Bank shares have bsmashed, despite CBA's latest record profit, as RBA governor Philip Lowe doubled-down on the urgent need for rate rises to quash inflation. Meanwhile, Fortescue boss Andrew Forrest told climate change deniers to "f*** off" out of public life.

Look back on the day's financial news and insights from our specialist business reporters.

Disclaimer: this blog is not intended as investment advice.

Key events

Live updates

Market snapshot at 5:00pm AEDT

By Michael Janda

ASX 200: -1.1% to 7,352 points

All Ords: -0.9% to 7,559 points

Australian dollar: -0.8% to 69.3 US cents

Hang Seng: -1.4% to 20,817

Nikkei: -0.5% to 27,479

Dow Jones (Tuesday close): -0.5% to 34,089 points

S&P 500 (Tuesday close): Flat at 4,136 points

Nasdaq (Tuesday close): 11,960 points

FTSE (Tuesday close): 0.1% to 7,954 points

EuroStoxx 600 (Tuesday close): 462 points

Brent crude: -1% to $US84.75/barrel

Spot gold: -0.5% to $US1,845/ounce

Iron ore: +2.3% at $US123.10/tonne

Bitcoin: -0.4% to $US22,160

ASX falls heavily as banking sector smashed

By Michael Janda

For a company that just posted a record half-year profit, the market didn't look kindly on CBA, or the banking sector as a whole.

Despite reporting a $5.2 billion net profit on the back of surging net interest margins — a key measure of bank profitability — investors fled CBA and its rivals.

Commonwealth Bank shares ended the day 5.7 per cent lower at $103, with Westpac off 4.3 per cent, NAB off 4.1 per cent and ANZ down 3.8 per cent.

It seems fears that CBA's net interest margin may have peaked, albeit at a reasonably healthy 2.1 per cent in the December half, were behind the sell-off.

That was combined with fears about the provisions the banks might have to book as higher interest rates see a growing number of home and business loans turn bad.

Falling loan loss provisions have boosted bank profits, so increasing ones will hurt them.

The strange thing is that none of this is particularly new or surprising, so today's sudden realisation that Australia's banks might be facing a tougher couple of years seems rather weird.

Overall, the financial sub-index plunged 3.3 per cent.

It's such a big part of the market that the ASX 200 fell 1.1 per cent, even though the number of companies that fell (96) was only just greater than those which rose (92). The broader All Ordinaries was off 0.9 per cent.

A 0.5 per cent gain for BHP and 1.5 per cent rise for Rio Tinto helped cushion the falls on the two main indices, although Fortescue fell 0.8 per cent with investors unimpressed by its results.

Wesfarmers had a modestly positive reception for its profit result, rising 1.3 per cent to $49.35.

After being walloped for two days in a row on shock news at the start of this week of falling revenue and a potential $1.6 billion write-down, Star Entertainment bounced back strongly today, although it's still down more than 20 per cent compared to where it was at the end of last week.

Five biggest falls:

- BrainChip Holdings: -13.6% to $0.51

- Corporate Travel Management: -8.7% to $15.75

- Treasury Wine Estates: -6.9% to $13.34

- Sayona Mining:-6.5% to $0.215

- Commonwealth Bank: -5.7% to $103.00

Five biggest gains:

- Star Entertainment: +14.4% to $1.47

- GUD Holdings: +8.1% to $8.94

- Cochlear: +7.8% to $225.28

- Magellan Financial Group: +7.1% to $9.45

- New Hope Corporation: +5.9% to $5.73

Thanks for coming along for a pretty wild ride today with me, Rhiana, Gareth and Sue. What a busy day on the markets and for our central bankers.

Climate deniers 'should not be in any position of influence' says Twiggy Forrest

By Sue Lannin

Mining mogul turned self-appointed climate saviour Andrew “Twiggy” Forrest pulled no punches today on what he really thinks about climate change denying politicians.

The billionaire has been expanding his iron ore miner Fortescue Metals Group into a renewable energy firm, which is developing project in areas including green hydrogen, solar power, geothermal, wind and hydropower.

While discussing FMG’s half-year profit results on a conference call with journalists and analysts today, Mr Forrest said that politicians who don’t believe in global warming should literally take a hike.

“People who do not understand the grave risk of climate change should not be in any position of influence, and if they exploit those who are trying to work against climate change, then history will judge them very, very badly.

“If they don’t believe the science, then they can just f**k off, right.

“They should be nowhere near having any responsibility whatsoever.”

That was in response to a question from Australian Financial Review mining reporter Peter Ker about the Federal Greens threatening to block Labor’s safeguard mechanism reform legislation, which is aimed at reducing carbon emissions from the heavy industrial sector and the resources industry, unless there is a ban on new coal and gas mines in Australia.

“Peter, thank you for that excellent smack in the middle of a landmine field question.”

Mr Forrest went on to say it was crucial for governments to do more to mitigate global warming.

“Every legislator in the world should bring themselves up to speed on the science and act accordingly.

“We need to be ambitious.

“This company, Fortescue, is leading by example.

“And I’m urging governments all over the world, wherever I go.

“It’s like I hit the road in the middle of COVID for effective(ly) years of my time, to educate governments that we are facing a real and present danger, and there are solutions, they do not have to wipe out our planet.”

It’s very rare to hear company executives swear on earnings calls (in more than ten years as a business reporter this is the only instance that I can recall), but Twiggy gave a passionate defence of the need to save the planet from climate catastrophe.

If you want to hear more from Andrew Forrest on climate change here is the 2020 Boyer Lecture, where he calls on business to do more to tackle global warming.

Two people missing in Queensland mine incident

By Michael Janda

Two people are missing in a mine incident in north-west Queensland.

Emergency services are on their way to the Dugald River mine site, 70 kilometres north-west of Cloncurry.

The Dugald River mine predominantly produces zinc concentrate, with by-products including lead and silver, and is an underground mine wholly owned by MMG Limited.

The mine employs around 500 employees and contractors in a mix of fly-in, fly-out and local residents.

You can follow the latest developments here.

Summary of Philip Lowe's Senate appearance

By Michael Janda

My Parliament House colleague Georgia Hitch was also listening in to RBA governor Philip Lowe's testimony before Senate Estimates.

"I understand why some people focus on the risks on the one side, but we've got to be attentive to the risk from higher inflation," Mr Lowe said.

"It's corrosive for the economy. And all the evidence is if inflation stays high for too long, expectations adjust and that leads to higher interest rates and more unemployment."

You can read Georgia's article, which summarises the key points, here.

Is targeting inflation with interest rates alone really the best idea?

By Michael Janda

Of course spending is up. I am not buying any additional things than I have previously, but the costs have skyrocketed. A trolley of groceries that I would have previously paid $50 is now $80+. Don't even get me started on daycare fees, which have increased to meet the increase in all the costs. Something needs to give. Interest rates and cost of living are all going up to breaking point. Does anyone else find it ridiculous that for costs to come down people need to be unemployed. In what world is that a good thing. Changes are needed, but it's not from everyday people suffering at the hands of the out of touch economists from their ivory towers.

- Bec

Bec has posed a really important question about whether raising interest rates to lower demand and increase unemployment is really the best way to manage the economy.

This is a question posed several times by my colleague Gareth Hutchens, including this piece where he quoted extensively from Guardian economics columnist and Centre for Future Work policy director Greg Jericho.

"Inflation targeting in Australia since 1993 has not been neutral," he says.

"That period of inflation targeting (especially below-target inflation from 2014 through 2020) was associated with a massive transfer of income and economic power from workers to businesses.

"Monetary policy has not been a technocratic exercise, intended to maximise public welfare in a general sense.

"It clearly reflects, and continues to reflect, value judgements and priorities placed on how the costs and benefits of inflation management are distributed across society."

You can read the full analysis here, and it has links to a number of other relevant pieces by Gareth and our ABC colleagues.

APRA not planning to change mortgage serviceability tests

By Michael Janda

Greens Senator Nick McKim questioned Mr Lonsdale about whether APRA has any plans to change its loan serviceability test buffers.

Currently, prospective home loan borrowers are tested as to whether they can afford to keep making loan repayments if rates went up 3 percentage points from the interest rate they are on at the time they are applying for the mortgage.

That buffer was raised from 2.5 percentage points late last year, but now that rates have returned towards more normal levels some have questioned whether it might be too high — i.e. what are the chances of interest rates rising a further 3 percentage points from current levels.

But Mr Lonsdale said the regulator had no plans to change things at the moment.

"We are comfortable with the macroprudential settings as they are now," he said.

"If the facts change so might our stance."

APRA has been criticised, including by your correspondent, for having ditched an interest rate floor of 7 per cent on its serviceability tests in mid-2019.

This move allowed home buyers to take out much bigger loans as interest rates plunged during the pandemic, both fuelling the house price boom and meaning that some borrowers now have repayments above the level they were tested to be able to cope with.

'Category of people who will experience some stress'

By Michael Janda

APRA's relatively new chair John Lonsdale is fronting Senate Estimates right now.

Liberal Senator Dean Smith was keen to know about what has been dubbed the fixed "mortgage cliff", with hundreds of thousands of Australians about to roll off super-cheap (often sub-2 per cent) fixed loans.

Mr Lonsdale said about a third of home loans are fixed at the moment, with about half of those fixed terms ending this year.

But he doesn't expect it to cause large losses for the banks or threaten financial stability.

"Right now, non-performing loans are very low," he observed.

However, he added:

"There is a category of people who will experience some stress."

This is mainly people who bought recently at the peak of the property market and borrowed at or close to their maximum capacity.

He said APRA has been encouraging banks to identify those at-risk customers and proactively contact them to provide assistance.

Mr Lonsdale said banks are "very well capitalised, very liquid", especially when compared to before the global financial crisis, and are regularly "stress-tested" by APRA.

"We look at big shocks on housing, big shocks on unemployment … and the banks are very resilient."

Half-year company earnings results

By Rhiana Whitson

On the company news front, here are some from results released today:

Half-year net profit at Cochlear, which makes hearing implants, was down 16 per cent to $142 million. Total revenue was up 8 per cent to $885 million, due to operating expenses and a new product launch.

Despite the fall in profit, is launching a $75 million share buyback.

Treasury Wines' half-year net profit after tax rose 72.5 per cent to $188.2 million, while revenue rose 9.1 per cent to $1.31 billion.

Vicinity Centres’ half-year net profit after tax dropped to $176.3 million, from $650.2 million.

Alternative ways to tackle inflation

By Michael Janda

It’s very old fashioned to use interest rates to control inflation, it’s very slow because many of us (savers) are better off and spend more money ,Do one of two things to achieve the same thing , increase purchase tax then it’s fair for everyone this reduces the amount give people a purchase tax credit to redeem in the future or tell employers to take a % of take home pay and put it in super accounts again allowing withdrawal in the future when inflation slows , the only winners now are the banks and people with money , the losers now are young families in particular it’s just not fair .

- Robert Glenton

My colleague Gareth Hutchens wrote a comprehensive analysis on this very topic on Sunday.

Philip Lowe's smiling

By Michael Janda

Dr Lowe seems to be a good Australian but the complete lack of compassion by smiling during his responses says everything about this entire RBA board having no idea where and what Australias financial position is. It's embarrassing how this RBA board clearly doesn't understand inflation and more importantly the real world outside their mortgage free mansions is so foreign I bet they wouldn't know how to boil and egg. Mr chamlers the RBA can't continue being a private constitution .

- Daren Savy

Daren has commented about RBA governor Philip Lowe's propensity to smile.

Having met Dr Lowe in person a few times, I can assure you Daren that he simply smiles a lot.

I'm quite sure that it's not because he isn't taking something seriously or because he lacks compassion, he just smiles a lot, even when talking about serious matters.

Bank and super regulator fronts the Senate

By Michael Janda

The banking, insurance and superannuation regulator APRA is next up before Senate Estimates.

Amongst its many duties, APRA is responsible for maintaining prudent lending standards in order to protect depositors from the risk of losses that could occur if the banks suffered large losses.

But there are questions about how prudent the Australian Prudential Regulation Authority has been, particularly when rates were slashed during the pandemic.

I asked some of those questions in this piece from late last year.

ACCC to finalise investgation into why banks aren't passing on full rate hikes to savers by Dec

By Rhiana Whitson

Any savers out there would know banks have been slow to pass on rate hikes.

Treasurer Jim Chalmers has formally asked the ACCC to investigate why.

Australian households reportedly hold more than $1.3 trillion in savings and deposit accounts.

The ACCC has been asked to release an issues paper in the "coming months", and report to the Treasurer by December 1 2023.

"Australians should see the benefit of higher interest rates flow through to their savings accounts – it should be the silver lining when rates increase," Treasurer Jim Chalmers said in a statement.

"It’s a fact that banks have been a lot slower to pass on the increases in interest rates to savers than to mortgagees," he says.

"I’ve asked the ACCC to take a good look at this issue and shine a light on the dynamics of the retail deposit market."

It comes as CBA announced a record half-year profit. The bank's stocks are down though, because some analysts reckon the good times might have peaked.

NAB's monthly data insights report

By Rhiana Whitson

Dr Lowe's grilling at Senate estimates is over. He'll face more questions from MPs on Friday.

So, it's back to business as usual for the markets blog.

NAB has released its monthly data insights data report for January.

Here are the key points:

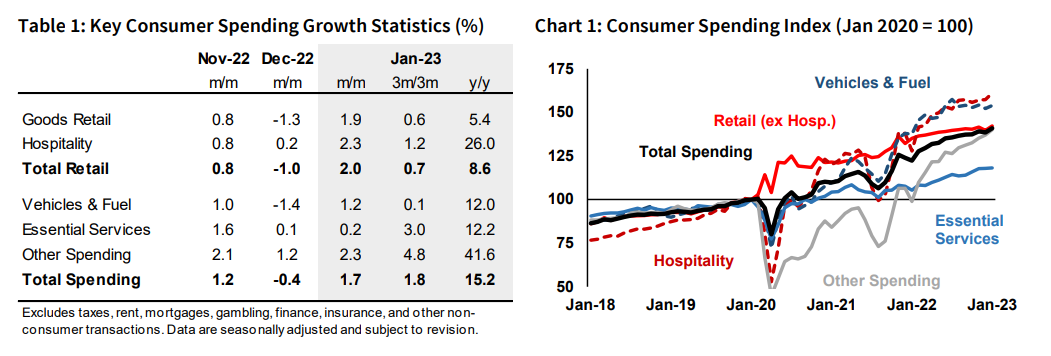

- Consumer spending rose 1.7% in January, more than reversing the small fall seen in December. Spending rose across every major category, with notable increases in retail, ‘other’ spending, and vehicles & fuel. Total spending was 1.8% higher over the past three months.

- Retail spending rose 2.0%, with increases in both goods retail (up 1.9%) and hospitality (2.3%). The pickup followed a soft December reading as seasonal spending shifted earlier into November.

- Business credits rose 0.3% in January. Credits are up 9.4% from a year ago but have flattened out in level terms since mid-2022, with credits down 0.2% over the past three months.

This is what NAB Chief Economist Alan Oster has to say about the data:

“Our monthly transaction data indicates that spending picked back up in January after a small fall in December, with strength across most spending categories," Mr Oster notes.

“The pick-up in January suggests that the softness seen in December was primarily the result of changing seasonal patterns with Christmas spending moving earlier into November to take advantage of Black Friday sales.," he says.

"Underlying spending behaviour appears to have remained fairly robust.”

Phil Lowe wraps up

By Gareth Hutchens

That's it for Phil Lowe's appearance at senate estimates today.

What did we learn?

It doesn't feel like we learned much new, unless I'm going crazy?

Dr Lowe is clearly feeling the pressure of public criticism. He mentioned it three times at least. He also twice reminded everyone that he's not the only member on the RBA board.

On his public communication, maybe he feels like he can't win.

He said he'd begun to wonder if maybe he was talking too much in public, which carries its own risks, and that's why his public communications have been cut back this year. But now he's being criticised for not speaking enough in public.

When it comes to interest rates, he repeatedly made the point that he understands that many people are in pain at the moment, especially households who rent, and households with mortgages.

But he said if we don't get control of inflation then many more people will be in even greater pain.

At one point, he said maybe Australians had come to take low inflation for granted, and had forgotten how damaging high inflation can be, because we've lived for so long without much inflation.

He also pushed back against any suggestions that the current economic policy architecture needs to change. He said the central bank is still the best institution to manage inflation and the economic cycle.

And finally, he intends to see out his full term (which ends in September).

An ex-mining point

By Gareth Hutchens

Hi Gareth, Agree that central banks are largely responsible for wider wealth dispersion over past 20 years - low rates reward the asset rich. But, it is not correct to suggest that wages have suffered relative to profits. On an ex mining basis the profit share in the economy has tracked sideways for last decade - refer ABS stats

- Mike

HI Mike, sure, but you have to use the ex-mining basis to make that point.

This is a point that I find fascinating. Mining is a huge part of Australia's economy and culture. The big miners have political influence and make political donations. They're a big weight on the stock market. When thinking of Australia's political economy, can't make an ex-mining analysis of the country.

But for argument's sake let's accept your point.

As Professor Ross Garnaut argued years ago, when talking about Australia's "dog days" between 2013 and 2019 when households' disposable income stagnated. He said that trend was set to continue until 2024-25, making it the longest stretch of stagnant income in the modern era. That was before the pandemic.

This has all happened in the inflation-targeting era.

Did the expansion of the money supply cause this inflation?

By Gareth Hutchens

One Nation senator Malcolm Roberts asks Dr Lowe if the expansion of the money supply caused this inflation.

Dr Lowe said it contributed to it, but it was not the main driver.

He said between 50% and 75% of this inflation has come from supply issues, driven by the war in Ukraine and other issues.

He said government fiscal support during the pandemic also contributed. By that, he's referring to the amount of savings that people now have, as well as the low rate of unemployment that means far more people are employed and have income than before the pandemic.

The RBA actually put out a paper on this money supply issue last year, which I wrote about here:

It's how things work

By Gareth Hutchens

So, can we really get this straight? The economic modelling used by the RBA wants less people employed, and wants to keep wages (which are at historical lows compared to mortgage debt and housing availability) as stagnant as possible. How exactly is this in the best interests of Australians?

- Michael

This is how our economy has been managed for decades.

According to the model they use, the unemployment rate is probably too low at the moment. It's probably contributing to some of this rising inflation.

In the post-war era, full employment used to mean genuine full employment.

But today, "full employment" means the rate of unemployment at which wages and inflation are reasonably contained.

Does Dr Lowe speak to common people who are suffering?

By Gareth Hutchens

Greens senator Nick McKim asks governor Lowe if he talks to the common person on the street who is really suffering.

Mr McKim said the RBA regularly talks with business executives and other bankers, but he asks Lowe if he ever talks to the average person so he can understand their world.

Dr Lowe said he recently he met with the head of the Australian Council of Social Service (ACOSS).

He gets letters from people in distress and he "reads them with a heavy heart."

He said he also speaks to other groups, like ACOSS, that provide social services.

He said the RBA board is always talking about these issues too, and has them front of mind.

More on the economic architecture

By Gareth Hutchens

Governor Lowe has had a bit more to say about the current economic policy framework, where the RBA has much of the responsibility to manage the economic cycle and inflation.

He says the reason why policymakers have chosen this system (which we've had for 30 years now), is partly because it can be really difficult to manage aggregate demand with fiscal policy, because you have to wait for the obvious policy skirmishes to work themselves out, and for new policies to pass through parliament.

He said that's why it's better to have independent central banks managing things, because they're free from political interference and can act more quickly.

All very reasonable.

But we should also remember, this era of inflation-targeting, where fiscal policy has been relegated to the sidelines, has coincided with growing wealth inequality, a growing divide between home owners and renters, a socially destructive increase in property prices, falling rates of productivity, a noticeable shift of the national income from workers up to businesses, and more.

So the current way of doing this is not perfect. It's contested ground.

When it comes to housing and job security and pay, the material circumstances for people aged 40 and under (Millennials and Gen Z) are very different from past generations.