Johnson & Johnson (JNJ) stock has not been immune to the recent stock market selloff, although it’s held up better than the S&P 500.

So far on the year, Johnson & Johnson stock is down 4%. That’s better than the 16.5% drop in the S&P 500. Of course, today’s action is helping, as J&J stock is about 2.5% higher at last check.

The move comes after the health-care giant announced a $5 billion buyback plan and affirmed its full-year profit outlook.

So while uncertainty among investors is quickly climbing — thanks mainly to Tuesday’s hotter-than-expected inflation report — J&J management is reassuring investors by talking the talk -- reaffirming guidance -- and walking the walk -- with the buyback.

That’s helping give the stock a boost today. But will it last? Let’s look.

Trading Johnson & Johnson Stock

Chart courtesy of TrendSpider.com

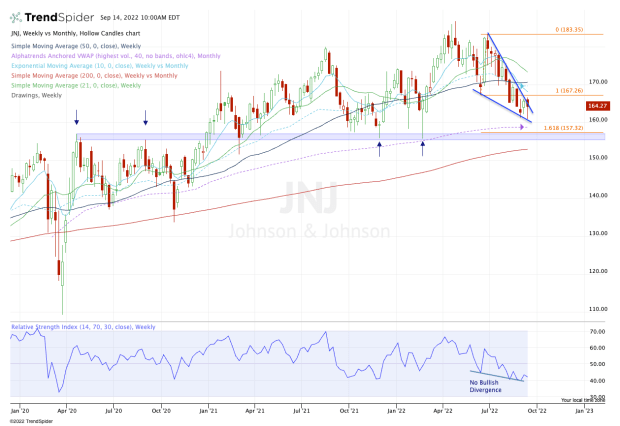

On the weekly chart above, we have a falling wedge pattern in Johnson & Johnson stock. That's bullish if the stock can break out to the upside. That’s a big “if,” particularly in a tape like this.

About a month ago, we outlined a key support area near $155 to $157.50.

While the monthly VWAP has climbed from that area just a bit, investors should take note of several measures near that zone. Most important, this area has served as a pivotal support and resistance area over the past several years.

Just below this zone is the 200-week moving average. While this measure could very well act as support as well, investors hope that the $155 to $157.50 area is enough to buoy J&J shares.

On the upside, let’s see if the stock can reclaim the $167.25 level. Above that opens the door to $170.

Above $173.75 and it’s possible that Johnson & Johnson stock rallies back to $180 or higher.

It’s bullish to see today’s rally and great to hear about management’s confidence. That said, if the overall market goes into a larger selloff, it’s hard to imagine that J&J stock will be able to withstand the selling pressure.

If major support holds, the stock will look like an opportunity for investors.