Hunt Valley, Maryland-based McCormick & Company, Incorporated (MKC) manufactures, sells, and distributes spices, seasoning mixes, condiments, and other flavorful products. Valued at $18.5 billion by market cap, the company supplies its products under McCormick, French’s, Frank’s RedHot, Cholula Hot Sauce, and OLD BAY brands in the Americas.

Shares of this global leader in flavor, seasonings and spices have underperformed the broader market over the past year. MKC has declined 8.6% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 14.4%. However, in 2026, MKC stock is up 3.6%,surpassing the SPX’s 1.4% rise on a YTD basis.

Narrowing the focus, MKC’s underperformance is also apparent compared to First Trust Nasdaq Food & Beverage ETF (FTXG). The exchange-traded fund has gained about 6% over the past year. Moreover, the ETF’s 12.8% gains on a YTD basis outshine the stock’s single-digit returns over the same time frame.

MKC's performance was impacted by unexpected commodity inflation and tariff costs, which offset efficiency gains. Despite volume-led growth in both consumer and flavor solutions segments, gross margins were squeezed. CEO Brendan Foley highlighted resilient consumer demand and innovation-driven sales growth, but noted ongoing inflationary pressures and ERP costs will constrain profitability. The company expects continued volume growth via new products and distribution, but profitability will be impacted by costs and investments.

On Jan. 22, MKC shares closed down more than 8% after reporting its Q4 results. Its adjusted EPS of $0.86 did not meet Wall Street expectations of $0.87. The company’s revenue was $1.85 billion, falling short of Wall Street forecasts of $1.86 billion. MKC expects full-year adjusted EPS in the range of $3.05 to $3.13.

For fiscal 2026, ending in November, analysts expect MKC’s EPS to grow 3.3% to $3.10 on a diluted basis. The company’s earnings surprise history is mixed. It beat the consensus estimate in two of the last four quarters while missing the forecast on two other occasions.

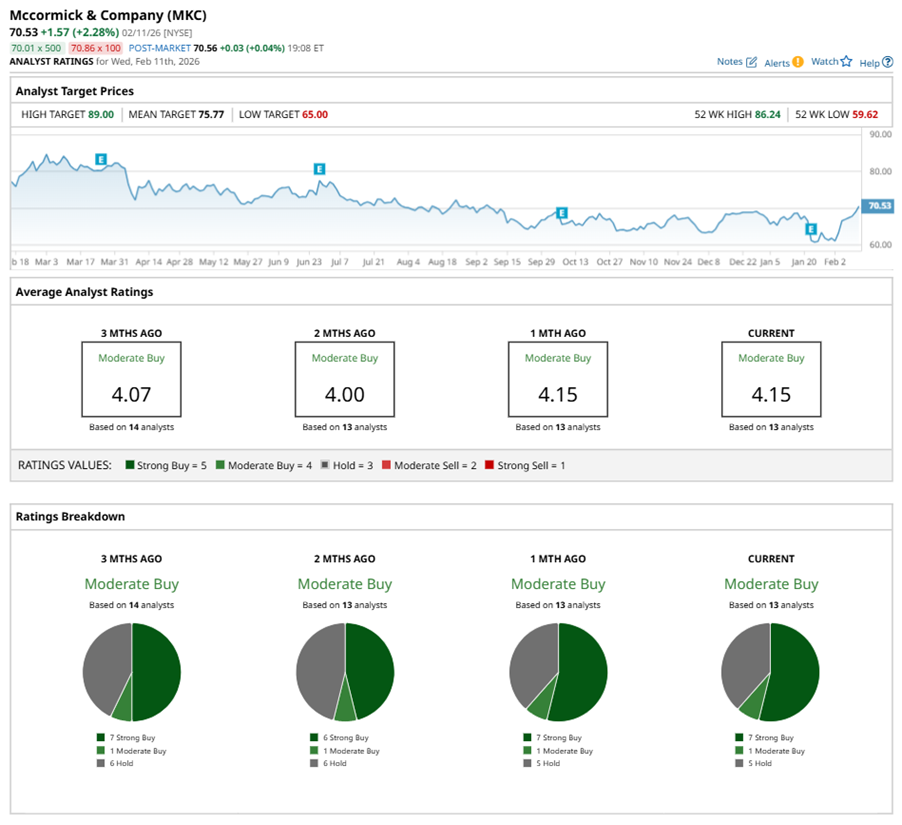

Among the 13 analysts covering MKC stock, the consensus is a “Moderate Buy.” That’s based on seven “Strong Buy” ratings, one “Moderate Buy,” and five “Holds.”

This configuration is more bullish than two months ago, with six analysts suggesting a “Strong Buy.”

On Jan. 28, Bank of America Corporation (BAC) analyst Peter Galbo maintained a “Buy” rating on MKC and set a price target of $80, implying a potential upside of 13.4% from current levels.

The mean price target of $75.77 represents a 7.4% premium to MKC’s current price levels. The Street-high price target of $89 suggests an upside potential of 26.2%.