The real net worth of United States' residents grew overall during the pandemic period, but the size varied significantly depending on the different demographics.

According to a new report by the New York Federal Reserve, White people's net worth outgrew that of Latinos by 9 percentage points between the first quarter of 2019 and the second quarter of 2023. Black Americans' net worth was 30 percentage points under Whites during the same period.

The difference can be largely explained by the swift growth experienced by the U.S. stock market during the pandemic, a period marked by widespread government stimulus. According to The Associated Press, a separate Fed survey showed that, by 2022, almost two thirds of White household had investments in stocks, compared to 28.3% for Latinos and 39.2% for Black households.

Even though the performance of the stock markets reversed course in 2022 after the Federal Reserve began rapidly rising interest rates to quash inflation, the drop did not offset many of the gains seen during the growth period.

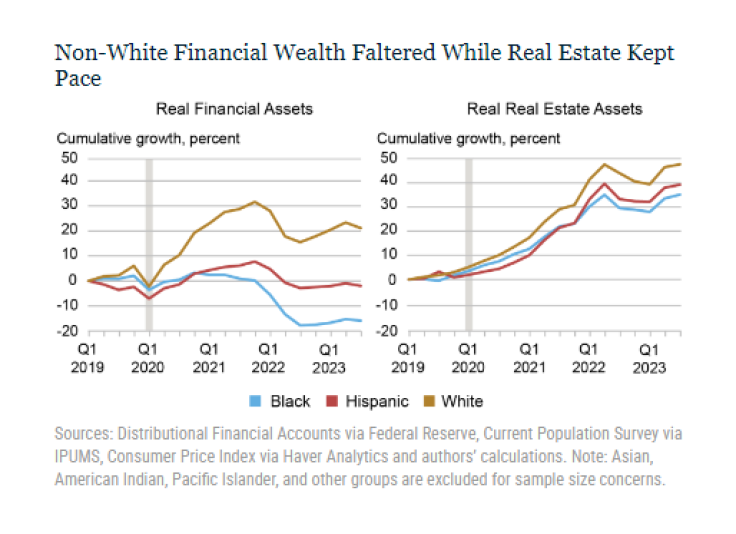

Another factor that explains the disparity is the composition of investments, especially differences seen in the performance of financial and real estate assets. "total white assets in 2019:Q1 were about 70 percent financial and 20 percent real estate assets and total Hispanic assets were 50 percent financial and 40 percent real estate," the report explains.

"We find much of the divergence in net worth by race and ethnicity since 2019 can be attributed to divergence in the real values of financial asset holdings," it adds, saying that "white-held financial assets outpaced Blacks' and Hispanics' by 23 and 37 percentage points, respectively. Real estate assets, in contrast, showed minimal variation during the period. "The real value of Hispanic-held financial assets dipped below its 2019:Q1 level in 2022:Q2 and stagnated," the report added.

A separate report by NAHREP shows that Latino household wealth rose to $63,400 in 2022, with homeownership and self-employment as two of the main drivers.

Latino wealth has tripled since 2013, a much rapid pace that the rest of the demographics in the U.S. But it's still far away and less than a third than the general population median, which was of $192,160 in 2022.

When breaking down the composition of Latino wealth, home equity stands out as the main source, representing 33.3% compared to the general population's 21.1%. Business equity and non-cash financial assets hold lower significance for Latinos than the rest: the former represents 17.8% of their total wealth compared to 21.7% of the general population. For the latter, percentages are 28.1% for Latinos and 41.7% for the rest.

© 2024 Latin Times. All rights reserved. Do not reproduce without permission.