Miners have weighed on the ASX along with worries about US debt ceiling negotiations, and the Commonwealth Bank has lifted interest rates on variable rate home loans.

Meanwhile, New Zealand's Reserve Bank has raised official rates by 0.25 per cent to 5.5 per cent, the highest level in more than 14 years.

Disclaimer: this blog is not intended as investment advice.

Key events

To leave a comment on the blog, please log in or sign up for an ABC account.

Live updates

Markets snapshot at 4:45pm AEST

By Sue Lannin

ASX 200: -0.6% to 7,214

All Ordinaries: -0.7% to 7,393

Australian dollar: -0.4% to 65.84 US cents

Shanghai Composite: -0.9% to 3,216

Nikkei 225: -0.9% to 30,683

NZ50: +0.2% to 11,972

Dow Jones: -0.7% to 33,056

S&P 500: -1.1% to 4,146

Nasdaq Composite: -1.3% to 12,560

FTSE: -0.1% to 7,763

Spot gold: -0.1% to $US1972.59 an ounce

Brent crude: +1% to $US77.61 a barrel

Iron ore: -3% to $US99.10 a ton

Bitcoin: -1.9% to $US26,709

How the ASX finished up

By Sue Lannin

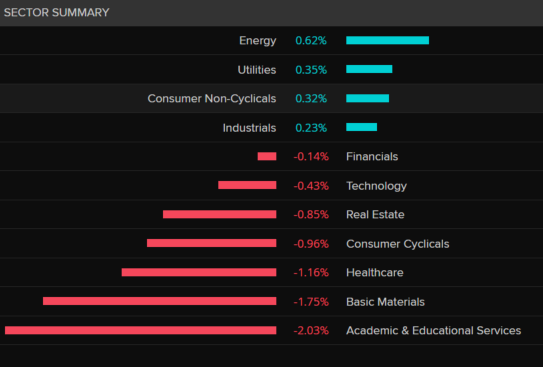

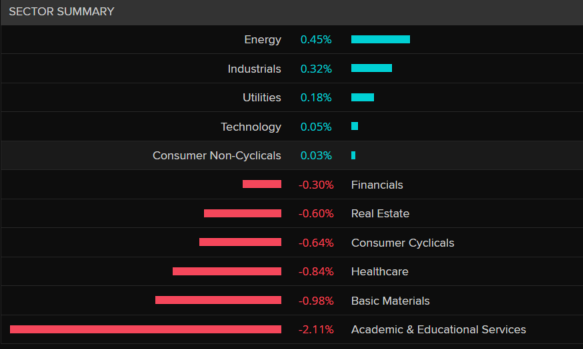

Most sectors fell on the ASX 200 today with miners weighing on the market, while energy stocks gained on higher oil prices.

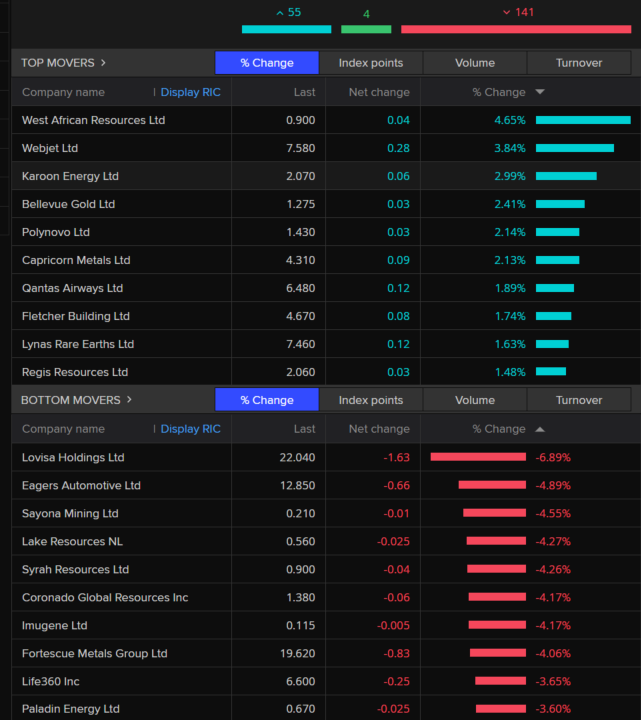

And here are the best and worst performing stocks.

ASX market movers

By Sue Lannin

Iron ore prices fell below $US100 a ton in Singapore as steel prices slumped in China on economic recovery worries.

That saw the Australian market drop further and the All Ordinaries index lost 0.7 per cent to 7,393.

The ASX 200 index fell 0.6 per cent to 7,214.

BHP (-2.2 per cent), Rio Tinto (-2.1 per cent), and Fortescue Metals (-4.1 per cent) all lost ground.

Online travel agency Webjet rose 3.8 per cent as it returned to profit for the year on strong travel demand.

Jewellery firm Lovisa (-6.9 per cent) was the biggest loser in the ASX 200, while car retailer Eagers Automotive (-4.9 per cent) lost ground as it warned port delays were affecting deliveries.

It expects revenue to be $1 billion higher in 2023.

Retailer Universal Store (-23.9 per cent) fell the most on the All Ordinaries as it warned that trading conditions had further tightened in April and May, and it expects the subdued environment to continue into 2024.

ASX falls as iron ore price drop pulls down miners

By Sue Lannin

The Australian share market has ended in the red with investors cautious amid the standoff over the US debt ceiling, and as iron ore prices fell this afternoon.

The ASX 200 index dropped 0.7 per cent with most sectors in the red.

Among the losers were miners, healthcare, technology firms and financials.

Energy stocks led the gains on higher oil prices.

Copper falls below $US8000 a ton

By Sue Lannin

Concerns about the outlook for global demand and a stronger greenback have seen copper prices fall below $US8000 a ton for the first time this year.

The metal is vital for producing batteries for a low carbon future, but the current state of play is more challenging with worries about a US recession, and a slowdown in China.

Copper jumped above $US9,500 a tonne in January on the London Metals Exchange.

But an increase in stockpiles, has seen the price of the metal come back down to earth.

Copper prices are often seen as a sign of economic health as it is used in industries including construction, manufacturing, power and transport.

However, ANZ economists think the sell-off could "incentivise China to increase purchases."

"The import arbitrage has reopened, making shipping of the metal to China profitable."

More trouble for Bubs Australia

By Sue Lannin

Baby formula and food maker Bub Australia has lost another key executive, just two weeks after the founder and former chairman were sacked for failing to comply with board directions.

The company says chief financial officer Iris Ren has resigned for "domestic reasons".

Robin Johnston has been appointed as interim chief financial officer.

Earlier this month, the company sacked chief executive Kristy Carr for "failure to comply with reasonable board directions."

Bubs Australia shares are down 2.5 per cent to $0.20 today, and are down by more than one third this year.

Markets snapshot at 2:10pm AEST

By Sue Lannin

ASX 200: -0.5% 7,225

All Ordinaries: -0.5% to 7,406

Australian dollar: -0.2% to 65.96 US cents

Shanghai Composite: -0.5% to 3,230

Nikkei 225: -0.9% to 30,693

NZ50: +0.3% to 11,980

Dow Jones: -0.7% to 33,056

S&P 500: -1.1% to 4,146

Nasdaq Composite: -1.3% to 12,560

FTSE: -0.1% to 7,763

Spot gold: +0.1% to $US1976.19 an ounce

Brent crude: +1% to $US77.58 a barrel

Iron ore: -3% to $US99.10 a tonne

Bitcoin: -1.7% to $US26,741

40 per cent of migrant workers underpaid

By Sue Lannin

One in six migrants are paid less than the national minimum wage according to a new report by the Grattan Institute.

The report finds that migrant workers are 40 per cent more likely to be underpaid than long-term Australian residents

But many Australians are also paid less than the minimum wage of $21.38 an hour, with up to 9 per cent of Australian workers paid less than the minimum wage.

Here's more from business reporter Nassim Khadem.

RBNZ highlights migration and tourism as key risks to inflation

By Michael Janda

While the RBNZ's aggressive interest rate hikes have smashed New Zealand's housing market, where prices have fallen nearly 18% nationally, and the broader economy (GDP fell 0.6% in the December quarter), the central bank is concerned that a population boom may prop up demand and inflation.

"The increase in net inward migration is providing some relief in a very tight labour market, but the net impact on demand – including for housing – is uncertain, as is the impact on inflationary pressure," the bank's meeting summary observed.

"Members noted this increase in migration is assumed to be temporary. Migration is assumed to fall back towards the average inflows seen in the years preceding COVID, and settle at an inflow of around 36,000 working age people per year."

But it isn't clear yet whether the extra demand generated by a bigger population will add more to inflation than the extra labour supply will subtract from wages and cost increases.

"Views on the outlook for the inflationary impact of migration were mixed," the statement noted.

"Some members saw the risk that strong migration inflows could persist for longer than assumed in current projections and boost spending and inflation.

"Other members saw the risks as more balanced. In particular, there were not yet obvious signs that high rates of migration were affecting house prices and spending – and there were reasons to believe that current strength reflects pent up demand, and will prove temporary. In addition, migration could further alleviate labour shortages."

On the other hand, a return towards pre-COVID tourist flows would keep adding to demand.

"The Committee noted that while the total number of international visitors remains below pre-COVID-19 levels, its recovery since the border was reopened has supported aggregate demand," the statement observed.

The RBNZ also noted that recent visa changes for New Zealanders wanting to settle in Australia might see more Kiwis cross the ditch permanently.

"There has also been a recent change in policy settings in Australia that eases the pathway to citizenship for emigrating New Zealanders. The effect of this on both the quantity and composition of net migration has yet to be seen."

Australia's Reserve Bank also recently noted that it wasn't entirely clear what effect the nation's record migration intake would have on inflation, when the boost to demand was balanced against the increased supply of workers.

CBA raises variable home loan rates for 4th time in 3 months

By Sue Lannin

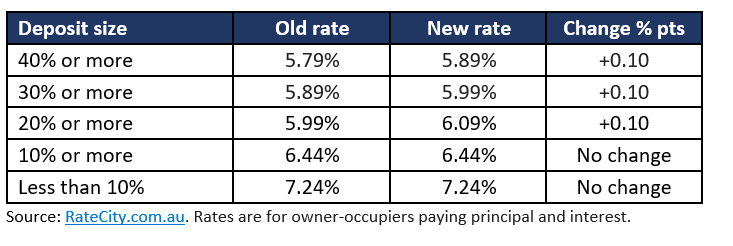

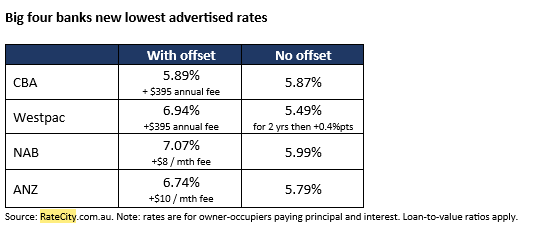

Yet another big bank has raised mortgage interest rates for new customers.

The Commonwealth Bank lifted its variable home loan rate for the fourth time in three months, on top of Reserve Bank rate increases.

The CBA increased the rate on its Wealth Package home by 0.1 percentage points for new customers according to RateCity.

The lowest variable rate for CBA Wealth Package customers has risen by 0.82 percentage points since March 1, while existing customers have seen their rates rise by 0.5 percentage points.

The move follows the National Australia Bank lifting variable rates for some new customers yesterday.

RateCity.com.au research director, Sally Tindall says the big banks are trying to boost their squeezed profit margins.

“Things are looking increasingly bleak for new customers hoping to get a loan with Australia’s biggest bank.”

“The rising cost of funding is putting pressure on the bank’s (CBA's) profit margins for new customers.

" CBA has decided to protect this margin, even if it means potentially missing out on new business."

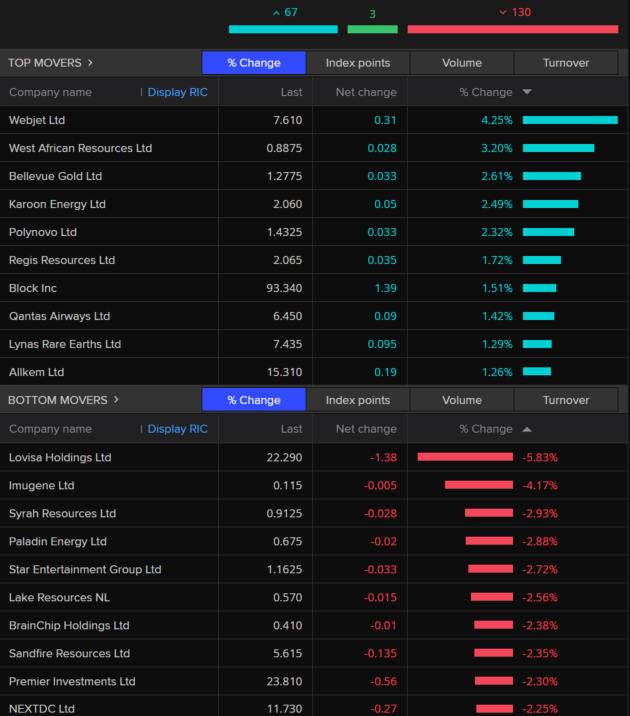

ASX movers

By Sue Lannin

Miners and banks are weighing on the market over lunchtime with 6 out of 11 sectors lower on the ASX 200 index.

In terms of companies, online travel agency Webjet (+4.3 per cent) is the best performer on the ASX 200 after it swung from loss to profit, while the worst performer is jewellery retailer Lovisa (-5.8 per cent)

The biggest loser on the market today is fashion retailer Universal Store Holdings( -27.5 per cent), which has slumped after saying some customers appear to have reduced spending in April and May.

"The group expects this subdued environment to continue for the balance of FY23 and FY24."

However, it says its on track to deliver record sales over the year.

Kiwi 'pulverised' as RBNZ looks done on rates

By Michael Janda

Some quick analysis from IG's Tony Sycamore on today's Reserve Bank of New Zealand decision to raise interest rates from 5.25 to 5.5%.

"The RBNZ was one of the first countries in the world to raise rates during the current round of monetary policy tightening. Hence the market was keen to see how it would approach the end of its rate-hiking cycle," he wrote.

"Heading into the meeting there was a ~33% chance the RBNZ would hike by 50bp [basis points].

"This morning the market was pricing on an RBNZ terminal rate of 5.9% by August of this year. However, the RBNZ said today they see the OCR peaking at 5.5% (at today's high) before rate cuts from 3Q 2024.

"Reflecting the lower terminal rate and the acknowledgement of future rate cuts in response to an expected downturn, the NZDUSD has been pulverised, diving from .6255/57 to a low of .6170. The AUDNZD cross rate has surged from 1.0568/70 to a high of 1.0680."

Abhijit Surya from Capital Economics believes the RBNZ will be forced to cut rates much sooner than it currently expects.

"As we've learned time and again, when central banks move fast, they tend to break things and there's no reason to think this time will be different," he wrote.

"With contractionary monetary policy taking its toll on the economy, we think the RBNZ will probably cut rates by year-end."

Markets snapshot at 12:10pm AEST

By Sue Lannin

ASX 200: -0.4% 7,231

All Ordinaries: -0.4% to 7,415

Australian dollar: -0.2% to 65.92 US cents

Nikkei 225: -1% to 30,650

NZ50: -0.6% to 11,878

Dow Jones: -0.7% to 33,056

S&P 500: -1.1% to 4,146

Nasdaq Composite: -1.3% to 12,560

FTSE: -0.1% to 7,763

Spot gold: +0.3% to $US1974.72 an ounce

Brent crude: +2.2% to $US77.68 a barrel

Iron ore: -3% to $US99.10 a tonne

Bitcoin: steady at $US27,219

Australian shares lower at midday

By Sue Lannin

The Australian market has fallen modestly amid the stalled US debt ceiling talks.

The ASX 200 index is down 0.5 per cent to 7,226 on track for its third loss in a row.

Bank stocks are weighing on the market, but gold and oil stocks picked up as the price of the commodities rose overnight.

Saudi Arabia's energy minister raised concerns of a supply squeeze as he took aim at speculators who were betting that prices would fall.

Major oil producers announced surprise production cuts last month that lifted prices and meet again next week.

Online travel agency Webjet (+4.2 per cent) is the top gainer on the ASX 200 index after it swung from loss to profit.

RBNZ raises interest rates to 5.5 per cent

By Michael Janda

If you think interest rates in Australia are high, just be glad you don't live across the ditch.

The Reserve Bank of New Zealand has just raised its official cash rate again, from 5.25% to 5.5%.

The RBA's cash rate here is still only 3.85%, despite 11 rate rises over the past year and a bit.

The New Zealand economy has already suffered one quarter of contraction, at the end of last year, and another quarter would confirm that the RBNZ has pushed the economy into recession in its efforts to stamp out inflation.

It is also worth noting that headline inflation in New Zealand was lower (6.7%) in the March quarter than in Australia (7%).

That's the outcome that Australia's Reserve Bank is trying to avoid by staying on its "narrow path".

The RBNZ's decision was not unanimous, with a summary of the meeting showing that board members voted on two options, a pause or a 0.25 percentage point rate hike.

Two voted in favour of the pause, while the other five board members voted for the hike.

The RBNZ does look like it is at, or getting close to, the top of its rate rise cycle, noting that the economy was already slowing down quite dramatically.

"Consumer spending growth has eased and residential construction activity has declined, while house prices have returned to more sustainable levels," it noted in its post-meeting press release.

"More generally, businesses are reporting slower demand for their goods and services, and weak investment intentions.

"Businesses report that a lack of demand, rather than labour shortages, is now the main constraint on activity."

Plenti sees higher revenue but makes net loss

By Sue Lannin

Fintech consumer and commercial lender Plenti says revenue jumped by nearly two thirds over the year to a record $143.5 million.

But it made a net loss of $13.6 million as it doubled provisions to cover expected credit losses because of high interest rates and the end of pandemic stimulus.

Cash profit was higher despite a substantial increase in funding costs.

Loans rose by more than one third to $1.8 billion, and loan arrears increased by 16 per cent to 0.42 per cent.

Plenti shares jumped 19.5 per cent near midday because of its upbeat outlook.

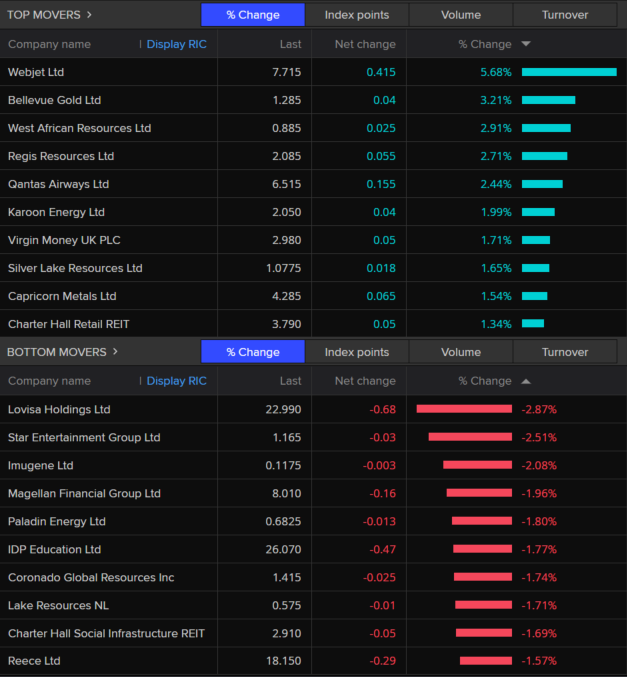

ASX movers and shakers

By Sue Lannin

The Australian share market has slipped this morning after there was no progress in talks overnight in Washington to lift the US government's $US31.4 trillion borrowing limit.

Nearly all sectors are lower on the ASX 200 today.

Among them banks, technology, and miners.

Only oil stocks are higher after oil prices rose overnight on concerns about tightening supply.

Online travel agency Webjet (+5.6 per cent) surged after revenue more than doubled over the year as demand for travel rebounds from the pandemic.

Australian shares open in the red

By Sue Lannin

The Australian share market is lower in early trade after Wall Street slumped amid stalled US debt negotiations in the US.

The ASX 200 index has lost 0.4 per cent, with most sectors in the red led down by healthcare, academic firms and consumer stocks.

Miners and banks are also weighing on the market.

Gold miner Bellevue Gold (+2.8 per cent) is doing the best, while artificial intelligence firm BrainChip Holdings (-3.6 per cent) is having another bad day.

Markets snapshot at 10:10am AEST

By Sue Lannin

ASX 200: -0.4% 7,233

All Ordinaries: -0.4% to 7,421

Australian dollar: -0.6% to 66.09 US cents

Dow Jones: -0.7% to 33,056

S&P 500: -1.1% to 4,146

Nasdaq Composite: -1.3% to 12,560

FTSE: -0.1% to 7,763

Spot gold: +0.3% to $US1974.72 an ounce

Brent crude: +2.2% to $US77.68 a barrel

Iron ore: -3% to $US99.10 a tonne

Bitcoin: steady at $US27,219

Traditional owners mark Juukan Gorge destruction

By Sue Lannin

Three years ago today Rio Tinto destroyed 46,000 year old sacred caves at Juukan Gorge in the Pilbara to mine iron ore.

The events of May 24, 2020, triggered a Senate inquiry, forced three Rio Tinto executives to resign including former chief executive Jean Sebastian-Jacques, and saw Western Australia update its cultural heritage law.

In the wake of the incident, the Federal Government will draft new national heritage laws to increase protections for Indigenous sacred sites and review native title legislation.

Rio Tinto is working with the Juukan Gorge traditional owners, the Puutu Kunti Kurrama people (PKKP) to rehabilitate the site.

But traditional owner Burchell Hayes says that will never make up for the destruction.

"The destruction of our most significant cultural heritage site should not have happened, and to ensure that we will never experience this senseless feeling of loss and devastation in the future, we are driven towards achieving a co-management process of country with mining companies."

"We have already started to see minor aspects of the co-management model working at Juukan Gorge, though rehabilitation works of some of the surrounding areas."

“Overall, we are pleased with the rehabilitation and remediation works that have since occurred through the committee’s instructions and directions, but in saying this, nothing will make up for the destruction at Juukan Gorge."

Here's more on the fallout from the destruction of the Juukan Gorge caves from my colleagues in the ABC's Indigenous Reporting Team.