Cleveland, Ohio-based The Sherwin-Williams Company (SHW) engages in the development, manufacture, distribution, and sale of paint, coatings, and related products to professional, industrial, commercial and retail customers. With a market cap of $89.4 billion and operates through Paint Stores Group, Consumer Brands Group, and Performance Coatings Group segments.

Shares of Sherwin-Williams have underperformed the broader market over the past year. SHW stock has risen 1.5% over this time frame, while the broader S&P 500 Index ($SPX) has returned 14.9%. However, shares of the company are up 12.5% on a YTD basis, outpacing SPX’s 1.8% gain.

Narrowing the focus, the paint and coatings maker stock has lagged behind the State Street Materials Select Sector SPDR ETF’s (XLB) 18.7% increase over the past 52 weeks.

Shares of Sherwin-Williams rose 1.4% on Jan. 29 after the company reported stronger-than-expected Q4 2025 adjusted EPS of $2.23 and revenue of $5.6 billion. Also Sherwin-Williams delivered record full-year net sales of $23.57 billion and guided 2026 adjusted EPS to a healthy range of $11.50 to $11.90.

For the fiscal year ending in December 2026, analysts expect SHW’s adjusted EPS to rise 4.3% year-over-year to $11.92. The company's earnings surprise history is mixed. It topped the consensus estimates in three of the last four quarters while missing on another occasion.

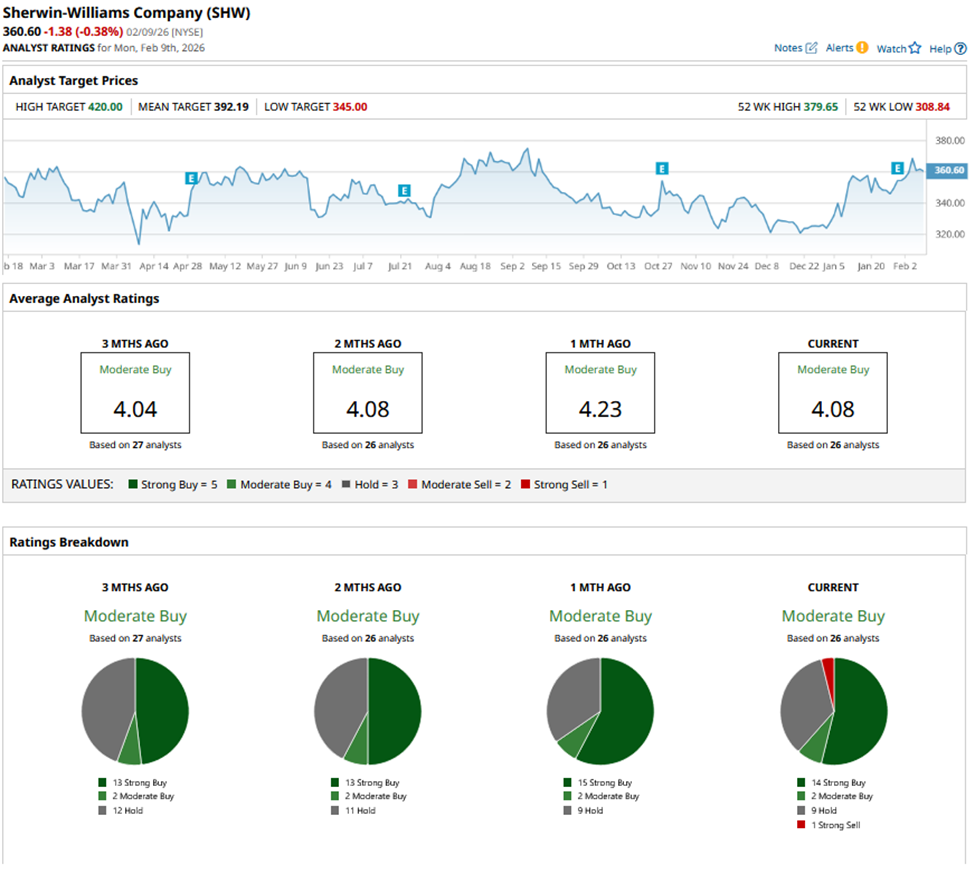

Among the 26 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 14 “Strong Buy” ratings, two “Moderate Buys,” nine “Holds,” and one “Strong Sell.”

On Jan. 30, Mizuho raised Sherwin-Williams’ price target to $400 and maintained an “Outperform” rating.

The mean price target of $392.19 represents a premium of 8.8% to SHW's current levels. The Street-high price target of $420 implies a potential upside of 16.5% from the current price levels.