Spotlight

Basheera Begum, 65, suffers from diabetes and had one of her legs amputated recently. She is bedridden with no support system to speak of. She says that the I Monetary Advisory (IMA) ‘halal’ investment Ponzi scheme that was busted in 2019 in Bengaluru and COVID-19 that followed have reduced her to this state.

Basheera’s husband, Wali Ahmed, worked in West Asia for many years and returned home with a life savings of ₹55 lakh in 2017, when IMA was all the rage in the city, especially in the Muslim community as investors were promised and were getting high monthly returns and was approved and advertised as a “halal investment option” by a section of the city’s ulema.

The childless couple invested their entire life’s savings in IMA. Wali Ahmed invested ₹42 lakh in his name and ₹13 lakh in Basheera’s name in 2017. “We hoped we could lead a peaceful retired life. IMA did give us good interest for over a year, which made us happy. But suddenly, IMA went bust, and all our hard-earned money vanished,” Basheera said.

Her husband was diagnosed with COVID-19 and passed away in 2020. Basheera says he died a broken man waiting to recover his life’s earnings. Basheera had to get her leg amputated due to gangrene the following year. She now waits with the hope that the ongoing investigation and auction of assets of IMA will get her investment back. “If I get our money back, it will sustain me for the rest of my life, for my medical care, among other needs,” she said.

One among 63,000

Basheera is only one among thousands whose savings sank when the IMA halal investment Ponzi scheme went bust in 2019. It was estimated to owe over 63,000 investors around ₹2,600 crore. However, after considering all the claims filed before it, the Competent Authority has pegged the total liability of the depositors at ₹1,400 crore.

The Ponzi scheme, initially a gold investment scheme, diversified its interests into real estate, education and healthcare and lured investors by promising high monthly dividends. Like all Ponzi schemes, when the going was good, Mansoor Khan, the founder of IMA Group, paid high dividends, attracting a steady supply of new investors.

He advertised it as a “halal” scheme. Charging or payment of interest is not considered to be Sharia-compliant as it is deemed to be an exploitative practice. IMA worked on a Limited Liability Partnership basis and did not involve interest in the investment.

But 2018-19 was terrible for Khan. He suffered a few setbacks in his businesses. Investments, which were taken from customers and were ploughed into bullion and real estate, did poorly. He faltered on monthly payments, and regulatory agencies tightened the screws. The company finally went kaput in June 2019. Khan fled the country only to return the next month to be arrested. Several officials and politicians have been accused of being hand-in-glove with IMA and cheating the public with their hard-earned money.

The IMA scam has robbed many families, mostly poor working-class Muslims, of their life savings. Several families broke up since the fraud led to marital disputes. Many investors died waiting to get their money back, like Basheera’s husband.

Firdouse, a 40-year-old homemaker, took ₹50,000 from her husband, who runs a puncture shop, and invested it in IMA for the future of their two children in 2018. “We got an interest on that money for two months. That was the first time in our life we had invested. We were excited to get returns of ₹3,000 in two months. My husband was proud of me for choosing a halaal investment option,“ Firdouse recalled. But her joy and her husband’s praise were short-lived, and soon, the monthly payments became irregular, and the company was eventually closed. “Life has become hard ever since. There is no peace as my husband blames me for the loss,” she said.

A new ray of hope

While getting full investment back looks like a pipe dream, these investors may recover a small part of their investments soon.

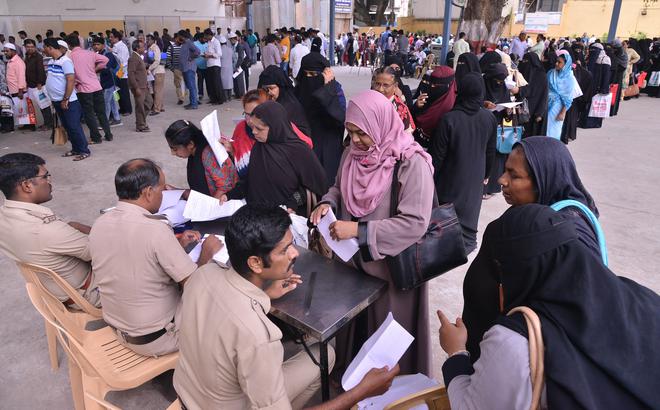

The special court for cases registered under the Karnataka Protection of Interest of Depositors in Financial Establishments Act, 2004, on Thursday (October 5), approved the scheme suggested by the Competent Authority to disburse funds and asked the Authority to disburse the available funds in the next 20 days.

In the second tranche, the Competent Authority has decided to disburse ₹69 crore, recovered from auctioning movable assets of IMA to over 55,000 depositors of IMA. This has come as a fresh ray of hope among investors who have been cheated of their savings.

Anwar Jahan, 65, a retired school teacher from Nagshettyhalli, is overjoyed at the prospect of getting any money at all. “My husband Syed Hussain, a retired lab assistant at the University of Agricultural Sciences, had invested ₹25 lakh of his retirement money a month before the IMA shut down,” she said. The couple have three daughters. Her husband died one-and-a-half years ago. She is relying on the return of money to secure her daughter’s future.

Only a small fraction

But what the investors will get back in the second substantial tranche is also only a fraction of their investment. The Competent Authority appointed by the Karnataka government to recover money from IMA and redistribute it to depositors has seized movable and immovable assets of IMA and its directors worth an estimated ₹450 crore. Of this, the Competent Authority settled claims of 6,800 small depositors whose dues were lower than ₹50,000, worth a total of ₹19.12 crore in the first tranche in 2021.

Now, a city court has approved the distribution of ₹69 crore in the second tranche, this time to over 55,000 depositors. Money being disbursed in both these tranches comes from the auction of movable assets like jewellery, motor vehicles and furniture,e among other assets.

In an affidavit to the court, the Competent Authority said they would follow an equitable principle for the disbursal of funds. As against their investments and the returns they had already got before the company went kaput, the Competent Authority has graded the depositors as most affected and least affected. Those most affected will get a higher settlement than those who are least affected.

Meagre settlement

Settlements in these two tranches only add up to ₹88.12 crore. The Competent Authority is keen on auctioning other immovable assets of IMA Group and its directors it has seized, valued at an estimated ₹350 - ₹375 crore, to make a substantial settlement to the depositors who got cheated. However, these properties are also attached by the Directorate of Enforcement, which is also probing the IMA case for money laundering. The Competent Authority is expected to move the ED court, seeking clearance to auction these immovable assets.

However, even if these immovable assets, mainly prime real estate properties, are auctioned, and the money returned to depositors, which will likely be the last tranche of settlement, it would only be a small fraction of ₹1,400 crore pegged as outstanding by the Competent Authority when the Ponzi scheme went bust in June 2019.

A senior police official with considerable experience in investigating economic offences said in most of the Ponzi schemes, people who invest money in the scheme close to when the company goes bust would suffer the most, even as initial investors would have made profits.

“Recovery of the proceeds of crime should ideally not be limited to seizure of movable and immovable assets of the accused, but also include profits made by initial investors. While their principle is rightfully theirs, the profits they have earned amount to the proceeds of the crime. If they are made to pay the profits, only then will the State have enough cash to refund all depositors their money,” the official said. However, the State government has not initiated such a move to date.

Probe suffers setbacks

Meanwhile, the Central Bureau of Investigation (CBI), probing the case, has filed multiple charge sheets against over 30 accused in the case, including several senior bureaucrats, and senior politician and former Shivajinagar MLA R. Roshan Baig.

However, the CBI case has suffered several legal setbacks. The High Court of Karnataka in March 2021 held the probe against senior IPS officer Hemanth Nimbalkar “illegal” as the probe against him commenced much before sanction for investigation was obtained. The court also held that materials produced before it “do not prima facie disclose the ingredients of any of the offences” alleged against Mr. Nimbalkar, warranting his prosecution.

CBI has appealed against the order in the Supreme Court. A departmental inquiry also cleared Mr. Nimbalkar recently. The High Court quashed the chargesheet against another IPS officer, Ajay Hilori, on the grounds that the inquiry based on the same set of allegations, including bribery, could not establish anything.

Officials who were named accused in the chargesheets and got it quashed in the courts have contended that the CBI has been selective in naming officials as accused, even as multiple probes into IMA were closed at the government level. They also contend that even in probes that involved officials named as accused were a part of, not all officials in the chain of command have been named accused.

The probe agencies have also come under criticism for failing to provide enough evidence to attach properties of all the accused. For instance, the special court set up for cases registered under the KPIDFE Act, 2004 quashed a provisional attachment order of the State government that attached all properties of Baig and his family members. Baig is an accused in the Central Bureau of Investigation chargesheet in the case. The court held that agencies did not produce any documents to show unsecured loan amounts from IMA were indeed credited to Baig, the crux of the allegations against him.

Waiting for ‘real Eid’

As the long wait for justice for IMA victims is only expected to drag on with no full closure, Arif Pasha, President of the Integrated Welfare Association for IMA investors, said, “We know it will take many years to recover the money lost to IMA, if at all we do it fully ever. However, the fight will continue till we get the rightful dues to investors, and that day would be the real Eid for us.” Till such time, the struggle of Basheera and many like her will continue.