Many of the mega-cap technology names have snapped back off the lows since entering correction territory. Jim Cramer on Thursday provided an interpretation of the recent strength in the tech-heavy Nasdaq.

"I look at the Nasdaq and I think maybe the bear market is finished," Cramer said on CNBC's "Squawk On The Street."

As the Nasdaq climbs back off of the lows, Cramer is seeing a sentiment shift. He noted people are starting to feel comfortable putting money to work in a lot of the Nasdaq names.

Cramer remains bullish on NVIDIA Corporation (NASDAQ:NVDA). He suggested the stock could be the "bellwether" for tech.

No one should be more interested in Nvidia than Meta Platforms Inc (NASDAQ:FB), he added.

"The meta platform could be gigantic for them because that's exactly what Jensen [Huang] showed off in his speech," Cramer said. "So I like mega-cap, I really do."

Nvidia CEO Jensen Huang laid out plans to accelerate artificial-intelligence technology development during the company's investor day conference this week.

Related Link: 5 Nvidia Analysts On AI Inflection, A $1-Trillion Opportunity, Silicon-Software Split And Sky-High Valuation

Cramer noted Alphabet Inc (NASDAQ:GOOG) (NASDAQ:GOOGL) offers the best value of all the FAANG stocks at current levels.

"Alphabet is so undervalued on a basis of just pure earnings, back out cash."

All of the positives he's seeing in the Nasdaq point to an end of the bear market in tech, according to Cramer.

NVDA, FB, GOOG Price Actions: At publication time, Nvidia was up 6.87% at $273.94, Meta was up 1.84% at $217.39 and Alphabet was up 0.62% at $2,787.11.

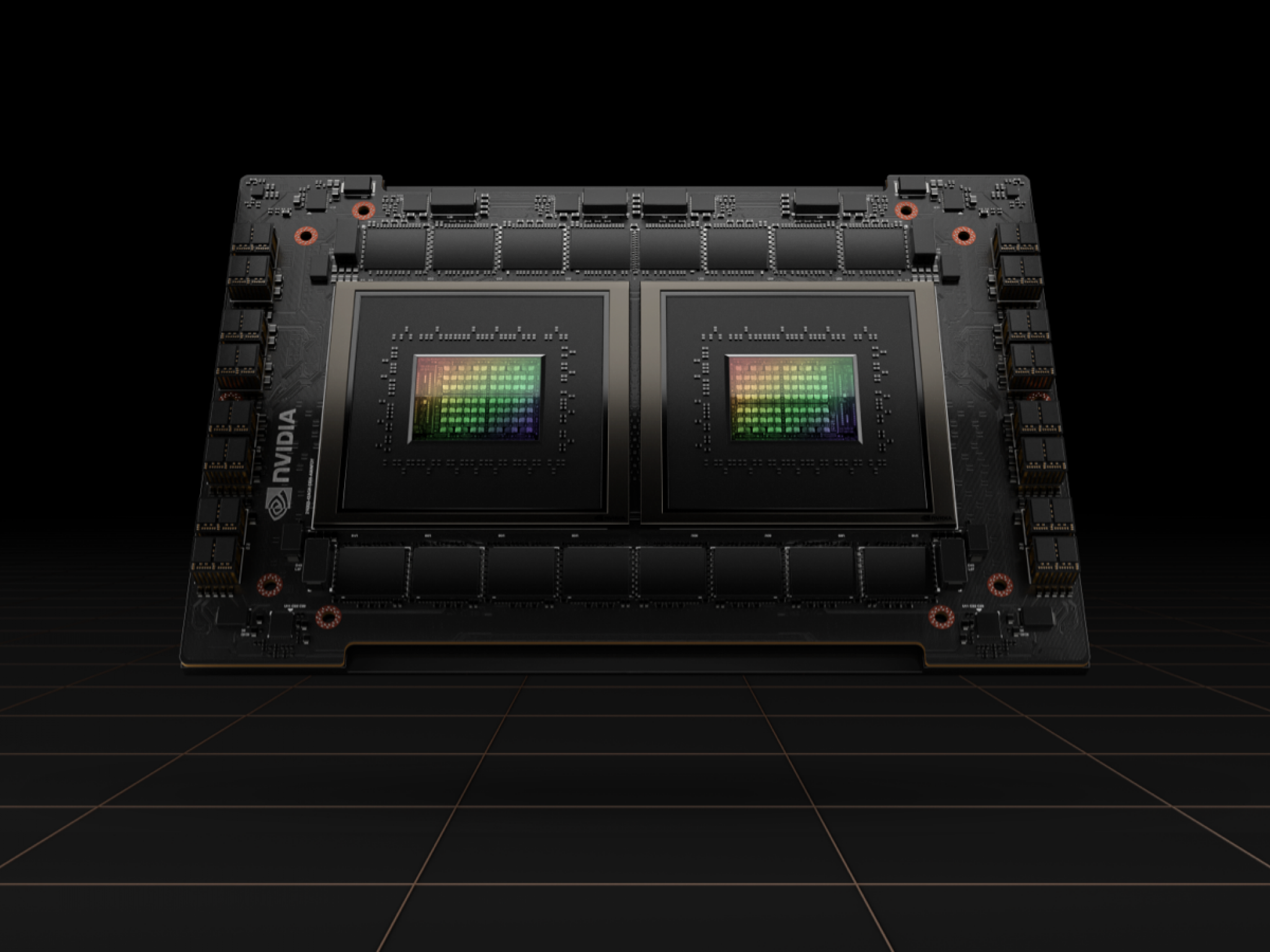

Photo: Courtesy Nvidia