Williams-Sonoma, Inc. (WSM) operates as a leading omni-channel specialty retailer specializing in premium home furnishings, kitchenware, and decor. Headquartered in San Francisco, California, the company oversees a portfolio of iconic brands such as Williams Sonoma, Pottery Barn, West Elm, and Rejuvenation.

It delivers products through e-commerce platforms, catalogs, and international franchises, prioritizing cooking essentials, furniture, bedding, and custom furnishings. The company has a market capitalization of $22.17 billion, which classifies it as a “large-cap” stock.

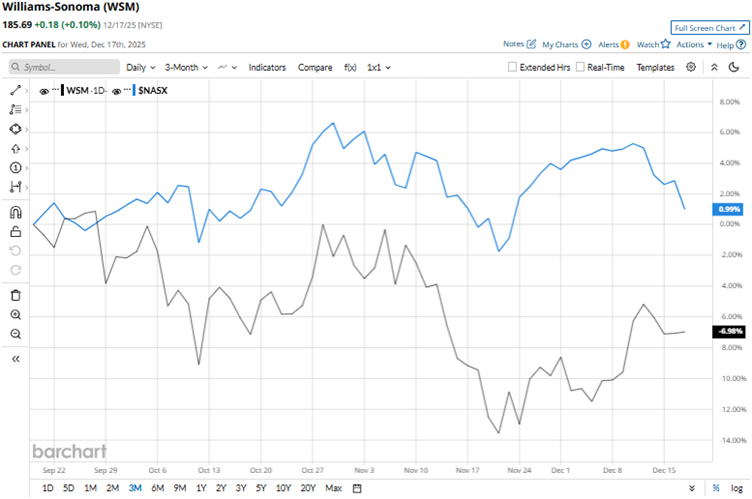

Williams-Sonoma’s shares had reached a 52-week low of $130.07 in April, but are up 42.8% from that level. Due to tariff concerns and tepid sentiments surrounding it, the stock has declined 5.6% over the past three months. On the other hand, the broader Nasdaq Composite ($NASX) index gained 1.9% over the same period.

Over the past 52 weeks, Williams-Sonoma’s stock has dropped 6.3%, while the Nasdaq Composite index is up 12.9% over the same period. However, over the past six months, the stock has gained 18.3%, while the broader index has increased by 16.3%. The stock has been trading above its 200-day moving average since early December and is currently near its 50-day moving average.

On Nov. 19, Williams-Sonoma reported its third-quarter results for fiscal 2025 (quarter ended Nov. 2). The company recorded a positive topline comp, as its comparable brand revenue increased by 4%. Its net revenues grew 4.6% year-over-year (YOY) to $1.88 billion, exceeding the $1.85 billion that Wall Street analysts had expected. Its EPS was $1.96, up 4.8% YOY and higher than the $1.87 that analysts had expected. Based on its modest growth, the stock dropped 3.4% intraday on Nov. 19.

We compare Williams-Sonoma’s performance with that of another specialty retail stock, Best Buy Co., Inc. (BBY), which has declined 18.3% over the past 52 weeks, but gained 3% over the past six months. Therefore, Williams-Sonoma has been the clear outperformer over these periods.

Wall Street analysts are moderately bullish on Williams-Sonoma’s stock. The stock has a consensus rating of “Moderate Buy” from the 20 analysts covering it. The mean price target of $203.61 indicates a 9.7% upside compared to current levels. The Street-high price target of $230 indicates a 23.9% upside.