The airline space is making today a Merger Monday. Or at least, it's trying to.

JetBlue (JBLU) shares are trading lower on the day, down about 4% after making a hostile takeover bid for Spirit Airlines (SAVE) at $30 a share. For its part, Spirit stock is up about 12% on the day.

The deal is an all-cash offer, which is nice for investors as it does not over-complicate matters like an all-stock deal would. As reported earlier at TheStreet:

“Spirit, which had been planning a $6.6 billion tie-up with low-cost rival Frontier Group Holdings (ULCC) and has twice rejected JetBlue's approach, citing the difficulty of receiving regulatory approval, has as least conceded that JetBlue's offer of $33 per share could be a "superior proposal" that shareholders may need to consider.”

Does that mean a $33 offer would get the deal done? I’m not sure, but for now, there is a bid in Spirit stock and sellers in JetBlue stock.

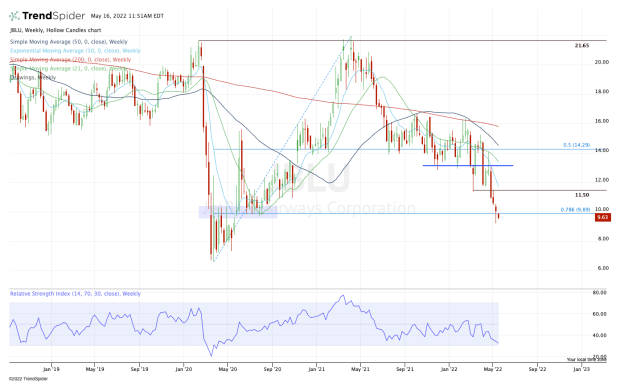

Interestingly, JetBlue was one of the best-performing airline stocks. You’ll notice on the weekly chart below that it actually recovered all of its Covid losses and momentarily took out its pre-Covid high.

Trading JetBlue Stock

Chart courtesy of TrendSpider.com

JetBlue stock is down in three straight weeks, but today’s action suggests we could be heading for a fourth straight weekly decline.

Last week, the stock traded down to and bounced from its 78.6% retracement. Currently below that level now, traders want to see if the stock can reclaim this mark. If it can and shares trade back above $10, then JetBlue stock could be looking at a larger rally.

Specifically, I would have my eye on the $11.50 area. That was support in March, which broke in April and became resistance earlier this month.

If the stock can press above that, then we could be looking at a push into $13. This was a prior support zone that turned into resistance. It’s also near where the declining 21-week moving average comes into play.

As for the downside, this is a key area for JetBlue stock.

The previously discussed 78.6% retracement comes into play near the psychologically relevant $10 mark, but also near a key area from the first and second quarter of 2020.

If JetBlue stock goes weekly-down below last week’s low of $9.22 and can’t reclaim this level, then we could be looking at a decline down into the $7.50 to $8 region.

Admittedly, that seems unlikely. But the levels don’t lie and if JetBlue can’t hold $9.22, then we have to start looking at lower levels.