The Australian share market ended the trading week on a high, with the ASX boosted by industrials, banks and miners.

This was the day's financial news and insights from our specialist business reporters.

Disclaimer: this blog is not intended as investment advice.

Key events

Live updates

Markets snapshot at 4:20pm AEDT

By Michael Janda

- ASX 200: +0.4% to 7,284

- All Ords: +0.3% to 7,484

- Australian dollar: +0.2% to 67.40 US cents

- Nikkei: +1.2% to 27,840 points

- Hang Seng:+0.7% to 20,575 points

- Shanghai: +0.1% to 3,315 points

- Dow Jones (Thursday close): +1.1% to 33,004 points

- S&P 500 (Thursday close): +0.8 % to 3,981 points

- Nasdaq (Thursday close): +0.7% to 11,463 points

- FTSE (Thursday close): +0.4% to 7,944 points

- EuroStoxx 600 (Thursday close): +0.5% to 460 points

- Brent crude: -0.2% to $US84.55/barrel

- Spot gold: +0.1% to $US1,838/ounce

- Iron ore: +0.2% to US$127.02/tonne

- Bitcoin: -4.4% to $US22,379

Markets close higher, despite only half the index gaining

By Michael Janda

The benchmark ASX 200 index closed 0.4 per cent higher at 7,284, despite only 102 of the 200 companies on it gaining ground.

While the best sector on the market was industrials, both mining and financials rose, with BHP, Rio and the big four banks all making solid gains and hoisting the ASX up with them.

The broader All Ordinaries index, which includes many of the smaller listed firms, climbed 0.3 per cent to 7,484.

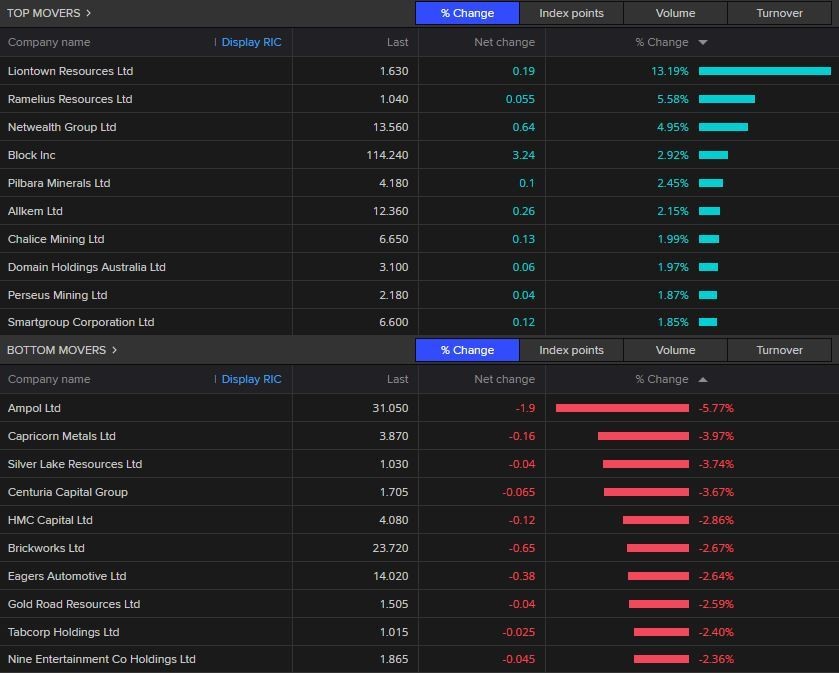

These were the top gains and losses on the ASX 200:

I'll return on Monday morning to bring you the start of next week's market action.

AMP Capital says 0.25 per cent rate hike likely on Tuesday

By Rhiana Whitson

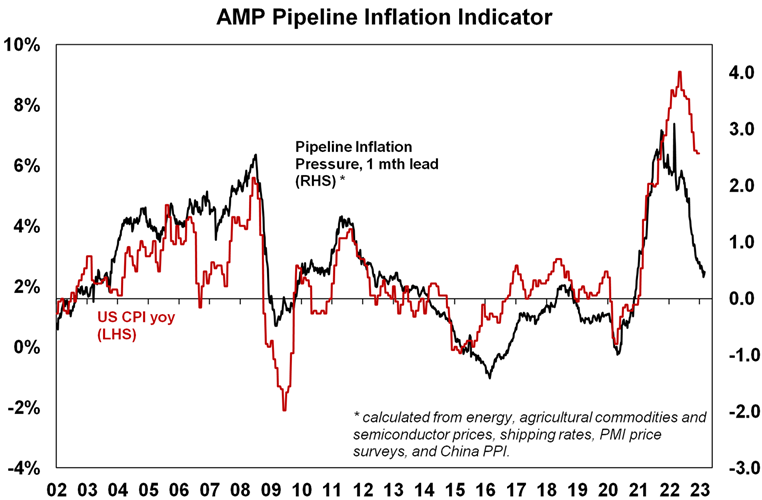

AMP Capital Chief Economist Shane Oliver says global inflation and the global inflation and the risk of more rate hikes triggering a recession remains the main concern for investment markets.

However, he says: The good news is AMP's US Pipeline Inflation Indicator, despite rising slightly in the last week, continues to point to a further fall in inflation reflecting improved supply, lower freight costs & the downtrend in business surveys regarding costs & prices.

That's good news for everyone.

Mr Oliver also says the RBA has done enough to cool growth and inflation, so should pause to allow more time for lags to work particularly given the run of soft recent data.

However, he notes: "The extent of the RBA’s recent hawkishness – flagging that 'further increases in interest are likely to be needed' - means that recent data is unlikely to have been enough to prevent it hiking again at its meeting on Tuesday so we are expecting another 0.25% hike taking the cash rate to 3.6%.

"Nevertheless, the run of softer data is a bit hard to ignore and we expect that the RBA will ease its tightening bias a bit, perhaps dropping in its rate guidance back from 'further increases in interest rates are likely' to something like the somewhat less hawkish wording it used in December that it “expects to increase interest rates further'," Mr Oliver notes.

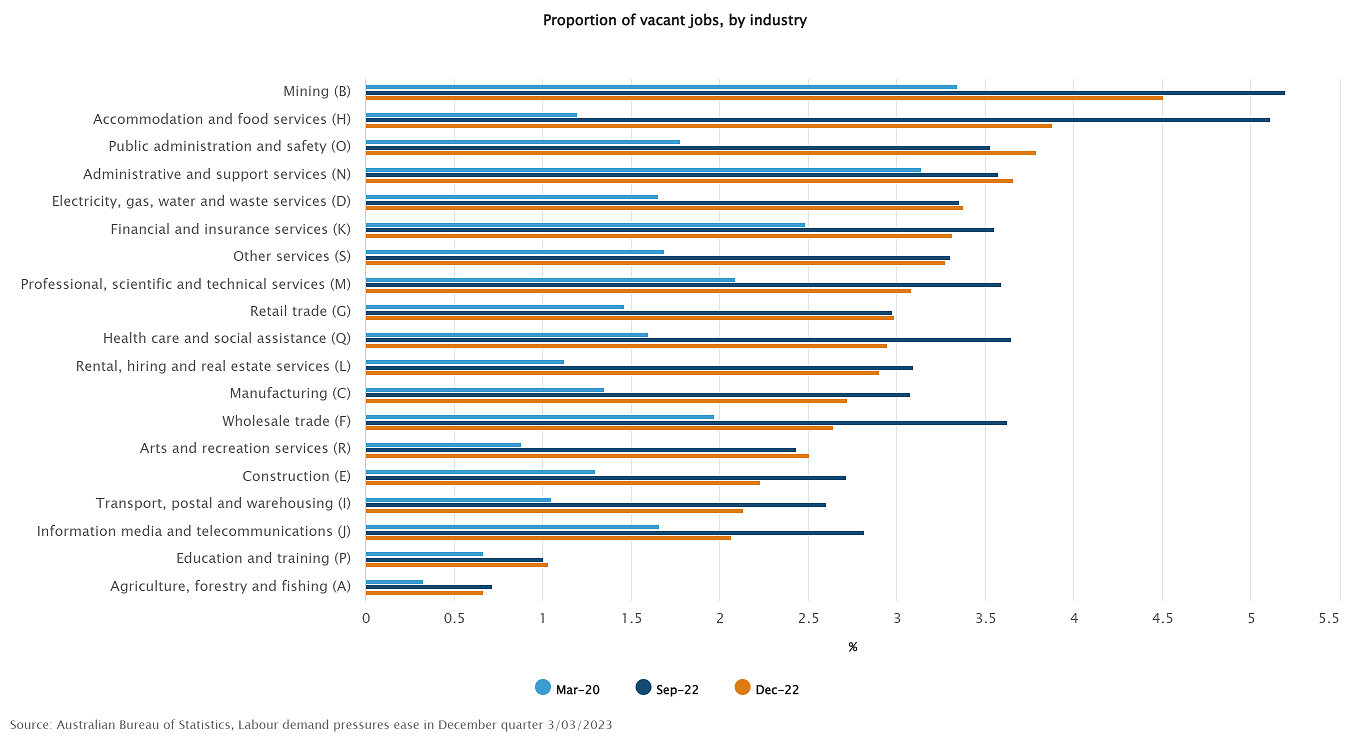

Job vacancies fall in December quarter

By Rhiana Whitson

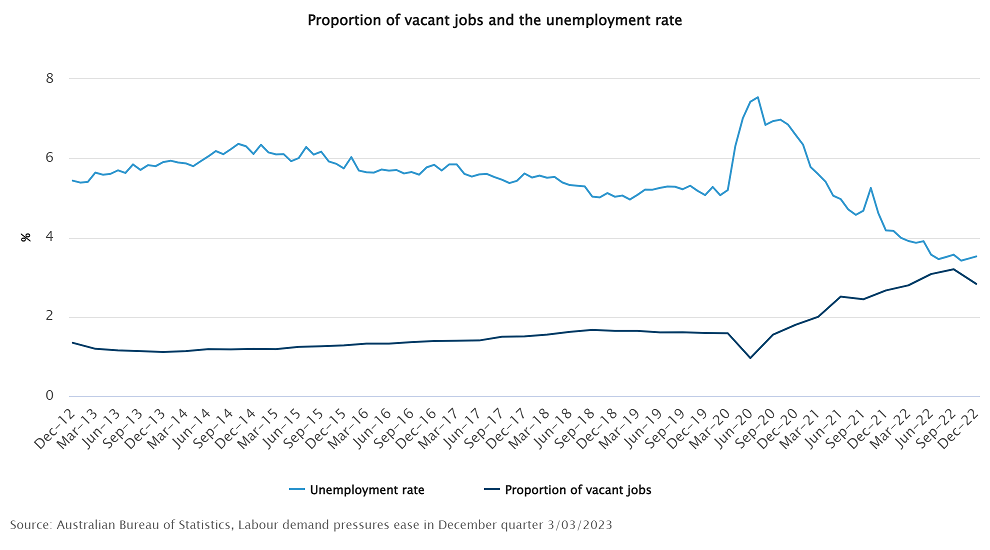

The demand for workers fell in the December quarter, with the proportion of vacant jobs from 3.2 per cent to 2.8 per cent, according to new figures from the Australian Bureau of Statistics (ABS).

“While the proportion of vacant jobs was lower in December, this came off a record high in the previous quarter, following a year of increases," Bjorn Jarvis, ABS head of labour statistics said.

It's also important to note the proportion of vacant jobs was still well above the pre-pandemic level of 1.6 per cent.

So, the labour market is still tight.

Mr Jarvis said the fall largely reflected a decrease in job vacancies, rather than the increase in total jobs in the labour market:

Actual vacancies fell by 11.2 per cent, also coming off recent historical highs. But they're also 94 per cent higher than March quarter 2020.

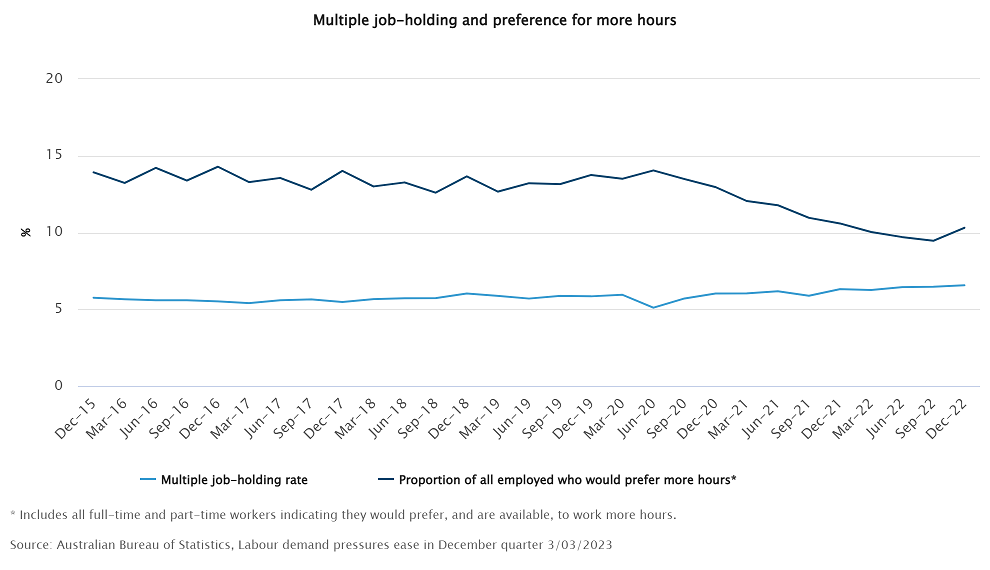

More Australians have multiple jobs

The rate of people with more than one job was up 6.6 per cent - that's the highest in the Labour Account series (which goes back to 1994).

The number of secondary jobs also reached a series high, increasing by 1.7 per cent to 1.0 million.

“Almost one in every fifteen employed people now hold more than one job, with some of these people working more than two jobs at the same time,” Mr Jarvis said.

Industry

Here you can see which industries are most in need of workers:

While there's still a lot more job vacancies than there were before the pandemic (when Australia was in a very soft patch economically), we're also well off the very high unrequited demand for workers that existed for most of last year.

My colleague Gareth Hutchens penned this piece in July last year.

Markets snapshot

By Rhiana Whitson

Here's a quick look at the key numbers as we approach 1:00pm AEDT:

- ASX 200: +0.34% to 7,279.80

- All Ords: +0.25% to 7,478.60.

- Australian dollar: +0.2% to 67.40 US cents

- Nikkei: +1.2% to 27,840 points

- Dow Jones (Thursday close): +1% to 33,003 points

- S&P 500 (Thursday close): +0.7 % to 3,981 points

- Nasdaq (Thursday close): +0.9% to 12,044 points

- FTSE (Thursday close): +0.3% to 7,944 points

- EuroStoxx 600 (Thursday close): +0.5% to 660 points

- Brent crude: -0.5% to $US84.30/barrel

- Spot gold: +0.2% to $US1,844/ounce

- Iron ore: +0.2% to US$127.02 / tonne

- Bitcoin: -5% to $US22,293

First home buyers dry up after stimulus-induced wave during COVID

By Michael Janda

The number of first time buyers taking out home loans has plunged to its lowest level since early 2017, as interest rates keep rising and after pandemic stimulus measures ended.

Lending finance data from the Australian Bureau of Statistics showed fewer than 7,000 first time home purchasers took out loans in January, seasonally adjusted.

"The number of new owner-occupier first home buyer loan commitments fell 8.1 per cent in January 2023," said Mish Tan, the head of finance and wealth statistics at the ABS.

"Owner-occupier first home buyer lending continued to decline from the high reached in January 2021. The decline coincided with the winding down of COVID-19 pandemic stimulus measures.

"Anecdotal feedback from lenders suggested that reduced borrowing capacity due to rising interest rates further dampened overall demand for new housing loans in recent months."

First home buyers weren't the only ones avoiding the property market, though.

The overall value of new loan commitments for housing fell 5.3 per cent to $22.1 billion in January 2023.

The value of total new owner-occupier loan commitments fell 4.9 per cent to $14.7 billion, while new investor loan commitments fell 6.0 per cent to $7.4 billion.

Refinancing of existing loans with new lenders also eased off a little in January, although it remains near record highs as borrowers try to minimise the burden of rising interest rates.

Markets at midday

By Rhiana Whitson

The ASX 200 has continued to rise, gaining 0.4 per cent to 7,283.

Tech, miners and telecommunications were the biggest boosts to the benchmark index.

The broader All Ordinaries rose 0.3 per cent to 7,435.

The Aussie dollar is up 0.3 per cent at 67.46 US cents.

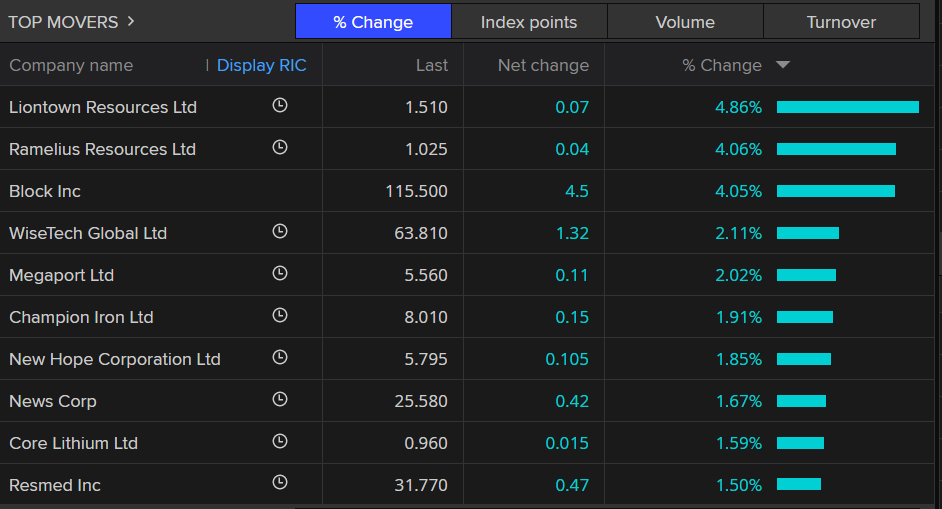

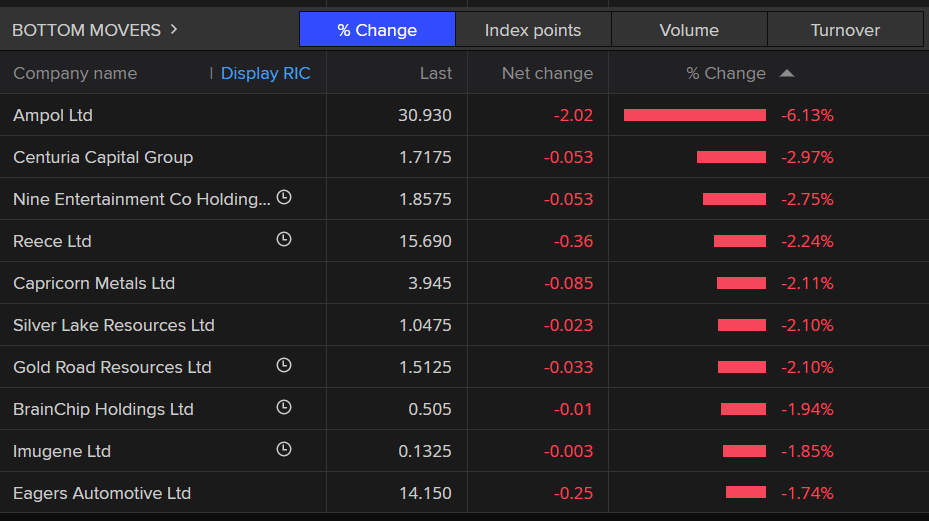

Here's a look at top and bottom stocks on the ASX:

NAB CEO backs super changes

By Rhiana Whitson

NAB CEO Ross McEwan told RN Breakfast he backs the government's superannuation changes, he says "3 million is a lot of money to have in a super fund" and that the move "needed to be made".

It comes as the RBA prepares to lift rates again, while the latest NAB survey shows more and more Australians are finding money a significant source of stress.

RN Breakfast host Patricia Karvelas also grills him about NAB's recent profit result:

Unions say Qantas is trying to lure back cabin crew on lower pay and conditions

By Rhiana Whitson

Qantas Group expects to create over 8,500 jobs over the next decade.

The airline sacked more than 6000 workers and stood down another 2500 during the pandemic.

“We look forward to working with the industry, training organisations, unions and governments to finalise details for the engineering academy," CEO Alan Joyce says.

“In the near term, we’re gearing up to meet the growth in all of the markets we serve. We have more aircraft arriving every month, and that means we need more pilots, engineers, cabin crew and others.

“Over the next 18 months, we expect to create more than 2,000 new jobs plus replacing natural attrition, so if you’ve ever wanted to work in aviation or at the national carrier, now’s a great time to join,” he says.

TWU National Secretary Michael Kaine said Qantas is attempting to bring back cabin crew on lower pay and conditions than they previously had at the airline.

“This is not a time for plaudits for rehiring new workers on inferior terms and conditions to fill decimated jobs, but a time for apology and action to reinstate workers and return pay and conditions to those that kept workers in jobs for life," Mr Kaine says.

"The Spirit of Australia was built by workers who held sought-after careers at Qantas, but those workers are gone and jobs are now lower-paid and insecure.

“After $2.7 billion of taxpayer funding and a $1.4 billion half-year profit, the airline should be back to full capacity and airfares at pre-covid prices, but that is impossible with a decimated and inexperienced workforce," he says.

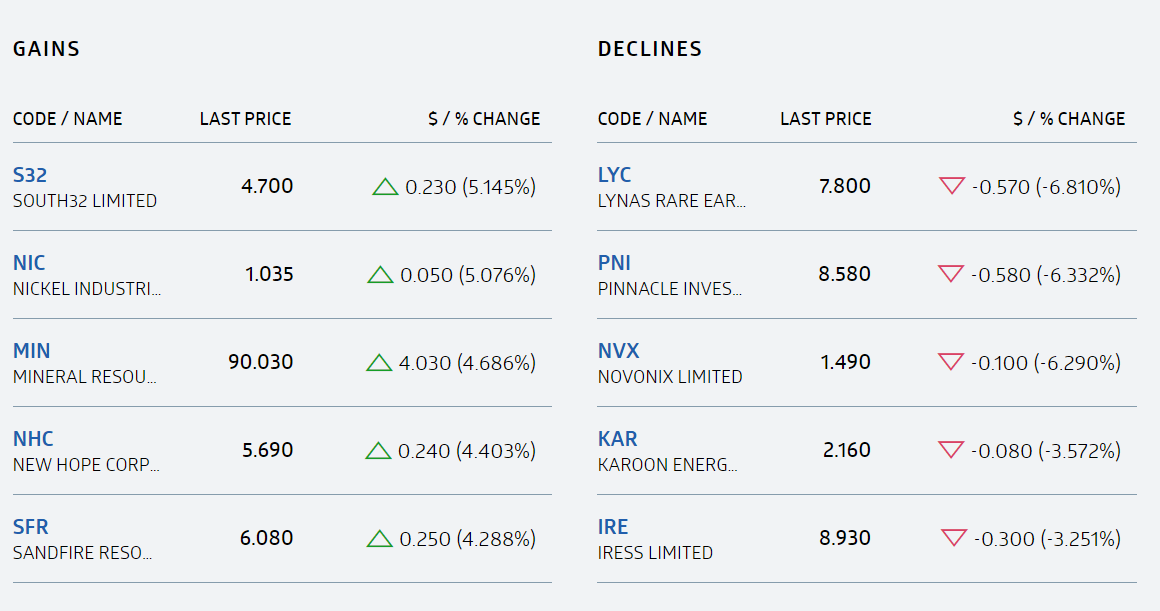

ASX trading higher

By Rhiana Whitson

Here's how local shares are going shortly after open.

The ASX200 is up, gaining 26.60 points or 0.4 per cent to 7,282.00.

The top performing stocks are NICKEL INDUSTRIES LIMITED and MINERAL RESOURCES LIMITED, up 5.1 per cent and 4.69 per cent respectively.

Economist Nouriel Roubini is tipping a "great stagflationary debt crisis"

By Rhiana Whitson

The man dubbed "Dr Doom", US-based economist Nouriel Roubini, is warning that the world is facing a "perfect storm" of high inflation, rising interest rates and recession that will be "the worst of all worlds for workers".

Check out his interview with The Business presenter Alicia Barry:

Nation's biggest lender CBA expects 25 basis points rate rise

By Rhiana Whitson

CBA head of Australian economics Gareth Aird has put out an interesting note on rates this morning.

"We expect the RBA to raise the cash rate at the March Board meeting by 25bp to 3.60 per cent," Mr Aird notes.

Mr Aird also notes:

"Our central scenario is that the peak in the cash rate is 3.85%. And we look for 50bp of policy easing in Q4 23. We expect the unemployment rate to be 4.3% in Q4 23 compared with the RBA’s forecast of 3.8%. We also expect inflation to recede more quickly, which should open the door for rate cuts in late 2023. We believe this will be required to stop the unemployment rate from rising to 4.5-5.0%."

He notes:

- Key domestic economic data over the past month has largely printed softer than consensus and RBA expectations, but the Board is unlikely to change their tone or assessment on the economic outlook just yet.

- That said, the Governor may soften the line a touch from the February Statement that “the Board expects further increases in interest rates will be needed over the months ahead”.

- Specifically that line could be tweaked to, “the Board expects to increase interest rates further over the period ahead”.

- The Governor will deliver a speech at the AFR Business Summit on Wednesday 8 March (8.55am AEDT) –the speech will fully flesh out the RBA’s latest thoughts on the economic and monetary policy outlook.

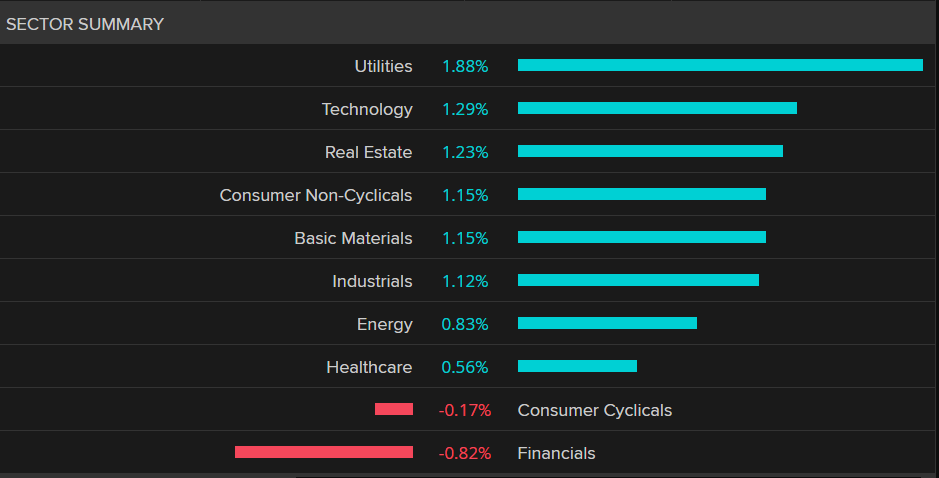

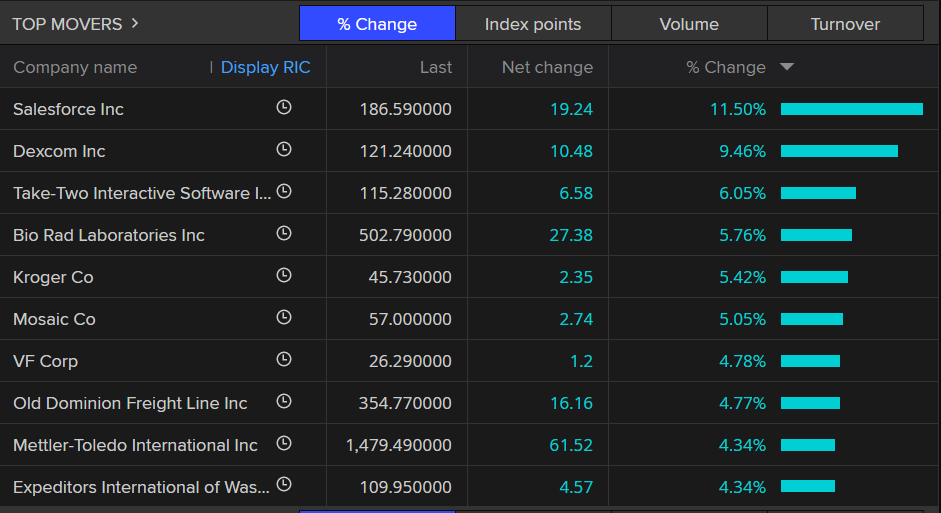

The best and worst of the S&P 500

By Rhiana Whitson

This is how the benchmark S&P 500 index closed:

US markets close

By Rhiana Whitson

US stocks ended higher as investors tried to shake-off concerns about interest rates.

The Dow Jones Industrial Average added 1.05 per cent, to close at 33,003.

The S&P 500 gained 0.7 per cent to close at 3,981. The Nasdaq Composite rose 0.7 per cent to 11,462.

The yield on 10-year Treasury notes had earlier touched a fresh four-month high of 4.091 per cent after data showed the number of Americans filing new unemployment claims fell again last week, indicating continued strength in the labour market.

A separate report showed US labour costs grew faster than initially thought in the fourth quarter.

The two-year US Treasury yield, had earlier touched a fresh 15-year high at 4.91 per cent.

Salesforce soared, after the cloud-based software firm forecast first-quarter revenue above analysts' estimates and doubled its share buyback to $20 billion.

Tesla fell after Chief Executive Elon Musk and team's four-hour presentation failed to impress investors with few details on its plan to unveil an affordable electric vehicle.

Macy's jumped after the department store operator forecast full-year profit above Wall Street estimates,

Silvergate Capital plunged after the crypto-focused lender delayed its annual report and said it was evaluating its ability to operate as a going concern.

I'll post the best and worst performing stocks shortly.

Bostic: Quarter-point US rate increases best to limit risk to economy

By Rhiana Whitson

Investors in the US have reacted to comments from Atlanta Federal Reserve President Raphael Bostic saying the impact of rate rises may only bite in the northern hemisphere's Spring (March). He reckons that's a reason why the central bank should stick with "steady" quarter-point rate increases.

"I am still very much of a mindset that slow and steady is going to be the appropriate course of action," Bostic said in comments reported by Reuters:

The cumulative effect of the Fed rate increases "should bite through the spring ... Going at a measured pace reduces the likelihood we overshoot" and damage the economy.

But Bostic at the same time said he was ready to keep lifting rates higher if inflation does not slow, and was still mulling how recent, stronger-than-anticipated inflation data might shape Fed policy.

The Fed could be close to a stopping point in the rate increases that have lifted the target federal funds rate from near zero a year ago to a "restrictive" level between 4.5% and 4.75% as of February, said Bostic, who is not a voter this year on interest rate policy.

He has pencilled in another half percentage point of increases as likely needed, but that depends on what upcoming data show about an economy that continues to outperform expectations.

The Fed could be close to a stopping point in the rate increases that have lifted the target federal funds rate from near zero a year ago to a "restrictive" level between 4.5% and 4.75% as of February, said Bostic, who is not a voter this year on interest rate policy. He has pencilled in another half percentage point of increases as likely needed, but that depends on what upcoming data show about an economy that continues to outperform expectations.

"We want to be very deliberative," Bostic said.

"Continue to raise rates for a time further until we start to see inflation trend clearly in a way that gives me confidence, we can get to 2%."

The Fed targets a 2% rate of annual increase in the Personal Consumption Expenditures price index, which as of January was increasing at a 5.4% annual rate.

- from Reuters

Markets snapshot

By Rhiana Whitson

Here's how are things were looking shortly after 7am AEDT:

- ASX futures: +0.3% to 7,225

- Australian dollar: -0.5% to 67.25 US cents

- US markets: Dow Jones (+0.8%), S&P 500 (+0.5%), Nasdaq Composite (+0.4%)

- Europe: DAX (+0.1%), FTSE 100 (+0.3%), STOXX 600 (+0.5%)

- Gold: $US1,841 an ounce (-0.2%)

- Brent crude oil: $US84.59 a barrel (+0.3%)

- Bitcoin: $US23,447 (flat)