Johnson & Johnson (JNJ) spun off its Kenvue (KVUE) consumer brands division on Thursday, raising the most cash from an initial public offering (IPO) in more than a year.

Johnson & Johnson said it sold 172.8 million shares at $22 a pop in Kenvue, giving the company whose brands include Band-Aid, Tylenol and Listerine a valuation of roughly $40 billion.

Johnson & Johnson, a component of the Dow Jones Industrial Average, raised $3.8 billion from the offering. That's the largest haul from an IPO since late 2021, according to Renaissance Capital. The IPO market dried up in 2022 amid a historically bad year for stocks and the hangover from 2021's frenzy of fizzled SPAC offerings.

Indeed, direct listings and IPOs with an initial valuation of at least $50 million numbered just 71 last year, down from nearly 400 in 2021, per Renaissance Capital.

JNJ announced the split of its consumer brands business from its pharmaceutical and medical devices divisions in late 2021. The healthcare giant's aim – as is pretty much always the case with these sorts of breakups – is to liberate faster-growth, higher-margin businesses from the drag of slower-growth, lower-margin businesses.

Johnson & Johnson said it continues to own about 90% of Kenvue after the IPO, with plans to distribute shares to its own shareholders perhaps in the second half of this year.

Johnson & Johnson's aims

As for the proceeds from the KVUE offering, Johnson & Johnson said it will retain $1.1 billion in cash and cash equivalents, with the remainder being used for general purposes.

Kenvue, meanwhile, hits the market with a roughly $40 billion market value. On a pro forma basis, the company recorded annual net income of $1.5 billion on almost $15 billion in revenue.

"Being spun out of Johnson & Johnson, consumer health giant Kenvue is pitching a mature and profitable business with a healthy dividend yield, bolstered by a portfolio of well-known brands like Tylenol and Listerine," notes Renaissance Capital.

JNJ, whose 60-year streak of annual dividend increases makes it one of the best dividend stocks for dependable dividend growth, does get a Buy recommendation from analysts, according to S&P Global Market Intelligence – but with very mixed conviction. That places it pretty far down the list of Wall Street's favorite Dow stocks.

The overhang of litigation stemming from allegations that the talc in its iconic baby powder is carcinogenic has been just one issue for JNJ. And although the Kenvue separation should help the company's margin profile, there's no denying that JNJ became one of the best stocks of the past 30 years as a three-headed business.

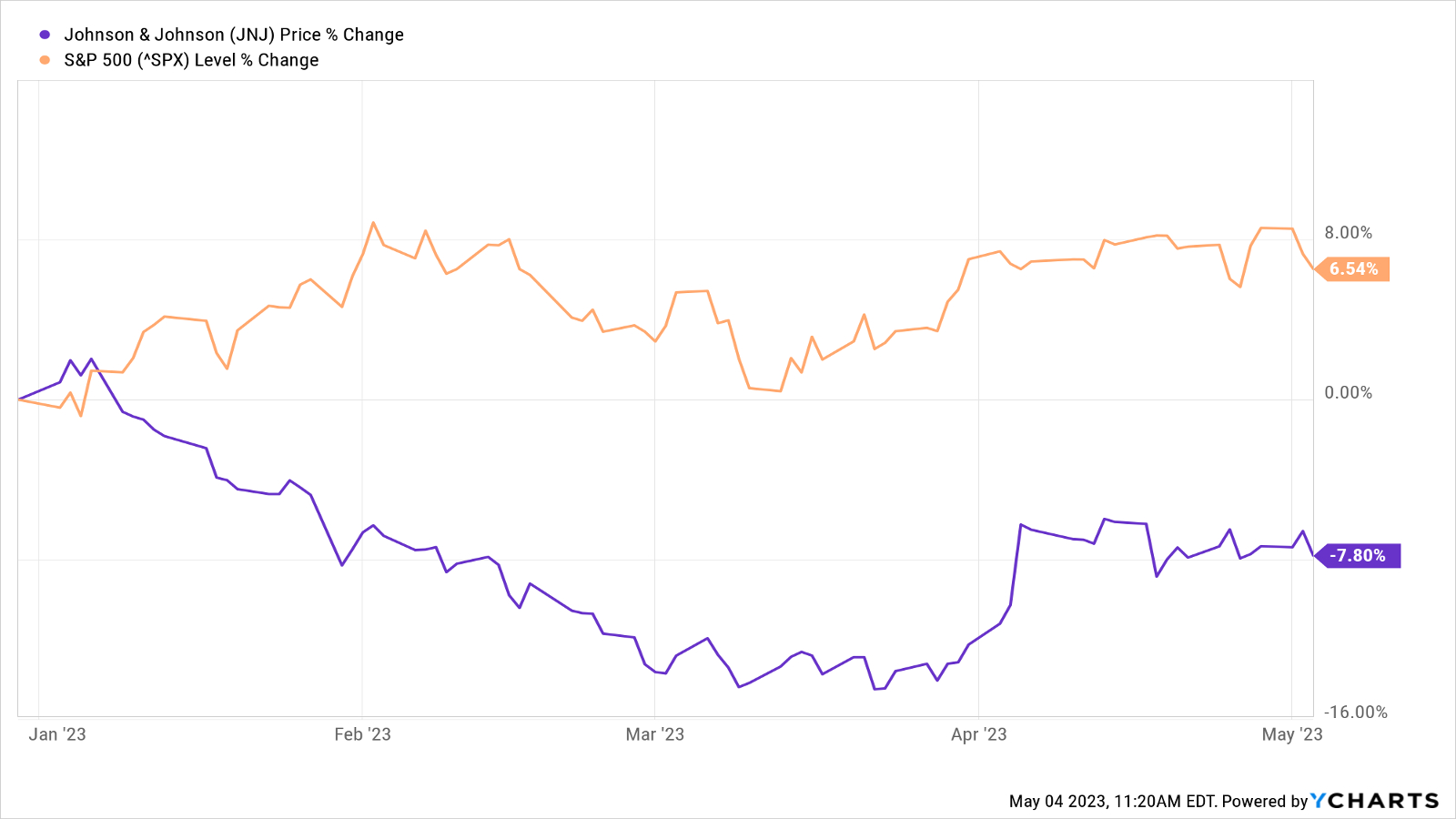

As you can see in the chart below, shares in Johnson & Johnson were off nearly 8% for the year-to-date through May 3, lagging the broader market by about 14 percentage points.

With an average target price of $178.79, analysts give JNJ stock implied upside of about 10% in the next 12 months or so. Add in the dividend yield, and the implied total return comes to roughly 13%.