Tokyo (AFP) - Economics professor Kazuo Ueda was nominated Tuesday as the Bank of Japan's next governor, tasked with navigating a way forward after a decade of extraordinary monetary easing.

The respected economist, described as careful and cautious, was a surprise pick for the change of guard after the outgoing governor's deputy reportedly turned down the job.

The position will likely be tough going, with Ueda facing pressure to join international peers in tightening while avoiding panic by suddenly unwinding the bank's longstanding ultra-loose policies.

In an example of the economic headwinds facing Japan, data released Tuesday showed that GDP expanded just 0.2 percent in the last quarter of 2022, a smaller rebound than expected despite a long-awaited reopening to tourists.

Ueda was nominated by Prime Minister Fumio Kishida, according to a government document handed to reporters -- a decision expected to be easily approved in parliament where the ruling coalition commands a healthy majority.

BoJ official Shinichi Uchida and former bureaucrat Ryozo Himino were nominated as deputy governors, completing another all-male line-up at the top of the institution.

A former BoJ policy board member, Ueda will take the reins from Haruhiko Kuroda, the central bank's longest-serving leader and the architect of its easing policies.

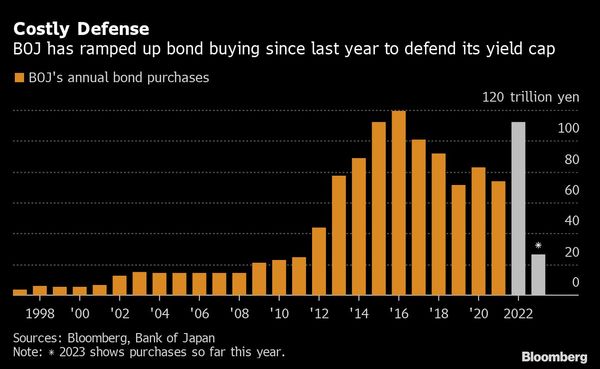

Since Kuroda became governor in 2013, his attempts to boost Japan's moribund economy have ranged from a negative interest rate to spending vast sums on government bonds.

In the past year, he has held firm, even as other central banks hiked rates to tackle inflation, with the resulting policy gap causing the yen to slump against the dollar.

Kuroda, 78, is due to step down on April 8 when his second term ends.

He leaves 71-year-old Ueda the challenge of working out the bank's next steps, said Saori N. Katada, an international relations professor at the University of Southern California.

"This is probably the hardest job at the worst time to take up.Professor Ueda is very brave to accept it," she told AFP.

Japan's easy money policies have become "extreme...and no one knows how to get out", as sudden pivots could "jeopardise fiscal sustainability", Katada said.

"In the next five years, though, the BoJ has to change course" as rising inflation, the weak yen and high government spending make easing unsustainable, she said.

'Cautious' approach

The yen tumbled from around 115 against the dollar in February 2022 to a three-decade low of 151 yen in October.

It has since recovered to about 132 yen, and briefly strengthened when Japanese media first reported Ueda would be nominated instead of Kuroda's dovish deputy Masayoshi Amamiya.

Amamiya had been seen as a continuity candidate likely to keep the BoJ's stimulus policies.

But that does not mean Ueda -- who has a PhD in economics from the Massachusetts Institute of Technology and served on the BoJ's policy board between 1998 and 2005 -- should be viewed as a hawk, analysts said.

"The current BoJ policy is appropriate, and I think it's important to maintain monetary easing policy for now," Ueda told reporters on Friday.

Katada described him as "one of the most respected macroeconomists in Japan" and a good communicator who is "relatively cautious".

Kazuo Momma, executive economist at Mizuho Research and Technologies and a former BoJ assistant governor, told AFP that Ueda had "never been hawkish with regard to the BoJ's monetary policy".

The bank's approach dates to the era of former prime minister Shinzo Abe, whose "Abenomics" plan aimed to stimulate growth and banish the deflation that plagued Japan from the end of the 1980s boom.

Inflation hit a multi-decade high of four percent in Japan in December -- above the BoJ's longstanding two-percent target -- fuelled partly by soaring energy bills.

But because the trend has not been driven by demand or steady wage increases, the BoJ has said it sees no reason to abandon its policies.

So Ueda "will assess very carefully whether the two-percent inflation target will be achieved in any reasonable time horizon, and take a cautious position in terms of possible policy changes," Momma said.