Another round of data out of the US is pointing towards inflation there easing, which could mean the Federal Reserve is done with rate hikes, at least for now.The ASX followed the optimism, while Bitcoin and gold also rallied.

Follow all the breaking business news as it happened on our Friday blog.

Disclaimer: this blog is not intended as investment advice.

Key events

Live updates

Market snapshot at 4:35pm AEST

By Michael Janda

ASX 200: 7,361 (+0.5%)

All Ordinaries: 7,560 (+0.5%)

Australian dollar: 67.77 (-0.1%)

Dow Jones: 34,029 (+1.1%)

S&P 500: 4,146 (+1.3%)

Nasdaq: 12,166 (+2%)

FTSE 100: 7,843 (+0.3%)

DAX: 15,729 (0.2%)

CAC 40: 7,480 (+1.1%)

Brent crude: $US86.41 (+0.4%)

Gold: $US2,043 (+0.2%)

Bitcoin: $US30,844 (+1.8%)

The ASX closes higher on positive leads from Wall Street

By Michael Janda

Some weaker than expected producer price readings out of the US have again raised hopes globally that the surge in inflation, and therefore interest rates, is nearing an end.

That saw Wall Street gain strongly overnight and the local market tagged along.

Education was the standout sector, but industrials, financials and mining stocks also performed well.

Gold miners had a good day as a falling US dollar helped boost the precious metal's price. The biggest gain today was Silver Lake Resources' 6 per cent jump to $1.33.

The worst performer was Karoon Energy (-5.4%), even though the energy sector was up overall as oil prices edged higher.

I'll be back on Monday morning with the start of next week's trading action.

Are surging mining profits to blame for rampant inflation?

By Michael Janda

The debate rolls on over who is to blame (and who is profiting) from soaring prices.

The Reserve Bank has said it isn't companies — if you exclude mining.

The Australia Institute has hit back, arguing that you can't exclude mining and energy, which accounted for more than half of Australian corporate profits last year.

It says including mining also makes sense because surging raw materials costs, especially energy, were one of the biggest drivers of inflation.

Independent economist Saul Eslake leans more towards the Reserve Bank's point of view.

The ABC's Gareth Hutchens has dived deep into the debate in this article, spare five or ten minutes to have a read.

ANZ tips a longer interest rate pause for the RBA

By Michael Janda

After NAB's flip-flop on its rate forecasts over the first few months of this year, ANZ is also (slightly) softening its hawkish stance.

Having previously expected the cash rate to hit 4.1 per cent by May, it now expects the RBA to pause until August before one more rate hike takes the cash rate to a peak of 3.85 per cent.

Here's the reasoning from the ANZ's economics team:

"The RBA's current stance is to take additional time to assess the impacts of the cumulative 350bp [basis points] of hikes delivered so far, and a one-month pause is not consistent with this.

"The RBA will likely take comfort that headline inflation appears to be falling faster than it has forecast, with slower goods and tradables inflation.

"Our central scenario has the next hike in August, bringing the cash rate to a 3.85 per cent peak for the cycle. This hike would be in response to persistent stickiness in the Q2 CPI report (due late July)and a stronger wage outlook.

"Risks remain tilted towards a higher terminal rate in our view. And an upside surprise to our Q1 trimmed mean forecast would increase the probability of a hike in May."

This is still a fairly contrarian view, with the vast bulk of economists expecting consumption to slow over this year, leading to a rise in unemployment over the second half, with those leading to decreases in both wage and inflation pressures.

In fact, CBA's economists (and they're not alone) think a rate cut is more likely than an increase by August — although CBA does still expect one more rate rise in May.

Port Hedland reopens after Ilsa near miss

By Michael Janda

Hi all, I'm stepping in for Emilia to take you through the rest of the trading day's action.

First, some good news for Australia's massive iron ore export juggernaut.

Tropical Cyclone Ilsa passed further north of the key export hub of Port Hedland than had been feared, meaning the town and port escaped major damage from the category five cyclone.

After inspections of the port infrastructure, navigation aids and shipping channels this morning, authorities declared the port re-opened at 11:00am WA time.

"Pilbara Ports Authority is liaising with terminal and vessel operators and stakeholders to plan the recommencement of shipping," the authority noted.

No word yet on how long it will take to load up the backlog of ships that were sent offshore to avoid damage ahead of the cyclone, but we have asked.

Next step towards battery hub

By Stephanie Chalmers

There've been moves today that could increase Australia's footprint in the global battery supply chain, a growing industry as the world transitions to electric vehicles.

Minerals miner IGO and Wyloo Metals, which is backed by Andrew Forrest's private investment group, have secured land with their sights on developing an integrated battery material (IBM) facility.

What is an IBM facility? Essentially, it's a further step down the line than simply processing the individual components, such as nickel or lithium.

The IGO-Wyloo proposed IBM processing plant would take nickel, cobalt and manganese and combine them into a precursor material, that would eventually become a battery component.

Today, the firms announced they've secured a lease from the WA government in Kwinana.

The location would put the proposed project in close proximity to a lithium hydroxide refinery — so, a plant producing yet another battery component.

Also in Kwinana, BHP's Nickel West project refines nickel powder and then processes it into nickel sulphate, that is then exported to overseas markets.

The IGO-Wyloo proposal would take Australia a step further down the battery supply chain.

"We believe the area where Australia can be most competitive is in the mid-stream battery chemical processing," IGO acting chief executive Matt Dusci said.

However, it's a way off being confirmed, let alone coming to fruition — IGO and Wyloo say they're "working towards making a financial investment decision on the development of the project".

Announcing the land allocation, the WA government said there's "no better home" for the country's first commercial precursor cathode active material producer.

"When it comes to battery and critical minerals, Western Australia has significant competitive advantages both nationally and internationally," WA Mines and Energy Minister Bill Johnston said.

"I look forward to seeing how this project helps the state move down the battery value chain and grow the industry for years to come."

Investors liked the update — IGO shares are up 4.9 per cent at the moment.

Have the banks hit the limit on interest rates?

By Emilia Terzon

CBA has today announced it is changing interest rate offers for new customers on a range of home loans.

Its three-year fixed product is going down 0.4 of a percentage point.

However, variable home loan rates are going up for a section of new borrowers coming to it with LVRs under 80 per cent.

Loans with LVRs under 80 per cent are more likely to be people refinancing, as those with higher LVRs are often first home buyers.

CBA is increasing interest repayments by as much as 0.12 per cent for an LVR of up to 80 per cent on variable home loans.

In a statement, the big four bank says this is "part of our ongoing review of funding costs, interest rates and market conditions".

Home loan analyst website RateCity says this is the second time CBA has lifted rates on new home loan offerings in recent weeks, and it follows similar moves by the bank's rivals.

Its research director, Sally Tindall, has this to say:

At the start of the RBA hikes, the big four banks cut new customer rates repeatedly in a bid to bring in new business. This aggressive discounting is now in reverse.

After 10 cash rate hikes and steep increases to wholesale funding globally, the big banks are now quietly slipping their biggest discounts off the table.

While the refinancing boom has driven banks big and small to offer competitive new customer rates, the unprecedented volume of loans now refinancing is no doubt putting added pressure on profit margins.

It’s likely to be getting too expensive for the banks to hand out discounts of this magnitude at these volumes.

Meanwhile, Sally Tindall says it appears the bank has lowered the rates on its three-year fixed loan, in line with market expectations that the latest rate hike cycle is ending.

After a pause this month, economists are split as to whether the RBA will hike again in May.

"The tide is starting to turn as we approach the cash rate peak, particularly among smaller lenders," Ms Tindall says.

“[Our] database shows 16 lenders have taken the knife to fixed rates in the past two weeks, while just 8 have hiked rates.

“That said, fixing is still very much on the nose. The latest ABS lending indicators shows just 5 per cent of new and refinanced loans opted for a fixed rate in February."

What would you do right now? Fix? Variable? No mortgage?

#BREAKING Port Hedland port to re-open at 11am (Perth time)

By Emilia Terzon

This just in.

The port authorities for Port Hedland will re-open it at 11am (Perth time) this morning after no damage was found.

While Cyclone Ilsa made landfall as a category five system in WA, emergency services had previously told ABC News this morning that Port Hedland escaped the "brunt" of it.

Port Hedland is a key export gateway for minerals and is one of the biggest ports for iron ore in the world.

The port was closed as the system passed through.

Authorities that manage the town's port inspected for any damage this morning. This from them:

Pilbara Ports Authority has undertaken inspections of navigation aids, the channel and berths and has confirmed safe operations can resume.

As of 11:00am Pilbara Ports Authority will reopen the Port of Port Hedland.

Pilbara Ports Authority is liaising with terminal and vessel operators and stakeholders to plan the recommencement of shipping.

According to industry press, Port Hedland has not been forced to shut since 2019, when tropical cyclone Veronica struck the coast in March.

Meanwhile, speaking of iron ore, we have the price of it globally still on the decline. Here's ANZ analysts on the subject:

Iron ore extended its losses as China plans to cap steel production for 2023. This in response to slower demand recovery and to curb emissions. However, steel production rose by 2.7 per cent to 2.32mt earlier this month.

Subdued domestic demand and strong production saw steel inventories at Chinese mills rising by 6% to 18.3mt. Weaker demand sentiment led some Chinese mills to slash their selling prices.

On the supply front, Port Hedland in Australia is closed in preparation for Tropical Cyclone Ilsa. This could cause a temporary disruption in supply flows.

More on tropical cyclone Ilsa here:

ASX goes into lunchtime in positive territory

By Emilia Terzon

The ASX has now decided to follow US markets.

Better late than never, folks.

The ASX 200 opened slightly down but now it's up 0.3% around lunchtime.

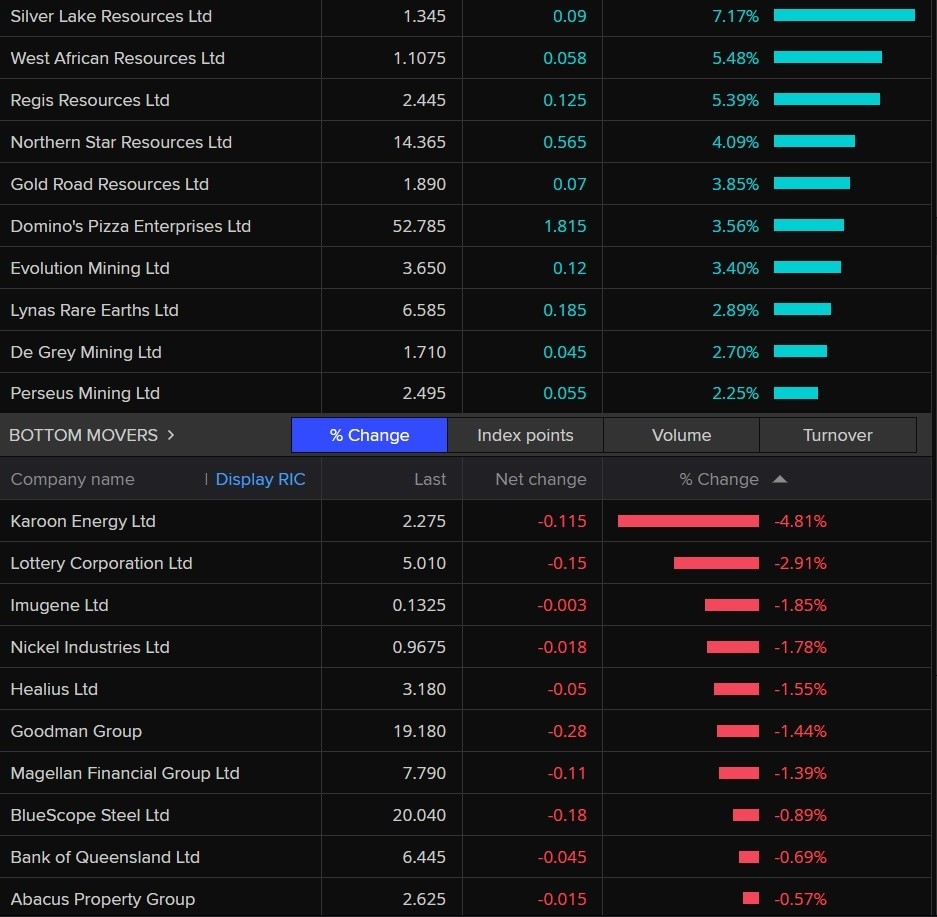

Here's the top and bottom stocks:

As you can see, the share market is being helped along by gold and technology stocks.

Gold stocks jumped 2.8 per cdent to hit their highest since January 2021 and were on track for a fifth straight weekly gain.

While the positive fortunes on US markets are being helped by traders feeling optimistic that there are no more rate hikes from the Fed (for this cycle), there are differing opinions here.

Our latest jobs data out yesterday pointed to a tight labour market. With the unemployment rate held near 50-year lows, many economists are suggesting that the Reserve Bank of Australia might hike rates further.

There are some differing opinions.

We just got a note from ANZ, which is sticking to its projections of no rate hike in May.

It is basing this on the next round of inflation data. Here are its projections:

We expect headline CPI inflation to have fallensharplyin Q1to 6.9% y/yfrom a peak of 7.8% in Q4.

The RBA will likely take comfort thatheadline inflation appears to be falling fasterthan itforecast in February (6.7%y/y for Q2).

We therefore expect the RBA tokeep the cash rate on holdat 3.6%in May.

In other news, index majors Newcrest Mining and Northern Star Resources have advanced 1.9 per cent and 3.3 per cent, respectively.

Financials added 0.2 per cent, with the so-called "big four" banks trading in positive territory.

Meanwhile, miners were flat after iron ore futures slumped overnight on prevailing pessimism over steel demand in top producer China.

Sector giants BHP Group and Rio Tinto fell 0.7 per cent and 0.8 per cent, respectively.

Among individual stocks, Bank Of Queensland BOQ.AX slipped as much as 3.9 per cent after it said it would undertake an integrated risk programme to mitigate risk management, which will reflect A$60 million ($40.71 million) hit in 1HFY23 results.

Where we are sitting at 12:30pm AEDT

By Emilia Terzon

- ASX 200: 7,346 (+0.3%)

- All Ords: 7,547 (+0.4%)

- Australian dollar: 67.88 (+0.2%)

- Dow Jones: 34,029 (+1.1%)

- S&P 500: 4,146 (+1.3%)

- Nasdaq: 12,166 (+2%)

- FTSE 100: 7,843 (+0.3%)

- DAX: 15,729 (0.2%)

- CAC 40: 7,480 (+1.1%)

- Brent crude: US$86.26 (-1.3%)

- Gold: US$2,054 (+1.5%)

- Bitcoin: US$30,331 (+1.5%)

#ICYMI Jobs data increases chance of another rate hike

By Emilia Terzon

This story aired last night on ABC's The Business by my colleague Rachel Pupazzoni.

ASX trading flat as it weighs up rate hikes

By Emilia Terzon

The ASX 200 and All Ords are trading flat.

That's despite a bounce of optimism over in the US, where equity markets jumped on the latest data signalling inflation may be easing.

The Australian share market also closed down yesterday after strong jobs data and fears that another rate hike is around the corner spooked traders.

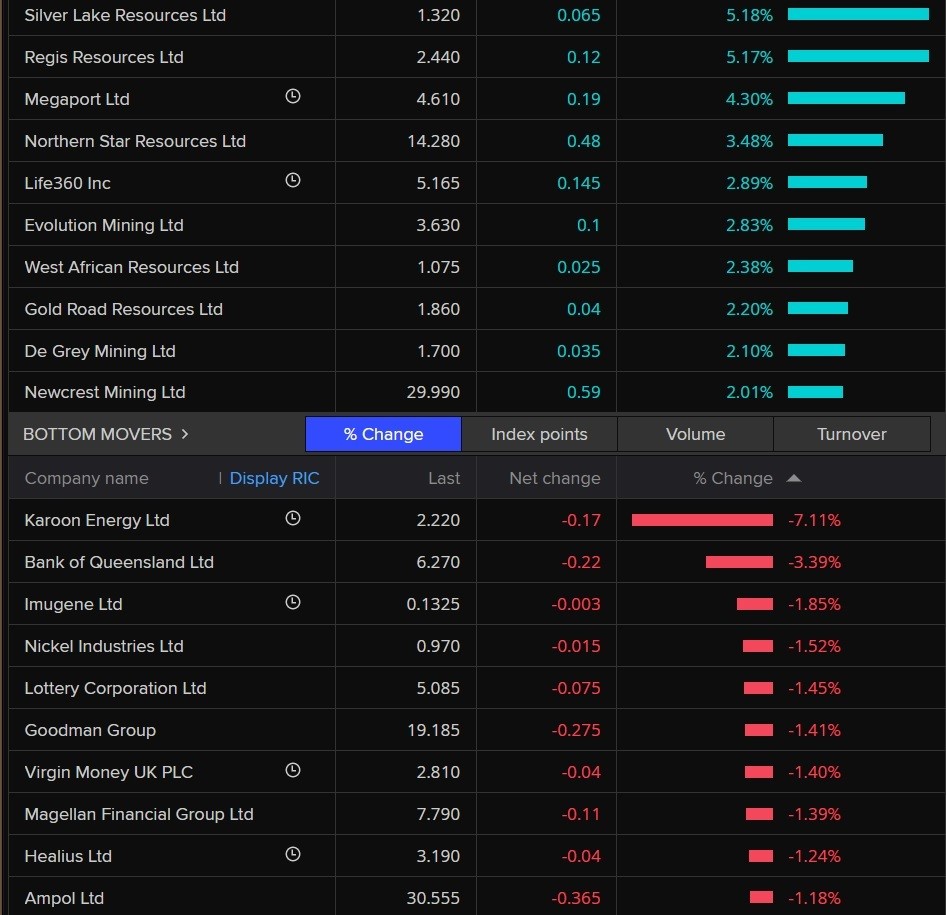

So far these are the top and bottom movers this morning:

You're probably noticing a fair few gold stocks in those top performers. That's as the spot price on the global market hits a one-year high.

Meanwhile, Corporate Travel Management's stock is still gaining this morning (+0.8 per cent) after its bumper payday yesterday.

The Australian company, which manages travel bookings, especially for larger companies, jumped most in nearly 2.5 years yesterday after receiving a contract from the UK Home Office for a total transaction value of $3 billion.

This just out from UBS on CTM:

A large contract win, highlighting the strength of the UK business and the way CTD is regarded by the UK Gov.

We have been conservative in our assumed net contribution (+2 per cent EPS in FY24/25E), however we estimate potential upside of +10-13 per cent, assuming no offsetting factors.

Here's where we are at 10:30am AEDT

By Emilia Terzon

- ASX 200: 7,317 (-0.1%)

- All Ords: 7,517 (-0.1%)

- Australian dollar: 67.88 (+0.2%)

- Dow Jones: 34,029 (+1.1%)

- S&P 500: 4,146 (+1.3%)

- Nasdaq: 12,166 (+2%)

- FTSE 100: 7,843 (+0.3%)

- DAX: 15,729 (0.2%)

- CAC 40: 7,480 (+1.1%)

- Brent crude: US$86.26 (-1.3%)

- Gold: US$2,054 (+1.5%)

-

Bitcoin: US$30,331 (+1.5%)

Port Hedland escapes brunt of Cyclone Ilsa

By Emilia Terzon

Some good news this morning.

While Cyclone Ilsa made landfall as a category five system in WA, emergency services have told ABC News that Port Hedland and Bidyadanga appear to have escaped the "brunt" of it.

Here is Superintendent Peter Sutton from WA's Department of Fire and Emergency Services.

Port Hedland is a key export gateway for minerals and is one of the biggest ports for iron ore in the world.

The port was closed as the system passed through. It is unclear when it will re-open, with Peter Sutton telling ABC News just this morning that emergency services still need to assess the area for safety.

Authorities that manage the town's port say it'll be inspected for any damage this morning.

According to industry press, Port Hedland has not been forced to shut since 2019, when tropical cyclone Veronica struck the coast in March.

Meanwhile, speaking of iron ore, we have the price of it globally still on the decline. Here's ANZ analysts on the subject:

Iron ore extended its losses as China plans to cap steel production for 2023. This in response to slower demand recovery and to curb emissions. However, steel production rose by 2.7 per cent to 2.32mt earlier this month.

Subdued domestic demand and strong production saw steel inventories at Chinese mills rising by 6% to 18.3mt. Weaker demand sentiment led some Chinese mills to slash their selling prices.

On the supply front, Port Hedland in Australia is closed in preparation for Tropical Cyclone Ilsa. This could cause a temporary disruption in supply flows.

We'll keep you across the news as we get it out of WA. We are thinking of all of the communities there as they get through yet another severe weather event.

You can also stay updated on another ABC News blog specifically about Cyclone Ilsa.

Why markets are rallying in the US

By Emilia Terzon

Good morning friends!

We've had some big gains on the US markets overnight, with the tech-heavy Nasdaq up a sizeable 2 per cent. The S&P closed at its highest level since February.

That's after data called the producer price index was released. The PPI measures prices paid by companies for items, and is often seen as a leading indicator of consumer price inflation.

This round of PPI data showed a decline of 0.5 per cent, which came far below many economists' expectations.

And by now we're all well versed in how markets react to cooling inflation. It makes us ponder the Fed's next move, right?

While equity markets in the US reacted very positively to the PPI data, analysts are pointing out that US yields were not as optimistic. Here is NAB's morning note:

Yields were mixed with the curve steepening: the 2yr held broadly steady at 3.96 per cent, while the 10yr rose 4.9bps to 3.45 per cent.

The implied inflation breakeven was broadly steady at 2.29 per cent with most of the move reflected in the 10yr TIP yield at 1.15 per cent.

Equities in contrast had a much sharper reaction.

Not everybody is convinced the Fed is done hiking. Here's a note from ANZ analysts this morning:

Given the slow-changing nature of many consumer service prices, it will take time for any easing in PPI service inflation to show up in the main consumer price indices.

We continue, therefore, to expect the Fed to raise interest rates 25bp next month.

The ASX 200 closed down yesterday on jobs data here that showed unemployment is still at historical lows, which traders took to suggest another rate hike by our RBA.

But today with ASX 200 futures up 0.3 per cent it looks like we may follow the leader and take a bit of that American optimism.

You may also have noted in our morning rundown that the Aussie dollar jumped overnight against the greenback.

That's more of a, "it's not me, it's you", situation.

As CBA analysts note this morning, the US dollar actually made a noticeable move when that PPI data was released.

USD took another leg down against all the major currencies overnight.

The USD does not normally react much to producer prices. But it did yesterday.

Meanwhile, gold has just hit a one-year high. That's as those rate hike fears subside and some even ponder the possibility of a recession.

We also have Bitcoin rallying again, which we will try to dig into for you later. Let us know if you're keen on more crypto news?

Settle in!

Where we are sitting at 7:30am AEDT

By Emilia Terzon

- ASX 200 futures: 7,356 (+0.2%)

- Australian dollar: 67.84 (+0.2%)

- Dow Jones: 34,029 (+1.1%)

- S&P 500: 4,146 (+1.3%)

- Nasdaq: 12,166 (+2%)

- FTSE 100: 7,843 (+0.3%)

- DAX: 15,729 (0.2%)

- CAC 40: 7,480 (+1.1%)

- Brent crude: US$86.26 (-1.3%)

- Gold: US$2,054 (+1.5%)

-

Bitcoin: US$30,331 (+1.5%)

- Iron ore: $US116.30 a tonne (-1.6%)