It’s often said in business circles that good companies manage their balance sheet, and bad companies manage their P&L (profit and loss account). That same aphorism applies to governments.

And by that standard, Josh Frydenberg’s fourth budget is a triumph. Net debt is forecast to peak at 33.1% of GDP in 2024-25, compared to 40.9% in last year’s budget. Net interest payments stay below 1% of GDP—a better result than every year from 1984 to 2000.

This is an extraordinary turnaround, and much of it comes in the year to the end of June this year. Rather than net debt of A$729 billion by June 2022 (as forecast in last year’s budget), it is expected to be $632 billion. This reflects the stronger economy.

Unemployment is lower so welfare payments are, too. High commodity prices have helped the budget bottom line, but so too have the tax receipts from increased employment and consumer spending.

At the start of the coronavirus pandemic in 2020, the government outlined a clear fiscal strategy: spend big to support the economy, and shrink away the debt involved through higher economic growth.

It worked. Australian GDP is 3.4% higher than it was pre-pandemic. Only the United States, at 3.2%, is close to that performance among the world’s seven largest economies. France is up just 0.9%, Canada 0.1%, while Germany, Japan, the United Kingdom and Italy have all shrunk.

Amid this good news is a lingering concern. By 2025-26, the budget deficit is still estimated to be 1.6% of GDP. That’s a $43.1 billion gap between government revenues and expenses.

It is a reminder that while two governments — one Liberal and one Labor — have steered the nation through the global financial crisis and the coronavirus pandemic, they have not repaired our structural deficit.

The next government — whichever party that is — faces a difficult task. It needs to close that $40 billion structural gap without a turn to austerity that would damage the economic growth engine that’s put us in this enviable position.

It’s something of a high-wire act. And it is the litmus test of good economic management.

Some big spending

It’s not hard to see why. Defence spending will grow from $35.8 billion this year to $44.5 billion by 2025-26. Given the global security outlook, it could easily go higher.

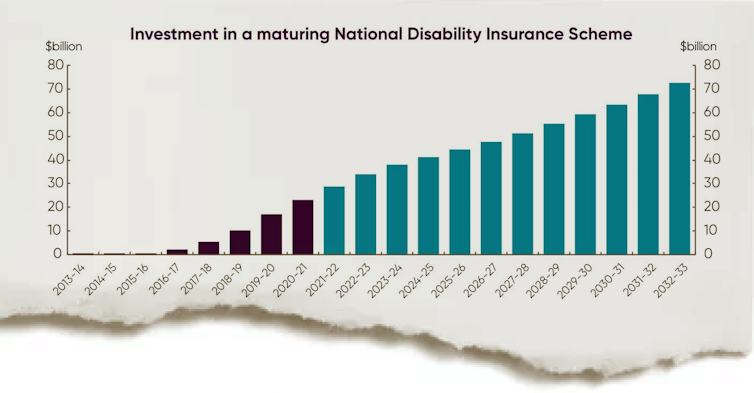

And spending on the National Disability Insurance Scheme (NDIS) will grow from $30.8 billion this year to $46.1 billion over the same time frame.

That’s growth of 10.6% per annum. In fact, by 2033 the NDIS is forecast to represent more than $70 billion in government spending.

That spending is life changing for half a million Australians. But those figures tell us such spending is only sustainable with a strong economy.

If unemployment doesn’t stay low, and economic growth comparatively high, then spending growth in areas like the NDIS and defence will become unsustainable.

The fuel excise holiday

One hotly anticipated measure in the budget is a 50% cut in the fuel excise from 44.2 cents to 22.1 per litre, for six months. Let’s be clear: this is great politics. The treasurer said in his speech:

“Whether you’re dropping the kids at school, driving to and from work or visiting family and friends, it will cost less”.

This is a beautiful rendition of the time-honoured political tradition of feeling the voters’ pain.

In one way this makes perfect economic sense, too. Why should households bear the risk of petrol prices bouncing around based on global conflict and decisions by the OPEC cartel?

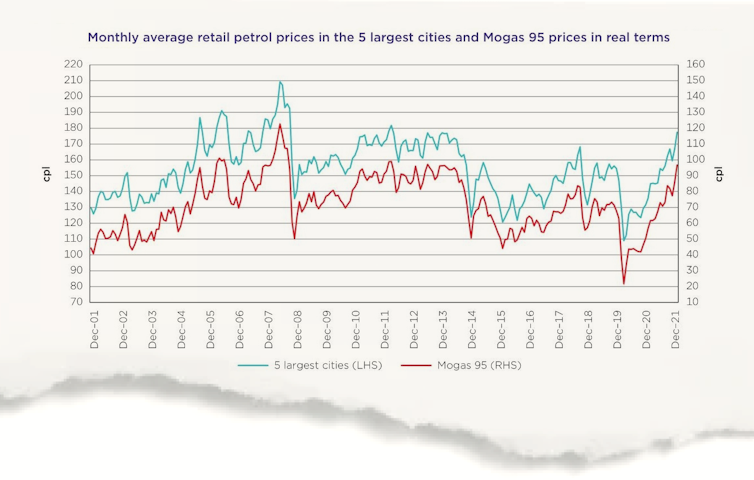

As the Australian Competition Consumer Commission has demonstrated, prices at the pump basically move one-for-one with the Singapore price of the Mogas 95 unleaded petrol sold to Australia.

By setting the fuel excise lower when oil prices and high, and higher when oil prices are low, the government is acting like a big social insurance company. That’s part of their job (see Medicare, NDIS, unemployment benefits).

But there’s a wrinkle to this. According to figures from the Bureau of Statistics’ Household Expenditure Survey, the bottom fifth of households by income spend $27 a week or 3.5% of their income on petrol.

Read more: Budget 2022: Frydenberg has spent big – but on the whole, responsibly

By contrast, the top fifth of households spend $42 a week or 1.8% of their income on petrol. So, a per litre cut in petrol benefits higher-income households more in dollar terms. It also doesn’t discourage people from driving less.

It would be more progressive (and better for the environment) to just give all households a flat rebate.

A good plan, well executed

The tone at the budget press conference this year was in striking contrast to that at the announcement of the pandemic fiscal strategy in early 2020.

Back then there were sharp questions about fiscal irresponsibility, leading then-Finance Minister Matthias Cormann to exclaim: “What would you have us do?”

Read more: View from The Hill: if money talks, the government has the megaphone out

This time, there were a series of relatively minor questions about whether Victoria was getting enough GST revenue or if medical students who studied in regional Australia would stay there.

That is the consequence of a government that jettisoned decades of political branding in March 2022, laid out a compelling plan to get Australia through the pandemic, and delivered on it.

Read more: A cost-of-living budget: cuts, spends, and everything you need to know at a glance

Richard Holden is President of the Academy of the Social Sciences in Australia.

This article was originally published on The Conversation. Read the original article.