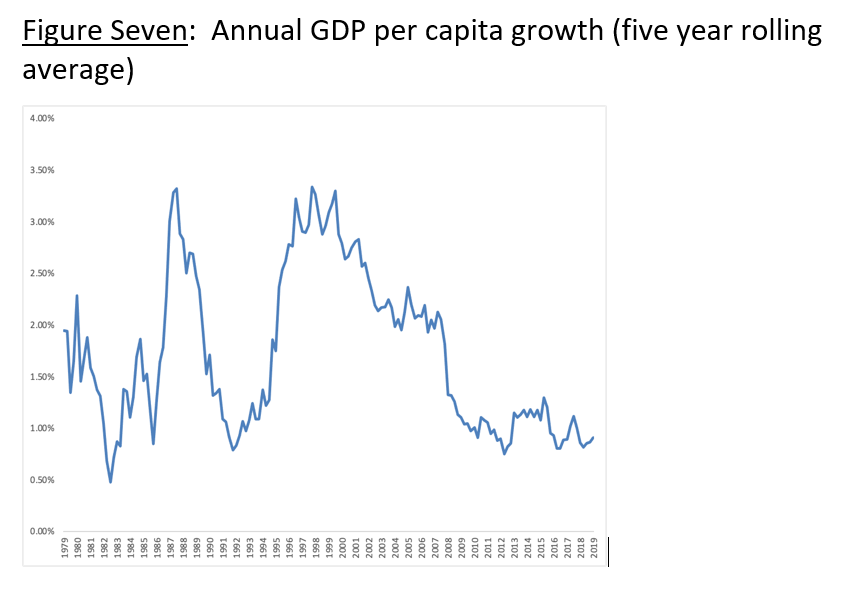

A couple of weeks ago, Dr Ken Henry (a former Treasury secretary) delivered a speech to the Tax Institute in which he explained why Australia's economy has experienced such low productivity growth and wages growth in the 21st century.

He dedicated some of that speech to talking about the economy in per capita terms.

And he said in the entire decade pre-COVID, Australia recorded the sort of growth rates per person that were only previously recorded in recessions.

That's before we were hit by COVID and experienced this surge in inflation.

He showed this graph to the audience:

And here's what he had to say about it:

"For many years prior to the pandemic, the Australian economy had been performing poorly.

"Figure Seven provides the five-year average rate of growth in real GDP per capita over four decades, commencing at the end of 1979, through to the end of 2019, immediately pre-COVID.

"The chart clearly shows that, before the onset of the pandemic, GDP per capita growth had been weak for many years.

"More than that, it had been in trend decline for two decades.

"The recessions of the early 1980s and 1990s stand out clearly in the chart. By the middle of the first decade of the 21st century, GDP per capita growth appeared to have settled at around 2 to 2 ¼ per cent a year.

"But then the global financial crisis hit. And growth hasn’t recovered.

"In the entire decade pre-COVID we recorded the sort of growth rates only previously recorded in recessions.

"COVID has made this record a lot worse, of course. And yet, in recent years, you would have had no end of politicians and commentators wanting to tell you how strongly the Australian economy has been performing."

That was before COVID hit Australia.

Would many of those long-term trends still be in play right now? Dr Henry thinks they are.

That's it for Philip Lowe's address at the National Press Club

By Kate Ainsworth

Well, where did that hour go?!

There was a lot in Mr Lowe's address, and plenty more in the questions he was asked afterwards.

What stood out to you? How are you feeling now about your mortgage and the economy? Is there something you wish he touched on? What else would you like to know?

Let us know by using the big blue comment button up top.

(And thank you to those who have sent questions and comments through — we see you!)

What lessons can Australia learn from the US and Europe banking crisis?

By Kate Ainsworth

A little shift away from questions about the economy — Philip Lowe has just been asked whether there are any lessons for Australian banks in light of the banking crisis in North America and Europe.

Mr Lowe says there a few issues that he thinks need to be looked at globally, not necessarily in Australia.

"The first is how do we deal with the situation that bank runs can occur electronically and instantaneously?" he says.

"Previously bank runs people had to line up at the ATM or the branch and the money got taken out.

"But bank runs can occur much more quickly and in larger volumes. So what do we do, how should we think about bank liquidity and what are the regulatory responses to that?

"Another issue that's coming up is the need for banks to hold capital against the interest rate risk they hold.

"it's worth taking a look at the design of the deposit insurance schemes again. In the US, they discovered, which is something that I already knew — that failures of mid-sized banks would be quickly systemic and then they had to kind of backtrack on, on their planned response.

"Another issue that's been discussed a lot is the operation of single-name credit default swap markets. Those markets are very liquid and just one or two trades can move the price and the financial media, particularly in Europe.

"The most important, this is one we do well in Australia, is making sure the supervisor does first rate supervision.

"It's not about lack of regulations but about supervision, APRA again is a world leader on that front, so there's a lot of issues floating around in the international sphere."

Lowe refuses to entertain the idea of a 'per capita recession'

By Kate Ainsworth

Michael Pascoe from The New Daily has asked Philip Lowe about a section of his speech that notes household per capita consumption will be negative for at least two quarters.

Lowe acknowledged that per capita household consumptions is trending down and that the RBA would publish an update to its financial stability review soon.

But when asked to clarify if that meant there would be a technical per capita recession, Lowe said he wouldn't use that language, but said growth would be slower.

"I don't like using that language, but ... our last set of forecast growth, economic growth, around 1.5%. Population growth probably close to 2," he said.

Lowe was then pressed by NPC chair Laura Tingle on whether that growth suggested a per capita recession.

"They're both forecasts ... One of the issues we're going to have to work through with our next set of forecasts is how does the stronger population growth flow through to consumption, investment spending, because that's been a big change and, you know, our last set of forecasts we thought population growth would be much slower," he said.

"We have to spend some time working out what are the implications of that."

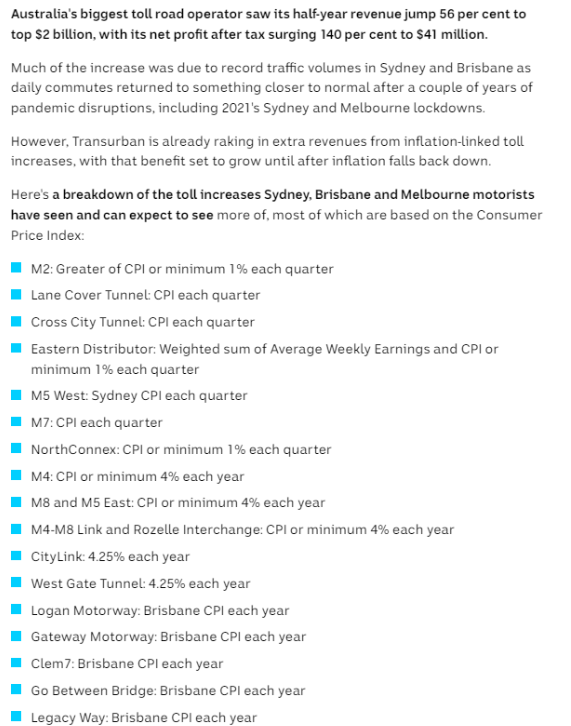

Do rate rises add to inflation?

By Gareth Hutchens

Question: would interest rate rises (increases to cost of money) just to add to inflationary pressures?

- Rod

In some ways they do, and Dr Lowe mentioned one in his speech.

For example, as interest rates increase, many landlords will raise rents to try to cover their increased rate costs, and we've seen that happening in this rate hike cycle.

This is what Dr Lowe noted in his speech: "As rents make up 6 per cent of the CPI, what happens [in the housing market] can have a significant influence on overall inflation."

But here's another thing to think about.

There are lots of prices in the economy that are deliberately indexed to CPI (the consumer price index), so they'll increase whenever inflation increases, which then feeds back into higher inflation (and higher and higher we go).

One example is the tolls on toll roads.

We talked about this a little bit on the blog during profit reporting season earlier this year.

Here's a screenshot of that conversation:

Lowe says corporate profits 'not the source' of inflation

By Kate Ainsworth

There has been plenty of discussion leading up to today's address about whether corporate profits have been the culprit of high inflation.

Philip Lowe was just asked about this, but he says that corporate profits are not to blame.

"Rising profits are not the source of the inflation we have. Outside the resources sector, the share of national income that goes to profits is basically unchanged," he says.

"I think what has been happening is demand is strong enough to allow firms to pass on the higher input costs into prices so the firms have not suffered at a decline in their profits as their costs have gone up with the exception, I think, of the construction sector.

"But most sectors have been able to pass on the higher input costs into higher prices an kept their profit margins the same.

"So rising profits as a share of national income is not the source of inflation, it's the supply side issues and the strong demand in parts of the economy because of the pandemic response.

"That's our interpretation of the data and we looked at this very carefully.

It is 'way too early' to discuss when rates will be cut, Lowe says

By Kate Ainsworth

Philip Lowe just said future rises might be on the table, but what about at the other end of things? When might we see cuts?

There's no crystal ball unfortunately, and Mr Lowe says it is far too soon for us to be having that conversation.

"I do think it's too soon to talk about interest rate cuts," he says.

"We've got the highest inflation rate in 30 years. The lowest unemployment rate in 50 years, and still two years before we get inflation back to the top of the target range.

"So I think it's too early, way too early, to be talking about interest rate cuts and the balance of risk like further rate rises, but it will depend upon the data."

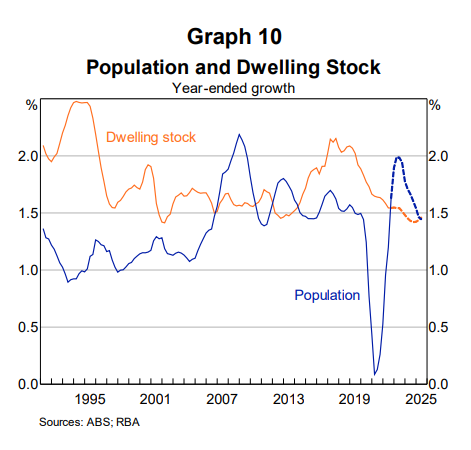

It takes times for housing supply to adjust to surges in population

By Gareth Hutchens

Back to his speech for a moment.

Dr Lowe said there's a lot going on in Australia's housing markets at the moment, with immigration picking up sharply and peoples' housing preferences still adjusting to a post-pandemic world.

He said population growth had picked up sharply and it now seemed likely that the annual rate of population growth would soon be around 2 per cent, which would be close to the peak reached during the resources boom.

But, in contrast, the expansion in the supply side of the housing market was expected to be "fairly modest."

"It takes a long time for housing supply to respond fully to shifts in population growth – in the previous episode of strong population growth, it took around five years," he said.

He supplied the below graph, which compares the growth rate for dwelling stock to the growth rate for population.

You can see how population growth has rebounded sharply from those record lows it hit in the pandemic.

The dash-lines to the right of the graph show his forecasts for population growth and dwelling stock.

Those forecasts suggest the growth rate of dwelling stock will even decline a little from here before slowing picking up again.

What would be the trigger for the RBA to lift rates again?

By Kate Ainsworth

Here's what governor Philip Lowe just told Stella Qiu from Reuters.

"At our next meetings we'll have a new set of forecasts, we'll have an updated inflation reading, and regular flow on the monthly data on the labour market and sentiment and household spending," he says.

"So we'll take all that together and if we decide that we need higher interest rates to get inflation back to target over the next couple of years, that will be the trigger.

"At the moment, we think we may well have to increase interest rates again, but we're not 100% certain of that. And the flow of data from month-to-month will determine whether we need to move higher."

Why is the RBA pausing on rates when other central banks are pushing them up?

By Kate Ainsworth

Tom Dusevic from The Australian has just put that question to Philip Lowe.

He says there's a few different reasons why:

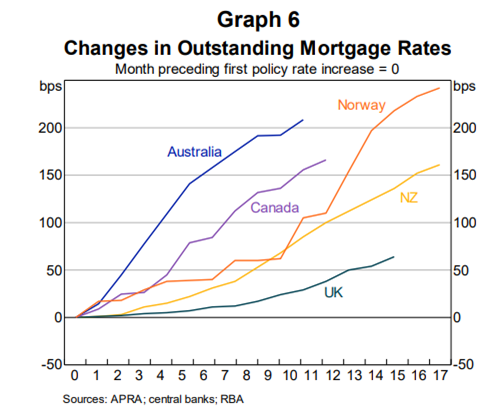

"One is that wages growth here hasn't picked up to the same rate as it has in some other countries, particularly in North America. Wages growth in aggregate at the moment, maybe 3.5%," he says.

"In Canada and US it's maybe 4.5, 5%, and in some European countries it's picked up as well. So we got lower wages growth which allows us to be a bit slower with raising interest rates. I think the other factor is that we have all this variable rate debt.

"As I showed in one of my graphs, the increase in the average mortgage rate that Australians pay has been faster and larger than elsewhere around the world. We expect that one would have a subduing effect on household consumption.

"A third one is that the Reserve Bank board is prepared to have a slightly slower return of inflation to target than some other Central Banks. Our last set of forecasts have inflation returning to target by mid-2025.

"Some other Central Banks are getting inflation back down more quickly. We have discussed that in our board meetings. Whether it's beneficial to get inflation back down to 3% a year earlier, there's argument for that, but it would mean job losses, more job losses.

"Our judgement at the moment is that if we can get inflation back to 3% by mid-2025, and preserve many of those job gains that had been delivered in the last few years, that's a better outcome than getting inflation back to 3% one year earlier and having more job losses."

'We face a challenging environment, but Australia is better placed than many countries'

By Kate Ainsworth

Philip Lowe's speech is coming to an end now.

He finishes by saying although we have challenges ahead of us, Australia is well placed to navigate them.

"Our banking system is strong. We have the lowest unemployment rate in decades. The prices of many of our exports are very high. And many households saved a lot of extra money during the pandemic, he says.

"These are all positives for our economy.

"At the same time, many households are feeling a painful squeeze on their budgets, inflation is also too high, although it is now coming down due to both a resolution of some supply side problems and the effects of the RBA's earlier tightening of monetary policy.

"This month, the board decided to hold the cash rate steady after increasing interest rates at the previous 10 meetings. This will provide more time to assess how the various influences on the economy are balancing out.

"At our next meeting, we will again review the monetary policy with the benefit of an updated set of forecasts and an updated set of scenarios."

Is a return to sharehousing the answer to soaring rents? Lowe says it's possible

By Kate Ainsworth

Mr Lowe says the RBA board is also closely looking at the balance of supply and demand in the housing market.

"As rents make up 6% of the CPI, what happens here can have a significant influence on overall inflation," Mr Lowe says.

He says the growth in the number of dwellings in Australia exceeded growth in population until recently, when international borders reopened.

Despite this, there has only been a modest increase to the rental vacancy rate, as people sought bigger homes and reduced their household size during the pandemic.

But Mr Lowe says there could be a return to the sharehouse.

"One possible adjustment over the next short period of time is that the average number of people living in each dwelling might increase reversing the pandemic period for," he says.

"If that were to happen, it would reduce overall demand for new dwellings.

"But even if it were to happen, it's likely that the balance between demand and supply in the housing market will result in rent inflation being quite high for a while yet.

"And this will be one of the factors adding to inflation over the period ahead."

Why increases in mortgage rates are hitting Australian households so heavily

By Gareth Hutchens

RBA governor Philip Lowe has made an important point about rate increases.

He said due to the peculiar institutional arrangements and bank practices in Australia, where so many households with mortgages are sitting on variable rates (rather than fixed rates, like in so many other countries), it means the RBA's rate increases hit Australian households much harder and faster than in other countries.

"Since interest rates started rising, the average mortgage rate that Australians pay has increased more quickly than average mortgage rates paid in other countries," he said.

"This increase in mortgage rates has had a significant effect on household budgets and we anticipate that required mortgage payments will reach a new record high of almost 10 per cent of household disposable income by the end of next year."

He included this graph in his presentation.

It shows how much faster mortgage rates have increased for Australian households compared to households in other countries.