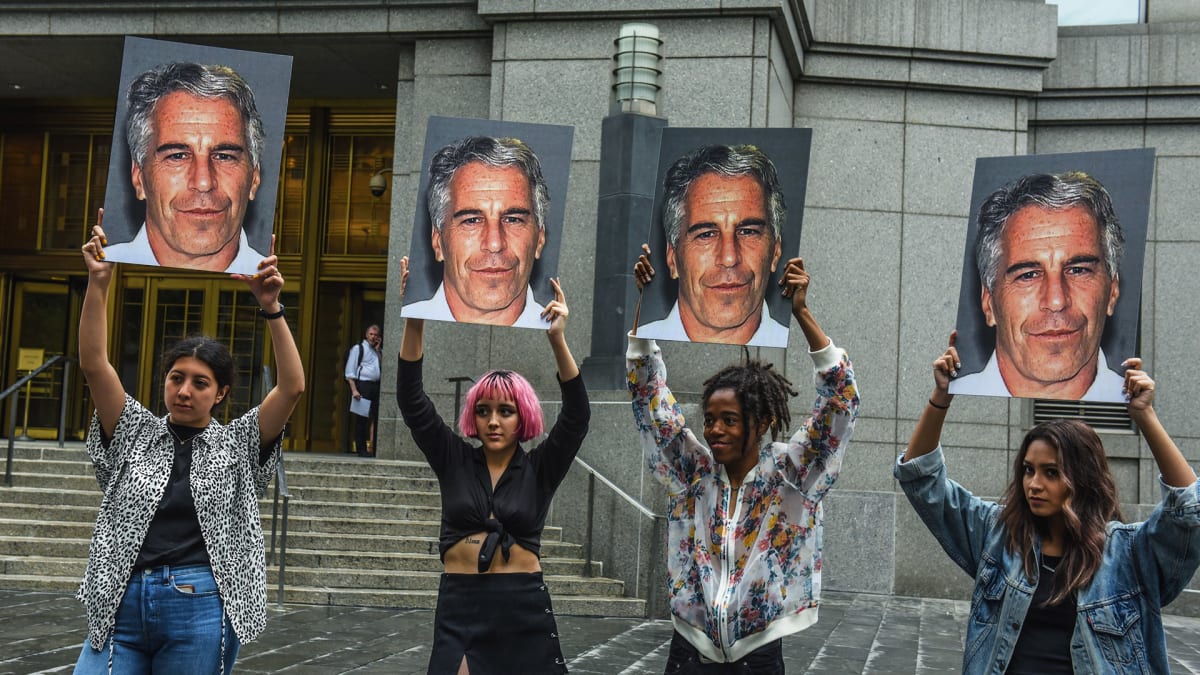

While convicted sex offender Jeffrey Epstein died in prison in August 2019 in an apparent suicide, the reverberations of the financier's extensive sex trafficking ring are still reverberating across many different sectors -- on March 8, JPMorgan Chase (JPM) filed a lawsuit against one of its former senior bankers for ties to Epstein that entangled the investment firm in the fallout around Epstein's conviction.

Last December, the government of the U.S. Virgin Islands sued the largest bank in the U.S. over keeping Epstein on as a client and "too-little too-late efforts" to tip off the federal government when the trafficking ring allegations first started to come to light.

DON'T MISS: Barclays CEO Jes Staley Steps Down After Probe Into Ties With Jeffery Epstein

A few weeks earlier, a woman going under "Jane Doe" filed a class action lawsuit accusing JPMorgan of "financially benefitting from participating in Jeffrey Epstein's sex trafficking by providing the requisite financial support for the continued operation of Epstein's international sex trafficking organization from 1998 through August 2013."

JPMorgan has repeatedly denied the allegations made in both lawsuits.

Here's Why JPMorgan Chase Is Suing Jes Staley

As first reported by the Wall Street Journal, JPMorgan responded by filing a lawsuit against its former senior banking executive Jes Staley.

Identifying him as the "powerful financial executive" named in the lawsuit against the bank, the complaint filed in Manhattan federal court claims that Staley's concealed information from the bank while his "intentional and outrageous conduct" led to it also being associated with Epstein.

The lawsuit demands that, should Staley be found liable, he cover any damages ruled by court independently while also paying back all compensation he earned through JPMorgan from 2006 to 2013 -- an amount that would equal tens of millions of dollars.

Staley, who started working for JPMorgan in the 1980s and eventually came to head its asset management division, first developed a "longstanding professional relationship" with Epstein in 2000.

Staley left JPMorgan in 2013 and eventually came to head Barclays (BCLYF) before resigning in 2021 after U.K. financial regulators started probing his connection to Epstein. One report found that Staley exchanged over 1,200 emails with Epstein between 2008 and 2012.

Employees to 'Act With Honesty And Integrity,' Says JPMorgan Chase

"Staley persisted for years -- from at least 2006 until his departure from JPMC in 2013 -- in protecting Epstein in the face of attempts by JPMC to end the company's relationship with Epstein, omitted material information, made misrepresentations in the process, and continued to do so," JPMorgan says in the lawsuit.

The new lawsuit attempts to shift blame away from the bank and toward Staley personally for "putting his own personal interests ahead of the company's." While the lawsuit says that the bank officially cut off all of Staley's accounts when he left in 2013, Reuters reports that he was at one point being considered as a successor for current chief executive Jamie Dimon.

A spokesperson for JPMorgan told CNBC that the allegations regarding the "conduct of our former employee Jes Staley" were "troubling."

"We expect all of our employees at every level of the firm act with honesty and integrity," the spokesperson said. "If these allegations against Staley are true, he violated this duty by putting his own personal interests ahead of the company's."