Kroger (KR) shares have been sharply volatile on Thursday.

After the grocery giant rallied in five straight trading sessions, the shares opened about 6% lower. They were down 7.7% at today’s low and at last check they were off 3.4%.

The decline came after the company reported earnings before the open.

Earnings of 99 cents a share beat analysts’ expectations by 9 cents. Revenue grew 5.4% to $34.82 billion but missed expectations by $70 million.

Overall, the headline numbers were solid, particularly as management affirmed the company’s full-year earnings outlook and gave a slight boost to its outlook for adjusted free cash flow.

Don't Miss: SoFi Stock Has Doubled in a Month; Here's the Trade

It’s been a tough stretch for many retail stocks, as Kroger, Target (TGT) and others have struggled for upside traction. Let’s look at the post-earnings dip in Kroger.

Trading Kroger Stock After Earnings Dip

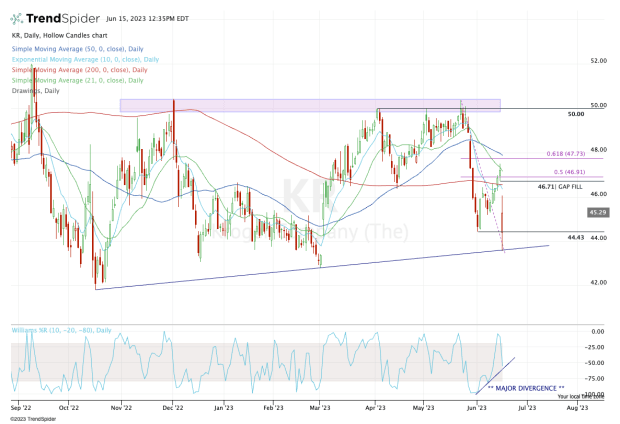

Chart courtesy of TrendSpider.com

Kroger stock faded hard from the $50 area but bounced nicely ahead of the earnings report. The shares opened Thursday’s session right near the previous June low at $44.43 and dipped.

Buyers stepped in at uptrend support (blue line) and regained the $44.50 area. The dip was bought, but the chart still reflects some technical damage.

If Kroger shares continue higher, I want to see how they handle the $46.70 to $47 area. This zone marks the 200-day moving average, the 50% retracement and the gap-fill from this morning’s dip.

Don't Miss: Alphabet Stock Lags in the FAANG Race. Can It Catch Up?

If the stock climbs that high, the bulls will need to see whether this area is resistance or whether the stock can regain the level.

If it pushes through, the $48 area could be in play next. That area is the 61.8% retracement and the 50-day moving average.

Ultimately, the bulls are looking for a return to $50, which has been stiff resistance.

On the downside, the bulls can navigate against today’s low near $43.50. A break or close below this mark could usher in a move down to the $42s.

From here, see that Kroger stock holds $43.50 on the downside and see how it handles a potential rally to the $46.70 to $47 zone.

Receive full access to real-time market analysis along with stock, commodities, and options trading recommendations. Sign up for Real Money Pro now.