/Hewlett%20Packard%20Enterprise%20Co%20sign%20by%20Lutsenko_Oleksandr%20via%20Shutterstock.jpg)

Spring, Texas-based Hewlett Packard Enterprise Company (HPE) delivers solutions that allow customers to capture, analyze, and act upon data seamlessly. Valued at $29 billion by market cap, the company provides servers, advanced storage products, high-performance computing, AI-driven platforms, and more.

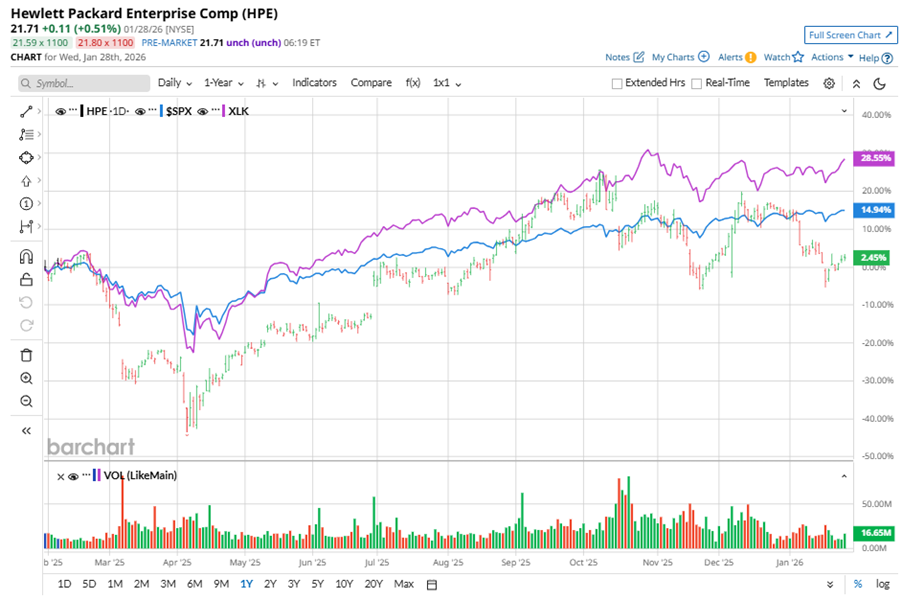

Shares of this global technology leader have underperformed the broader market over the past year. HPE has gained 1.2% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 15%. In 2026, HPE stock is down 9.6%, compared to SPX’s 1.9% rise on a YTD basis.

Narrowing the focus, HPE’s underperformance is also apparent compared to the Technology Select Sector SPDR Fund (XLK). The exchange-traded fund has gained about 27.7% over the past year. Moreover, the ETF’s 3.7% returns on a YTD basis outshine the stock’s dip over the same time frame.

HPE's struggles are due to slipped AI server shipments, softened storage demand, and disruptions from a U.S. government shutdown.

On Dec. 4, 2025, HPE shares closed up by 2.9% after reporting its Q4 results. Its revenue increased 14.4% year over year to $9.7 billion. The company’s adjusted EPS came in at $0.62, up 6.9% year over year.

For the current fiscal year, ending in October, analysts expect HPE’s EPS to grow 26.6% to $1.95 on a diluted basis. The company’s earnings surprise history is mixed. It beat the consensus estimates in two of the last four quarters while missing the forecast on two other occasions.

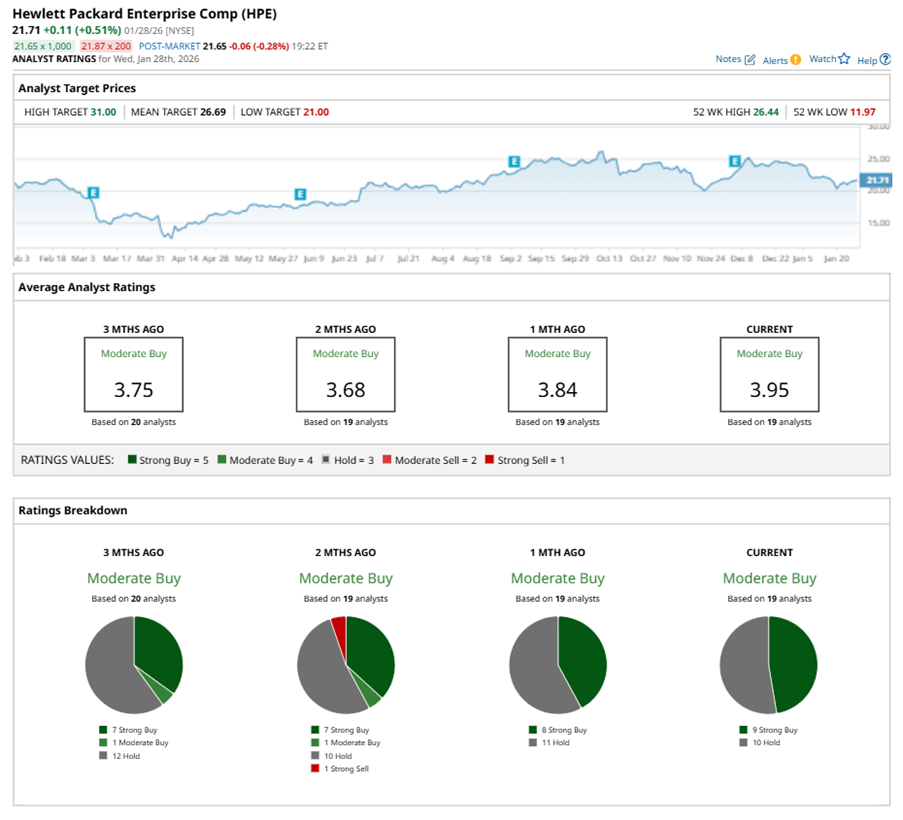

Among the 19 analysts covering HPE stock, the consensus is a “Moderate Buy.” That’s based on nine “Strong Buy” ratings, and 10 “Holds.”

This configuration is more bullish than a month ago, with eight analysts suggesting a “Strong Buy.”

On Jan. 27, Bernstein analyst Mark Newman maintained a “Hold” rating on HPE and set a price target of $24, implying a potential upside of 10.5% from current levels.

The mean price target of $26.69 represents a 22.9% premium to HPE’s current price levels. The Street-high price target of $31 suggests an ambitious upside potential of 42.8%.