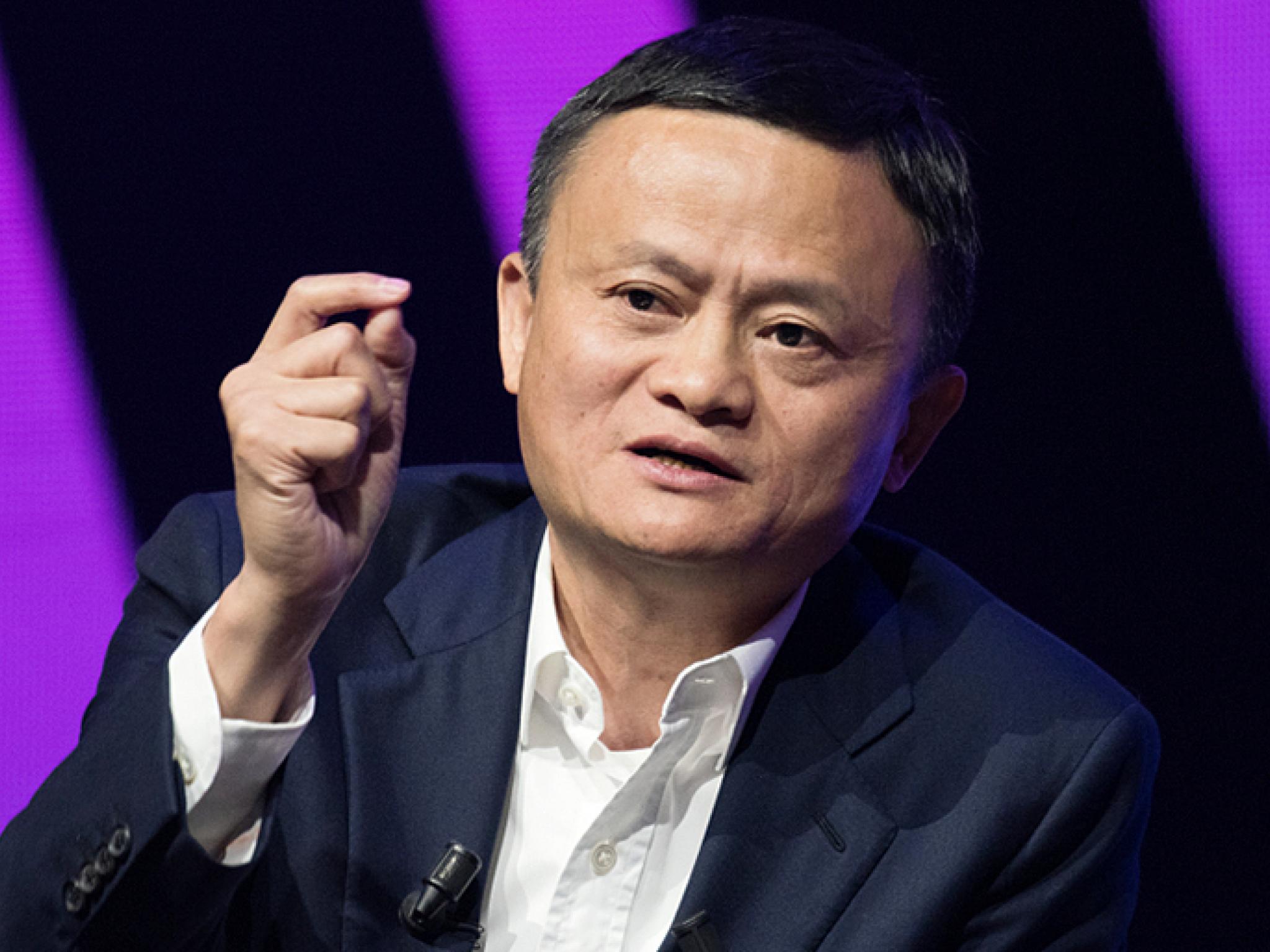

Alibaba Group Holding (NYSE:BABA) co-founder Jack Ma appeared on Sunday at the 20th anniversary of his co-founded Alibaba fintech affiliate Ant Group.

This is Ma’s first public appearance at the fintech giant event since he shunned public appearances after the Chinese regulators scrapped Ant Group’s $39.7 billion initial public offering in November 2020.

Ma lauded Ant Group for its accomplishments, expressed optimism over the next two decades for the fintech giant, and said he expected “more miracles” as he drew parallels with the revolution the internet brought two decades back, SCMP cites Chinese media reports.

Also Read: TikTok Loses Court Appeal Against Ban, Meta, Reddit Stocks Hit All-Time High

Prior reports indicated Ant Group doling out $2.9 billion on research in 2023 to drive its artificial intelligence goals. In 2024, Alibaba received a clean chit from the Chinese antitrust regulator after over three years of investigative scrutiny. The regulator fined Alibaba $2.8 billion in 2021, equivalent to 4% of the e-commerce juggernaut’s 2019 revenue.

Ant Group Chair Eric Jing Xiandong, Alibaba and Alipay co-founder Peng Lei also graced the Ant Group event.

In 2023, Ma disassociated himself from Ant Group by surrendering his corporate roles.

Recently, Xiandong shared plans to relinquish the CEO position to finance chief Cyril Han Xinyi in March 2025. Ant Group had restructured its shareholding in 2023, giving Ma 53.5% of the voting power.

Meanwhile, Ant Group unit Ant International reported robust growth across its core business segments following a spin-off in March as its mobile payment platform, Alipay+, gained traction globally, SCMP reports.

Ant International told the SCMP that its four business pillars – Alipay+, Antom, WorldFirst, and Embedded Finance – have delivered strong performance.

At the end of November, Alipay+ linked over 90 million merchants in 66 markets to 1.6 billion user accounts, up from 88 million merchants in 57 markets and 1.5 billion users in December last year.

Cross-border transactions through Alipay+ partners surged threefold in 2024. WorldFirst, a global business-to-business payment service, hit an annual total payment volume (TPV) of $100 billion.

Antom nearly doubled its TPV year-over-year from January to November 2024, with robust card processing volume growth.

The Embedded Finance segment has emerged as a new growth driver, offering financial solutions powered by artificial intelligence (AI) and blockchain technologies.

Alibaba Group Holding stock gained 15% year-to-date courtesy of China launching fiscal stimulus to drive the economy.

Price Action: BABA stock closed higher by 9.04% at $93.70 at the last check on Monday.

Also Read:

Image via Shutterstock