After posting a weekly fall, the Australian share market jumped at the start of trading ahead of inflation data and the RBA governor speaking this week.

The positive mood on markets followed an "agreement in principle" on US debt ceiling talks. Meanwhile, embattled consulting firm PwC stood down nine partners over its tax scandal.

Look back at the day's financial news and insights from our specialist business reporters on our blog.

Disclaimer: this blog is not intended as investment advice.

Key events

Live updates

Market snapshot at 4:25pm AEST

By Kate Ainsworth

- ASX 200: +0.9% to 7,217 points

- All Ordinaries: +0.7% to 7,395 points

- Australian dollar: +0.5% to 65.50US cents

- Nikkei: +1% to 31,233 points

- Hang Seng: -0.8% at 18,599 points

- Shanghai: +0.3% to 3,220 points

- S&P 500 (Friday): +1.3% to 4,205 points

- Nasdaq (Friday): +2.2% to 12,975 points

- FTSE (Friday): +0.7% to 7,627 points

- EuroStoxx (Friday): +1.2% to 461 points

- Spot gold: +0.1% to $US1,948/ounce

- Brent crude: +0.5% to $US77.32/barrel

- Iron ore (Friday): +5.9% to $US101.30/tonne

- Bitcoin: +4.7% to $US28,009

ASX finishes Monday trade 0.9pc higher on US economy optimism

By Kate Ainsworth

The Australian share market has finished higher today, gaining nearly a full per cent at market close.

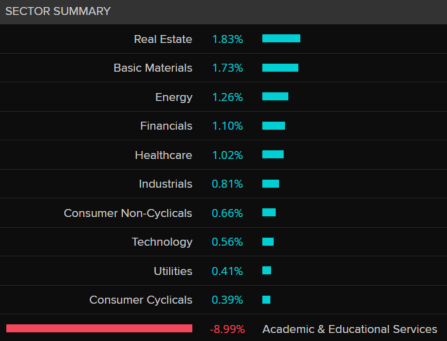

The buoyant finish is largely thanks to gains in real estate and financials, coupled with fresh optimism out of the US after a debt ceiling deal was reached.

But it wasn't all rosy on the markets — especially for the academic and educational services sector, which was down 15.9% (yes, you read that correctly).

That's because of IDP Education, which has spooked investors after changes in Canada that will mean it won't be the only provider for English language proficiency tests for student visa holders.

The top five winners for Monday were:

- BrainChip Holdings +4.7%

- Charter Hall Social Infrastructure REIT +4.55

- Syrah Resources +4.1%

- Lynas Rare Earth +3.8%

- Cromwell Property Group +3.7%

And the bottom five worst performers for the day:

- IDP Education -15.9%

- Telix Pharmaceuticals -6.1%

- ALS -4.2%

- Polynovo -3.9%

- Megaport -3.8%

Elsewhere, the Nikkei has continued its strong performance after hitting a three-decade high, while Bitcoin has continued to gain ground.

That brings Monday's markets blog to a close — thanks for your company.

We'll be back to do it again tomorrow, but until then you can catch up on Tuesday's developments below, or download the ABC News app and subscribe to our range of news alerts for the latest news.

Why are IDP Education shares slumping?

By Stephanie Chalmers

Shares in IDP Education are down around 14 per cent and it's been the worst performer among the top 200 since early trade, leaving education the only sector in the red.

Given the big move and the number of shares being traded, the ASX issued a please explain and now IDP has responded.

It turns out investors have been spooked by some changes in Canada, which will mean IDP will have competition when it comes to providing English language proficiency tests for student visa holders.

Immigration, Refugees and Citizenship Canada will now recognise additional providers of the test for a visa scheme that allows priority student visa processing for students from some countries.

Previously a test administered by IDP and the British Council had been the only recognised test.

The company says it shouldn't have a material impact on its earnings or revenue.

But it's certainly having a pretty big impact on the stock this session.

Rain hasn't dampened gold's glitter

By Rachel Pupazzoni

Hello, Rachel Pupazzoni jumping in with a little gold update for you.

Australia's gold production slumped in the first three months of this year, but with the price for the yellow metal at record highs, it's not all bad news.

Analysis by Surbiton Associates reveals Australian gold mines produced 72 tonnes of gold in the three months to the end of April - down 6 tonnes, or 8%, on the December quarter.

Gold analyst Dr Sandra Close said it's because of bad weather caused by the cyclone season limiting mining companies' ability to get work done.

But the gold price has been on a tear, currently worth about $AU2,971, ($US1,941) so fewer tonnes are still delivering good results for the miners.

"At prevailing price and exchange rates, the Australian gold industry is now worth around $AU30 billion on an annual basis," Dr Close said.

Production was down 66,000 ounces at US miner Newmont's Boddington mine, while it slumped 35,800 ounces at Australian miner Newcrest's Cadia mine.

Meanwhile, Newmont's acquisition of Newcrest is still waiting regulatory approval.

If the deal goes ahead, Newcrest shareholders will receive 0.4 Newmont shares for each Newcrest share they own.

The offer values Newcrest at $28.8 billion.

Newcrest shares are trading higher today, worth about $25.98 at 12.30pm today.

No naming and shaming by PwC, acting boss admits governance failure

By Stephanie Chalmers

Consulting firm PwC Australia has resisted calls to release the names of individuals who were party to emails related to leaked tax information.

Instead, it has committed to releasing a report it has commissioned into the incident in full, after previously planning to publish only a summary.

Acting chief executive Kristin Stubbins, who stepped into the role after the previous boss quit in the wake of the scandal, admitted that the firm was "aggressive" in marketing its corporate tax services at the time.

"Over a period, this aggressive behaviour and drive for growth permeated certain parts of our leadership and allowed for profit to be placed over purpose.

"Our governance process failed to identify and keep this in check."

You can read the full story from Michael Janda here:

ASX remains strongly higher mid-session

By Stephanie Chalmers

The local share market is off its early highs but is managing to hang onto most of its gains at lunchtime.

The All Ordinaries and the ASX 200 remain more than 1 per cent higher, with some strong gains from the major miners, including BHP (+1.6%), as well as a good session for the banks, led by NAB (+1.6%).

Real estate is the best performing sector, with Charter Hall Social Infrastructure REIT (+3.5%), HMC Capital (+3.4%) and Charter Hall Group (+3.3%) among the top movers.

162 of the top 200 stocks are in positive territory.

The optimism on the local market and around the region has been fueled by the in-principle agreement reached to raise the US debt ceiling.

But UBS chief US economist Jonathan Pingle says "it's not over, until it's over."

Mr Pingle says the fact that 'X-date', or the date when the government will run out of measures to meet its debts and could potentially default, has been moved to June 5, from June 1, has substantially reduced the odds of the worst case scenario being realised.

"The later X-date and agreement being reached significantly lower the odds of negative market and economic impact."

Market snapshot at 12:30pm AEST

By Stephanie Chalmers

- ASX 200: +1% to 7,228 points

- All Ordinaries: +1% to 7,408 points

- Australian dollar: +0.3% to 65.38US cents

- Nikkei: +1.5% to 31,380 points

- Hang Seng: flat at 18,748 points

- Shanghai: +0.3% to 3,223 points

- S&P 500 (Friday): +1.3% to 4,205 points

- Nasdaq (Friday): +2.2% to 12,975 points

- FTSE (Friday): +0.7% to 7,627 points

- EuroStoxx (Friday): +1.2% to 461 points

- Spot gold: -0.1% to $US1,943/ounce

- Brent crude: +1% to $US77.68/barrel

- Iron ore (Friday): +5.9% to $US101.30/tonne

- Bitcoin: +5.2% to $US28,155

PwC Australia denies all named on emails involved in wrongdoing

By Stephanie Chalmers

PwC Australia has responded to calls for it to release the names of individuals who received emails outlining plans to use confidential government information about new tax laws to assist clients.

In early May, Senate Estimates published internal emails concerning the tax leak, but names of recipients were redacted.

In a statement and an open letter from acting chief executive Kristin Stubbins, the consulting firm said the assumption that all those who's names had been redacted were involved in wrongdoing was "incorrect".

Here are the full comments from Ms Stubbins:

"I fully understand and acknowledge the calls for PwC to release the names of the individuals in the emails released by the Senate on 2 May 2023.

"There has been an assumption by some that all those whose names have been redacted must necessarily be involved in wrongdoing. That is incorrect.

"Based on our ongoing investigation, we believe that the vast majority of the recipients of these emails are neither responsible for, nor were knowingly involved in any confidentiality breach.

"We have and will continue to take appropriate action against anyone who is found to have breached confidentiality or failed in their leadership duties."

PwC did not release the redacted names.

PwC Australia admits 'failure of leadership and governance'

By Stephanie Chalmers

PwC Australia has announced further steps it is taking in response to the tax leak scandal, which is putting mounting pressure on the consultancy firm.

In a statement released today, PwC said nine partners have been directed to go on leave, effective immediately.

It is in the process 'ringfencing' the parts of the business that provide services to federal government departments and agencies, expected to be complete by the end of September.

Two independent directors will also be appointed to its governance board, and it will publish the report of a previously-announced independent review in full.

"It is now clear that when we learned of the confidentiality breach and related issues we failed to conduct an appropriate root cause investigation and thorough assessment of accountability for both the conduct at issue and the culture that allowed the underlying conduct to occur," the statement reads.

"That was the result of a failure of leadership and governance."

National floristry business taken to court over 'local' claims

By Stephanie Chalmers

The consumer watchdog has launched court proceedings against Meg's Flowers, a national online florist.

In the Federal Court proceedings, the ACCC is alleging that Meg's Flowers made false or misleading representations that it was a local florist, between January 2019 and February 2022.

Meg's distributes flowers for delivery from warehouses or through sub-contractors, but the ACCC says it used 156 location-based websites and in 7,462 Google Ads to portray itself as a local florist supplying flowers in suburbs and towns across Australia.

Here's what ACCC Commissioner Liza Carver had to say:

"Many consumers prefer to seek out local businesses to support, and many also wish to source the freshest flowers in a suburb close to the recipient's address.

"We are taking this court action because we allege Meg's Flowers misled consumers into thinking they were ordering flowers from a local florist, when they were actually dealing with a national business and the orders were often fulfilled from a corporate warehouse outside of that suburb."

The ACCC is seeking declarations, penalties, compliance orders, corrective notices and costs.

Tokyo's Nikkei hits highest level since 1990

By Stephanie Chalmers

It's been a positive start here, but even more so in Japan - Tokyo's Nikkei 225 index is up 1.7 per cent at the moment.

Earlier, it hit its highest point since July 1990 as the optimism around the US debt ceiling deal was felt around the region.

198 of its 225 stocks were making gains a short time ago.

Miners, real estate lead rally on ASX

By Stephanie Chalmers

Now that we're a bit further into the session, let's take a look at what's driving the broad-based rally so far.

The real estate and materials sectors are leading charge, while only education is in the red.

The best performers on the ASX 200 so far are:

- BrainChip Holdings (+4.7%)

- Nickel Industries (+4.4%)

- Syrah Resources (+4.1%)

- Core Lithium (+3.9%)

- Life360 (+3.9%)

On the flipside, the biggest falls are for:

- IDP Education (-9.6%)

- ALS (-3.8%)

- Telix Pharma (-1.4%)

- Polynovo (-1.3%)

- Chalice Mining (-1.1%)

Looking at stocks that have a bit of news out this morning, AMP shares are up 0.9% after announcing a reshuffle that involves dissolving its Australian wealth arm.

Shares in buy now, pay later firm Humm are up 10.3%, recouping Friday's sharp fall, after confirming it was back accepting new customers.

Leo Lithium has jumped 12.4% in early trade after signing a deal with China's Ganfeng Lithium to raise $106 million in capital and cooperate on a project in Mali.

Market snapshot at 10:15am AEST

By Stephanie Chalmers

- ASX 200: +1.3% to 7,249 points

- All Ordinaries: +1.3% to 7.435 points

- Australian dollar: +0.2% to 65.28 US cents

- S&P 500 (Friday): +1.3% to 4,205 points

- Nasdaq (Friday): +2.2% to 12,975 points

- FTSE (Friday): +0.7% to 7,627 points

- EuroStoxx (Friday): +1.2% to 461 points

- Spot gold: -0.2% to $US1,941/ounce

- Brent crude: +0.7% to $US77.45/barrel

-

Iron ore (Friday): +5.9% to $US101.30/tonne

- Bitcoin: +5.4% to $US28,218

Opening bounce for Australian stocks

By Stephanie Chalmers

It's (very) early days for the local session but very much one-way traffic so far.

The ASX 200 and the All Ordinaries are both up by around 1.3 per cent after 10 minutes of trade.

So far just six of the top 200 stocks are falling, with 189 rising.

Shake-up for AMP with CFO retiring, wealth mgmt restructured

By Stephanie Chalmers

Financial services firm AMP is restructuring, removing some executive roles and dissolving its wealth management business.

Chief financial officer Peter Fredricson, who joined AMP earlier this year, will retire, and from the start of July will be replaced by Blair Vernon, a current executive who will retain some of his existing responsibilities.

AMP is also shifting to a "flatter" structure, after the recent sales of its AMP Capital businesses.

That will see its Australian Wealth Management business dissolved, meaning the chief executive position for that business will also be removed.

The current AMP Australia boss Scott Hartley will lead the transition for the next six months before exiting.

"Following the AMP Capital sales we are a much simpler business, and we need to reflect that in our leadership team and structure," AMP CEO Alexis George said.

Buy now, pay later service Humm says it's back accepting new customers

By Stephanie Chalmers

ICYMI, on Friday the corporate regulator ordered buy now, pay later service Humm to stop providing its products to new customers.

This morning, Humm says it's back in full business after addressing ASIC's concerns, resulting in the regulator lifting the interim stop order.

The statement from the BNPL company hit the stock exchange this morning, but is dated Friday, so perhaps customers trying to sign up would've only had a day of disruption.

Humm shares dropped 8.2% on Friday so we'll see if it makes back that ground this morning.

'Perception of contamination' as AFP investigate PwC

By Stephanie Chalmers

The scandal engulfing PwC Australia continues to escalate, with a senator alleging "contamination" surrounding the police investigation into the consulting firm.

As my colleague Daniel Ziffer explains, the Australian Federal Police (AFP) are investigating a former PwC partner over potential crimes.

PwC also holds lucrative contracts with the AFP, as its auditor.

Senate documents reveal PwC is by far the AFP's preferred firm, with more than $20 million in contracts since 2021.

Senator Barbara Pocock is concerned that the contract muddy the investigation:

"We really can't have confidence when that level of contracting is so high to PwC.

"The contamination of the process, and the perception of contamination can happen on both levels in terms of contracts and personnel."

The AFP has said it is confident it can manage a criminal investigation into PwC despite the contracts.

Read the full story here:

US debt deal could see Fed hike further: ANZ

By Stephanie Chalmers

While it looks like markets here will rally in response to the in-principle agreement to raise the US debt ceiling, a word of caution from ANZ analysts this morning.

Brian Martin and Daniel Hynes from ANZ Research write this morning that the debt ceiling deal still faces significant hurdles.

It will need to pass the House and the Senate by the June 5 deadline.

Any Senate lawmaker can force procedural votes, holding up the bill for days.

[House speaker Kevin McCarthy & President Joe Biden] sounded an optimistic tone; others less so.

Despite all the uncertainty, economic activity is continuing to hold up well and US domestic demand started Q2 briskly.

We think that if a debt ceiling agreement is reached, the Fed will need to tighten further.

Overall demand, the labour market and inflation are all stronger than when the FOMC last updated its forecasts in March.

Whilst all eyes will be on the debt deal next week, May US labour market data may determine whether interest rates are lifted again in a few weeks.

Market snapshot at 8:35am AEST

By Stephanie Chalmers

- ASX 200 futures: +1% to 7,245 points

- Australian dollar: +0.1% to 65.22 US cents

- S&P 500 (Friday): +1.3% to 4,205 points

- Nasdaq (Friday): +2.2% to 12,975 points

- FTSE (Friday): +0.7% to 7,627 points

- EuroStoxx (Friday): +1.2% to 461 points

- Spot gold: -0.1% to $US1,943/ounce

- Brent crude: +0.8% to $US77.54/barrel

-

Iron ore (Friday): +5.9% to $US101.30/tonne

- Bitcoin: +4.9% to $US28,066

Rebound rally in sight after US debt ceiling deal

By Stephanie Chalmers

Good morning, Stephanie Chalmers here to take you through the day's markets and finance news.

And it looks like it could be a pretty good day for the local share market — last week may have seen a steep fall despite modest gains on Friday, but this morning futures are pointing higher, suggesting Australian stocks are set to rebound.

That's because over the weekend, a deal was struck to lift the US debt ceiling, ending the impasse as the deadline for a default — although it still has to pass Congress.

Markets in both the US and the UK are closed for holidays on Monday, their time, so it's markets around our region that will be the first to react over the next few days.

Locally, we have Reserve Bank governor Philip Lowe appearing before the Senate Economics Committee on Wednesday, the same day the latest monthly inflation indicator will be released, ahead of next week's June RBA interest rates decision.

In the meantime, here's some more on why the debt ceiling keeps coming up as an issue from Alan Kohler: