Released earlier this week, research company MoffettNathson's report "Media Content Spend Post-Streaming Wars" elegantly showcased how the major media conglomerates were decelerating content spend in order to curb DTC losses.

Next TV, however, ignored some rather interesting reading at the back of the report, analyzing profitability of various linear and streaming platforms based on content spend, scale and revenue.

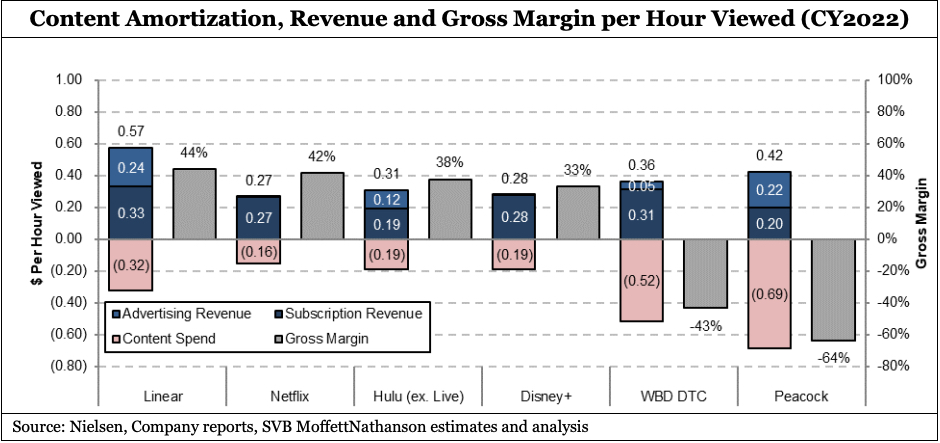

Based on a per-hour viewed basis, MoffettNathanson found that combined force of linear platforms still generate margins of 44%, with backers spending 32 cents on content, but recouping 33 cents in subscription revenue and 24 cents in advertising coin, on average.

Netflix came in second in this video business efficiency analysis with a margin of 42%.

Notable is the influence of scale.

NBCUniversal was expected to have spent only around $3 billion on sports, news, movies and TV shows for Peacock in 2022, vs. a reported content spend of around $17 billion for Netflix.

Netflix, however, has more than 230 million paid members worldwide vs. only around 20 billion for Peacock. The net effect is that margins per hour streamed are much bigger for Netflix.

"Zooming out, Netflix did not make streaming more economical by reducing spend," wrote study author Robert Fishman. "It did so by increasing spend continually until it managed to buy effective scale."

Given the pressure Wall Street is putting on media companies to reduce EBITDA losses on direct-to-consumer streaming, Fishman doesn't believe that Disney, Warner Bros. Discovery, Paramount Global and Comcast/NBCUniversal will enjoy the same kind slow, methodically expensive scale ramp-up Netflix was able to pull off.

"The current sub-scale players do not have that same luxury of time," he added. "All in all, in today's environment, pulling off the streaming pivot is more difficult than ever."