The local market suffered its biggest falls since September, as banks, miners, energy and tech tumbled. It followed declines on Wall Street as investors get nervy about Silicon Valley Bank's capital raising.

Look back at the day's financial news and insights from our specialist business reporters on our blog.

Disclaimer: this blog is not intended as investment advice.

Key events

Live updates

Here's where the market finished up shortly after 4:30pm AEDT

By Rhiana Whitson

- ASX 200: -2.3pc to 7,114

- All Ords: -2.2pc to 7,348

- Aussie dollar: Flat at 65.90 US cents

- On Wall Street: Dow -1.2pc, S&P 500 -1.5pc, Nasdaq -2pc (Thursday)

- In Europe: Stoxx 600 -0.2pc, FTSE -0.6pc, DAX +0.1pc (Thursday)

- Spot gold: -0.1pc to $US1,832.70 an ounce

- Brent crude: -0.5pc to $US81.14 a barrel

- Iron ore: +1.7pc to $US129.48

Okay, that's it for me

By Rhiana Whitson

Thanks for joining us on what has been a gloomy day for the local share market.

We'll be back with more markets and business news on Monday — but until then, you can keep up-to-date with other news on the ABC's website, by subscribing to our mobile alerts, and by watching News Channel or listening to local radio here.

Enjoy your weekend.

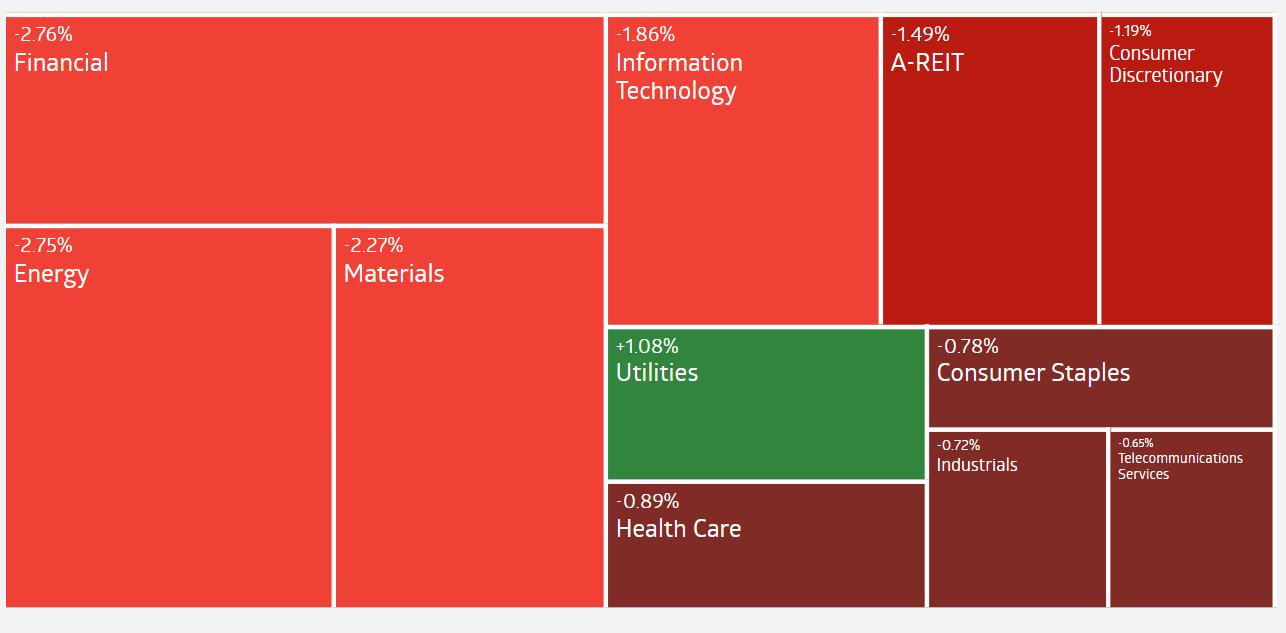

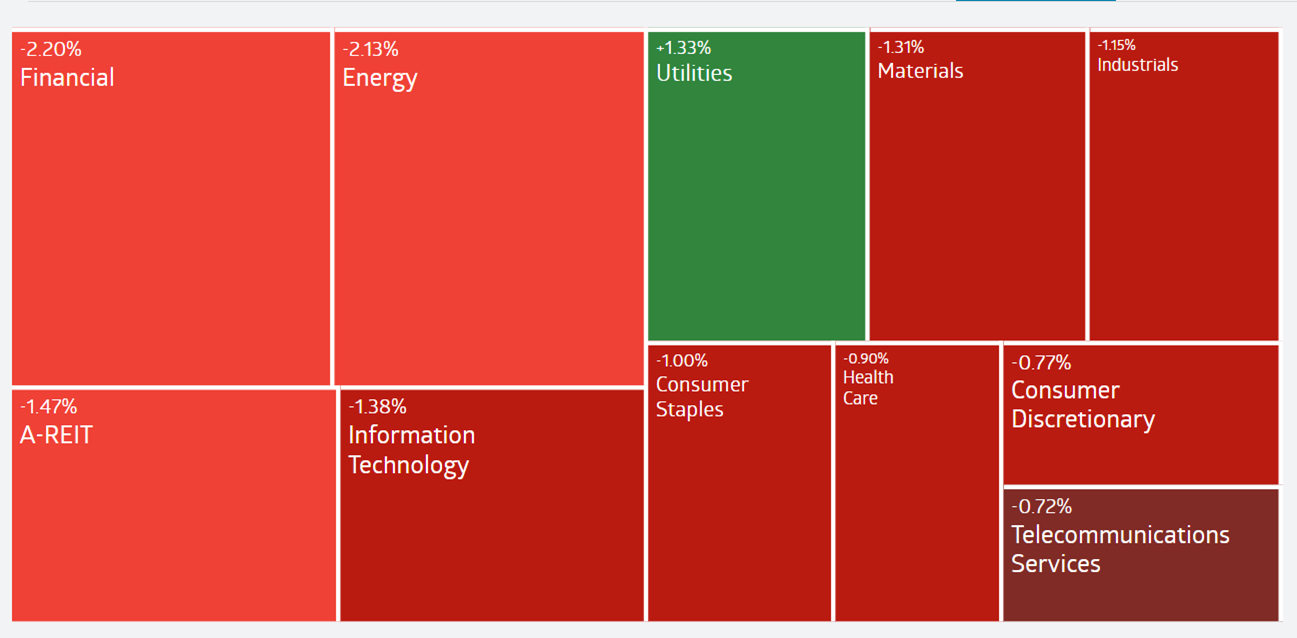

ASX suffers worst falls since September last year

By Rhiana Whitson

It was a shocker of a day on the ASX 200.

The main index closed 2.3 per cent lower, at 7,144.

That's the biggest fall since September, when the index lost almost 2.6 per cent.

Energy, miners, bans and tech led the falls.

Utilities was the only sector in the green.

The carnage on the local market followed a sell-off on Wall Street, after investors fretted about Silicon Valley Bank's financial woes and rate rises.

ANZ fined $10 million for accepting loans referred by cleaners and real estate agents

By Rhiana Whitson

ANZ has been penalised $10 million by the Federal Court for accepting from third party unlicenced professions like cleaners and real estate agents.

The bank's Home Loan Introducer Program (Introducer Program) involved home loan referrals to ANZ from third party ‘introducers’ from various unlicensed professions.

"Under consumer protection laws, ANZ’s Introducer Program should have only accepted names and contact details for customers from unlicenced third parties," ASIC Deputy Chair Sarah Court said.

"Instead, ANZ was sent sensitive information by unlicensed intermediaries, including pay slips and copies of identification documents. In some cases, these documents were fraudulent," she said.

The federal court found that between March 2017 and March 2018, ANZ broke consumer credit protection laws by accepting information and documents for 50 home loans from people who were not licensed to engage in credit activity.

ANZ didn't have adequate compliance and failed to take reasonable steps to ensure ANZ’s representatives complied with consumer credit protection laws.

"By failing to have robust compliance and training processes in place, ANZ made it possible for third party intermediaries to misrepresent consumers’ financial details in order to receive commissions on loans approved based on possibly misleading information," concluded Ms Court.

ANZ admitted the contraventions and has agreed to conduct a review of its policies and procedures around its Introducer Program to ensure ongoing compliance with credit legislation.

ANZ has also been ordered to pay ASIC’s costs.

In October 2020, National Australia Bank (NAB) paid a $15 million penalty for dealing with unlicenced home loan introducers.

ABC News business reporter Dan Ziffer has written a lot on these dodgy loans.

Booktopia fined $6 mill for misleading customers

By Rhiana Whitson

|

|---|

The Federal Court has fined online bookseller Booktopia $6 million after the retailer told customers they could only get a refund for faulty items if they told the company within two business days of delivery.

The penalty follows the Australian Competition and Consumer Commission (ACCC) launching court action against Booktopia in December 2021. The watchdog alleged the business made false and misleading statements in its online “terms of business” between January 2020 and November 2021 about when a shopper could get a refund or return items.

Booktopia is Australia’s largest online bookseller.

"Under Australian Consumer Law, a consumer is entitled to a refund or replacement, or may request a repair, within a reasonable timeframe if something they bought has a major fault," the ACCC notes.

"Businesses cannot place restrictions on consumer rights."

Roger Montgomery on sticker shock

By Rhiana Whitson

Roger Mongomery, from Montgomery Investment, sent through a note about sticker shock and the market carnage we're seeing today.

What is sticker shock?Shock or dismay experienced by the potential buyers of a particular product on discovering its high or increased price.

"The market suffered a serious case of sticker shock after the US Federal Reserve Chairman, Jerome Powell, addressed the US Senate Banking Committee in the first of two hearings on Capitol Hill this week, opening the door to raising rates higher and faster than recently anticipated," Roger notes.

Mr Montgomery says it was the first public acknowledgment by the Fed Chair, that strong labour and inflation data may force the Fed to go harder and higher.

"Back in December, US Fed officials estimated rates would rise to a peak of 5 to 5.25 per cent. Only a small minority of members suggested 5.25 to 5.5 per cent," Mr Montgomery notes.

"Overnight, Powell indicated expectations for the peak rate would need to be adjusted by more, noting the Fed’s inflation targeting is “very likely” to come at a cost to the labour market.

"Powell told the committee, “The process of getting inflation back down to two per cent has a long way to go and is likely to be bumpy,” adding “The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated”, and “If the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate rises.”

"Investors may recall the US Fed raised rates by three-quarters of a point repeatedly last year, slowed to 50 basis points in December and then slowed again to 25 basis points in early February. The consequence was the fastest pace of rate rises since the 1980s.

"Initially, the policy appeared to be slowing consumer spending and inflation but recent data suggests inflation hasn’t weakened as much as expected. Indeed, January inflation rose faster than expected. Meanwhile, the labour market remains tight and consumer spending has picked up again. Powell said the unexpected strength would probably require a stronger policy response.

"Understandably, U.S. equities fell sharply, and the bond market saw 2yr yields higher and the 10yr yield down, resulting in the yield curve inversion – a sign of impending recession - reaching a full percentage point for the first time since 1981. The comments saw the yield on two-year Treasury notes hit 5% for the first time since July 2007.

"Powell’s comments have some investors now anticipating a terminal monetary policy rate above six per cent. Consequently, those stocks and assets that benefited from enthusiasm about recent disinflation have either lost momentum or reversed.

"Financial stocks, particularly the banks, which are especially sensitive to rising rates, reversed sharply. Wells Fargo and M&T Bank declined almost five per cent. The S&P 500's financial sector dropped 2.4 per cent."

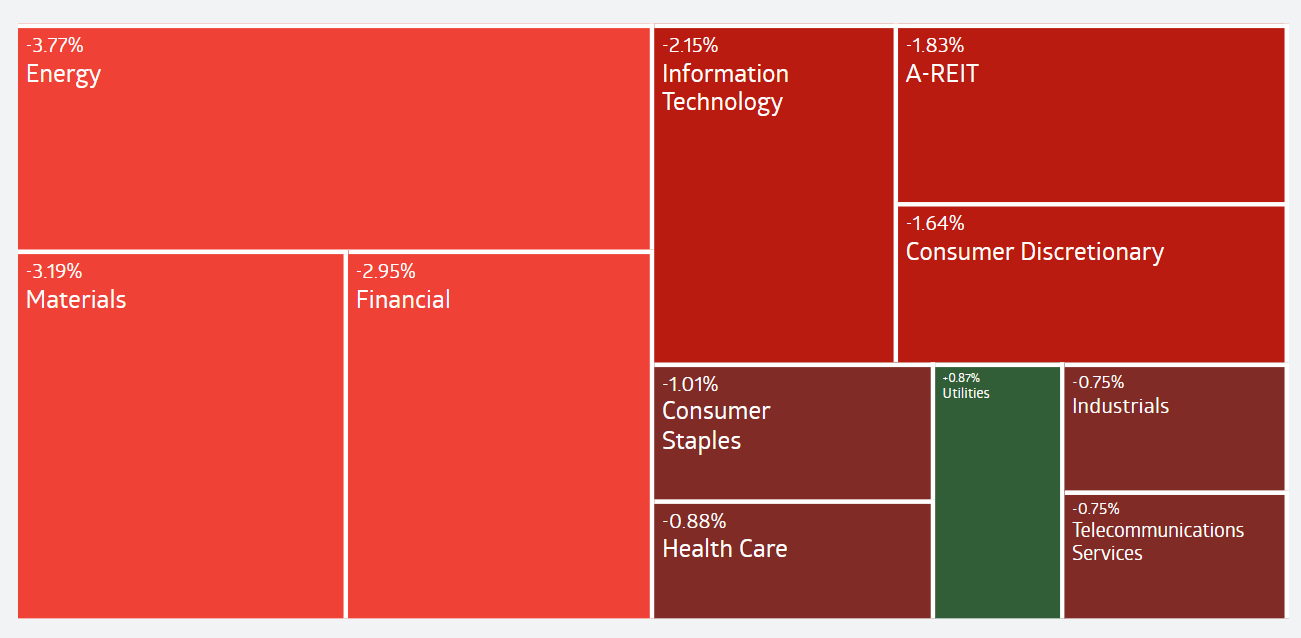

ASX decline worsens

By Rhiana Whitson

We're getting close to the final hour of trade.

The sell-off has worsened.

The ASX200 has tumbled 2.21 per cent to 7,149.

The All Ords has dropped or 2.17 per cent to7,351.

Utilities is the only sector in the green.

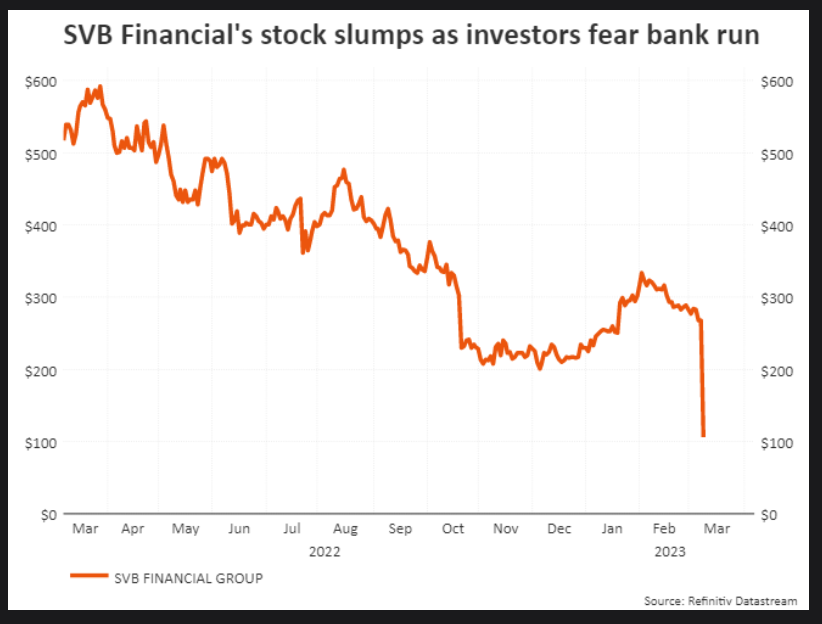

What's behind the Wall Street sell-off?

By Rhiana Whitson

Issues at SVB, or Silicon Valley Bank, in the US have investors very worried.

In the US, SVB Financial Group scrambled to reassure its venture capital clients their money was safe after a capital raise led to its stock collapsing a whopping 60 per cent.

The share plunge contributed to wiping out over $80 billion in value from bank shares on Wall Street.

SVB, or Silicon Valley Bank, launched a $US1.75 billion share sale on Wednesday to shore up its balance sheet.

It told investors it needed the proceeds to plug a $US1.8 billion hole caused by the sale of a $21 billion loss-making bond portfolio consisting mostly of US Treasuries.

Investors in SVB's stock fretted over whether it would be enough, given the deteriorating fortunes of many technology startups that the bank serves.

The company's stock collapsed to its lowest level since 2016, and after the market closed shares slid another 26 per cent in extended trade.

SVB's CEO Gregory Becker has been calling clients to assure them their money with the bank is safe, according to two people familiar with the matter who spoke to Reuters.

The problems at SVB have triggered some startups to tell their founders to withdraw money from SVB as a precautionary measure, the sources added.

One of them is Peter Thiel's Founders Fund, according to one of the sources.

One San Francisco-based startup told Reuters they successfully wired all their funds out of SVB on Thursday afternoon, and the funds had appeared in their other bank account as a "pending" incoming wire by 4 pm Pacific Time on Thursday.

However, the Information publication reported the bank told four clients that transfers could be delayed.

SVB did not respond to Reuters' multiple requests for comment.

A crucial lender for early-stage businesses, SVB is the banking partner for nearly half of US venture-backed technology and healthcare companies that listed on stock markets in 2022.

"While VC (venture capital) deployment has tracked our expectations, client cash burn has remained elevated and increased further in February, resulting in lower deposits than forecasted," Becker said in a letter to investors seen by Reuters.

ABC News/Reuters

Markets snapshot

By Rhiana Whitson

The ASX has tumbled in trade today. Here's a quick look at where we're at shortly after 1:00pm AEDT:

- ASX 200: -1.9pc to 7,172

- All Ords: -1.9pc to 7,378

- Aussie dollar: -0.1pc 65.82 US cents

- On Wall Street: Dow -1.2pc, S&P 500 -1.5pc, Nasdaq -2pc (Thursday)

- In Europe: Stoxx 600 -0.2pc, FTSE -0.6pc, DAX +0.1pc (Thursday)

- Spot gold: Flat at $US1,835 an ounce

- Brent crude: Flat at $US81.60 a barrel

- Iron ore: +1.7pc to $US129.48

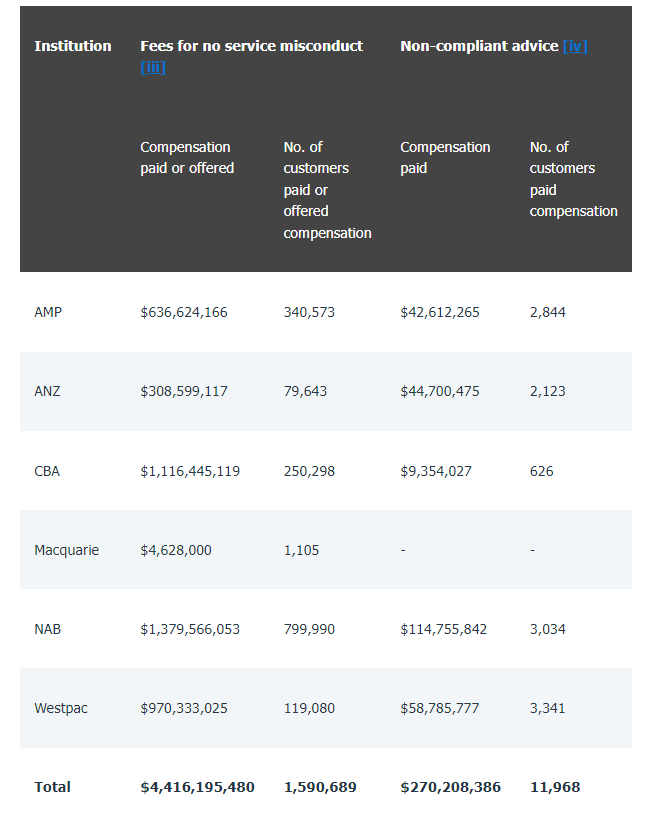

Banks pay billions in compensation for dodgy fees and financial advice

By Rhiana Whitson

Australia's six largest banks have paid or offered $4.7 billion in compensation to customers who suffered losses for fees charged for services that were not provided and non-compliant financial advice.

The Australian Securities and Investments Commission (ASIC) has investigated the systems which led to wrongful fees being charged by the country's four biggest banks - Commonwealth Bank of Australia, Westpac Banking, ANZ and NAB. It also looked at investment bank Macquarie Group and wealth manager AMP.

The review was prompted by the banking royal commission.

NAB's coughed up $1.49 billion in compensation as of the end of 2022, followed by CBA and Westpac's of $1.13 billion and $1.03 billion, respectively.

ASIC said it anticipates this will be the final update on compensation because most of the programs have been completed.

ASX down, as banks, miners and energy drag

By Rhiana Whitson

Friday is shaping up to be a bad end of the week for the Australian share market.

The ASX 200 is sharply lower, down 1.8 per cent to 7,181.

The All Ordinaries is also down about 1.8 per cent t to 7,381.

What's going on?

Banks, energy, tech and materials are weighing most heavily on the benchmark index.

Losses and tech come after sector declines on Wall Street.

Interest rates are weighing on financials and tech, the latter of which is shedding jobs globally.

On the ASX 200, Block dropped as much as 5.4 per cent and was the biggest loser on the sub-index

Xero, which has announced hundreds ofjob losses globally, was down 1.4 per cent.

As for the big for banks: CBA's down 2.6 per cent, Westpac's fallen 2.8 per cent, NAB is down 2.9 per cent, ANZ lost 3.1 per cent.

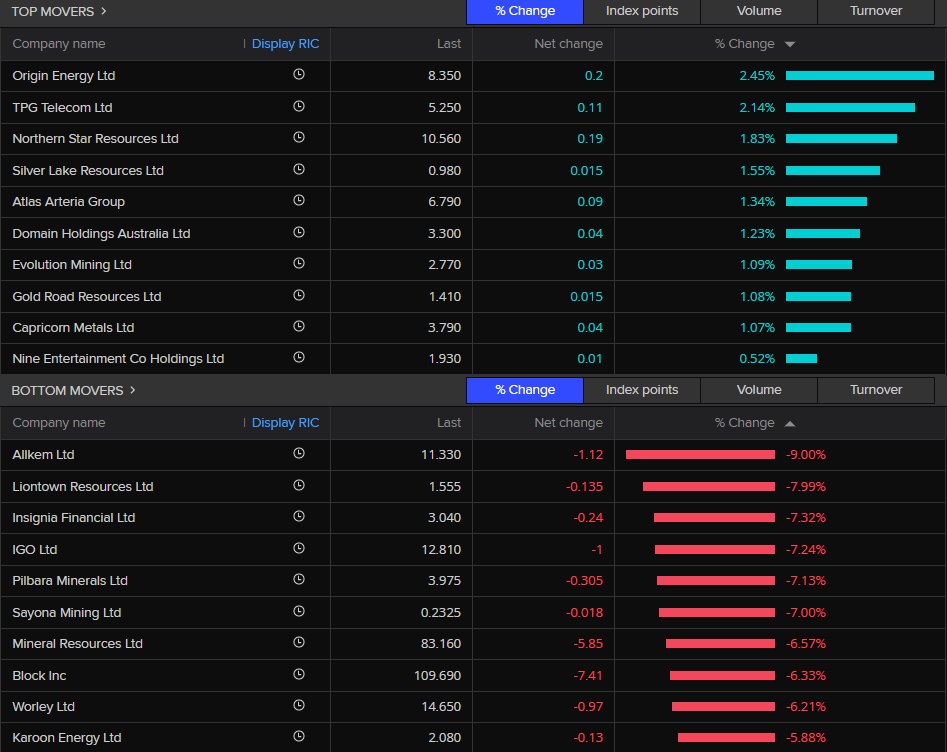

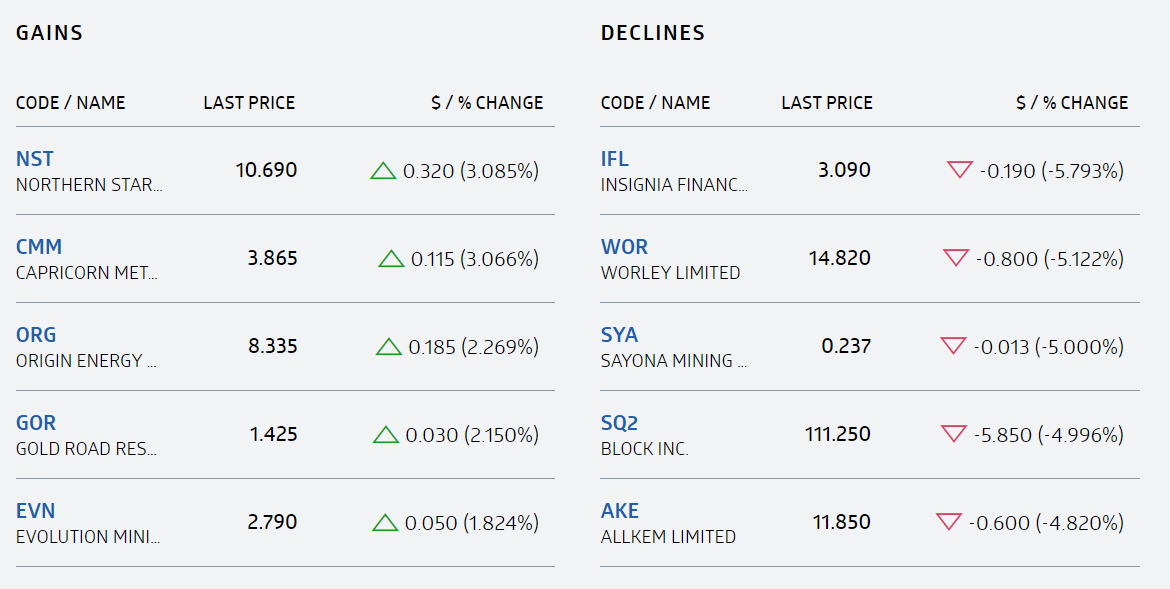

ASX at 11:30am AEDT

By Rhiana Whitson

The ASX 200 is sharply lower, dropping 119.20 points or 1.63 per cent to7,191.

It's close to 11:30am AEDT, and this is how things are looking:

Utilities is the only sector boosting the index.

These are the top and bottom stocks:

I'm taking a break and will be back shortly at midday.

Is corporate Australia profiteering off high inflation?

By Rhiana Whitson

Rising prices have seen margins improve for some consumer-facing businesses, such as Woolworths and Qantas, higher interest rates have boosted CBA's coffers, mother nature has helped insurers such as Suncorp, and energy producers such as Woodside have benefited from the war in Ukraine.

ABC News business reporter Rachel Puppazoni investigates. Check out her video story here:

Bad news is bad news overnight on Wall Street

By Michael Janda

Good morning, I thought I'd jump in with a little guest analysis on the US economy and markets.

Markets have become so fixated on interest rates (no surprise given debt levels and their heavy correlation with speculative asset values) that economic bad news has often been good news for stock prices lately.

The reason? The Fed is trying to slow the US economy with aggressive rate rises, so any evidence it's succeeding is also evidence it might stop sooner rather than later.

But last night bucked that trend.

"US weekly claims finally jumped after 7-weeks below 200k to 211k in the week to 25 Feb from 190k and a 195k forecast," noted NAB senior foreign exchange strategist Rodrigo Catril.

"This represents the biggest jump since November, that said it is too early to suggest we are now seeing a change in the trend."

While it is far too early for a trend, especially given bad winter weather in key parts of the US in that period, another private sector dataset delivered a more ominous jobs reading.

"The Challenger and Gray series on job cut announcements for February was also released today, this series has a good leading relationship with claims and it revealed a relatively high 78k jump in layoffs with the combined January/February reading at its highest level since 2009 of 181k," Mr Catril continued.

Remember, in 2009, the US was in the midst of "The Great Recession", sparked by the global financial crisis.

That's not a great sign for the future of US employment and, therefore, the economy.

In response, US stocks dropped sharply, despite falling short and long term bond interest rates.

"Somewhat uncharacteristically to what we have seen in recent weeks, where bad economic news has been deemed as good news by equity investors, reaction to the claims and Challenger data releases overnight weighed on US equities with the decline in main US equity indices accelerating into the close," Mr Catril observed.

Tonight we get the main game as far as US employment figures go, the Bureau of Labor Statistics non-farm payrolls.

Economists are expecting the addition of 215,000 jobs and unemployment to stay steady at 3.4 per cent.

If the number is much higher then a half-a-percentage point Fed rate rise in about a fortnight's time looks very likely, if it disappoints then maybe the Fed will start sounding a little more like our RBA this week when it eased off its aggressive rate rise rhetoric.

Markets snapshot after 10:30am AEDT

By Rhiana Whitson

The ASX has opened lower after falls on Wall Street.

- ASX 200: -1.4pc to 7,206

- All Ords: -1.5pc to 7,403

- Aussie dollar: Flat at 65.85 US cents

- On Wall Street: Dow -1.2pc, S&P 500 -1.5pc, Nasdaq -2pc

- In Europe: Stoxx 600 -0.2pc, FTSE -0.6pc, DAX +0.1pc

- Spot gold: Flat at $US1,835 an ounce

- Brent crude: -1.3pc at $US81.56 a barrel

- Iron ore: +1.7pc to $US129.48

Low-income households feel the pinch

By Rhiana Whitson

The peak of inflation might be behind us, but rates are still rising, and people are really hurting.

ABC senior business correspondent Peter Ryan speaks to CEDA senior economist Andrew Barker about low-income households.

What about a four-day working week?

By Rhiana Whitson

If your boss said you could work four days and get paid for five, would you?

A senate committee chaired by Greens senator Barbara Pocock has recommended a trial.

Senate committee recommendations often end up just gathering dust on a desk somewhere in Canberra, but you never know.

Read more about the committee's recommendations here:

These companies are certified carbon neutral. But that may not mean what you think it does

By Rhiana Whitson

The ACCC is investigating greenwashing.

A quick look on the websites of some of Australia's largest companies — from fossil fuel and electricity providers, to telecommunications and banks — shows many are "certified carbon neutral".

But what does that actually mean? ABC News environment reporter Nick Kilvert explains.

Markets snapshot after 8am AEDT

By Rhiana Whitson

Here's how things are looking at 8:20am AEDT.

- ASX SPI futures: -1.1per cent to 7,239

- Aussie dollar: Flat at 65.85 US cents

- On Wall Street: Dow -1.2pc, S&P 500 -1.5pc, Nasdaq -2pc

- In Europe: Stoxx 600 -0.2pc, FTSE -0.6pc, DAX +0.1pc

- Spot gold: +0.9pc $US1,835 an ounce

- Brent crude: -1.3pc at $US81.53 a barrel

- Iron ore: +1.7pc to $US129.48

Wall Street falls, banks the biggest drag

By Rhiana Whitson

It wasn't a great day on Wall Street.

Wall Street's three major stock indexes closed lower on Thursday (US time).

- S&P 500 index lost 1.5 per cent to 3,918

- Dow Jones Industrial Average fell 1.2 per cent 32, 254.

- Nasdaq Composite 2 per cent to 11,338.

Bank stocks created the biggest drag while investors worried that Friday's jobs report could spur aggressive interest rate hikes by the Federal Reserve.

The S&P 500's bank index hit its lowest level since October as investors fled the sector after tech-industry lender SVB Financial Group launched a share sale to shore up its balance sheet due to declining deposits from startups struggling for funding.

But investors were also stressing out before Friday's US non-farm payrolls report for February with expectations for large wage increases fuelling inflation concerns.

Fed Chair Jerome Powell this week exacerbated concerns about upcoming interest rate hikes as he highlighted the battle with high inflation.

Traders were betting that chances of a 50-basis-point rate hike at the Fed's March meeting were around 60 per cent, according to CME Group's FedWatch tool, up sharply from a probability of 31 per cent before Powell's Tuesday and Wednesday appearances in Congress.

"There's a lot of anticipation around tomorrow's jobs report. We're going to get a slew of data in the next week and a half," Mona Mahajan, Senior Investment Strategist at Edward Jones, said.

Earlier on Thursday, Labor Department data showed initial claims rose 21,000 to a seasonally adjusted 211,000 for the week ended March 4, compared with economist forecasts for 195,000 claims.

The February non-farm payrolls report is expected to show a February payrolls increase of 205,000 after January's blowout 517,000 figure, which had already led markets to increase their expectations for U.S. interest rates.

ABC News/Reuters