Throughout the last three months, 4 analysts have evaluated IDEX (NYSE:IEX), offering a diverse set of opinions from bullish to bearish.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 3 | 0 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 1 | 2 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

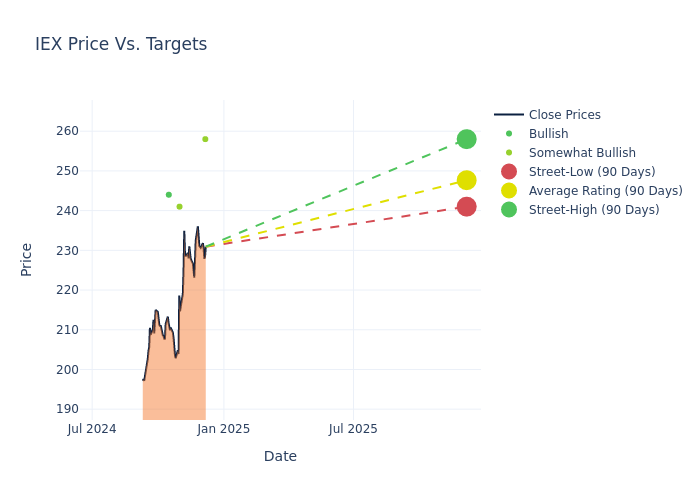

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $247.75, along with a high estimate of $258.00 and a low estimate of $241.00. This upward trend is apparent, with the current average reflecting a 3.12% increase from the previous average price target of $240.25.

Decoding Analyst Ratings: A Detailed Look

The perception of IDEX by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Deane Dray | RBC Capital | Raises | Outperform | $258.00 | $248.00 |

| Deane Dray | RBC Capital | Raises | Outperform | $248.00 | $236.00 |

| Michael Halloran | Baird | Lowers | Outperform | $241.00 | $245.00 |

| Nathan Jones | Stifel | Raises | Buy | $244.00 | $232.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to IDEX. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of IDEX compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of IDEX's stock. This comparison reveals trends in analysts' expectations over time.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of IDEX's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on IDEX analyst ratings.

About IDEX

Idex manufactures pumps, flow meters, valves, and fluidic systems for customers in a variety of end markets, including industrial, fire and safety, life science, and water. The firm's business is organized into three segments: fluid and metering technologies, health and science technologies, and fire and safety and diversified products. Based in Lake Forest, Illinois, Idex has manufacturing operations in over 20 countries and has over 7,000 employees. The company generated $3.3 billion in revenue in 2023.

Breaking Down IDEX's Financial Performance

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Positive Revenue Trend: Examining IDEX's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 0.6% as of 30 September, 2024, showcasing a substantial increase in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: IDEX's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 14.92% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): IDEX's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of 3.19%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): IDEX's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of 1.85%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: IDEX's debt-to-equity ratio is below the industry average at 0.55, reflecting a lower dependency on debt financing and a more conservative financial approach.

What Are Analyst Ratings?

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.