8 analysts have shared their evaluations of WESCO Intl (NYSE:WCC) during the recent three months, expressing a mix of bullish and bearish perspectives.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 4 | 2 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 4 | 1 | 0 | 0 |

| 3M Ago | 1 | 0 | 1 | 0 | 0 |

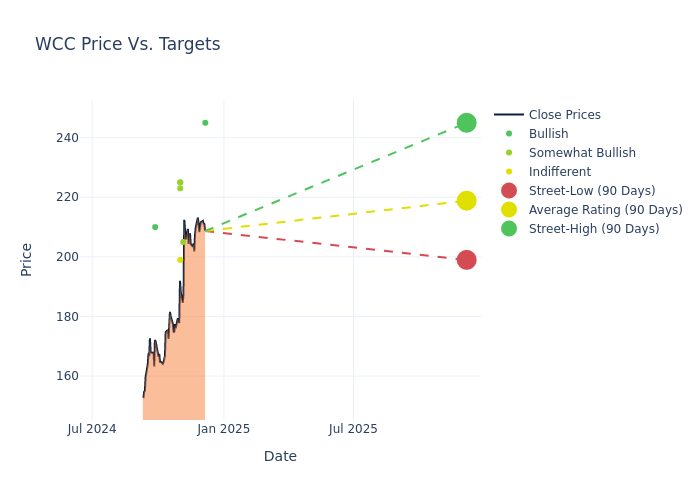

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $214.88, a high estimate of $245.00, and a low estimate of $187.00. Surpassing the previous average price target of $197.12, the current average has increased by 9.01%.

Interpreting Analyst Ratings: A Closer Look

A comprehensive examination of how financial experts perceive WESCO Intl is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Stephen Volkmann | Jefferies | Raises | Buy | $245.00 | $225.00 |

| Tommy Moll | Stephens & Co. | Raises | Overweight | $205.00 | $190.00 |

| Deane Dray | RBC Capital | Raises | Sector Perform | $199.00 | $186.00 |

| Christopher Glynn | Oppenheimer | Raises | Outperform | $225.00 | $205.00 |

| Ken Newman | Keybanc | Raises | Overweight | $225.00 | $195.00 |

| David Manthey | Baird | Raises | Outperform | $223.00 | $215.00 |

| Deane Dray | RBC Capital | Raises | Sector Perform | $187.00 | $171.00 |

| Chris Dankert | Loop Capital | Raises | Buy | $210.00 | $190.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to WESCO Intl. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of WESCO Intl compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for WESCO Intl's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of WESCO Intl's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on WESCO Intl analyst ratings.

Delving into WESCO Intl's Background

Wesco International is an industrial distributor that has three reportable segments, electrical and electronic solutions, communications and security solutions, and utility and broadband solutions. The company offers more than 1.5 million products to its 140,000 active customers through a distribution network of 800 branches, warehouses, and sales offices, including 43 distribution centers. Wesco generates approximately 74% of its sales in the United States, but it has a global reach, with operations in 50 other countries.

WESCO Intl's Financial Performance

Market Capitalization Analysis: Reflecting a smaller scale, the company's market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Negative Revenue Trend: Examining WESCO Intl's financials over 3 months reveals challenges. As of 30 September, 2024, the company experienced a decline of approximately -2.75% in revenue growth, reflecting a decrease in top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: WESCO Intl's net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of 3.46%, the company may face hurdles in effective cost management.

Return on Equity (ROE): WESCO Intl's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of 3.84%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): WESCO Intl's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of 1.25%, the company may face hurdles in achieving optimal financial returns.

Debt Management: WESCO Intl's debt-to-equity ratio is below the industry average. With a ratio of 1.12, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Analyst Ratings: Simplified

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.