Japanese Prime Minister Fumio Kishida recently unveiled an ambitious plan to double the country's defence budget to ¥43 trillion, roughly 2% of Japan's GDP, over the next five years. Notably, the country's massive rearmament programme, its biggest since the end of World War II, has not triggered a political or public backlash. With Japan facing multiple security threats, including North Korean missile tests, Chinese coast-guard ships encroaching on its territorial waters and Russia's militarisation of the disputed Kuril Islands (known in Japan as the Northern Territories), polls show public support for the proposed increase.

But the question of how Japan will pay for this massive military build-up has been the subject of intense controversy. Mr Kishida initially planned to fund the spending increase by raising taxes. The plan they produced included higher taxes on personal incomes, corporate profits and tobacco. But it did not include a much-needed increase in the rate of value-added tax (VAT), also known as the consumption tax, and was projected to fall short of covering the costs of the proposed budget increase.

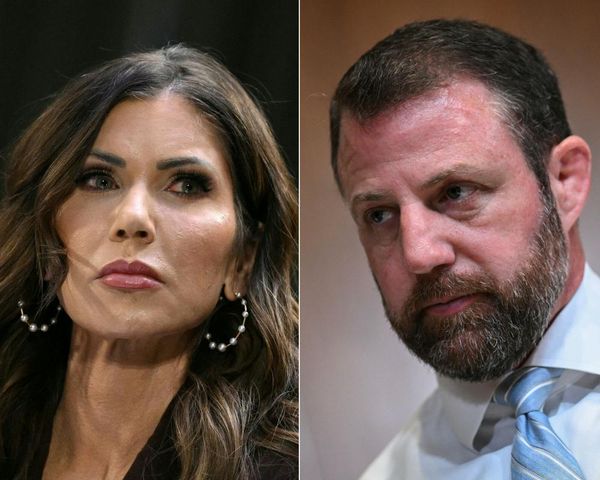

Mr Kishida was ultimately forced to postpone key parts of his plan to the next fiscal year after confronting a public outcry and fierce opposition within the LDP. The internal revolt was led by supporters of Mr Kishida's predecessor, the late Shinzo Abe, who was assassinated in July last year. Abe loyalists, like Economic Security Minister Sanae Takaichi, argued that the defence budget increase should be financed by issuing new government bonds, in line with Abe's economic agenda.

But financing the hike in defence spending through government debt would be unsustainable. For starters, increasing Japan's high debt-to-GDP ratio, which already exceeds 250%, could put pressure on the country's sovereign credit rating. And even Abe, who was famous for his opposition to tax hikes, raised the consumption tax from 5% to 10% during his eight-year tenure to increase revenues. But, most important, the country's huge debt burden makes it vulnerable to future shocks, endangering its long-term economic health and national security.

If Japan were attacked or invaded, the government would need to build up military capabilities very quickly to defend the country, issuing bonds to finance the required increase in defence spending. But when the country is not at war or in a recession, gradual fiscal consolidation is needed. A weak economy can be as dangerous as a weak military. The Soviet Union is a case in point.

Conservative politicians almost everywhere prefer small government, reflecting their affinity for the ideal of a "night-watchman state", in which the government does little more than enforce contracts and protect citizens from violence and theft. In Japan, however, LDP conservatives appear to be Modern Monetary Theory enthusiasts in disguise. Even the current inflationary surge, which seems to have diminished MMT's luster, has not convinced them that unlimited borrowing is no way to run a healthy economy.

MMT proponents often point to Japan as proof that the approach can work. Its enormous public debt has been absorbed by domestic financial institutions and the Bank of Japan, and monetary policymakers have maintained near-zero interest rates for years without triggering a surge in borrowing costs or inflation. But the fact that Japan is unlikely to default anytime soon does not mean that its current path is sustainable. Future generations will bear the costs of its debt-financed spending spree -- at least until the country's rapidly shrinking population renders this strategy obsolete.

Instead of running massive deficits, the government must finance its rearmament through tax increases. Hiking consumption taxes, such as the VAT, seems to be the fairest option. Raising corporate taxes may prevent large firms from repatriating overseas profits and discourage small and medium-size companies from raising wages. The VAT, on the other hand, is ideally suited to pay for essential government services like the police, the military, and the courts. In Japan, however, the VAT can be used only to fund social security, pensions, medical insurance, long-term care and policies addressing the country's low fertility rate.

But first, conservative leaders must adhere to the basic principles of their economic philosophy. Amassing more and more debt will not strengthen Japan's economy or contribute to its national security. But fiscal prudence just might get the job done. ©2023 Project Syndicate

Takatoshi Ito, ex-Japanese deputy vice minister of finance, is professor at the School of International and Public Affairs at Columbia University and senior professor at the National Graduate Institute for Policy Studies in Tokyo.