Phillips 66 (PSX), headquartered in Houston, Texas, operates as an energy manufacturing and logistics company. With a market cap of $63.5 billion, the company’s operations include oil refining, marketing, and transportation along with chemical manufacturing and power generation.

Shares of leading integrated downstream energy provider have outperformed the broader market over the past year. PSX has gained 27.2% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 14.4%. In 2026, PSX stock is up 21.9%, surpassing the SPX’s 1.4% rise on a YTD basis.

Narrowing the focus, PSX’s underperformance is apparent compared to the VanEck Oil Refiners ETF (CRAK). The exchange-traded fund has gained about 52.7% over the past year. However, PSX’s returns on a YTD basis outshine the ETF’s 17.5% gains over the same time frame.

On Feb. 4, PSX shares closed up by 4.5% after reporting its Q4 results. Its adjusted EPS of $2.47 topped Wall Street expectations of $2.11.

For the current fiscal year, ending in December, analysts expect PSX’s EPS to grow 75% to $11.27 on a diluted basis. The company’s earnings surprise history is mixed. It beat the consensus estimate in three of the last four quarters while missing the forecast on another occasion.

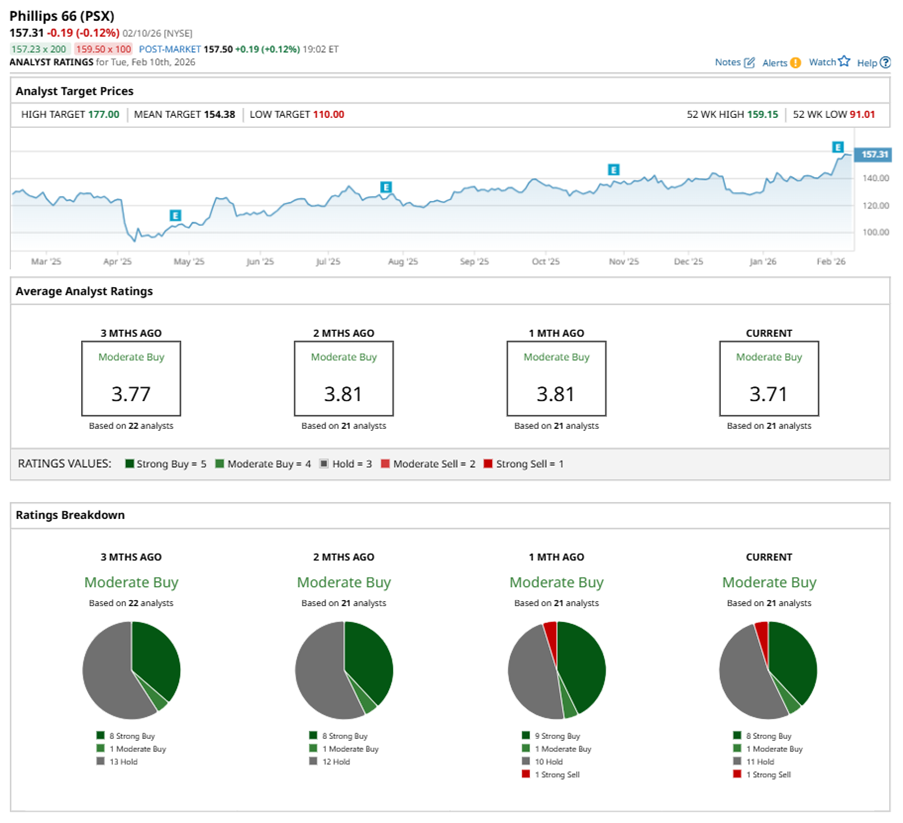

Among the 21 analysts covering PSX stock, the consensus is a “Moderate Buy.” That’s based on eight “Strong Buy” ratings, one “Moderate Buy,” 11 “Holds,” and one “Strong Sell.”

This configuration is less bullish than a month ago, with nine analysts suggesting a “Strong Buy.”

On Feb. 9, Citigroup Inc. (C) kept a “Neutral” rating on PSX and raised the price target to $159, implying a potential upside of 1.1% from current levels.

While PSX currently trades above its mean price target of $154.38, the Street-high price target of $177 suggests an upside potential of 12.5%.