It's becoming a story of the dove and the hawk. Australia's central bank is hinting it may soon ease off on rate hikes, while the US Fed is still getting stuck in. That's impacting the Australian dollar, which is plunging to its lowest rate in months.

Find out how it all unfolded on our ABC live markets blog.

Disclaimer: this blog is not intended as investment advice.

Key events

Live updates

How we ended up by 5pm AEDT

By Emilia Terzon

- ASX 200: -0.8% to 7,308 points

- All Ords: -0.8% to 7,504 points

- Australian dollar: -2.2% to 65.87 US cents

- Dow Jones (close): -1.7% to 32,856 points

- S&P 500 (close): -1.5% to 3,986 points

- Nasdaq (close): -1.3% to 11,530 points

- DAX (close): -0.6% to 15,559 points

- FTSE (close): -0.1% to 7,919 points

- Brent crude: -3.6% to $US83.29/barrel

- Spot gold: -0.2% to $US1,816.80/ounce

-

Bitcoin: -1% to US$22,157

ASX closes 0.8% lower as the dove and hawk dance

By Emilia Terzon

The ASX 200 has ended its 4 day winning streak.

It's all after Wall Street had big losses following concerns there that interest rates hikes aren't over.

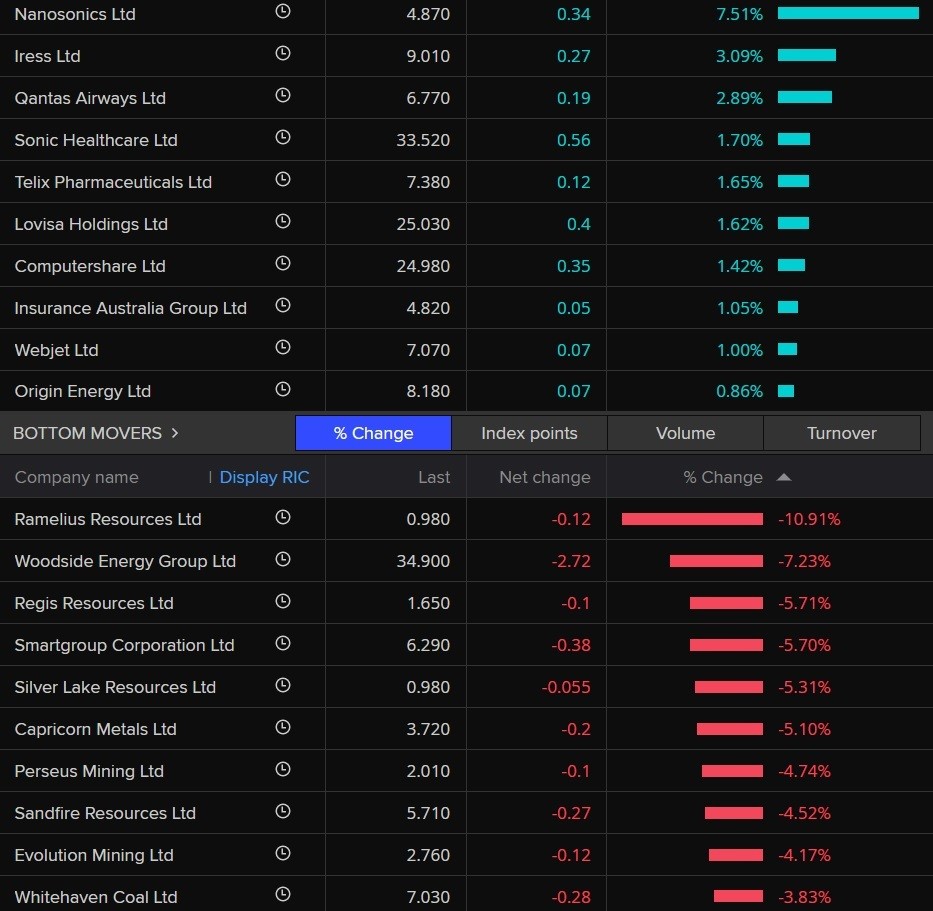

The ASX 200 fell 0.8% to 7,308 points with commodity stocks leading declines.

The benchmark rose 0.5% on Tuesday. Some are speculating the ASX 200 rallied too hard on rates day and now people have some post-party jitters. It happens. We get it.

Miners fell 1.2%, with BHP Group, Rio Tinto and Fortescue Metals shedding between 0.1% and 1.4%.

Energy stocks dropped 4.2% after oil prices slumped overnight on fears of those steeper US rate hikes.

Woodside Energy dropped the most in three months on ex-dividend trading.

Banks declined 0.7%, with all the big four banks closing in negative territory.

Meanwhile, CBA said its Indonesian unit had been hit by a cyber attack, involving unauthorised access of a software application. Its shares fell 0.3%.

Gold stocks plunged 3.4% as bullion prices fell after Powell's hawkish tone.

Federal government re-introduces Financial Compensation Scheme of Last Resort

By Emilia Terzon

If you've seen this headline before then it's not just déjà vu.

This compensation scheme has been talked about since the banking Royal Commission and is billed as it sounds: it's a compensation scheme of last resort for victims of companies that go broke.

The topline on this scheme is that it would help some (but not all) consumers who invest their cash into specific entities get money back if there's an AFCA complaint upheld.

In recent iterations compensation was being capped at $150,000 per claim. And you'd have to lose money to an entity covered by AFCA to be eligible to apply. AFCA members were proposed to fund the scheme.

However, it's been beset by problems for years to be passed.

The last Coalition government introduced it before the election. Then the new Labor government introduced it again. And round she goes again with it now being re-introduced in the House of Reps today.

Here's some lines from Assistant Treasurer Stephen Jones about it today on that news:

As we sit today, there are around 2000 people who are awaiting judgment through the tribunal to have their claims for compensation, heard and determine.

There are 30 people who have been awarded a grant of compensation through Africa, but have not been able to get their money because the compensation scheme hasn't been set up.

We're calling on the Senate to pass the bill. We're calling on them to to pass it without delay. If we don't get these bills through the parliament by March, we won't be able to have the scheme up and running by the end of the year.

Will the bill finally pass the Senate?

We've asked the Coalition if they'd support its passage. In a statement the shadow Treasurer Angus Taylor said:

The Coalition has been clear for months: we will support this legislation if it remains consistent with what the Coalition put forward before the last election.

The Coalition previously backed it, but argue it needs to reconsider the bill after changes to the legislation in a deal with the Greens. So essentially... it's a watch this space.

Where we are sitting at 12:45pm AEDT

By Emilia Terzon

- ASX 200: -0.9% to 7,296 points

- All Ords: -0.9% to 7,494 points

- Australian dollar: -2.2% to 65.87 US cents

- Dow Jones (close): -1.7% to 32,856 points

- S&P 500 (close): -1.5% to 3,986 points

- Nasdaq (close): -1.3% to 11,530 points

- DAX (close): -0.6% to 15,559 points

- FTSE (close): -0.1% to 7,919 points

- Brent crude: -3.6% to $US83.29/barrel

- Spot gold: -0.2% to $US1,816.80/ounce

-

Bitcoin: -1% to US$22,157

Next week's jobs numbers will be critical to April rates decision

By Michael Janda

RBA governor Philip Lowe says the board has "a completely open mind" when it comes to next month's rates decision.

It is flexible and data dependent.

Mr Lowe then went on to outline four key pieces of economic data that the board would be keeping an eye on between now and its next meeting on Tuesday April 4.

"Before our next board meeting we'll have important data on unemployment, we'll have another monthly inflation indicator, we'll have more detail on retail spending and the business survey," he explained.

"So they're four really important pieces of data that we'll look at, at our next board meeting.

"If, collectively, they suggest that the right thing is a pause, then we'll do that, but if they suggest that we need to keep going then we'll do that."

Obviously, the February monthly Consumer Price Index indicator data from the ABS out on March 29 is key, given that the RBA primarily targets inflation.

For rates rises to stop, it needs to keep showing signs of moderating.

However, the February jobs data out next Thursday March 16 is also critical, given that most economists (including at the RBA) have been caught off guard by a sudden deterioration in both job creation and the unemployment rate.

One factor sometimes ignored, but not by IFM chief economist Alex Joiner, is how reopened international borders are massively increasing labour supply.

Jobs were lost in January, which the RBA put down largely to a statistical quirk.

But, to stop unemployment rising, a lot of extra jobs need to be created — according to CBA estimates from earlier this year, around 26,000 per month.

My colleague Gareth Hutchens penned a great piece about a year ago explaining the mechanics of how this works.

Where things have ended up at 12pm AEDT

By Emilia Terzon

As tipped this morning, Australian shares are down today after Wall Street had some heavy losses.

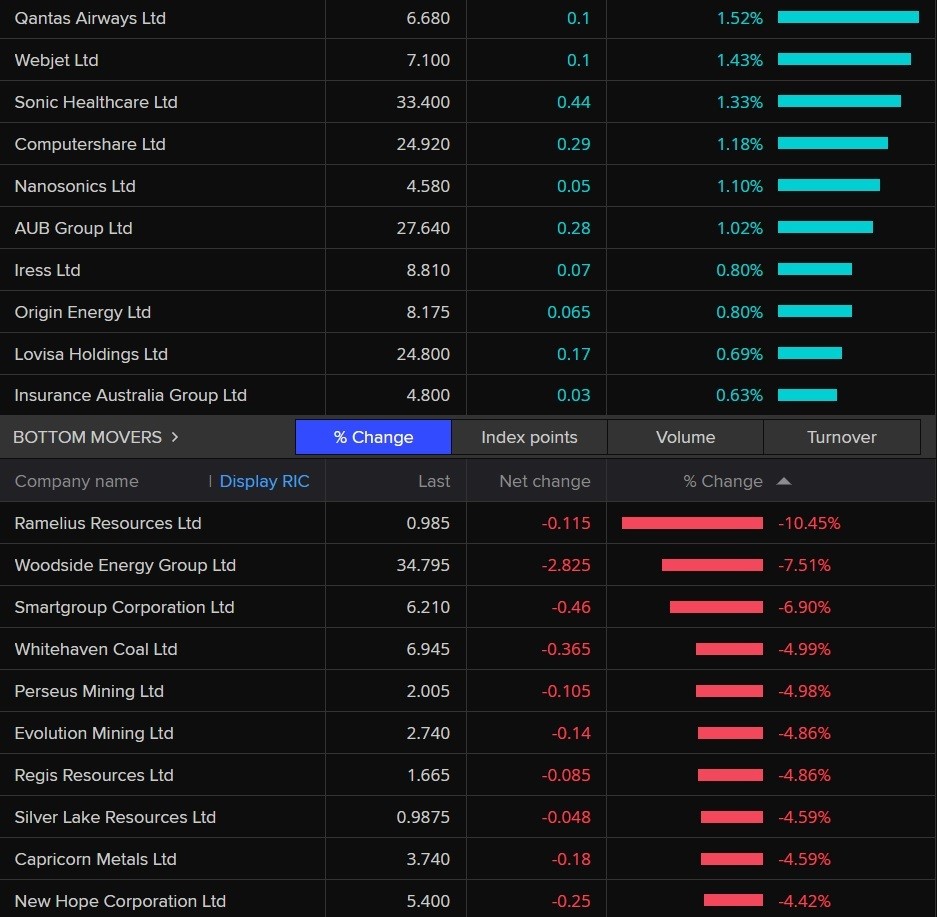

The ASX 200 is down around 0.7 per cent at 12pm AEDT. That's after four days of gains in a row and closing 0.5 per cent up yesterday.

Energy stocks are leading losses on the benchmark with a 5% drop after oil fell by $3 a barrel overnight.

Sector major Woodside Energy slipped 7.6%.

Mining stocks slumped 1.3% with heavyweight miners BHP Group and Rio Tinto losing 0.2% and 0.5%, respectively. As we know, this is happening as the AUD plummets.

Gold stocks dropped 3.6% after bullion prices fell more than 1%, while financial stocks retreated nearly 1%.

In other news, shares in Carsales.com are in a trading halt after the company said it was seeking to raise A$500 million to buy an additional 40% stake in Brazil-based automotive digital marketplace Webmotors SA.

We also have Qantas and Webjet as the biggest gainers so far in the ASX 200. That's as we keep seeing data that travel is proving resilient with consumers who are still seeking to get out and about post pandemic, despite the rising cost of living.

House price falls not improving affordability while rates keep rising: Moody's

By Michael Janda

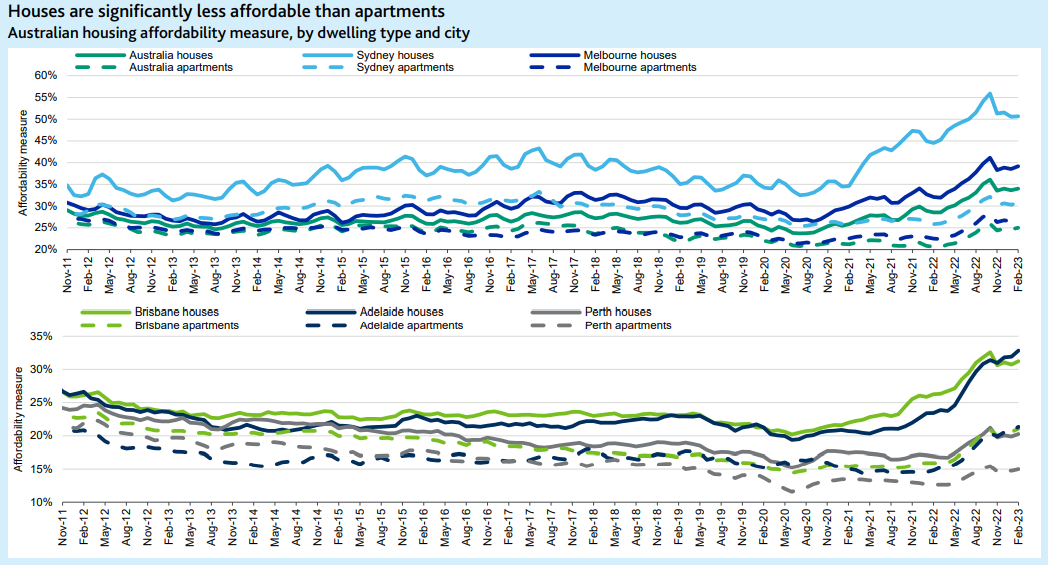

Moody's Investor Services has a new report on housing affordability for prospective buyers in Australia, and it's not cheery reading.

"Australian housing affordability, which worsened over 2022, will remain poor over 2023," it notes.

"We measure housing affordability as the proportion of household income borrowers need to meet repayments on new mortgages.

"On average, Australian households with two income earners needed 30.9% of monthly income to meet monthly mortgage repayments on new loans in February, up from 26.4% in May 2022 when interest rates began to increase, but down from a decade-high 32.4% in October 2022.

"Affordability has worsened in all capital cities since May last year. In Sydney, the least affordable city, new borrowers needed 40.7% of household income to meet mortgage repayments in February, much higher than Melbourne (34.5%), Adelaide (31.1%), Brisbane (27.9%) and Perth (19.3%)."

And things are unlikely to get better for those seeking to break into the housing market, even though property prices are still expected to keep falling.

"Over 2023, we expect that ongoing housing price declines and further interest rates rises will broadly balance out in terms of their effect on housing affordability," the report continues.

"We therefore expect the share of income that borrowers need to meet repayments on new mortgages will hold at around the February level."

And it's worse still if you want a house, not an apartment, especially in Sydney.

"Australian houses are much less affordable than apartments," the report observes.

"On average in Australia, house buyers needed 34% of household income to meet repayments on new mortgages in February, compared with 25% for apartments.

"The disparity between house and apartment affordability is most pronounced in Sydney, where house buyers needed 50.7% of household income to meet mortgage repayments in February (down from record-high 55.9% in October 2022), compared with 30.7% for apartments.

"Since the RBA started its interest rate rise cycle in May 2022, average prices have declined more for houses than apartments, particularly in Sydney, Brisbane and Hobart."

How we're looking at 10:30am AEDT

By Emilia Terzon

- ASX 200: -0.7% to 7,311 points

- All Ords: -0.8% to 7,503 points

- Australian dollar: -2.2% to 65.85 US cents

- Dow Jones (close): -1.7% to 32,856 points

- S&P 500 (close): -1.5% to 3,986 points

- Nasdaq (close): -1.3% to 11,530 points

- DAX (close): -0.6% to 15,559 points

- FTSE (close): -0.1% to 7,919 points

- Brent crude: -3.6% to $US83.08/barrel

- Spot gold: -0.1% to $US1,818.20/ounce

-

Bitcoin: -1.2% to US$22,108

#ICMYI How borrowers are feeling after a 10th rate hike

By Emilia Terzon

This story by my colleague Rhiana Whitson was on ABC's The Business last night.

'Flexible' RBA now at odds with 'hawkish' Fed

By Michael Janda

The Reserve Bank governor is indicating the board is considering a pause after 10 consecutive interest rate rises, but says the timing will depend on incoming economic data.

In a speech to the AFR Business Summit, RBA boss Philip Lowe revealed the bank's board had actively talked about the possibility of leaving the cash rate target on hold at a future meeting, now that it is in "restrictive territory" at 3.6 per cent.

"At our board meeting yesterday, we discussed the lags in monetary policy, the effects of the large cumulative increase in interest rates since May and the difficulties that higher interest rates are causing for many households," Mr Lowe said.

"We also discussed that, with monetary policy now in restrictive territory, we are closer to the point where it will be appropriate to pause interest rate increases to allow more time to assess the state of the economy.

"At what point it will be appropriate to pause will be determined by the data and our assessment of the outlook."

Mr Lowe's comments are in stark contrast to the US Federal Reserve, whose chair Jerome Powell last night flagged the possibility of more aggressive rate rises.

The divergence between the two central banks had already seen the Australian dollar lose a couple of per cent against the US dollar since yesterday's RBA meeting.

Mr Powell has talked up the prospect of bigger rate rises, with markets now pricing in an 80 per cent chance of a half-a-percentage point rise in March.

Instead, Mr Lowe is backing away from firmly locking the bank into further rate increases, as recent GDP, employment and wages data has disappointed, and with per capita consumer spending already falling in response to the rate rises implemented last year.

"Given these uncertainties, the board is monitoring the data very carefully month to month. It has the flexibility to respond as needed," he said.

Although it does look like Australian borrowers should expect at least one more rate rise, even if it doesn't come next month.

"Our judgement, though, remains that further tightening of monetary policy is likely to be required to bring inflation back to target within a reasonable timeframe," Mr Lowe added.

You can read more in my article about Mr Lowe's speech, and the Q&A session to follow, here.

Economists are shining their crystal balls again

By Emilia Terzon

We've got a lot of predictions coming in after yesterday's 10th rate hike in a row by the RBA.

First up, NAB is noting that Lowe's softer language was interpreted by the market as there potentially being a pause on the horizon for April.

The likes of CBA are still predicting a 0.25 rise for April. But some are diverging, including AMP and HSBC.

But why talk about April when you can predict when rates might start to go down?

ABC business reporter Peter Ryan had this interview air on national current affairs program AM this morning.

AUD plunges as rate hike divergence emerges

By Emilia Terzon

Good morning!

Well, if you've got a rates day hangover, you're not alone. So too does the Australian dollar which has plunged overnight.

On the one hand, we had the RBA's governor hint yesterday that the central bank's 10th rate hike in a row may be one of the last for a while. You can read more analysis about Lowe's statement by my colleague Michael Janda.

Overnight, however, we've had some more hawkish remarks out of the US from Lowe's counterpart. Jerome Powell is hinting that strong economic data out there may see a need for further rate hikes to tame inflation.

The Fed Funds futures market now sees an 80% chance of a 50bps hike in March, up from around 20% prior to Powell’s remarks, according to NAB this morning.

And all of this divergence is impacting the value of the Australian dollar compared to the greenback.

You've got the USD trading strongly off the rate hike remarks, while the AUD is also softer afer the RBA's policy meeting. Overall, we've this morning got the Aussie dollar at 65.80 US cents.

As CBA notes, this is a new low for 2023.

"AUD was also lower against the other major currencies. Yesterday’s less hawkish communication from the RBA stands in contrast to Powell’s hawkish comments overnight," they note.

IG analyst Tony Sycamore notes it's a combination of "dovish" and "hawkish" that's only likely to intensify, as the potential the the US federal rate hike projections to increase.

Or as another colleague David Taylor summed up:

This morning there could be more market moving statements by Lowe. He's speaking publicly at 8:55am AEDT in Sydney. Although we're sure per usual he'll choose his words carefully.

Where we are sitting at 7:30am AEDT

By Emilia Terzon

- ASX 200 futures: -0.1% to 7,273 points

- Australian dollar: -2.1% to 65.89 US cents

- Dow Jones: -1.5% to 32,928 points

- S&P 500: -1.4% to 3,992 points

- Nasdaq: -1.2% to 11,536 points

- DAX: -0.6% to 15,559 points

- FTSE: -0.1% to 7,919 points

- Brent crude: -3% to $US83.18/barrel

- Spot gold: -1.9% to $US1,819.50/ounce

-

Bitcoin: -1.2% to US$22,115