/ServiceNow%20Inc%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)

Santa Clara, California-based ServiceNow, Inc. (NOW) provides cloud-based solutions for digital workflows. Valued at a market cap of $112 billion, the company helps businesses integrate systems, reduce manual processes, and improve operational efficiency using AI-driven automation.

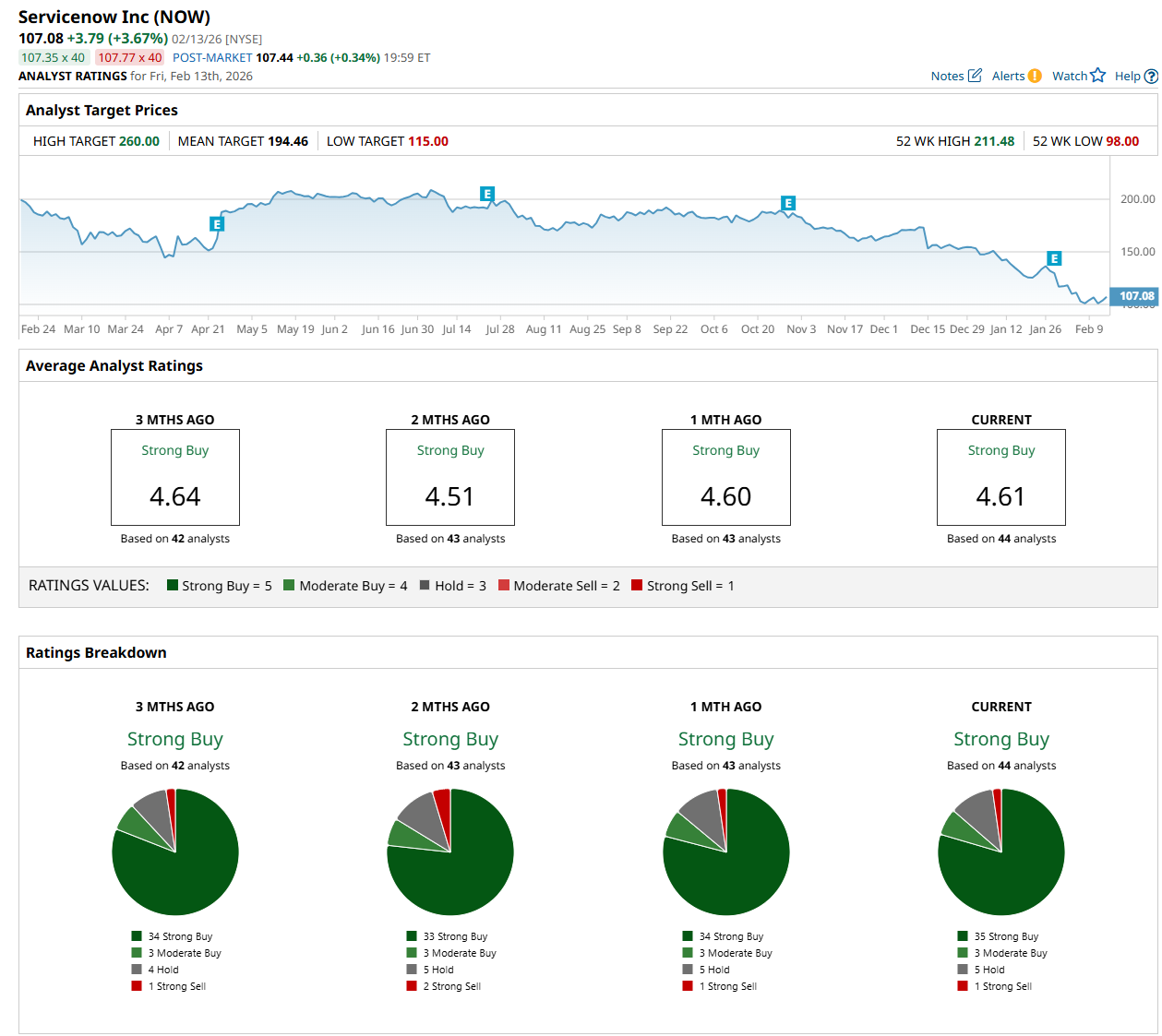

This software company has notably lagged behind the broader market over the past 52 weeks. Shares of NOW have declined 45.9% over this time frame, while the broader S&P 500 Index ($SPX) has soared 11.8%. Moreover, on a YTD basis, the stock is down 30.1%, compared to SPX’s marginal drop.

Narrowing the focus, NOW has also underperformed the State Street SPDR S&P Software & Services ETF (XSW), which decreased 23.2% over the past 52 weeks and 19.1% on a YTD basis.

On Feb. 9, shares of NOW surged 3.1% after analysts indicated that the recent “SaaSpocalypse” downturn had driven valuations into deeply undervalued levels, triggering opportunistic buying. The broader Software-as-a-Service (SaaS) sector had faced significant pressure in early 2026 amid concerns that autonomous AI agents could disrupt traditional seat-based subscription models. However, large institutional investors began shifting their money back into well-established companies with loyal customer bases and stable, recurring revenue streams. The rebound was supported by a Barclays PLC (BCS) report noting that enterprise migrations away from legacy systems typically take years rather than weeks, creating a durable competitive moat for leading providers, particularly in areas such as compliance and governance.

For fiscal 2026, ending in December, analysts expect NOW’s EPS to grow 26.5% year over year to $2.48. The company’s earnings surprise history is promising. It exceeded the consensus estimates in each of the last four quarters.

Among the 44 analysts covering the stock, the consensus rating is a "Strong Buy,” which is based on 35 “Strong Buy,” three “Moderate Buy,” five "Hold,” and one “Strong Sell” rating.

The configuration is more bullish than a month ago, with 34 analysts suggesting a “Strong Buy” rating.

On Feb. 9, Matthew Hedberg from RBC Capital maintained a "Buy" rating on NOW, with a price target of $150, indicating a 40.1% potential upside from the current levels.

The mean price target of $194.46 represents an 81.6% premium to its current price levels, while its Street-high price target of $260 suggests an ambitious 142.8% potential upside from the current levels.