The Australian share market has edged lower with miners tumbling because of plunging iron ore prices. But investors' main focus has been the latest consumer inflation data out later this week.

Disclaimer: This blog is not intended as investment advice.

Key events

To leave a comment on the blog, please log in or sign up for an ABC account.

Live updates

Markets snapshot 4:20pm AEST

By Sue Lannin

ASX 200: 7,322 (-0.1%)

All Ordinaries: 7,512 (down 0.05%)

Australian dollar: 66.73 US cents (down 0.25%)

Nikkei 225: 28,594 (up 0.1%)

Shanghai Composite: 3,275 (down 0.8%)

Hang Seng: 19,787 (down 1.4%)

NZ50: 12,026 (up 0.8%)

Kospi: 2,524 (down 0.8%)

Dow Jones: 33,809 (up 0.07%)

S&P 500: 4,133 (steady)

Nasdaq Composite: 12,072 (up 0.1%)

Brent crude oil: $US80.62 a barrel (down 1.3%)

West Texas crude: $US76.76 barrel (down 1.4%)

Spot gold: $US1980.40 an ounce (down 0.1%)

Iron ore: $US105.85 (down 8.3%)

Bitcoin: $US27,715 (up 1.7%)

ASX 200: Movers and Shakers

By Sue Lannin

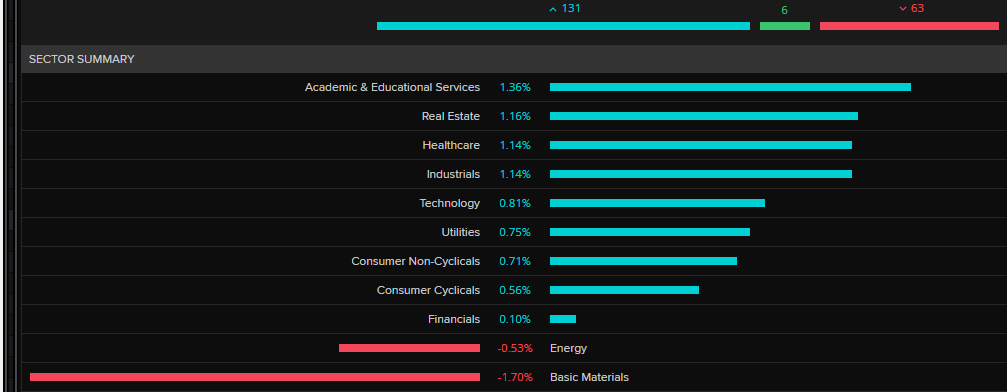

The ASX 200 ended in the red, although most sectors ended higher.

BlueScope Steel (0.3 per cent) shares retreated after hitting a one year high after it lifted its profit forecast for the second half of the financial year.

But the heavyweight miners pulled down the market as iron ore prices slumped towards $US100 a tonne on weak demand for steel in China.

ASX 200 ends lower ahead of ANZAC holiday and inflation data

By Sue Lannin

The local share market has ended in the red for another day ahead of tomorrow's ANZAC holiday and Wednesday's consumer figures.

The ASX 200 index fell 0.08 per cent to 7,325, while the All Ordinaries index lost 0.1 per cent to 7,514 at 4.01pm AEST.

Most sectors rose led by education firms, healthcare and real estate stocks.

But heavyweight miners and energy firms fell on lower commodity prices.

Verdict: Reserve Bank review

By Sue Lannin

As you've been hearing, some quarters have welcomed the RBA review, while others have questioned some of the 51 recommendations.

I spoke to AMP Australia deputy economist Diana Mousina for her take on ABC News Channel.

Inflation slowdown expected over early 2023

By Sue Lannin

The big news this week is that Australia's latest inflation figures will be out on Wednesday.

Economists surveyed by Bloomberg are predicting that consumer prices eased back over the March quarter from the December quarter.

They expect consumer inflation to rise by 1.3 per cent over the first few months of the year, compared to a 1.9 per cent increase over the last few months of 2022.

The economists predict that prices have increased by 6.9 per cent over the year to March, a slowdown from the 7.8 per cent annual rate over the year to December.

Here's my colleague business reporter Dave Chau on what to expect from Wednesday's numbers.

ASX 200: Movers and Shakers 3:10pm AEST

By Sue Lannin

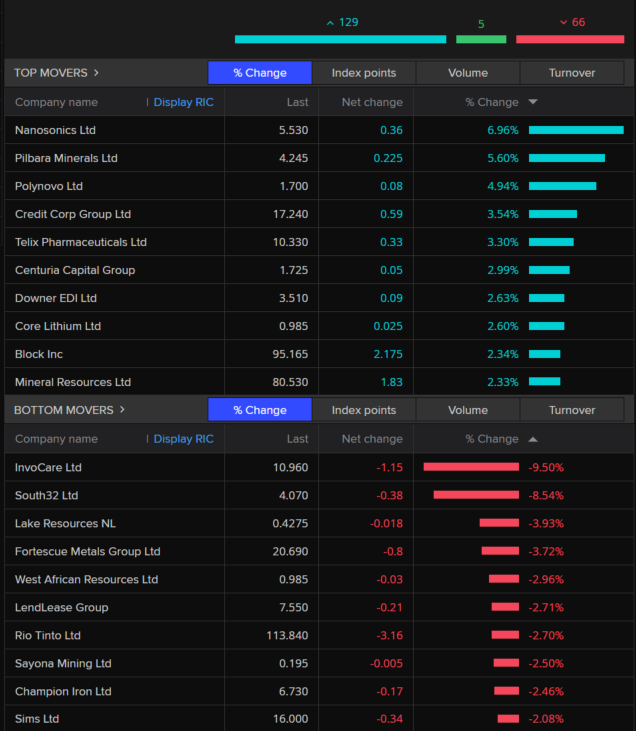

Here are the best and worst performers on the ASX 200 in late trade.

Funeral firm Invocare (-7.8 per cent) has plunged after private equity giant TPG withdrew a $1.8 billion takeover bid, which had offered $12.65 a share to investors.

Invocare had told shareholders that the offer "did not provide compelling value."

However, Invocare says it's willing to consider a better takeover bid, and it will consider TPG's request to nominate Genevieve Gregor as a non executive board director.

Invocare's shares initially fell as much as 17 per cent before recouping some lost ground.

New tenants pay higher-than-advertised rent prices, according to the ABS

By Kate Ainsworth

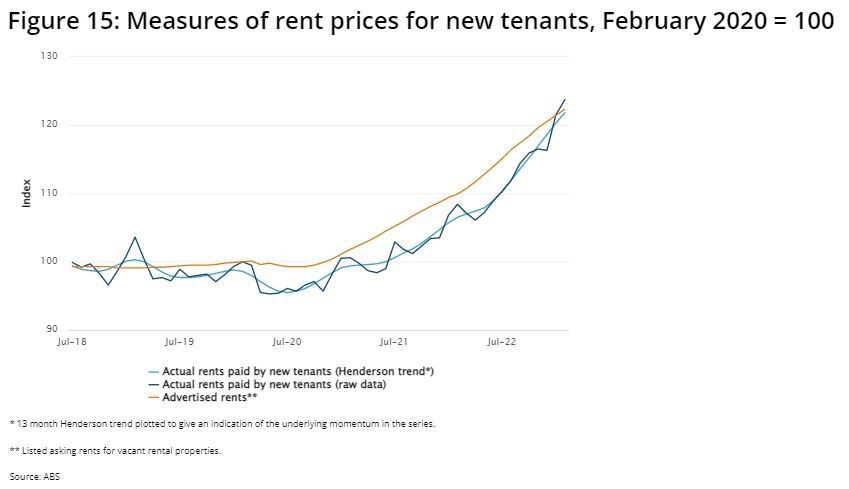

The ABS's rental market insight data has also showed new tenants are paying more in rent than the advertised listing price.

It notes that previously the best indicator of rents paid by new tenants was the advertised price, but the ABS said the rent agreement between a landlord and new tenant may differ — so it has created an index of actual prices paid by tenants.

The ABS says actual rents paid by new tenants increased by 14% over the year to February 2023 (9 percentage points higher than the CPI indicator), and has increased by 24% since the pandemic — compared to the 22% increase in advertised rents collected by CoreLogic.

Now the ABS notes that rent paid by new tenants is higher than CoreLogic's advertised rent, because the rent agreed upon between landlords and tenants has been higher on average than what's been advertised.

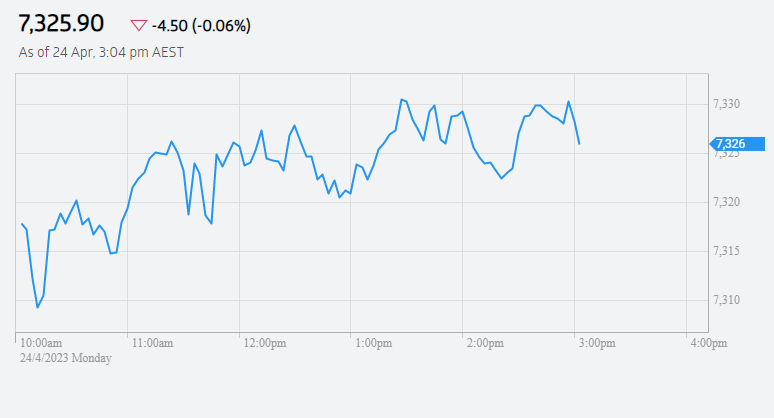

Australian market is little changed in late trade

By Sue Lannin

Another quiet day for the local share market ahead of the ANZAC day public holiday tomorrow.

The ASX 200 index is down slightly in late trade.

Iron miners are down after a 8 per cent plunge in the price of iron ore with Fortescue Metals (3.4 per cent) doing the worst after its production was flat over the March quarter.

Nanosonics (+7.2 per cent) is doing the best in the ASX 200 index, while funeral home operator Invocare (-8.9 per cent) is doing the worst.

Markets Snapshot 3pm AEST

By Sue Lannin

ASX 200: 7,329 (steady)

All Ordinaries: 7,519 (down 0.05%)

Australian dollar: 66.72 US cents (down 0.2%)

Nikkei 225: 28,608 (up 0.2%)

Shanghai Composite: 3,296 (down 0.1%)

Hang Seng: 19,950 (down 0.6%)

NZ50: 11,944 (up 0.1%)

Kospi: 2,526 (down 0.7%)

Dow Jones: 33,809 (up 0.07%)

S&P 500: 4,133 (steady)

Nasdaq Composite: 12,072 (up 0.1%)

Brent crude oil: $US80.73 a barrel (down 1.1%)

West Texas crude: $US76.95 barrel (down 1.2%)

Spot gold: $US1977.79 an ounce (down 0.25%)

Iron ore: $US105.85 (down 8.3%)

Bitcoin: $US27,715 (up 1.7%)

Rent rises becoming 'more common and larger', new ABS data shows

By Kate Ainsworth

New data released by the Australian Bureau of Statistics into the rental market this morning has found rent increases are becoming "more common and larger on average" as rents keep going up across the country.

The ABS says rent increases have come more common for most properties across Australia, but those increases have been typically higher for properties with a new tenant.

Over the past year, rental prices have gone up for nearly three-quarters of properties (up from around a quarter pre-COVID).

You can see in the graph that the majority of new tenants have been paying much higher rent than was charged for the same property a year earlier — and it's only increased since the RBA began increasing the cash rate in May last year.

Compare that to existing tenants over the same time period —there are still increases, but they are much smaller than those affecting new tenants.

Markets Snapshot 12:40pm AEST

By Sue Lannin

ASX 200: 7,323 (down 0.1%)

All Ordinaries: 7,512 (down 0.1%)

Australian dollar: 66.82 US cents (down 0.1%)

Nikkei 225: 28,646 (up 0.3%)

Shanghai Composite: 3,293 (down 0.2%)

Hang Seng: 20,015 (down 0.3%)

NZ50: 11,944 (up 0.1%)

Kospi: 2,526 (down 0.7%)

Dow Jones: 33,809 (up 0.07%)

S&P 500: 4,133 (steady)

Nasdaq Composite: 12,072 (up 0.1%)

Brent crude oil: $US81.02 a barrel (down 0.8%)

West Texas crude: $US77.20 barrel (down 0.9%)

Spot gold: $US1982.59 an ounce (steady)

Iron ore: $US105.85 (down 8.3%)

Bitcoin: $US27,715 (up 1.7%)

Call for oil giants to pay more petroleum tax

By Sue Lannin

As next month's budget approaches, the Federal Government is looking at increasing a tax on the oil and gas industry, amid long held criticisms that it doesn't raise enough money.

The Petroleum Resource Rent Tax is a 40 per cent levy on offshore energy projects, but companies can make deductions under the law which can reduce or wipe out their tax bill.

However, the oil and gas industry is warning of overreach if the tax is increased.

It says it pays its fair share of tax and is expecting to pay around $16 billion this year.

Here's an interview I did on ABC News Channel with Jason Ward, from the Centre for International Corporate Tax Accountability and Research.

He thinks the PRRT as it stands is not raising enough revenue.

I also spoke to Jason back in 2019 about the problems.

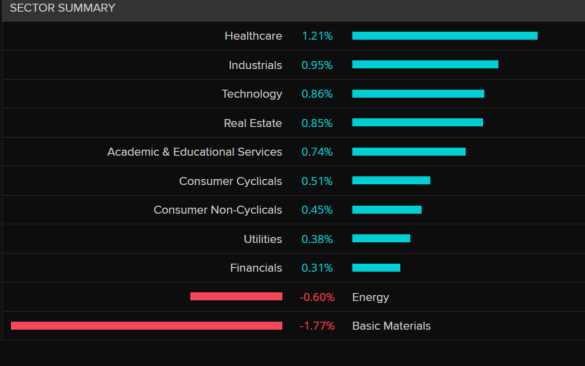

ASX Movers and Shakers 12:15pm AEST

By Sue Lannin

It's a pretty quiet day on the markets, but the ASX 200 index has come off its early lows, with most industry sectors higher.

Miners are weighing on the benchmark index, after a slump in iron ore prices.

Healthcare, industrials and technology stocks are among the gainers.

Miner South32 saw lower coal production over the March quarter because of wet weather and other temporary disruptions at its Appin metullurgical coal mine in the Illawara in southern New South Wales.

Its shares have plunged by 8.7 per cent in lunchtime trade.

Metullurgical coal is used to make steel.

Fortescue starts iron ore production at Iron Bridge

By Sue Lannin

It's another quiet day on the markets, but iron ore miner Fortescue Metals has released its quarterly production report.

FMG saw steady shipments of iron ore over the first few months of the year, with exports of 46.3 million tonnes.

However, cash rose by 12 per cent over the March quarter.

The good news for Fortescue is that it produced its first wet concentrate from its Iron Bridge Magnetite processing facility in Western Australia, after delays, cost blowouts, and the departure of top executives.

"This is a significant milestone for Fortescue as Iron Bridge represents our entry into the highest grade segment of the iron ore market," said FMG chief executive Fiona Hicks.

Magnetite is lower quality iron ore than needs to be processed, as opposed to higher quality hematite, which can be simply dug out of the ground and exported.

It is expensive and difficult to develop as other miners have found to their peril, such as China backed miners Sino Iron and Gindalbie Metals.

Iron ore quality is determined by its how much iron it contains.

The mineral is used to make steel, and is Australia's biggest export.

FMG left its forecast for annual shipments unchanged at 187 million tonnes to 192 million tonnes.

It sold its iron ore at an average price of $US109 a tonne over the March quarter, that's a 13 per cent discount to the benchmark price.

The company is also pressing ahead with renewable projects at its Fortescue Future Industries arm.

Fortescue Metals shares are down 3.6 per cent in midday trade because of a plunge in iron ore prices.

RBA review: not everyone agrees

By Sue Lannin

And of course, when any big government institution faces a shakeup, there are a variety of views.

RBA governor Philip Lowe was asked about the impact of the review on Thursday and he said he didn't think there would be much practical change, but rather changes on the margins.

Here's more from my colleague, business reporter, Stephanie Chalmers (she is not related to the Federal Treasurer, Jim Chalmers!).

Markets Snapshot 11:30am AEST

By Sue Lannin

ASX 200: 7,323 (down 0.1%)

All Ordinaries: 7,513 (down 0.1%)

Australian dollar: 66.94 US cents (up 0.06%)

Dow Jones: 33,809 (up 0.07%)

S&P 500: 4,133 (steady)

Nasdaq Composite: 12,072 (up 0.1%)

Brent crude oil: $US81.55 a barrel (down 0.2%)

West Texas crude: $US77.91 barrel (up 0.05%)

Spot gold: $US1983.55 an ounce (up 0.04%)

Iron ore: $US105.85 (down 8.3%)

Bitcoin: $US27,849 (up 2.1%)

'Nuclear option' of government intervention removed

By Sue Lannin

One of the recommendations of the RBA review was the repeal of the federal government's power to overrule Reserve Bank decisions.

Mr de Brouwer says that power has never been used, and would be a "nuclear option" if ever used.

He notes that while the government of the day may not be able to intervene in RBA decisions, the Parliament of Australia will retain that right.

"We are not losing anything making an independent institution not subject to political issues," he said.

RBA review authors explain their findings

By Sue Lannin

The authors of the landmark Reserve Bank review report, which was released last Thursday, are talking on a CEDA panel at the moment.

Their key recommendations: split the RBA board into two with a monetary policy board to decide on interest rates, and a governance board to oversee transparency, communication, staff, and the financials.

We are hearing from Dr Gordon de Brouwer, the secretary of Public Sector Reform in the department of Prime Minister and Cabinet, Professor Renee Fry-McKibbin from the Crawford School of Public Policy at the Australian National University, and Professor Carolyn Wilkins, who is an external member of the Financial Policy Committee of the Bank of England.

Mr de Brouwer just explained how the review panel looked at the Reserve Bank's policy decisions over recent years.

2016 to 2019: Mr de Brouwer says during a period when inflation was below the RBA's target of 2 to 3 per cent, the central bank could have better explained the thinking behind its monetary policy decisions.

He also says there was a need for greater clarity about the role of financial stability in monetary policy decision making.

The pandemic: During this time, the Reserve Bank announced emergency measures which included emergency interest rate cuts and buying government bonds to keep interest rates at 0.1 per cent, as well as finance the Morrison Government's COVID-19 stimulus program

But Mr de Brouwer says while it was a time of extreme uncertainty for the country, the RBA did not explain its decisions adequately enough, including in board minutes, board papers or the subsequent decisions.

He also noted that how the yield target (preferred interest rate on government bonds) worked was not explained enough publicly, and decisions on the target were sometimes made by RBA staff, and not the board.

Mr de Brouwer says there "information shortcomings" in what was presented to the board.

Finally from 2022 to 2023, the RBA was initially "slow to react" to try and contain surging inflation which was largely caused by the global supply chain squeeze, with soaring demand for products.

For more, my colleague political correspondent Brett Worthington explains the 51 recommendations of the RBA review, which the Federal Government has agreed to accept in principle.

ASX Movers and Shakers at 10:25am AEST

By Sue Lannin

Here are the best and worst performing stocks on the ASX 200 this morning.

Iron ore miners have taken a hit because of a slump in iron ore prices.

Markets Snapshot 10:10am AEST

By Sue Lannin

ASX 200: 7,321 (down 0.14%)

All Ordinaries: 7,510 (down 0.14%)

Australian dollar: 66.86 US cents (down 0.07%)

Dow Jones: 33,809 (up 0.07%)

S&P 500: 4,133 (steady)

Brent crude oil: $US81.55 a barrel (down 0.2%)

West Texas crude: $US77.91 barrel (up 0.05%)

Spot gold: $US1983.55 an ounce (up 0.04%)