The Australian share market took a further downward tumble on Thursday to end the day down, as traders bet on more interest rate hikes from the Reserve Bank, after the unemployment rate remained steady in March.

Read it as it happened on the ABC News blog with our specialist business reporters.

Disclaimer: This blog is not intended as investment advice.

Key events

To leave a comment on the blog, please log in or sign up for an ABC account.

Live updates

Here's where we are sitting at 4:45pm AEST

By Emilia Terzon

- ASX 200: 7,324 (-0.3%)

- All Ordinaries: 7,520 (-0.3%)

- Australian dollar: 67.12 (+0.2%)

- Nikkei 225: 28,156 (+0.3%)

- Hang Seng: 20,206 (-0.5%)

- Shanghai Composite: 3,322 (-0.1%)

- Kospi: 2,550 (flat)

- Dow Jones futures: 33,829 (+0.1%)

- S&P 500 futures: 4,126 (+0.2%)

- Nasdaq futures: 12,986 (+0.3%)

- FTSE 100: 7,824 (+0.5%)

- DAX: 15,704(flat)

- CAC 40: 7,396 (flat)

- Brent crude: US$87.09 (+0.3%)

- Gold: US$2,034 (+0.5%)

-

Bitcoin: US$30,081 (0.7%)

ASX 200 ends down as rate hike fears re-appear

By Emilia Terzon

Both the ASX 200 and All Ords ended 0.3 per cent lower.

That's after they were posting a few days in a row of gains.

The ASX 200 was dragged down by mining and banking stocks to close lower at 7,324.

Analysts are blaming the strong jobs data that came out today, which showed the jobless rate is staying firmly at a near 50 year low at 3.5 per cent. They say this points towards an extra rate hike by the RBA next month to tackle inflation.

"This increases the likelihood of a further (and likely final) rate hike at next month's meeting," said Anna Milne, an equity analyst at Wilson Asset Management.

Analysts at Citi said in a note they expected the labour market to loosen this year, likely in the second half.

Financials dipped 0.3%. Miners lost 0.6%. Iron ore futures fell on pessimism spurred by tepid steel demand in China.

Meanwhile, Rio Tinto, BHP Group and Fortescue Metals Group fell between 0.7% and 1.8%.

BHP won support from OZ Minerals shareholders to proceed with its A$9.6 billion ($6.44 billion) takeover of the Australian copper and gold producer.

On the other hand, energy stocks advanced 0.9%, with Woodside Energy and Santos adding 1.1% and 0.4%, respectively.

We'll see you tomorrow!

More people looking for work to cover surging costs?

By Michael Janda

Could it be that more people are actively entering the workforce to help cover the rising costs of mortgages and cost of living. I.e. stay at home parents now actively seeking and securing work to pay the bills.

- A thought

This is a good point, and one that I've been thinking for a while, as the participation rate has held near record highs despite a large cohort of Baby Boomers already heading into retirement.

Certainly, Dressed for Success believes that the surge in women coming through its doors looking for help to get a job is at least partly driven by the surging cost of living.

"Across all of our affiliates across Australia, we're all experiencing an increasing number of women returning to work," said its Sydney chair Amanda Webb.

"Now they need two incomes back into their household, more hours of income and work.

"So that is also putting some extra strain on people and their lives and therefore an increase in a spike in our need for our service as well."

You can read more about the record levels of female workforce participation, and the ongoing jobs boom, in this article from myself and Rachel Pupazzoni.

Is Australia set to be a dumping ground for old cars?

By Emilia Terzon

Emilia Terzon here covering off the end of today's finance blog for the ABC business team.

We've had a lot of jobs news today after the release of unemployment data, showing the jobless rate is steady at 3.5%.

For something different, we have some other news about EVs.

The US's Environmental Protection Authority (EPA) has released a new proposal outlining how it'll implement the Biden administration's pledge to lower emissions.

Under it's proposal, automakers are forecast to produce 60% EVs by 2030 and 67% by 2032 to meet requirements.

That is compared with just 5.8% of vehicles sold in the US in 2022 that were EVs.

It's a pretty bold proposal.

Compare this to Australia, which currently doesn't have these sorts of emissions standards outlining the amount of EVs or standard internal standard combustion (ICE) that need to be sold here, despite calls for many years to implement this.

We know the Labor Government has been consulting with industry here about what could be implemented to increase the uptake of EVs, including emissions standards.

The US decisions has reiterated calls from the EV lobby group here in Australia for action to be taken quickly.

Here's some quotes from Electric Vehicle Council chief executive Behyad Jafari.

This shift in position from the US is of monumental consequence to Australia.

Car companies will now be racing to meet the more stringent standards set in the US, Europe, China, and even New Zealand. If they continue to see Australia as the odd nation out, they will prioritise all other markets for their latest and best EVs.

Australia will be dumped with their outdated gas guzzlers because it will be one of the only markets where there will be no consequences for doing so.

The US decision is particularly relevant for Australia because the US is so similar to Australia in terms of driving culture. Its geography is broad and its culture of car ownership, especially larger vehicles, is strong. So if the US is able to move this decisively there is zero excuse for Australia not to follow suit.

The latest report by the Electric Vehicle Council found EV sales jumped 65 per cent in 2022 in Australia.

However, that was off a low base, with EVs still only representing 3.4 per cent of all new cars sold in Australia.

Jobs: the last word

By Sue Lannin

My colleague Peter Ryan says the jobs market remains resilient, but its strength stokes the risk of a May interest rate hike by the RBA.

He spoke to The World Today on ABC Radio earlier today.

Jobs: what the economists think

By Sue Lannin

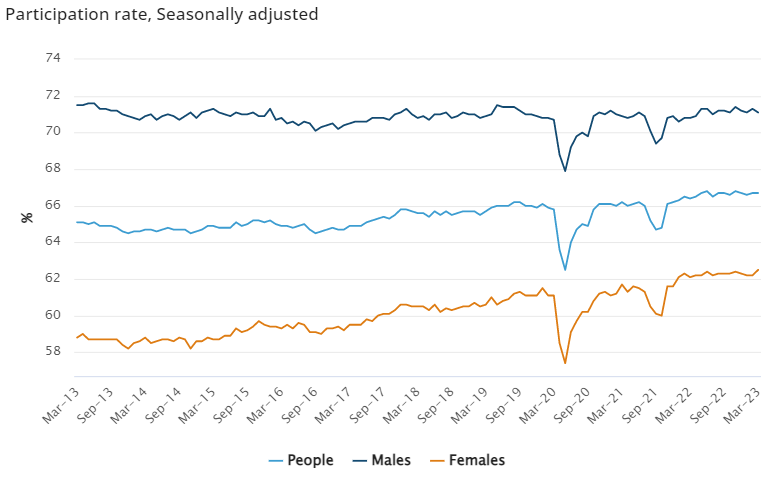

Westpac economists Justin Smirk and Ryan Well say the near fifty year low in the jobless rate suggests that the supply of labour, particularly women, "will remain a supportive factor" for now.

"Indeed, the lift in participation saw the labour force grow by 51,400, slightly lower than the gain in employment, resulting in the unemployment rate holding at 3.5 per cent, near the cycle-low of 3.4 per cent observed back in October 2022.

"Underlying these results has been a continued outperformance by females in broader labour market outcomes."

"In March, female participation rose to a record high of 62.5 per cent, and with continued strength in employment gains – a lift of 56,300 for females while male employment was effectively flat at 3,300, the female employment-to-population ratio also rose to a historical high of 60.4 per cent."

"The downtrend in the female unemployment rate remains firmly entrenched, even falling to a fresh record low of 3.4 per cent, while the male unemployment rate remains well off its cycle-low from October."

Capital Economics's head of Asia Pacific, Marcel Thieliant, thinks the strength of the labour market will see the Reserve Bank raise interest rates again.

"The strength of March's labour market data will probably prompt the Reserve Bank of Australia to deliver a final 25 basis point hike next month, but unemployment will rise before long," he said in a note.

While EY's chief economist Cherelle Murphy says the jobs keep coming and so could higher rates.

"Labour force data are often the last to show weakness when there is a turning point in the business cycle."

"But according to the latest March data, there is no turning point in the demand for workers."

"This is consistent with our observations from the corporate sector, which suggest conditions remain healthy despite the headwinds from weakening global growth, uncomfortably high inflation and tighter financial conditions as central banks lift rates."

"The latest National Australia Bank survey also showed that business conditions have been resilient, remaining well above their long-run average."

"The Reserve Bank will be pleased that the gains in the labour market are continuing, but concerned that it provides an upside risk to inflation over the remainder of the year, given the upside risks to wages."

"If this were to occur, and if inflation remains stubbornly high, a further rate rise would be warranted."

Markets snapshot 3pm AEST

By Sue Lannin

ASX SPI 200: 7,318 (down 0.35%)

All Ordinaries: 7,516 (down 0.3%)

Australian dollar: 67.10 (up 0.3%)

Nikkei 225: 28,140 (up 0.2 per cent)

Hang Seng: 20,210 (down 0.5 per cent)

Shanghai Composite: 3,328 (up 0.05%)

Kospi: 2,555 (up 0.2%)

NZ50: 11,901 (down 0.1%)

Dow Jones: 33,647 (down 0.1%)

S&P 500: 4,092 (down 0.4%)

Nasdaq Composite: 11,929 (down 0.9%)

FTSE 100: 7,825 (up 0.5%)

DAX: 15,704 (up 0.3%)

CAC 40: 7,396 (up 0.1%)

Brent crude: $US86.99 a barrel (down 0.4%)

Spot gold: $US2,017.50 an ounce (up 0.1%)

Iron ore: $US117.50 (down 1.9%)

Bitcoin: $US30,083 (up 0.4%)

ASX shaken by strong employment numbers

By Sue Lannin

Investors have been shaken by the strength of the employment market because it means the Reserve Bank may decide to start raising interest rates again.

The unemployment rate was unchanged in March at 3.5 per cent and around 53,000 people were hired.

The ASX 200 slipped further after the data came out, and the Australian dollar surged above 67 US cents on the news.

In late trade, the benchmark index is down 0.35 per cent to 7,318.

For some analysis here is Tony Sycamore from IG Markets.

"The ASX200’s rousing run of ten days of gains in the past eleven looks set to end today after hotter-than-expected jobs data bought the RBA’s May meeting back into play and after the FOMC (Federal Reserve Open Market Committee) meeting minutes noted that the banking crisis would likely send the US. economy into recession," Mr Sycamore noted.

"The sombre tone of the FOMC minutes saw Wall Street erase the early gains that followed reports that headline CPI (Consumer Price Index) in the US rose by 0.1 per cent in March, taking the year-on-year rate from 6 per cent to 5 per cent, the lowest rate of inflation since May 2021."

"While U.S economic data in recent weeks have shown signs of moderation and raised hopes that the Federal Reserve may be close to ending its rate-hiking cycle, today’s Australian employment data brings the RBA’s May board meeting back into play. "

And that's why the Australian dollar jumped.

In addition, the greenback is lower after Federal Reserve economists warned the banking crisis could cause a mild recession this year.

KPMG economist says "amazing strength" in the labour market

By Sue Lannin

KPMG chief economist Dr Brendan Rynne says the Australian labour market continues to outperform.

He made the comments after the jobless rate defied expectations and remained steady at 3.5 per cent in March.

"I was in the camp of about 20,000 new jobs that were going to be created in the month," he told ABC News Channel.

"What this shows is just an amazing strength within the labour market and the economy, and certainly much much stronger than any of us expected."

Mr Rynne spoke to my colleague Stephanie Chalmers live on ABC News Channel earlier.

More women in the workforce!

By Sue Lannin

Hallelujah! The percentage of women in the Australian workforce has climbed to a record high as employers grapple with worker shortages.

Here's another graph from the ABS.

Markets snapshot at 2pm AEST

By Sue Lannin

ASX SPI 200: 7,320 (down 0.3%)

All Ordinaries: 7,515 (down 0.3%)

Australian dollar: 67.10 (up 0.3%)

Nikkei 225: 28,109 (up 0.1 per cent)

Hang Seng: 20,186 (down 0.6 per cent)

Shanghai Composite: 3,328 (up 0.05%)

Kospi: 2,555 (up 0.1%)

NZ50: 11,989 (down 0.2%)

Dow Jones: 33,647 (down 0.1%)

S&P 500: 4,092 (down 0.4%)

Nasdaq Composite: 11,929 (down 0.9%)

FTSE 100: 7,825 (up 0.5%)

DAX: 15,704 (up 0.3%)

CAC 40: 7,396 (up 0.1%)

Brent crude: $US87.16 a barrel (down 0.2%)

Spot gold: $US2,017.50 an ounce (up 0.1%)

Iron ore: $US117.50 (down 1.9%)

Bitcoin: $US30,121 (up 0.5%)

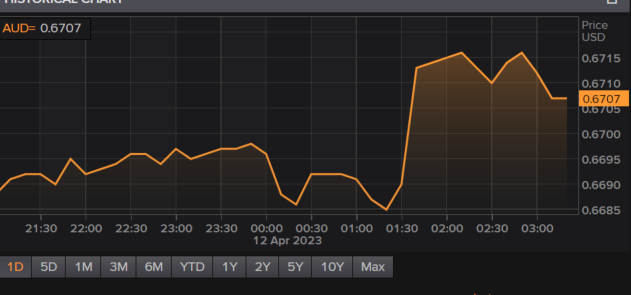

Australian dollar extends gains and ASX slips on jobs data

By Sue Lannin

The Australian dollar jumped above 67 US cents to a high of 67.20 US cents after the Bureau of Statistics said the unemployment rate remained steady at 3.5 per cent last month amid strong demand for labour.

The ABS says 53,000 jobs were created in March, more than double forecasts of 20,000 jobs by economists.

Full time employment surged by 72,200, and part time employment increased by 1,700, showing that employers are putting on more people on a full time basis to fill job shortages.

Youth unemployment remained at 7.8 per cent, and the underemployment rate, which measures the rate at which people are looking for more work, increased to 6.1 per cent.

The underutilisation rate, which measures the unemployment rate and the underemployment rate, stayed at 9.6 per cent.

The market slipped and the local currency surged because traders are now expecting another rate increase from the Reserve Bank because of the strong jobs market.

Last week, the RBA kept official borrowing costs on hold at 3.6 per cent.

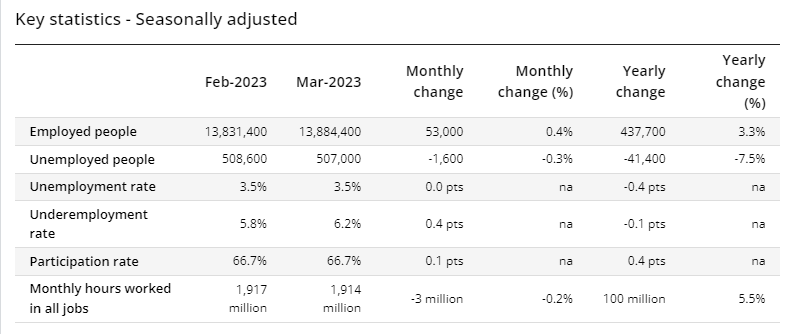

Unemployment rate steady as jobs boom continues

By Sue Lannin

As you've been hearing the unemployment rate remained at 3.5 per cent in March on a seasonally adjusted basis, according to the Australian Bureau of Statistics (ABS).

While migration has increased, employers are still struggling to find workers, and hired around 53,000 people last month.

Here's more from my colleague, Michael Janda:

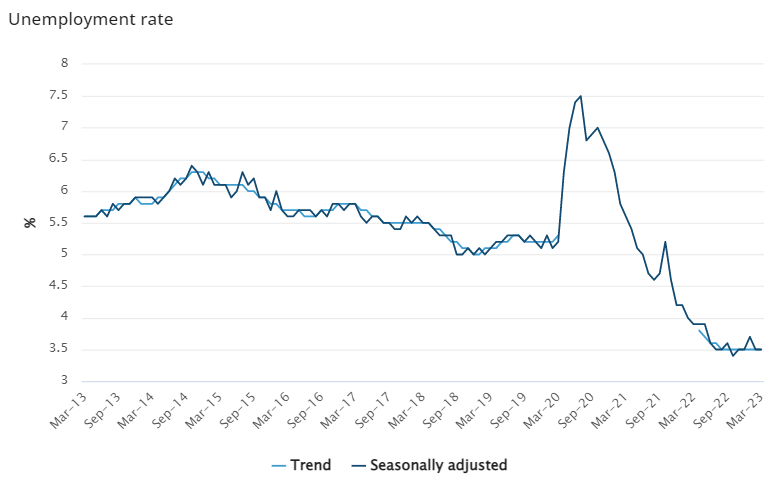

Australia's labour market in graphs

By Gareth Hutchens

Here are some graphs that tell the story of the state of Australia's labour market.

In trend and seasonally adjusted terms, the unemployment rate is currently 3.5%. It's been sitting at these levels since July last year.

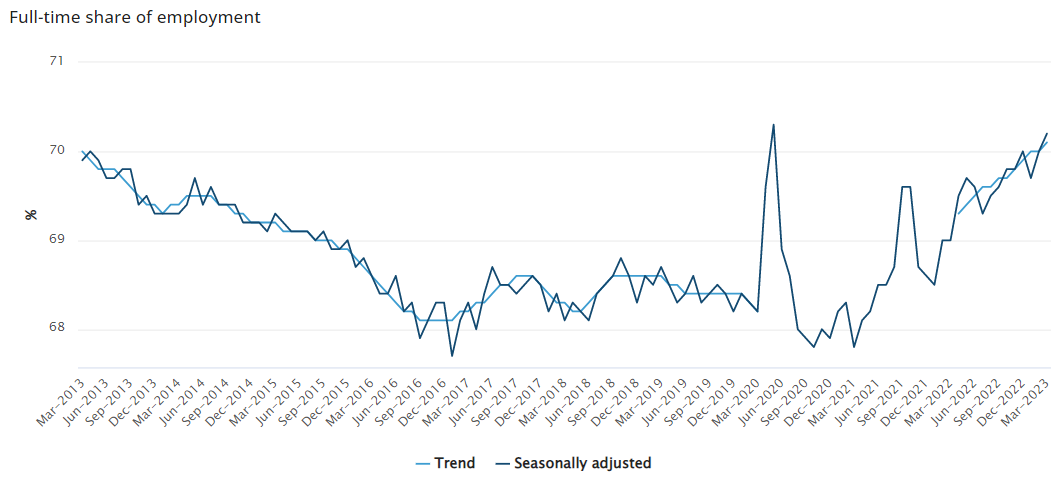

When it comes to full-time employment, the full-time share of employment is now back to where it was a decade ago.

Just before the pandemic, about 68.2 per cent of employed people were full-time workers, with that share having trended down for decades.

But it's now back to 70.1 per cent, which is very good news for workers.

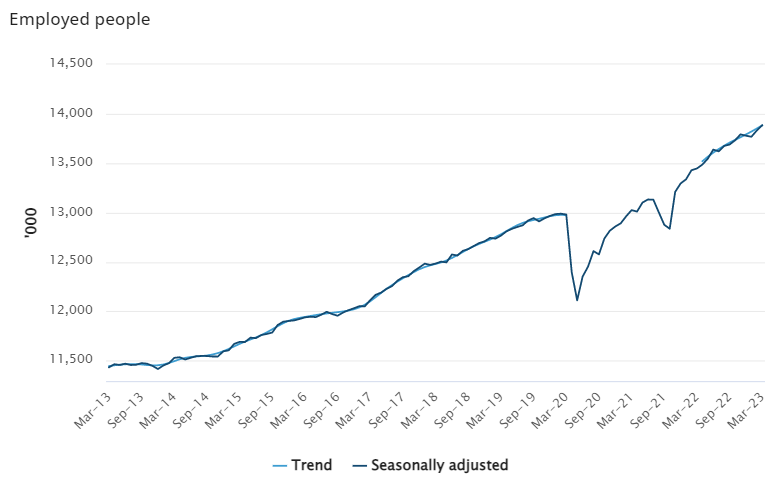

When it comes to the number of employed people, you can see how the growth in employment was knocked off course by the pandemic, but it's recovered really well and is basically back to trend.

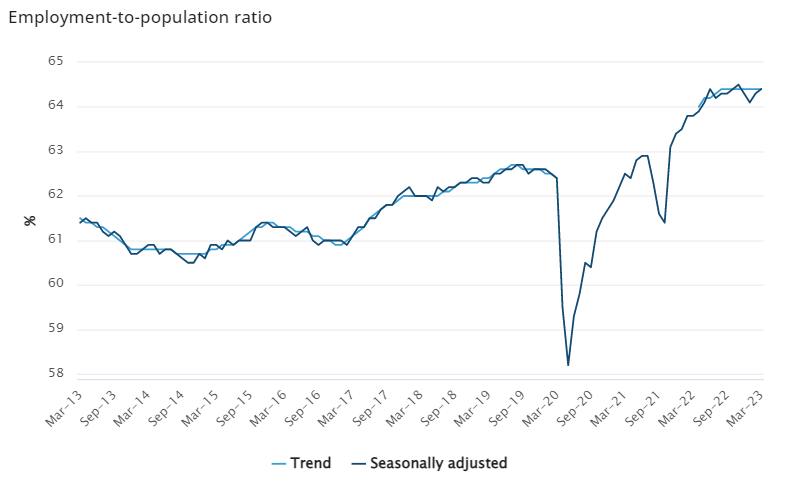

Then there's the employment-to-population ratio.

This shows the number of people in Australia who are employed as a proportion of everyone in the country who is 15 years of age and older.

It puts the "employment" number into perspective.

And the employment-to-population ratio has been sitting near a record high for months now.

All of these things show what economists are talking about when they say the labour market has not been this "tight" for 50 years.

Markets snapshot at 12pm AEST

By Sue Lannin

ASX SPI 200: 7,327 (down 0.25%)

All Ordinaries: 7,520 (down 0.2%)

Australian dollar: 67.13 (up 0.4%)

Dow Jones: 33,647 (down 0.1%)

S&P 500: 4,092 (down 0.4%)

Nasdaq Composite: 11,929 (down 0.9%)

FTSE 100: 7,825 (up 0.5%)

DAX: 15,704 (up 0.3%)

CAC 40: 7,396 (up 0.1%)

Brent crude: $US87.23 a barrel (up 1.9%)

Spot gold: $US2,017.50 an ounce (up 0.1%)

Iron ore: $US117.50 (down 1.9%)

Bitcoin: $US29,858 (down 0.4%)

ASX slips after good jobs data, Australian dollar surges

By Sue Lannin

The Australian share market has slumped back into the red after the latest official employment figures came out.

The ASX 200 index is down one quarter of a percentage point to 7,326 after ABS data showed the unemployment rate was steady last month as 3.5 per cent.

Job creation was strong with employers putting on more than 50,000 people.

Traders are betting that the Reserve Bank will resume its rate hiking stance because the employment market remains strong and employers are still desperate for workers.

The Australian dollar soared above 67 US cents after the data was released at 11:30am AEST.

Unemployment rate steady at 3.5%

By Sue Lannin

Australia's jobless rate remained unchanged in March at 3.5 per cent according to the Bureau of Statistics.

Employers hired around 53,000 people over the month.

Economists had predicted the unemployment rate to edged higher to 3.6 per cent because of slower jobs growth.

More migrants saw the participation rate, the percentage of people looking for work, remain steady at 66.7 per cent.

ABS head of labour statistics Lauren Ford says the unemployment rate remains near record lows, and the employment to population ratio and the participation rate remain near record highs.

"Both indicators were close to their historical highs in November 2022, reflecting a tight labour market and explaining why employers are finding it hard to fill the high number of job vacancies."

ASX recoups early losses in cautious trade

By Sue Lannin

The Australian share market fell as much as one fifth of a per cent in the first 15 minutes of trade.

But it has now clawed back those losses and is steady.

The ASX 200 index was down 0.04 per cent to 7,341 at 11am AEST.

111 stocks are lower, 9 are steady, and 80 are higher on the ASX 200 index in mid morning trade.

Investors are awaiting the latest Australian unemployment data out at 11:30am AEST.

Corporate Travel Management (+10 per cent) soared after winning a UK government contract, while payment firm Block (+5.8 per cent) is the worst performer on the benchmark index.

Beach Energy (-0.7 per cent) is down after a fall in production over the March quarter.

Oil stocks, banks and miners are limiting the losses on the ASX 200 index.

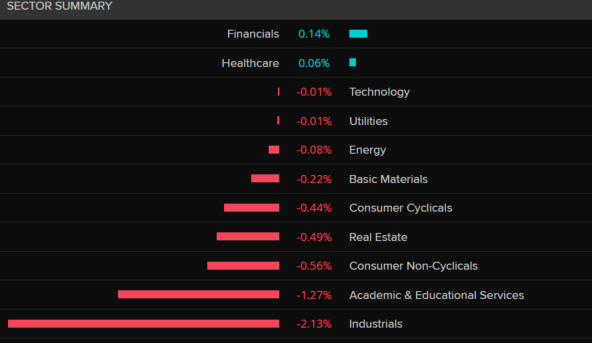

ASX 200 movers and shakers

By Sue Lannin

Most sectors are in the red on the ASX 200 after US central bank economists warned of a "mild recession" because of the recent banking turmoil.

Most sectors are in the red on the ASX 200.

Here are the best and worst performers:

Markets snapshot at 10:15am AEST

By Sue Lannin

ASX SPI 200: 7,336 (down 0.1%)

All Ordinaries: 7,529 (down 0.1%)

Australian dollar: 66.90 (steady)

Dow Jones: 33,647 (down 0.1%)

S&P 500: 4,092 (down 0.4%)

Nasdaq Composite: 11,929 (down 0.9%)

FTSE 100: 7,825 (up 0.5%)

DAX: 15,704 (up 0.3%)

CAC 40: 7,396 (up 0.1%)

Brent crude: $US87.23 a barrel (up 1.9%)

Spot gold: $US2,014.35 an ounce (up 0.6%)

Iron ore: $US117.50 (down 1.9%)

Bitcoin: $US29,858 (down 0.4%)