The Australian share market has come came off its lows as miners and energy stocks gained, and retail giant Coles has seen a surge in half-year earnings.

But BHP says bad weather and labour shortages hit its bottom line over the last six months of 2022, as it speeds up its move out of coal.

Look back at the day's financial news and insights from our specialist business reporters.

Disclaimer: this blog is not intended as investment advice.

Key events

Live updates

Markets snapshot at 4:10pm AEDT

By Sue Lannin

ASX 200: 7,336, down 0.2%

All Ordinaries: 7,545, down 0.1%

Australian dollar: 68.95 US cents, down 0.1%

Nikkei 225: 27,474, down 0.2%

Shanghai Composite: 3,294, up 0.1%

Hang Seng: 20,529, down 1.7%

NZ50: 11,801, down 0.8%

FTSE 100: 8,014, up 0.1%

DAX: 15,478, steady

CAC 40: 4,272, down 0.1%

Spot gold: $US1838.04, down 0.2%

Brent crude: $US83.05 a barrel, down 1.2%

Iron ore: $US130.85, up 3.5% a tonne

HESTA backs superannuation overhaul plan

By Sue Lannin

The health industry superannuation fund, HESTA, has backed the Federal Government's plans to overhaul the $3.3 trillion superannuation industry.

The consultation paper - released yesterday - includes legislating an objective to clarify the purpose of superannuation.

"Superannuation is to preserve savings and deliver income for a dignified retirement, alongside government support, in an equitable and sustainable way," said Federal Treasurer Jim Chalmers in a speech to the financial services industry.

Mr Chalmers also singled out the $36 billion in super funds that the former government allowed to be withdrawn during the pandemic, and tax breaks on super, which are nearing the cost of the aged pension.

HESTA chief executive Debby Blakey told me on ABC News Channel that she believes superannuation savings should be used for retirement, and not used for purposes like buying a home.

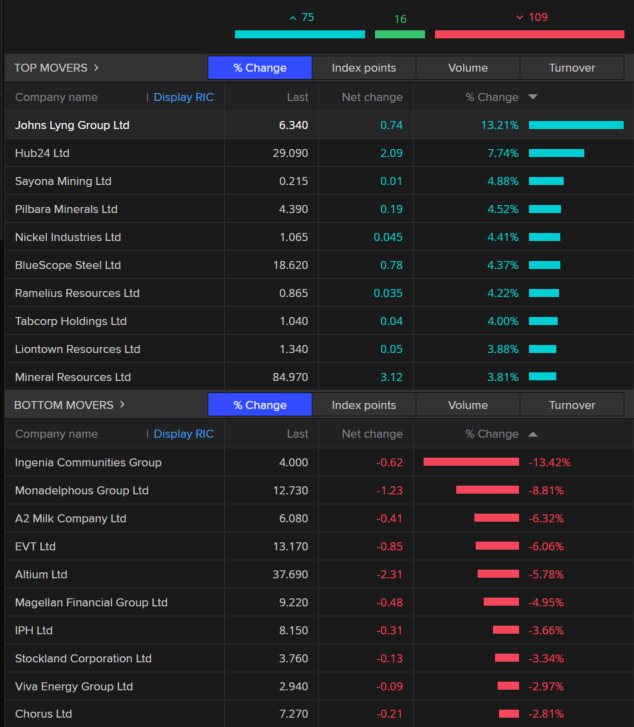

Australian market ends off its lows

By Sue Lannin

The Australian share market has ended in the red, but it was helped out of the doldrums by some strong profit results and as BHP regained most lost ground, despite lower earnings and dividends.

The ASX 200 index fell 0.2 per cent to 7,336, with the big banks weighing on the market.

While more sectors were lower than higher, a resurgence by miners and energy stocks helped limit the losses.

Big miner BHP (-0.3 per cent) finished slightly lower, after losing nearly 3 per cent at one point.

Building firm Johns Lyng Group soared 13.2 per cent as its profit surged thanks to emergency repairs and restoration because of bad weather and floods.

Retirement home operator Ingenia Communities (-13.4 per cent) did the worst after slashing its profit guidance and posting a 16 per cent fall in net profit for the half-year to $33.7 million.

Today's profit wrap

By Sue Lannin

Coles: The supermarket giant posted a strong half-year profit, up 17 per cent to $643 million, but Coles warned that shoppers may cut spending as higher interest rates bite.

Sales rose by 4 per cent, but a reduction in COVID-19 related costs helped improve profit margins.

Investors get an interim dividend of 36 cents a share, fully franked.

Supermarket price inflation was mainly driven by dairy, home care, and pantry items as suppliers raised their prices, and some fresh food prices eased slightly.

Retiring Coles chief executive Steve Cain says consumer behaviour is changing in the face of high inflation.

" We are expecting more customers to be value conscious, as cost of living increases, particularly around mortgages and energy," he said.

"We think we are well set up because we've got the largest range of home brand in Australia,

"Home brand sales increased by 12 per cent in the quarter as our customers looked for great value."

BHP: The big miner is selling two Queensland coal mines as higher royalties bite, and aims to recoup costs in NSW after government intervention in energy markets.

BHP is looking for buyers for the Blackwater and Daunia metallurgical coal mines as the significant shift in state royalties "increases our risk and worsens the economics of these mines".

The mining giant reported a 32 per cent drop in half-year profit to just under $US6.5 billion ($9.3 billion).

The drop came from a 16 per cent fall in revenue to $US25.7 billion ($37.2 billion).

BHP chief executive Mike Henry blamed bad weather in part for the decline.

The company is paying an interim dividend of 90 US cents a share ($1.30), down from $1.50 US cents over the last half of 2021.

Johns Lyng Group: The construction firm says revenue jumped by 70 per cent to $635.6 million as insurance repairs, restoration and reconstruction works surged nearly four-fold because of floods and bad weather.

Net profit for the first-half of 2023 more than doubled to $29.2 million, and investors get an interim dividend of 4.5 cents a share, fully franked.

Seek: The employment website saw revenue rise by one fifth over the first half of the 2023 financial year with net profit up 7 per cent to $135 million.

Investors get an interim dividend payout of 24 cents a share.

Tabcorp: The gaming giant says revenue rose 11 per cent over the last six months of 2022, but profit dropped by more than two thirds to $52 million.

Investors get a fully franked interim dividend of 1.3 cents a share.

Tabcorp said the gaming business had recovered strongly from the end of COVID-19 restrictions, which boosted revenue.

Over the past year, Tabcorp launched its new online gaming app, following the spin off of its lotteries and keno business.

Financial platform provider firm Hub24 saw revenue surged by almost 70 per cent to $137.7 million, while after tax profit jumped 85 per cent to$15.5 million.

Investors get an interim dividend payout of 14 cents a share, fully franked.

Fruit and vegetable grower Costa Group saw revenue rise 11 per cent to $1.36 billion over the year, but net profit fell by one fifth to $33.6 million.

Investors get a final dividend payout of 5 cents a share.

NAB says rising rates could lead to recession in Australia

By Sue Lannin

National Australia Bank has delivered a sobering assessment of how it expects the economy to perform this year.

It thinks the RBA's steep rate rises could tip the economy into recession this year.

NAB is expecting economic growth to slow to 0.7 per cent over 2023 and 0.9 per cent in 2024

"Looking forward, we see growth slowing sharply as consumer spending comes under pressure from both higher rates and inflation," NAB chief economist Alan Oster said.

Here's more from ABC business reporter David Taylor.

RBA says pausing rate hikes not an option

By Sue Lannin

Earlier this month, the Reserve Bank raises interest rates again by 0.25 per cent to 3.35 per cent, the highest level in around a decade.

Today we got some more information about the thinking behind that decision with the release of the RBA board minutes from the meeting.

The minutes show that the board thought that putting rate hikes on hold for the month was not considered, and further rate increases were needed to curb inflation.

The RBA board only discussed two options: raising rates by either 0.5 percentage points or 0.25 percentage points, a marked change from December when it considered staying on hold.

That came despite a loss of jobs and a slump in retail sales in December, which indicated that the RBA's steep rate rises are working.

"The recent inflation data had suggested more breadth and persistence in inflation than had been expected and that strong demand was leading to price increases in some parts of the economy," the RBA minutes said.

"While inflation was expected to decline, there was a risk that it could persist at an uncomfortably high level, which would entail longer term costs."

National Australia Bank head of market economics Tapas Strickland thinks the central bank will probably stick with 0.25 percentage point increases for the time being.

"The discussion to us suggests that there remains a high bar to stepping back to 50bp (0.5% percentage point) increments, predominantly because the RBA meets monthly and can regularly reassess the policy stance," he said.

The National Australia Bank forecasts the RBA could lift rates as high as 4.1 per cent, and NAB economists point out:

"The minutes also implicitly acknowledged rising recession risks as the RBA lifts rates to get inflation back down."

Dr Lowe and the RBA board have come under fire for telling the country during the pandemic that interest rates were unlikely to rise until 2024.

Unfortunately, some people took out mortgages based on those statements, which Dr Lowe has apologised for.

But he's stood by the guidance, saying the situation was dire and the RBA was throwing the kitchen sink at the economy to save it from catastrophe.

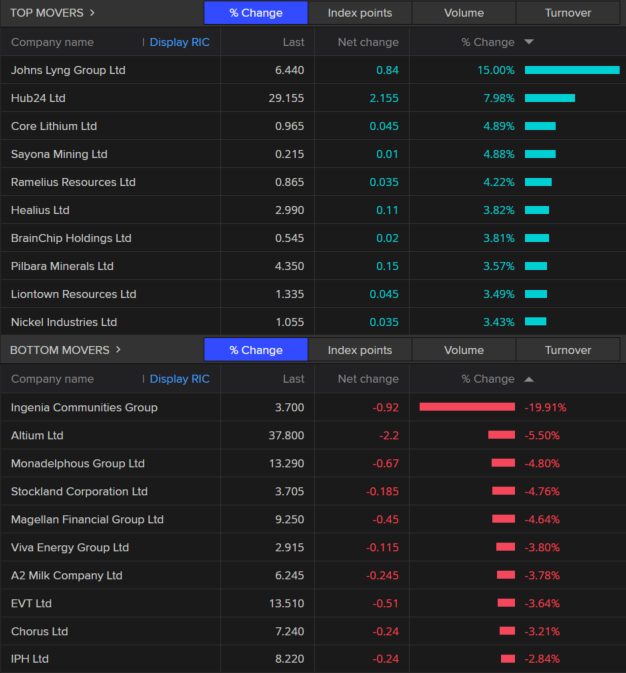

ASX movers and shakers at midday

By Sue Lannin

The Australian share market is having a down day, despite some good profit results, with retailer Coles (-1.1 per cent) seeing after tax profit for the six months to the end of December rise from $549 million a year ago to $643 million.

Leah Weckert has been appointed chief executive from May 1 to replace Steven Cain, who is retiring.

Ms Weckert will become the first woman to run the retail giant.

BHP (-2 per cent) is weighing on the market after half-year profit slumped by 32 per cent, and the miner reduced its dividend payout for investors.

The biggest gainer on the ASX 200 index is building and restoration firm John Lyng Group (+16 per cent) after a surge in half-year profit.

Retirement and holiday home property developer Ingenia Communities Group has lost one fifth of its value today after net profit for the half-year fell 16 per cent to $33.7 million, despite higher revenue for the period.

BHP selling more coal mines

By Sue Lannin

As you've heard, the world's biggest miner saw a fall in its half year profit, and it is continuing to get out of coal.

BHP saw after tax profit for the six months to the end of December slump by one third to $6.5 billion as revenue slipped.

Like Rio Tinto, which has already offloaded its coal mines, BHP is also seeking to wind down its coal operations as it ramps up decarbonisation.

The big miner announced today it would sell two coking coal mines in central Queensland, that it operates with its joint venture partner Mitsubishi.

The miners are seeking to sell the Daunia and Blackwater coking coal mines in Queensland's Bowen Basin.

"What we are doing here is further concentrating our portfolio on the best of the best," said BHP boss Mike Henry on a conference call with journalists this morning.

"Whilst high quality assets with growth potential, the Daunia and Blackwater mines would struggle to compete for capital under our capital allocation framework."

"We are seeking to divest those assets to an operator who is more likely to to prioritise the necessary investments for a continued successful operation." al.

Last year, BHP sold its 80 per cent stake in coking coal miner BHP Mitsui Coal to Stanmore Resources, which has coal mines in Queensland's Bowen Basin.

And the big miner warned workers last month that it could bring forward the closure of the giant Mount Arthur thermal coal mine in Muswellbrook, in northern New South Wales, with inflation and the New South Wales' government's reservation scheme and the Federal Government coal price cap hurting its bottom line.

Mr Henry was asked by journalists if the big miner had resumed coal sales to China, amid the detente between Beijing and Canberra, and the reopening of the Middle Kingdom after its COVID restrictions.

However, the BHP boss held its cards close to his chest over the end of China's ban on Australian coal.

"It's great to see the improved trade relationship," he said.

"I think that's really quite important that bodes well for the future."

"The coal trade opening up in China overall a net positive for the for the market."

"I don't want to get into the nitty gritty of whether we've sold, or we haven't sold, other than to say that of course, you know, we welcome the opportunity to engage with customers in China on potential coal sales, whilst keeping in mind that, you know, we did need to pivot our sales towards other markets and we've got very strong customer relationships there."

"But we are, and we'll be engaging further with, China is very important, and valued Chinese customers as well."

For more on the future of BHP's Mount Arthur mine, read this story from my colleague Amelia Bernasconi in the NSW Hunter Valley.

ASX 200 in the red in early trade

By Sue Lannin

With no lead from Wall Street, which was closed for the Presidents' Day holiday, the Australian share market has opened in the red.

The ASX 200 is down 0.5 per cent in the first half hour of trade with all sectors lower.

Real estate, banks, tech firms, and energy stocks are weighing on the market.

Best performer today on the ASX 200 is building services firm Johns Lyng Group (+11.1 per cent) on the back of its profit results, which saw half year income surge by 144 per cent to $29 million.

Investors get an interim dividend of 4.5 cents a share.

The worst performer is mining contractor Monadelphous (-7.3 per cent) after its profit results came out.

The engineering firm saw revenue slide 10 per cent and half-year net profit fell slightly to $29.1 million.

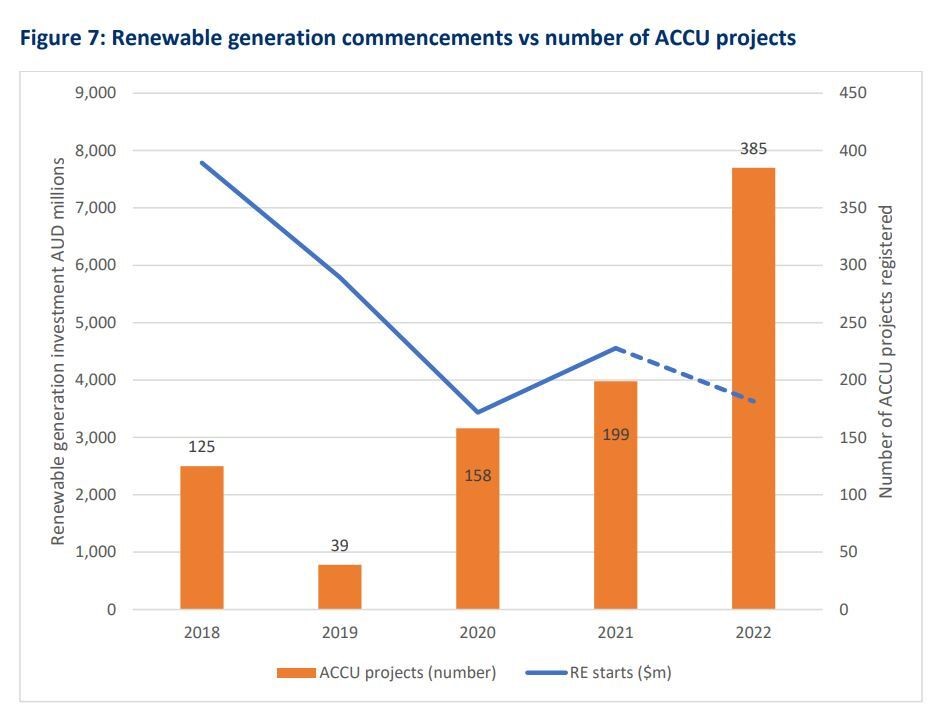

Are 'carbon credits' ruining the push to renewable energy?

By Daniel Ziffer

Hi team, just jumping in with an interesting report about decarbonising the economy, to try to prevent the worst impacts of climate change.

I know, I know, I've said both carbon and climate change, but this is really interesting (and important).

So there's two ways to get to 'net zero' carbon emissions, to reduce the amount of pollution by not doing things and by using new technologies like renewable energy.

Then there's 'offsets' or carbon credits, a system where you pay to have someone remove carbon from the atmosphere on your behalf, like planting a forest.

An issue has been that making credits cheaper just incentivises people to do that, rather than the more expensive work of using renewable energy or new technologies to reduce pollution.

A new report from think-tank The Australia Institute lays out what it thinks.

“Currently Australia has no policies that drive investment into real decarbonisation projects. The Safeguard Mechanism and the Powering the Regions fund offer enormous opportunities for genuine emissions reduction, but are poised to syphon money to the carbon offset industry," says Polly Hemming, Director of Climate & Energy at the Australia Institute.

“Policies like the Renewable Energy Target drive permanent decarbonisation in industry, while offset purchases simply allow polluters to delay this change.

The Australia Institute says the current policy settings are slowing down new renewable energy projects, because it's easier just to buy credits.

“When industry or government buys carbon credits to offset emissions - even if they are of high integrity - they are not spending money on technology that permanently displaces fossil fuel use and permanently reduces emissions. Every day we prevaricate is a day further away from Australia meeting its climate target. This data shows offsets are obstructing climate action in Australia.”

BHP profit falls, CEO positive on outlook

By Michael Janda

Mining giant BHP has reported a 32 per cent drop in half-year profit to just under $US6.5 billion ($9.3 billion).

The drop came from a 16 per cent fall in revenue to $US25.7 billion ($37.2 billion).

BHP chief executive Mike Henry blamed bad weather for part of the decline.

"Significant wet weather in our coal assets impacted production and unit costs, as did challenges in securing sufficient labour.

"Inventory movements during the half contributed to costs, including the planned draw-down at Olympic Dam after inventory built up during the smelter refurbishment last year.

"We expect these factors to abate in the second half and for unit costs to fall."

However, he is positive about the outlook for the next couple of years.

"We are positive about the demand outlook in the second half of FY23 and into FY24 [financial years 2023 and 2024], with strengthening activity in China on the back of recent policy decisions the major driver.

"We expect domestic demand in China and India to provide stabilising counterweights to the ongoing slowdown in global trade and in the economies of the US, Japan and Europe.

"The long-term outlook for our commodities remains strong given population growth, rising living standards and the metals intensity of the energy transition, including for steel making raw materials."

The company is paying an interim dividend of 90 US cents a share (130 cents), down from 150 cents in the same period last year.

Coles CEO to retire as supermarket posts bumper profit; shoplifting on the rise

By Michael Janda

Coles Group has posted a bumper half-year profit, increasing its net earnings by 17.1 per cent off the back of a smaller 4.1 per cent increase in sales on rising profit margins.

The supermarket giant reported a half-year net profit after tax of $643 million.

The company attributed much of the profit improvement to a $130 million reduction in COVID-related costs compared to the same period a year earlier.

However, its overall cost of doing business in the supermarket division rose slightly, while its gross margin increased from 26.1 per cent to 26.5 per cent.

Despite the improvement, Coles says its margins were partly hit by "investment in pricing", "increasing headwinds in markdowns" and "stock loss as a result of increasing theft".

The company says supermarket price inflation was 7.7 per cent for the second quarter, up from 7.1 per cent in the first quarter, driven primarily by dairy, homecare and pantry items as suppliers requested higher prices.

Coles says fresh food inflation eased slightly — with price falls for some items, such as tomatoes, capsicums and broccoli — although white meat and bread recorded big increases on rising grain costs.

The supermarket has announced Leah Weckert as its new chief executive, who will replace outgoing CEO Steven Cain when he retires on May 1.

Coles is facing a potential increase in remediation for alleged staff underpayments, with the Fair Work Ombudsman seeking an addition $108 million for 7,687 workers, and the supermarket also defending a class action on the issue.

Global shares mixed ahead of US Federal Reserve minutes

By Sue Lannin

Good morning, welcome to the ABC's Markets Blog, I'm Sue Lannin.

It was a quiet night on global markets with Wall Street closed for the Presidents' Day holiday.

The FTSE 100 in London rose 0.1 per cent as investors await the release of the latest minutes from the US Federal Reserve, to gain insights into the future direction of US interest rates.

Elsewhere on the continent, the DAX was steady, and the CAC 40 in Paris lost ground.

The Australian dollar is higher at around 69.12 US cents, while the local share market is expected to open lower with the ASX SPI 200 index down 0.4 per cent.

There's another big day of profit results with big miner BHP and big retailer Coles reporting their half year earnings today

Grab a coffee and let's go!